Brandon Bell/Getty Images News

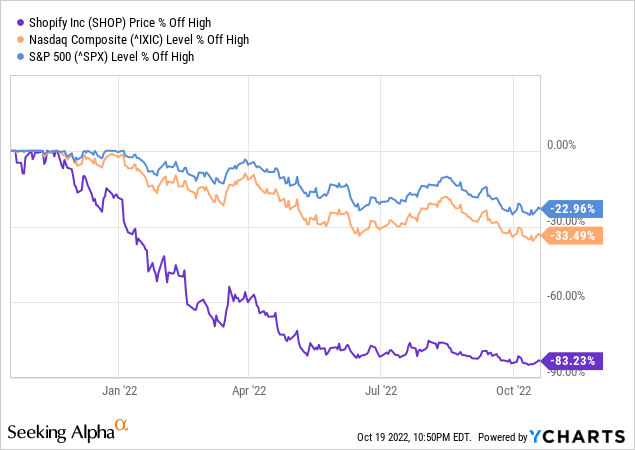

Shopify (NYSE:SHOP) has had a very difficult year, to say the least. After the e-commerce giant received a huge growth boost in 2020 and 2021 as businesses went exponentially more digital, shares plummeted nearly 85% this year back to 2019 levels, erasing all gains.

That said, we will employ several valuation methods to explain why Shopify may have bottomed out and why we believe it currently seems to have an attractive valuation. There are also numerous factors that could give the stock its well-deserved rebound.

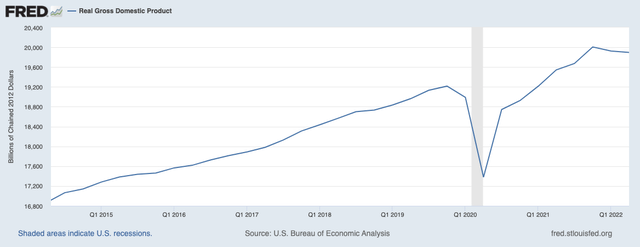

Macroeconomics & Growth

One of the main explanations for Shopify’s decline can be traced to rapid changes in the macroeconomic backdrop. Shopify went from an environment where the transition to digital commerce was booming, with interest rates near 0%, to an inflationary environment where the Fed is raising interest rates at the fastest pace in several decades.

Yet we think Shopify is well positioned for a bounce if it overcomes this period of macroeconomic uncertainty, inflation, slowing GDP growth and a shift to non-discretionary spending. Finally, the worst for Shopify may have already been priced in, as it announced that the coming quarters will not be too bleak financially. Shopify expects operating margins to be a lot lower in the third quarter, but that margins in the fourth quarter may be only slightly worse than in the second quarter.

Also completed this year is the acquisition of Deliverr, a shipping logistics company, for which they are paying about US$1.7BN in cash, combined with about US$420M in Class A shares. The fourth quarter is known in e-commerce for much higher sales because it is the holiday season, leading to a first quarter after which margins should improve again.

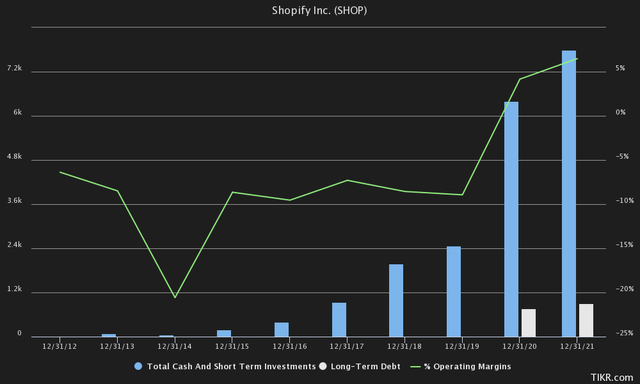

Shopify also has an excellent balance sheet to weather a recession, totaling more than US$6.95BN in cash and short-term investments.

Additionally, we believe there is still a lot of growth potential in the e-commerce market in general, as it is growing at a CAGR of 11.9%. By comparison, in the United States, 85% of commerce is still conducted physically, while in China it is less than 50%. One such trend driving Chinese e-commerce growth is Social Commerce, for example, which Shopify is currently emphasizing through their sales channels TikTok, Meta (META), etc.

That is combined with other factors such as growth in Gross Merchandise value (GMV). We believe this growth will be driven, for example, by the increase in offline point-of-sale (POS) users that recently increased 47% year-over-year, seizing an opportunity for bricks-and-mortar stores to integrate into an online platform where they can manage all their data, payment processing, inventory management, shipping, billing and more all at once.

Other social spending initiatives, such as Shopify Audiences, Deliverr, YouTube Collabs and more, should significantly increase Shopify’s value proposition as the company scales these initiatives in the coming years. The main goal of all these products is to generate more GMV, of which Shopify can pocket a portion. Finally, Shopify’s expansion into B2B and rolling out features in new countries should also contribute significantly to their near-term growth.

