Sergey_Ko

Investment Thesis

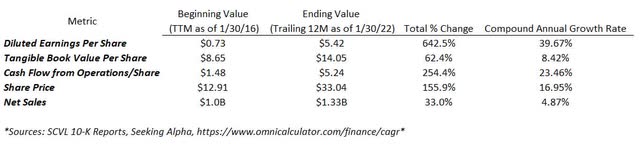

Investors probably think of one or more of the 141+ retail bankruptcies since 2015, according to CB Insights, when they first hear Shoe Carnival Inc. (NASDAQ:SCVL), if they’ve ever heard of the company at all. However, the primarily Midwest-based family footwear chain has bucked the trend and significantly increased nearly all measures of shareholder value over the long run, as shown in the chart below with a total shareholder return of ~156% over the last 6 fiscal years excluding dividends and a substantial increase in diluted earnings per share from $0.73 to $5.42 as of the most recently completed fiscal year. The Company’s earnings were recently boosted by government stimulus money and the recovery from the depths of the COVID-19 pandemic, but earnings are still projected to be around $4.00/share this year with growth in the years to come due to the newly acquired chain Shoe Station completed in December 2021, remodeling efforts, and organic growth. CEO Mark Worden took over in September 2021 after previously serving for the Company in chief sales and marketing roles. In my view, Worden should benefit from having experienced former CEO since 2012 and current Vice Chairman Cliff Sifford nearby.

SCVL Value Creation – Author Generated Image (SCVL SEC Filings, Seeking Alpha, OMNI Calculator)

Current Shoe Carnival Chairman and billionaire Wayne Weaver and family own ~35.6% of the shares according to the Company’s 2022 proxy filing and have “substantial influence” over the company’s operations, according to the 2022 10-K filing. In my view, the significant insider ownership has allowed the Company to maintain a long-term perspective and make the necessary investments to stay competitive while other chains have filed for bankruptcy and/or gone out of business.

In the next several years, I expect the stock to return to pre-pandemic valuation multiples as investors realize the strength of the Company’s omnichannel business model, opportunities for profitable expansion, and friendly capital allocation policies which are likely to create additional value for shareholders. As a result, I believe the stock could go as high as $60/share in the next several years based on projected earnings of $4.40/share in FY2023 and a return to P/E Ratio of at least 15x, which is in-line with previous valuation multiples seen in the stock before the pandemic. In my view, the Company has a stronger competitive position now than pre-pandemic as many competitors have exited the business and the Company records record profit margins. Positive upcoming initiatives include store modernization, the integration of the Shoe Station acquisition, and organic expansion.

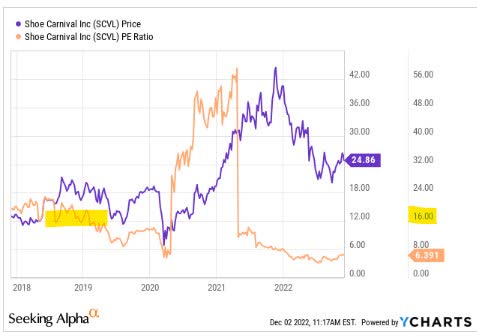

SCVL 5 Year PE Ratio History (YCharts)

Competitive Positioning

According to the Company’s 10-K, it competes with department stores, shoe stores, sporting goods stores, e-commerce sites, and mass merchandisers. In my view, investors are right to be concerned about the Company’s position among stronger e-commerce players and well-capitalized retail chains, however Shoe Carnival appears to have carved out a niche in many of its markets through a combination of superior customer service, reasonable prices, and strategic marketing. The main example of its marketing savvy is the Company’s 31.5 million customers part of its “Shoe Perks” loyalty program, which allows the Company to provide specialized offers and messaging to customers. For context, DSW parent company Designer Brands Inc. had 28 million loyalty program members as of January 29, 2022 despite having ~250 additional stores. In FY2021, Shoe Perks members made up 68% of Shoe Carnival’s comparable net sales. In the Company’s recent Q3 earnings release, it highlighted the 35% growth in loyalty member participants over the last 3 years.

Based on my research, the Company’s relationships with key suppliers, strong balance sheet, superior in-store experience, and customer relationship management capabilities combine to set it apart from the competition and allow it to earn solid returns on capital. An upbeat, customer service focused in-store experience differentiates Shoe Carnival from its competition when families or individuals could simply purchase shoes online instead. SCVL appears to be doubling down on this advantage even as e-commerce sales continue to make up a larger portion of total U.S. retail sales.

E-Commerce Sales % of Total Retail Sales (FRED) (FRED St. Louis Fed)

The Company expects to spend a record $70-75 million on capital expenditures for the full-year FY2022 with the majority going towards new stores and store remodels. It also expects to spend on upgrading its e-commerce offerings among other technology initiatives. Sales through E-Commerce made up 12%, 19%, and 6% in FY2021, FY2020, and FY2019, respectively. SCVL is aiming to have 400 stores in operation in 2023 and 500+ over the long-term (2026-2028) according to CEO Mark Worden’s comments during the most recent earnings call held on November 16:

Fourth, we are planning to expand scale of our store footprint of both banners over the next five years. The Shoe Carnival enterprise is on track to operate over 400 locations during 2023 and targeting 500-plus stores in the 2026 to 2028 horizon through organic expansion and targeted M&A activity. We see the largest white space opportunity for store growth is with our recently acquired Shoe Station banner, and as shared earlier, we aim to grow to over 100 Shoe Station stores in the 2026 to 2028 horizon.

