BanksPhotos

Thesis

Investors in leading gold mining company Newmont Corporation (NYSE:NEM) have had an awful year. NEM posted a price decline of more than 50% since its April highs, struck by a trifecta of menacing headwinds: geopolitical risks, record-high inflation – energy costs, and a rapid surge in the dollar index (DXY).

We postulated in our previous article highlighting that we believe the market had already forced NEM into a long-term capitulation low. Accordingly, NEM has outperformed the SPDR S&P 500 ETF (SPY) since our article, posting a total return of -3.5% against the SPY’s -8.4% (according to Seeking Alpha data).

We maintain our view that NEM is likely consolidating at its near-term support. Furthermore, we analyzed that the Street analysts have gone into panic mode over the past two months, cutting Newmont’s revenue and earnings estimates markedly. As such, it lifted its NTM EBITDA multiples well above its 10Y mean. However, we are not perturbed by the reaction from the Street analysts.

We believe the robustness of NEM’s price action suggests that NEM has a potential opportunity to bottom out at the current levels, even if the consolidation continues. Notwithstanding, we urge investors looking for a quick rebound to be wary as worsening macro headwinds, compounded by an increasingly hawkish Fed driving the dollar index higher, cannot be ruled out.

Despite that, we explain why we think investors can remain optimistic at these levels, as we postulate much of its near-term challenges have likely been reflected.

As such, we reiterate our Buy rating on NEM.

Wall Street Analysts Panicked, But NEM Held Firm

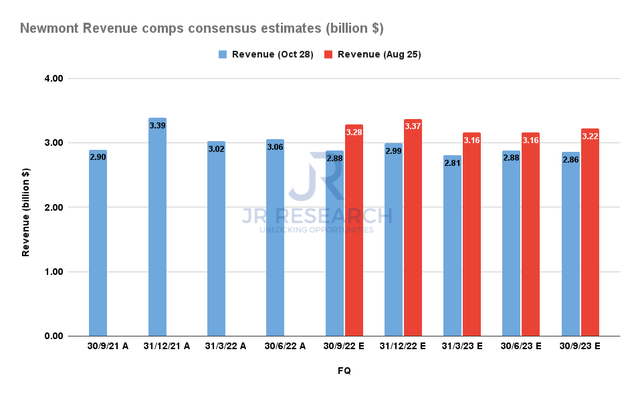

Newmont Revenue comps consensus estimates (S&P Cap IQ)

As seen above, Newmont’s revenue estimates have been slashed substantially from its August projections. Furthermore, Street analysts see the impact extended well into FY23. Hence, the Street has lowered its bar markedly for the company to cross when Newmont reports its upcoming Q3 earnings release on November 1.

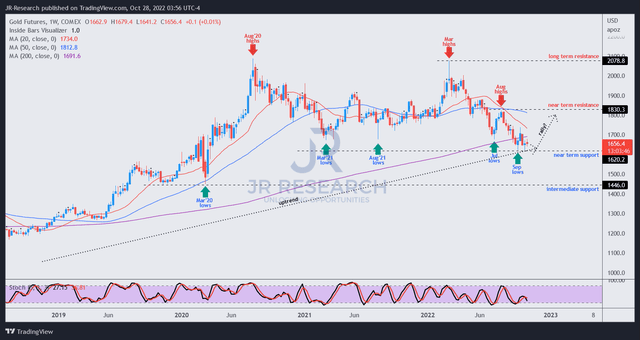

Gold futures price chart (weekly) (TradingView)

We parse that the revisions are prudent. Gold futures (GC1) fell nearly 11% from their August highs to their recent September lows. GC1 has been consolidating at those levels over the past month.

With the company’s operating performance sensitive to the volatility in gold prices, we assess the Street “rushed” to adjust their estimates in time for the company’s earnings release.

However, it’s also critical for investors to consider that gold futures have already pulled back to what we term as its “final defense line”: the 200-week moving average (purple line). It has supported GC1’s medium-term uptrend since its bottom in 2018. Hence, long-term buyers likely saw an attractive opportunity to enter at these levels, helping to support its recent buying momentum.