The Financial Valuation

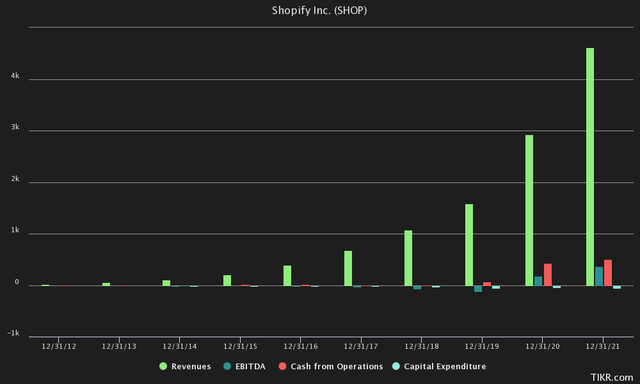

Several important factors must be taken into account when considering Shopify’s financial valuation. One is Shopify’s exceptional growth over the past 10 years, with an annualized revenue growth of 69.39%. Although that growth has stabilized more in the last 3 years and is closer to a CAGR of 50%.

Shopify itself acknowledges that some of this growth came as a boost during the pandemic, when e-commerce got a huge boost as businesses were forced to go digital. The interesting fact is that even though Shopify got that boost, it continues to follow the same growth curve as it did in 2019 but now on a higher base.

The big problem with Shopify, and perhaps why the stock has suffered so badly, probably has to do with the fact that the U.S. and the rest of the world are tightening monetary policy and raising interest rates at an insane rate to fight inflation. If a recession were to occur, Shopify could certainly suffer because its merchants primarily offer discretionary items.

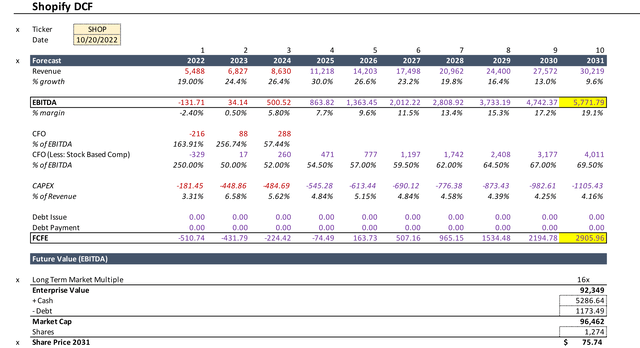

We incorporated this into our model and lowered Shopify’s revenue growth between now and 2024, which is close to the Wall Street consensus. We think that by 2025 at the latest, if inflation has slowed and economic growth slows, or if the labor market rattles, the Fed is likely to reverse.

Moreover, we think Shopify should be able to return to a more basic 30% growth rate and scale down to a single-digit growth rate by 2030 because it is a relatively young company that still has a track record of tremendous growth. This is also in line with the consensus on wall-street. Shopify makes its money primarily from subscription revenue, and from the merchant solutions it offers. Moreover, it is easiest to see that Shopify accounts for a portion of the total gross merchandise volume (GMV) on its platform.

In the second quarter, that GMV accounted for $46.9 billion. Currently and in recent years, Shopify has taken a margin of about 2.7% on that GMV. As Shopify expands its user base and helps merchants already on the platform sell more, Shopify should generate more revenue overall. We think Shopify also has a huge opportunity to increase margins and increase revenue by increasing just that portion of the GMV as more functionality is added and merchants become more reliable to the platform.

In the second quarter, Shopify has an annualized GMV of $187.6 billion. A 1% increase in GMV margin from, say, 2.7% to 3.7% could currently result in additional EBITDA of US$1.88BN, assuming demand is fairly inelastic because a large number of businesses depend on Shopify’s software. Shopify has kept its GMV margin at around 2.7% in recent years, despite growth of more than 50%. Shopify’s primary strategy is to grow its GMV as much as possible, but once growth slows down and the company matures, we think Shopify may choose to experiment with increasing its margin.

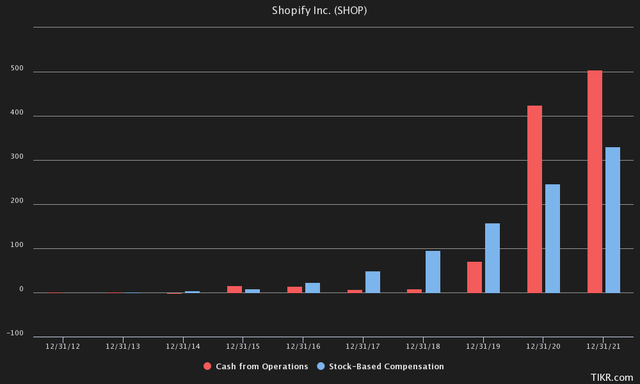

In the chart above, however, you can see that Shopify has very aggressively increased its share-based compensation, almost equaling the cash it generates from its operations (CFO). We also took this into account in our model and adjusted the CFO for current and future share-based compensation. Shopify has already recently reduced its headcount by 10%, and we believe share-based compensation will decline by the end of this decade as the company matures.

