DakotaSmith

Investment Thesis

Sherwin-Williams (NYSE:SHW) reported strong third quarter results. Robust performance in its North American retail stores pushed revenues significantly higher. I like the business’s fundamental outlook, especially in professional markets. However, I’d like to see the valuation drop more before I’d consider buying.

Sherwin-Williams Q3 Results

Sherwin-Williams reported strong third quarter results. Total revenue was up by 17.5% since last year. The business expanded its gross margins, allowing it to grow EBIT by 40%. Sherwin-Williams reaffirmed its full year adjusted EPS guidance of $8.50 to $8.80.

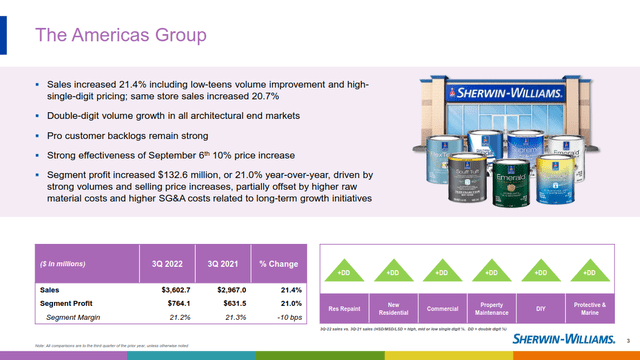

The standout performer was Sherwin-Williams’ The Americas Group segment. This division manages the company’s portfolio of North American retail stores. The segment grew its sales by double digits in every category. Total segment sales are up 21.4% since last year.

Sherwin-Williams Q3 2022 Earnings Slides

My major takeaway from this earnings report is that demand is staying strong. This is especially apparent in professional architectural markets. Volume in these markets increased by double digits since last year. I think this is impressive performance, and it’s compounded by product price increases. Management says that they expect commercial demand to maintain its momentum. They provided some details on their earnings call.

I’d say, the underlying demand on commercial is strong. Projects are resuming and starts are positive… Customers who are positive, they’re still reporting delays resulting from some labor and material shortages that we are seeing a terrific opportunity for our products. Infrastructure spending here as well is strong and schools, airports, hospitals and also areas such as data centers, our position here is strong. Again, we really leverage our platform. We leverage our specification teams. We’re calling on architects and continuously drive new products for customers that allow them to be more productive on the job…

So we’re very aggressive in pursuit of these customers. We feel as though our right to win and our value proposition is strong and getting stronger, and we’re looking forward to continuing to leverage this.

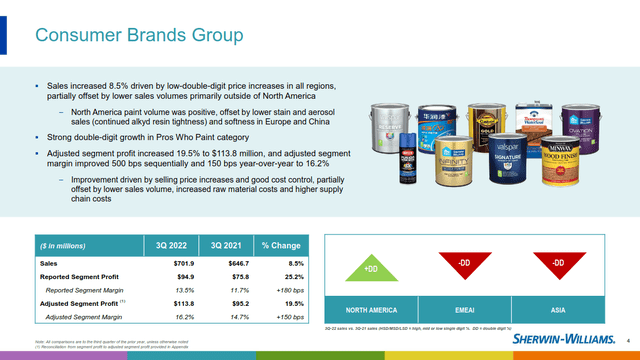

I like the demand outlook for the company’s North American segments. But on the other hand, Sherwin-Williams is struggling internationally. This is measured by the company’s Consumer Brands Group segment. The segment manages Sherwin-Williams’ branded products, including most international sales.

Sherwin-Williams Q3 2022 Earnings Slides

The company struggled to maintain its sales in EMEAI and Asia. Sales were down by double digits in both regions. These were due to a broad range of pressures, including continuing lockdowns in China. Management blamed poor European sales on a declining macro environment. They’re also reporting a slowdown in U.S. DIY purchases due to the broader economic pullback.

Overall, I think that Sherwin-Williams is still strong on a fundamental level. The business is reporting solid results, mostly held up by resilient professional demand.

What Is The Outlook?

The broader macro environment is obviously declining. Home sales are decreasing, and consumer budgets are being impacted by inflation. Management is taking action to prepare the company for these headwinds. They discussed the impact of the broader environment on their earnings call.

