JHVEPhoto

Thesis

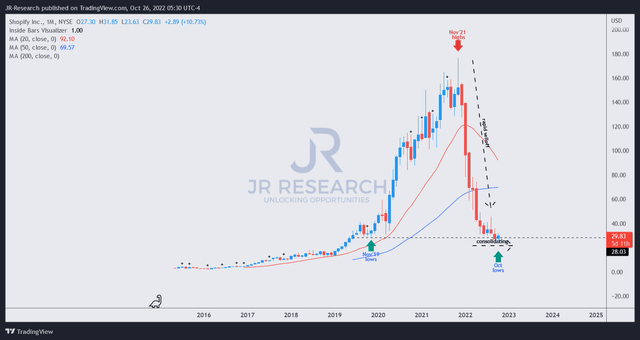

Shopify Inc. (NYSE:SHOP) is slated to release its Q3 earning card on October 27 to much anticipation. SHOP has stunningly broken below its COVID lows in October, which could prove to be a capitulation move.

Notwithstanding, SHOP has underperformed our expectations since our previous update, with the market having other ideas on high-growth speculative stocks.

Management remains confident that the direct-to-consumer (DTC) push is not a fad but something that has robust growth drivers supporting its penetration. Despite the massive slowdown, Shopify has also been growing faster than the US e-commerce market.

As such, Shopify’s execution through the coming recession would be critical as it invests in its infrastructure to deliver its asset-light Shopify Fulfillment Network (SFN). SFN is an essential piece of its jigsaw to complete the fulfillment process that could help close the gap with e-commerce behemoth Amazon (AMZN) on its terms.

Our analysis suggests that SHOP has been consolidating without much impetus for much further downside (relative to its early 2022 stunning decline). While near-term downside volatility could persist, we see the recent October 2022 re-test of its November 2019 lows as constructive.

Therefore, investors waiting for an opportunity to leverage a robust bottoming process should consider adding exposure at these levels. We parse that the market would likely still ascribe a growth premium to SHOP, given its higher potential growth rates.

As such, we reiterate our Speculative Buy rating but cut our medium-term price target (PT) to $40 (implying a potential upside of 34%).

Shopify Is Still Expected To Grow Faster Than The Market

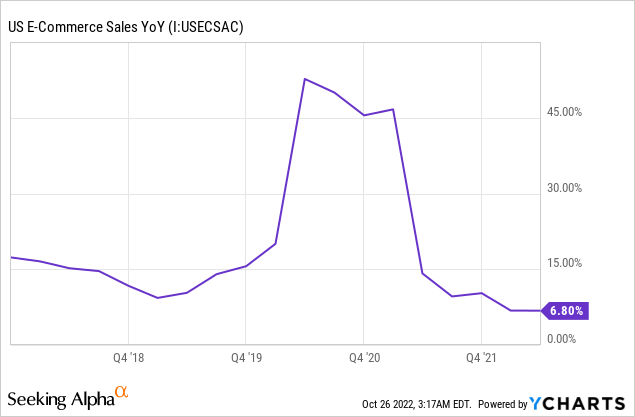

The US e-commerce market grew by 6.8% YoY in Q2, just below Q1’s 6.82%. Therefore, it seems the e-commerce market could stabilize despite worsening macro headwinds.

Furthermore, the record spike during the COVID days has also been digested, as the growth rates are well under the market’s long-run average of 19.2%.

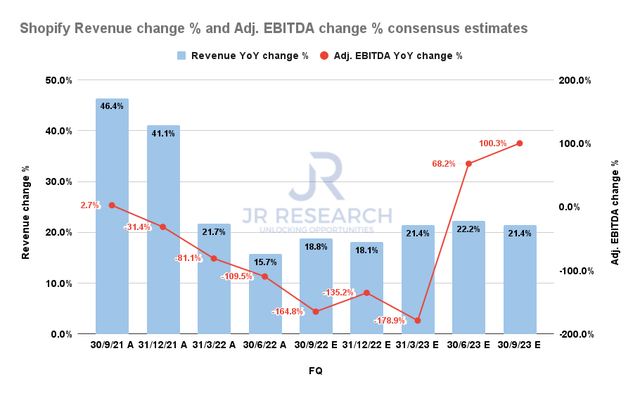

Shopify Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Therefore, Shopify’s Q3 earnings release should give investors a good indication of whether the slowdown in US e-commerce sales has reached a nadir. In addition, given that e-commerce juggernaut Amazon also reports on October 27, we would get a clear view of their guidance moving ahead as we head closer to a recession.