In 2020, Shopify had CFO worth $424.96. If we factor in share-based compensation, that leaves $178.02 million in CFO. We think this will drop significantly in 2022 and remain under severe pressure through 2024, amid a looming recession, margin compression and an additional layer of complexity from their acquisition of Deliverr. In the long term, however, we estimate that the CFO will continue to stay close to 70% of Shopify’s total EBITDA, including cash compensation.

CAPEX should also take a big hit over the next 2 years, as the company publicly announced a plan of about US$1BN in CapEx as a result of Deliverr. We estimate that this will gradually decrease to around 4% of revenue, as Shopify still remains primarily a software company that is not very capital intensive.

Author’s Calculations/Consensus Data

In terms of EBITDA, that brings us to US$5.77BN in EBITDA as Shopify moves toward our target of 20% EBITDA margins, due to previously mentioned factors such as operational efficiency, increased margins and maturity as a company. Currently, as the company is growing, OpEx is exceptionally high and possibly a bit off in recent quarters. In Q2 2021, Shopify managed to achieve an OpEx margin of 14.1%.

Applying a 16x EV/EBITDA multiple, we believe Shopify is reasonably valued in line with the historical average of the S&P 500. Early this year in the software sector, the average EV/EBITDA of positive EBITDA companies was 32.72. At 16x EV/EBITDA, that becomes a market cap of US$92.35BN, or US$96.46BN of enterprise value. Multiplied by the number of shares outstanding, this becomes $75.74 per share.

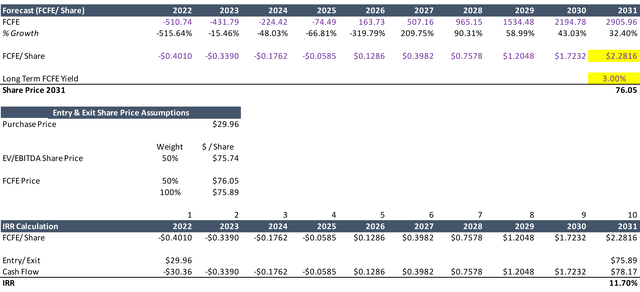

On a Free Cash Flow to Equity (FCFE) basis, taking into account CFO and CAPEX, we arrive at an FCFE of $2905.96 by 2031. That’s about $2.28 FCFE per share. Looking at peers in the software industry, and Shopify’s historical FCFE yield, we believe a 3% yield is a conservative and acceptable long-term return, bringing us to $76.05 per share.

Author’s Calculations/Consensus Data

If we take both EV/EBITDA and FCFE price targets, we get an average of $75.89 per share. Assuming an entry at the current market price of $29.96, and taking cash flows into account, we arrive at an Initial Rate of Return of over 11.70%. This leads us to the conclusion that we find Shopify an attractive investment, if bought below $30.

Where the short-term bottom lies is still difficult to speculate. On October 13, Shopify dipped briefly to $23.63 in pre-market, hitting a new multi-year low. At that price, Shopify would have an IRR of 14.64%, according to our calculations. We think there may be some more room to fall, but also that this price level looks like a good place to start adding in the long run.

Don’t Forget The Risks

Of course, we cannot forget the risks associated with the stock. In our opinion, Shopify’s main risk could be a slower growth rate due to the macroeconomic environment we touched on earlier. Although Shopify has so far been able to maintain a CAGR of 50%+ in terms of revenue, revenues seem to be slowing down.

However, we believe that these headwinds will be temporary and that Shopify will still outperform the overall e-commerce market. In an environment of inflation and recession, discretionary products may also suffer. On the other hand, Shopify is very special because it sells D2C and its merchants have higher profit margins. Wholesalers such as Walmart (WMT) and merchants working with companies such as Amazon (AMZN) may suffer, as margins are already low and may come under even more pressure in an earnings recession.

2 Consecutive Quarters Of Negative GDP (Federal Reserve)

One of the less worrisome risks, in our opinion, could be competitive pressure from other companies such as Wix (WIX), Squarespace (SQSP) and BigCommerce (BIGC). We believe Shopify still has an edge over their competitors due to their strong value proposition, ecosystem and competitive pricing, and expect this to continue in the future.

The Bottom Line

According to our valuation, at current pricing, Shopify should be able to offer alpha above broad benchmarks at an IRR of 11.70%. We think Shopify would become even more attractive should it fall to its previous bottom and its IRR get closer to 15%.

While Shopify may fall further, it can also be said that most of the bad news has already been priced in, following the drastic decline in its share price combined with the negative guidance from previous earnings calls, which is arguably leading investors to anticipate a difficult few quarters for Shopify.

Be the first to comment