For now, we continue to observe constructive price action. However, we need the buying cadence to improve and help GC1 to recover its medium-term bullish bias, which it had already lost. Without recovering its upward bias, a sustainable recovery in gold prices is unlikely, and GC1 could continue to move sideways, with a potential downside break below its 200-week support.

However, we have reasons to be positive.

Newmont Is Expected To Recover Its Growth

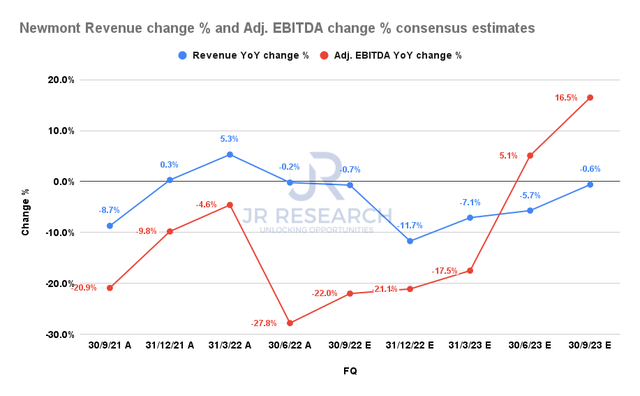

Newmont Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Even the analysts who slashed Newmont’s estimates ahead of its Q3 release project that Newmont’s revenue and adjusted EBITDA growth should recover through FY23.

Therefore, investors are reminded that Newmont’s operating performance could continue to come under significant challenges in H2’22. However, given the considerable battering in NEM over the past six months, we believe it’s arguable that a substantial downside has been reflected.

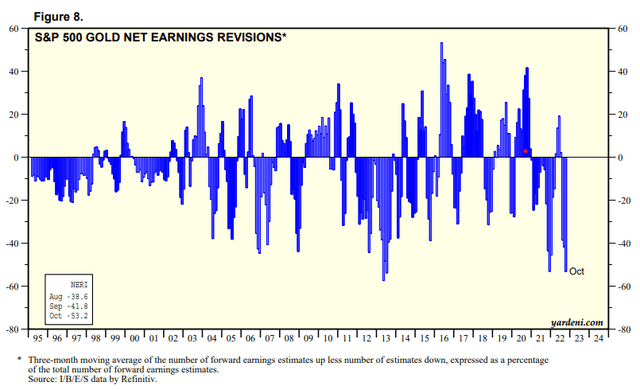

S&P 500 Gold mining industry net earnings revisions % (Yardeni Research, Refinitiv)

Furthermore, we noted that analysts have turned increasingly pessimistic over Newmont and its industry peers through September, as they continued to cut their earnings estimates markedly.

Is NEM Stock A Buy, Sell, Or Hold?

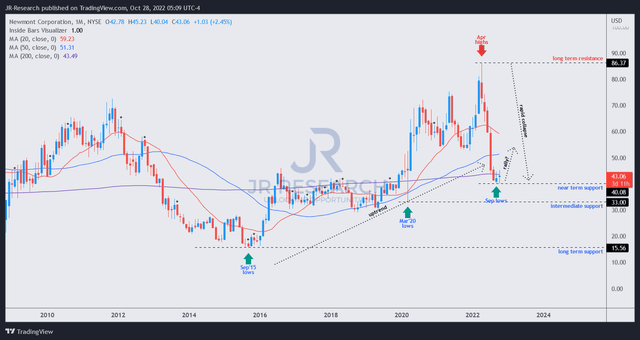

NEM price chart (monthly) (TradingView)

NEM has managed to hold its September lows robustly over the past month. Coupled with the lowered estimates, it sets up NEM well as it heads toward its Q3 earnings.

Hence, we believe that investors willing to take a position before earnings can consider adding exposure here. But of course, if the company guides much weaker than expected, downside volatility cannot be ruled out.

Despite that, we like NEM’s constructive price action, which forebodes well for an accumulation phase.

Therefore, we reiterate our Buy rating on NEM.

Be the first to comment