As seen above, the consensus estimates (bullish) suggest that Shopify’s revenue growth should have bottomed out in Q2, accelerating through FY23. Therefore, Shopify is still expected to grow much faster than the e-commerce market, deserving of its growth valuations.

Notwithstanding, the company remains in investment mode till 2024. However, the company doesn’t expect to “stun” investors with another massive CapEx drive, as Shopify President Harley Finkelstein articulated in a September conference:

We’re pretty much there already. We think an additional $1 billion to 2024 gets us the entire fulfillment and end-to-end logistics network that’s built specifically for modern brands. So there’s no risk there. But the Amazon model was totally different. The Amazon model is a race to get it as cheap and as fast as possible. They own all their warehouses, all their staff is on their payroll. And in our model, that’s not necessary. (Goldman Sachs 29th Annual Global Retailing Conference)

Therefore, it’s critical for investors to consider the key differentiations between Shopify’s asset-light SFN model that relies on third-party logistics (3PL) providers. The company believes that a 2-day delivery model is appropriate to meet its goals, and there’s no impetus to push toward a much faster network. The company believes holistic customer experience is more important than focusing on the cheapest and fastest deals, per Amazon.

We believe Shopify’s differentiation with DTC brands gives them an advantage over Amazon. So Shopify’s ability to nullify Amazon’s attempt to hijack its SFN model with its Buy with Prime model is critical. To this, management is confident as its merchants want to own that relationship with their customers. With Amazon, the worry is always there, as Finkelstein accentuated:

[Our potential partnership with Amazon has to be done] in the right way. And if it’s going to be done in a hacky way where merchants lose or they — or the customer information is obfuscated, that’s not the right way to do it. And if you look at all of our partnerships, across every one of these major commerce partnerships where Shopify is powering that new social media surface or that service in general, it is because we are coming in, in a way that actually allows the merchant to keep control of their customer. (Goldman conference)

Is SHOP Stock A Buy, Sell, Or Hold?

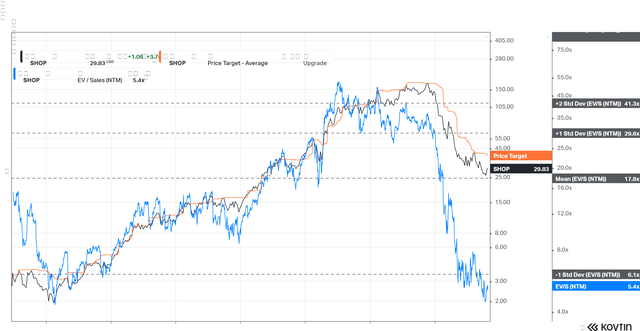

SHOP NTM Revenue multiples valuation trend (koyfin)

SHOP last traded at an NTM Revenue multiple of 5.4x. It is down way below its overvalued highs in 2021. However, it still trades at a premium against its peers (average: 1.56x), given its higher software margins and faster growth rates. Therefore, investors are still buying into the allure of Shopify’s ability to execute its growth strategies.

SHOP price chart (monthly) (TradingView)

SHOP has been consolidating after its hammering that led to its previous June 2022 lows. The selloff in October 2022 broke below its COVID lows but was supported robustly as it re-tested the lows last seen in November 2019.

As such, we postulate that SHOP seems to be forming a long-term base, which should help with a re-rating moving forward if it can execute well.

However, investors need to be wary about expecting a quick turnaround, given its growth premium and the worsening macro headwinds. Also, investors should expect near-term downside volatility if its Q3 release disappoints. However, investors should see that as an opportunity to accumulate than shun.

We reiterate our Speculative Buy rating on SHOP.

Be the first to comment