Our base case in this environment remains to prepare for the worst and hope for the best. I’m highly confident in our leadership team, which is deep in experience and has been through many previous business cycles. We’ve transformed our business in many ways since the last significant downturn, and we are now a stronger, more resilient company…

In challenging environments, we have the opportunity to become an even more valuable partner to our customers. We will continue to focus on new account growth and share of wallet initiatives. We will leverage our strength in recession resilient end markets, including residential repaint, property management, packaging and auto refinish, all of which are larger than they were in previous cycles.

I think that Sherwin-Williams would have a solid competitive position in a recession. The business has been growing in resilient categories such as residential repaint. These categories are less dependent on macro factors such as homebuilding and interest rates. In 2008, residential repainting made up about half of all residential paint sales. Now, it makes up two thirds of those sales.

Sherwin-Williams Q3 2022 Earnings Slides

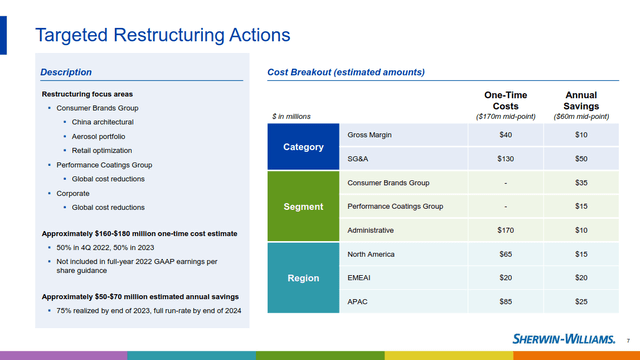

Management announced a restructuring program targeting long term cost savings. These savings mostly focus on the company’s struggling EMEAI and APAC operations. I think that the cost of this plan is somewhat high, with projections of $160 million to $180 million in expenses. This would create annual savings of $50 million to $70 million starting in 2024.

Overall, I believe that Sherwin-Williams can survive a recession and even become stronger. I think that it is well positioned to benefit from the severe housing deficit in the United States. Homebuilding will have to accelerate to keep up with demand. This long term tailwind should create secular growth for the home paint market.

Valuation

I’ve made the case that Sherwin-Williams is a good company on a fundamental level. But that’s only part of the equation. The company is currently valued at a forward P/E of 25.6 times. Even though I like its fundamentals, this valuation makes me hesitate.

I’m concerned about Sherwin-Williams’s free cash flow, which has dipped in the past year. In the past, Sherwin-Williams converted its earnings into cash at a healthy rate. But in the last four quarters, its cash from operations was only 76% of net income. Shares are trading at a LTM P/FCF of 61 times.

Sherwin-Williams Q3 2022 Earnings Slides

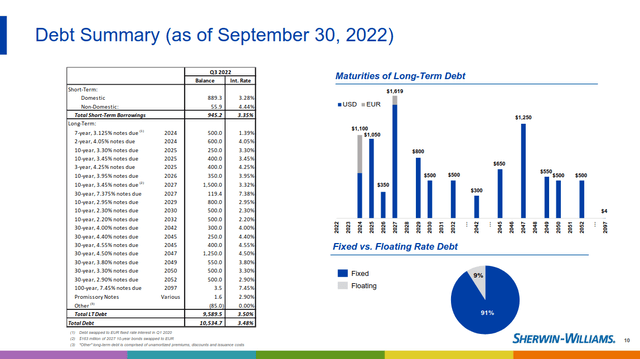

The business is spending heavily on buybacks, acquisitions, and dividends. It spent more on these categories than it generated in free cash flow in seven of the last eight quarters. As a result, its debt burden has increased. The business has $10.5 billion in debt and other obligations. This debt is equal to 3.2 times the company’s LTM EBITDA, which is above its long term EBITDA target of 2 times to 2.5 times. The debt is still low interest, but presents a headwind to future shareholder returns.

I think that this valuation is expensive. Sherwin-Williams only has a 1.63% free cash flow yield. The business pays a regular dividend with a 1.09% yield. The company’s buybacks yielded 1.6% in the last twelve months. I feel that these yields are relatively low compared to the company’s growth prospects.

Final Verdict

I still think that Sherwin-Williams is fundamentally strong. The business is well positioned in the professional paint market. I feel that this should help it deal with the current headwinds. But I don’t think the company’s fundamentals justify its valuation. I think that the risk to reward is unfavorable at the current price.

Be the first to comment