Bennett Raglin/Getty Images Entertainment

How a stock trades after disappointing results is just as important as the actual results in the short term. Shopify (NYSE:SHOP) has had a bad week with discussions of major layoffs and a big Q2’22 earnings miss, yet the stock held prior lows. My investment thesis is a lot more constructive on the stock following the kitchen sink quarter, but the stretched valuation leaves the view at Neutral.

Normalized Pain

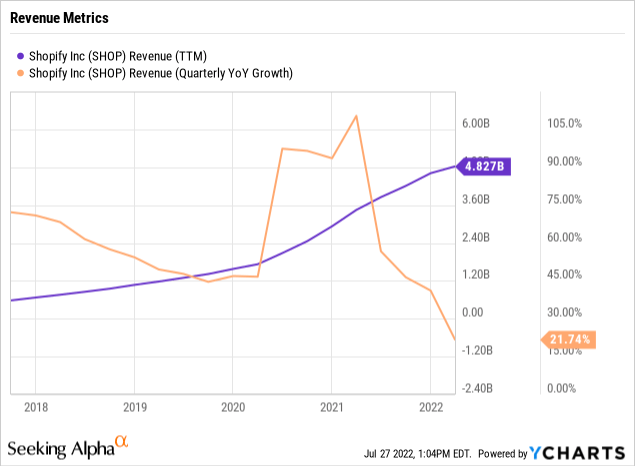

Shopify reported impressive Q2’22 sales considering the tough comps and currency impact. The company reported revenue grew 16% YoY to $1.3 billion, but Shopify had to top growth rates topping 100% back in 2021.

As mentioned my management, gross merchandise volume on the platform grew at a compound annual growth rate of 50% to reach $46.9 billion for Q2’22. Any major investments made on the continuation of such growth rates was clearly a huge mistake and obvious to anybody knowing that consumers would return to shopping in person as COVID fears subsided.

Online e-commerce is set to grow from these levels in 2022 for the decades ahead. Some moderation of growth this year will refresh the segment for solid growth into 2023. Investors should view Shopify from the big picture of how sales have grown from only $1.2 billion ending 2018 to $4.8 billion now.

Recalibrating Business

Shopify has ended in the odd position of growing substantially in the last couple of years while actually turning strong profits into solid losses. The online e-commerce platform has turned a rewarding period into a negative with excessive spending.

The company reported a Q2’22 adjusted operating loss of $42 million after generating an impressive profit of $237 million last Q2. Shopify was very mismanaged to invest so aggressively in the business that 16% revenue growth leads to a massive $279 million reduction in the profit picture, or the equivalent of over 20% of revenues.

A company might have impressive tools helping e-commerce retailers, but this isn’t the same as generating massive profits from those tools. The stock ultimately trades on the ability of a company to produce profits on any impressive tools. Customers aren’t always willing to pay for services no matter the quality level due to various market conditions such as competition or the lack of capital.

Shopify already implemented a 10% staff reduction to better align costs with the current business trends. Per CFO Amy Sapero on the Q2’22 earnings call, the company completed the lay off yesterday:

Upon completion of a comprehensive and careful analysis of the company, we identified certain areas where we could improve our operations and team that resulted in the elimination of approximately 10% of Shopify’s total headcount on July 26.

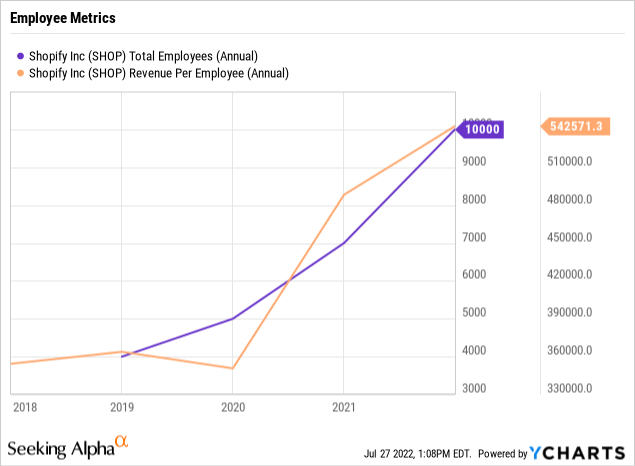

The company can use the employee reduction to cut underperforming staff members accumulated in the past few years. Shopify had already doubled employees in just 2 years heading into 2022 and the company further added staff in the 1H of the year.

The company was still efficiently adding employees heading into 2022 with the revenue per employee jumping to nearly $550K. The problem here necessitating the staff reductions is that Shopify actually forecasts ending the year with more employees despite this large lay off. Of course, Deliverr adds ~450 employees to the base contributing to the actual staff increase for the year.

After the Deliverr deal, Shopify has an adjusted cash balance of $5.25 billion. The deal is supposed to dilute gross margins starting in Q3 with the July 8 closing, but the delivery logistics firm provides small business merchants with the tools to vastly improve distribution.

Of course, the financial results will ultimately tell whether the costs to offer these solutions to customers is backed by profitable sales. Despite the 10% staff reduction, Shopify guided to larger operating losses in the second half of the year due in large part to the inclusion of the Deliverr business.

The stock appears to have bottomed considering the bounce above prior lows despite the weak Q2 numbers and forecast for larger operating losses. Shopify is positioned to capture out sized gains of e-commerce in the years ahead, but the stock is expensive trading at 6x sales with while now producing operating losses.

Takeaway

The key investor takeaway is that investors need to understand Shopify is only recalibrating the business. The layoffs aren’t a plan to alter the business from long-term growth initiatives, but rather one to right size the business for a return to normalized e-commerce growth and focus spending on the better opportunities ahead.

Shopify appears to have bottomed, but the stock valuation just isn’t attractive here.

Be the first to comment