Yuichi Yamazaki/Getty Images News

Investment thesis

ShinMaywa Industries, Ltd.’s (OTCPK:SHMWF) shares have been associated with increased military spending by the Japanese Ministry of Defense. This is a mild positive in our view, but not enough to offset weakening fundamentals as material prices increase and target economies in Asia and Oceania begin to react negatively to a global recession. Despite being a value stock trading on PBR 0.7x, we are sellers of the shares.

Quick primer

ShinMaywa Industries is a Japanese manufacturer of transportation equipment, ranging from special-purpose trucks (such as forestry trucks and garbage collectors), parking systems, industrial machinery & environmental systems, and aviation including commercial aircraft components and its own STOL (short take-off and landing) seaplanes. Founded in 1949, its business model is aligning itself towards megatrends such as urbanization and environmental infrastructure, expanding into areas such as manufacturing equipment for secondary auto batteries and wastewater treatment.

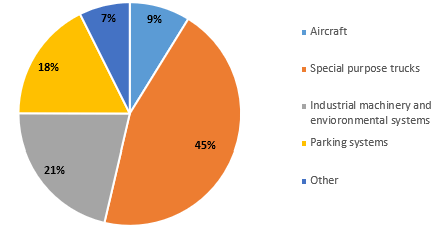

Only 14% of FY3/2022 sales were derived overseas, with a focus on Asia; overseas sales used to be higher at around 25% in FY3/2016. Although special-purpose trucks make up the majority of sales, profitability is average compared to higher returns in parking systems and industrial machinery & environmental systems. Peers include Kyokuto Kaihatsu Kogyo (7226), Nippon Sharyo (OTCPK:NPPSF), and Mitsubishi Heavy (OTCPK:MHVYF).

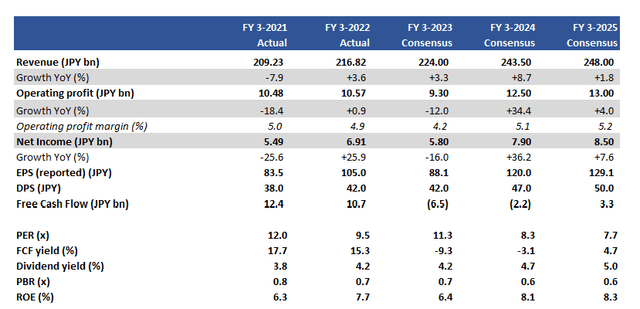

Key financials including consensus forecasts

Key financials including consensus forecasts (Company, Refinitiv)

FY3/2022 sales split business segment

FY3/2022 sales split business segment (Company)

Our objectives

ShinMaywa is a value stock trading on a PBR of 0.7x with a debt-equity ratio of 0.6x. In FY3/2019, the company raised JPY100 billion/USD0.7 billion of borrowing to conduct a JPY45 billion/USD0.3 billion share buyback, and the current debt outstanding is the remnant of this event.

The shares (listed in Japan) visibly spiked at the beginning of June 2022, when the company was associated as defense-related. We want to see whether there is any substance to this, as well as the outlook for the medium term.

Military spending is increasing, but the scale appears limited

Q1 FY3/2022 results were disclosed in July 2022. They were weaker than expected, with flat sales YoY but operating profit falling 43% YoY (versus FY guidance for a 15% decline YoY) due to increasing steel prices. However, order visibility appeared much better placed growing 23% YoY, with the key driver being the Ministry of Defense.

To put it into perspective, aircraft-related sales in FY3/2022 made up only 9% of the total, which included commercial aircraft components. It is not a major earnings driver for ShinMaywa (during the pandemic, it was unsurprisingly a loss-making segment), but it did contribute 11% of total Q1 FY3/2023 sales, so one could argue that its impact is getting larger.

Previously, there were comments about orders for the ShinMaywa US-2 seaplane (used primarily for sea rescue) rising during FY3/2022. With this trend appearing to continue, this provides some evidence that the company is being influenced by the Ukraine conflict as well as geopolitical tensions in Taiwan.

With defense spending reaching record highs in Japan, we admit that the company looks like a beneficiary of current world affairs. However, we do not see ShinMaywa seeing sustained growth in defense-related orders purely as its product offering is quite niche with a limited customer base.

Medium-term plans

The company has announced its financial targets for FY3/2031, aiming for JPY400 billion (25% from overseas) and an ROE target of 12%, with no mention of profitability or free cash flow. Whilst there are still 8 years of this plan to run, it does imply sales growth of 7.5% CAGR (2023-2031) which does look rather optimistic. The company has mentioned M&A as a means to drive growth, most likely to be bolt-ons as opposed to major acquisitions.

Geographically, the company is aiming most growth in Asia/Oceania followed by North America. Key themes include electric vehicles (“EVs”) with vacuum driers for secondary batteries and wire harness processing machines and recovery in commercial aviation with component demand and aircraft passenger boarding bridges. There is also an angle on providing components for drones for human travel (flying cars) for the U.S.

Whilst the company’s technology and expertise are high, operating margins remain in the low single-digits, with its overriding exposure to producing high-quality hardware.

We cannot comment with much confidence on the company’s long-term outlook. However, we can see three factors that will act as significant headwinds for the company, making it difficult to maintain a relatively high pace of revenue growth for the foreseeable future. Firstly, with increasing commodity prices into H2 FY3/2023, we expect cost inflation to play a significant role in pressuring margins. Secondly, a focus on emerging markets to generate growth will be difficult with recession warning signs increasing uncertainty and raising financing costs. Thirdly, order visibility is likely to experience delays or postponements as customers begin to review their capex plans with weakening fundamentals. Although the company has some recurring revenue streams from support and maintenance, this is not sizable enough to sustain earnings.

Despite the company being positioned to benefit from underlying growth themes such as EVs, environmental regulation, and military spending, we do not see these necessarily translating to a high-return business.

Valuation

Consensus forecasts imply that the company will burn cash for two consecutive years starting in FY3/2023 as capex increases. This illustrates that ShinMaywa’s business model is experiencing a capital-intensive period, placing some doubt over how cash flow generative the business will be compared to its historically sound track record. Whilst this negative should be priced in, we believe there is downside risk as fundamentals look set to weaken due to cost inflation.

Risks

Upside risk comes from a major influx of orders related to defense spending, with demand accelerating both at home and abroad. Major infrastructure-related government spending plans may provide a boost to parking systems and environmental systems.

Downside risk stems from cost inflation, both from increasing raw material prices as well as the weakening Japanese yen (as most commodities are priced in US dollars). Order visibility could weaken as customers begin to re-assess capex plans.

Conclusion

ShinMaywa shares have been in the spotlight with its exposure to defense spending, but this business is unlikely to be either significant or sustainable. The immediate picture points to weakening fundamentals with cost inflation and economic uncertainties in emerging markets, and these trends could persist for the medium term. The shares are valued cheaply on PBR 0.7x, but we are sellers of the shares.

Be the first to comment