– Shoe Carnival CEO Mark Worden

SCVL Store Locations (SCVL Investor Presentation 5.20.2021)

Superior Capital Allocation

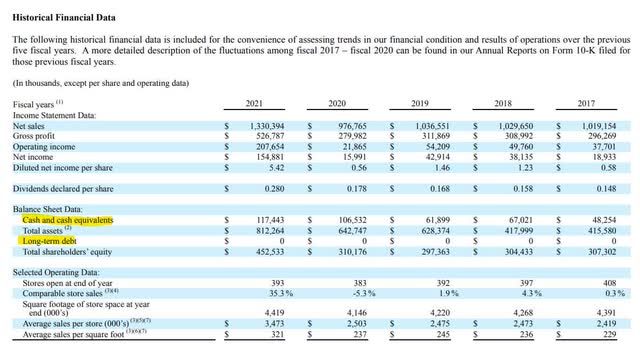

The Company’s strong balance sheet and cash generation ability arguably allow it to make greater investments than competition of a similar size. In both FY2020 and FY2021, SCVL ended the year with over $100 million in cash and no long-term debt when excluding lease liabilities. The company also has an unutilized $100 million revolving credit facility.

SCVL Balance Sheet Strength (SCVL 2021 10-K)

SCVL ended the most recent quarter with a relatively low cash balance of $37.1 million as it spent $63.1 million on capital expenditures and $108.1 on inventory in the first three quarters of this year. SCVL CFO Kerry Jackson highlighted the Company’s capital allocation priorities in the Q3 earnings call:

Our first thought is how do we fund growth and are there any opportunities there, and then we fund our dividend, and if we have excess cash that we don’t think we’re going to need to deploy and we continue to build cash later, then we’ll do a buyback when we see the stock being unfavorably viewed by the street. We’ll still be opportunistic in the future, but we’re really focused more on the growth side of the business, and as we transition to store growth next year, that’s going to be our primary focus.

– Shoe Carnival CFO Kerry Jackson

In my view, the focus on growth while many competitors are cutting back amid a difficult macroeconomic environment is encouraging and will allow Company to take market share in the years to come. Additionally, the emphasis on buying back shares based on price is somewhat unique in the market and showcases management’s concern for shareholders.

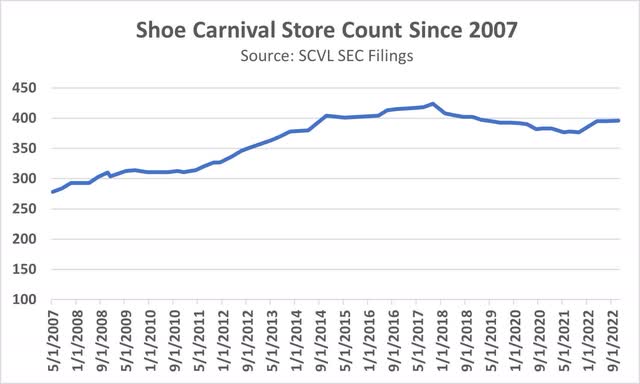

Opportunities

Shoe Carnival has the opportunity to grow its store count in the near-term and eventually to over 500 stores according to management projections. The Company’s single distribution center located in Indiana supports 460 stores and the Company has an option to expand the facility by 200,000 sq feet to support 650 potential stores. Store growth has been somewhat uneven in recent years as many underperforming stores have been closed (see chart below). Although the store count growth has slowed in recent years, I view this as a positive as management is monitoring returns on capital rather than growing the store count haphazardly simply for the sake of growth.

SCVL Store Growth (SCVL SEC Filings, Author Generated Image)

The acquisition of Shoe Station, which was the first acquisition in the Company’s history, comes with 21 stores and serves as a platform for future growth. Over time, the Company expects Shoe Station to reach 100 stores under the new ownership. The acquisition, which is exceeding management’s expectations according to the most recent earnings call, is expected to provide an additional $100 million in revenue with 10% operating margins for FY2022. It’s clear from the Shoe Station website that management is currently working on a new e-commerce offering in addition to adding new stores:

Shoe Station Website (Shoe Station)

Separately, the store modernization efforts for the Shoe Carnival brand are expected to reach 50% of the total store count by the middle of next year, up from 41% today. The following slide from the Company’s 2021 investor presentation does a nice job of summarizing future growth opportunities:

SCVL Growth (SCVL Investor Presentation 2021)

Valuation

Shoe Carnival’s current valuation of ~6.3x projected FY2022 earnings of ~$4.00/share is undemanding and even less so when projecting future earnings for FY2023 of $4.40, the consensus analyst estimate from the few Wall Street analysts who cover the stock.

Shoe Carnival shares traded for ~12-18x earnings between 2018 and 2020, and in my view, they could return to that valuation within a few years as investors appreciate the Company’s growth strategy and ability to compete with other online retailers. The current retail environment is much worse than it was over most of the last few years, and investors seem to be unfairly punishing the company. A 12x P/E multiple on the stock and $4.40/share in earnings would result in a share price of $53/share versus $25/share today. A 18x P/E multiple would result in a share price of $79.

Risks

The primary risk involved in an investment in Shoe Carnival involves competition, especially from e-commerce and larger retail chains. Additionally, an economic downturn would significant impact spending at the stores, although it should be noted that Shoe Carnival produced positive free cash flow through each of the last two major recessions. Further, expansion plans may not occur at the pace or extent to which management predicts. Finally, investors’ negative attitude towards most retail stocks could continue, especially if high inflation and rising interest rates persist.

Final Thoughts

At current levels, I believe Shoe Carnival shares represent a very good value for investors based on the Company’s financial state, growth profile, management skill, and capital allocation priorities. If the share price continues to lag, management will likely take advantage by repurchasing shares and increasing continuing investors’ ownership of a solid business. Investors are valuing the Company as if it has a bleak future, but I believe it will continue to have a strong position in the market with its balanced focus on price, customer service, wide selection, and prudent expansion.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment