blinow61

Investment Thesis

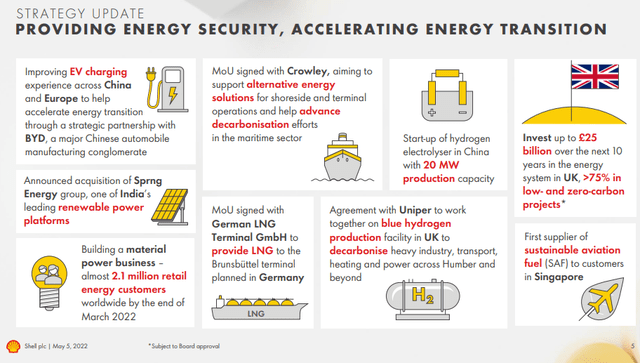

Shell (NYSE:SHEL) is an integrated energy company, and their portfolio includes the traditional petrochemical value chain (upstream, midstream, refining, and chemical) along with renewable energy sources. This is an attractive value proposition, as the traditional petrochemical business will generate tons of cash flow in the near term, while renewable power platforms will secure future business. Particularly, their recent announcement regarding a new hydrogen plant is very exciting. I reiterate a Buy rating, and I believe Shell will be a successful company for a long time and a great investment choice because:

- Petrochemical value chain is generating tons of cash right now, and this will be the case for the foreseeable future.

- Hydrogen plant is true clean energy, and has a great chance of satisfying both profitability and environmental goals.

- Shell is also making strides towards EV charging, solar, and other renewable platforms.

Strategic Positions of Shell (Shell Investor Relations)

Solid Current Business And Financial Position

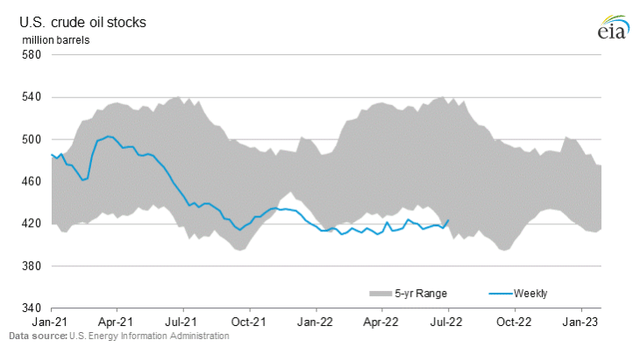

Due to underinvestment in developing new oil sources for the past couple of years, the oil supply has become quite low, leaving the industry unable to meet strong demand. U.S. crude oil stocks have fallen below the five-year trend, and are now barely cracking into the lower end of the five-year range. As a result, crude oil price has been high, and Shell has been making tons of money from the trend. It takes years to develop new oil assets, so I expect the oil price to stay elevated for a while.

U.S. Oil Inventory (EIA)

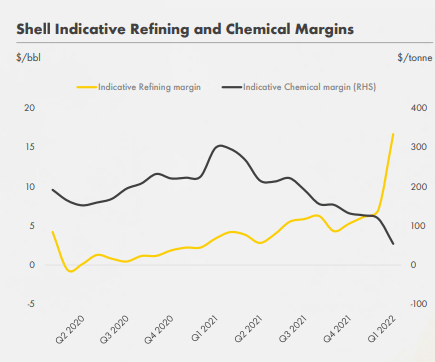

The same trend (underinvestment in the past and surging demand), is allowing their downstream refinery business to rake in money as well. Thanks to this profitability from the traditional oil and gas business, Shell has achieved very strong results in the past several quarters. Last quarter, they had earnings of $9.1 B, operating cash flow of $14.8 B, and free cash flow of $10.5 B. With this strong financial position, they are targeting AA credit metrics to maintain lower interest rates for their debt and support investment for future energy platforms (hydrogen, solar, wind, and EV charging stations). It is very encouraging to see that both their current and future pillars of business are in good shape.

Refining Margin and Chemical Margin (Shell Investor Relations)

Investment In Hydrogen

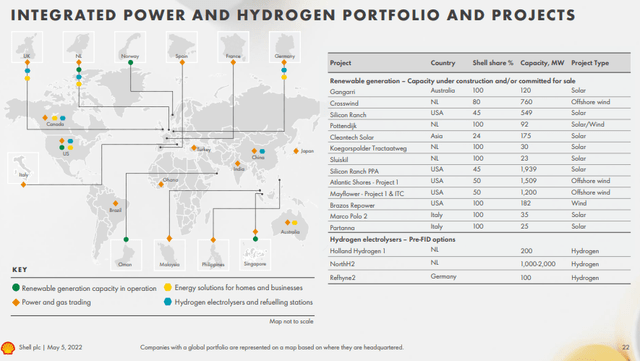

Last week, Shell announced that they will build Europe’s largest renewable hydrogen plant. I was very excited to hear that as an investor because hydrogen has a great chance of satisfying both profitability and environmental goals at the same time. Traditional oil and gas generates a lot of profit, but there is pushback from both environmental groups and governments to move towards cleaner energy. Renewable energy (wind and solar) is environmentally friendly, but profitability has not been satisfactory.

Hydrogen as a fuel can address both of these issues. First, it’s environmentally much more favorable. Burning hydrogen generates water (steam), and greenhouse gas emissions are negligible (mostly from impurity). Second, hydrogen is storable and easy to transport, which is a main challenge for renewable sources. Wind and solar may generate huge amounts of energy, but it’s very expensive to store electricity, which makes them unreliable during inclement weather. Finally, hydrogen fuel can utilize the current infrastructure (pipeline, gas station, etc.) with minimal repurposing. Therefore, I think it is a great move by Shell to focus on the hydrogen business.

Divestment And Investment

In order to achieve a clean energy transition, Shell has to juggle many different aspects of the business. They have to 1) divest the high carbon business to reduce emissions and raise capital, 2) invest in upstream development to maintain healthy cash flow, and 3) expand the portfolio of renewable energy. Shell is making progress on all three fronts.

Shell divested several major refineries in the U.S. and Europe in the past couple of years to reduce their carbon footprint, while raising billions of dollars to support future products. After nearly stopping investment in upstream development during the pandemic, Shell has resumed major upstream projects, and their upstream production is on the rise, which will ensure a healthy cash flow to support the energy transition. Also, they are making key investment in the aforementioned hydrogen portfolio, carbon capturing & storage projects, renewable energy platforms, and EV charging.

Hydrogen Portfolio and Projects (Shell Investor Relations)

Intrinsic Value Estimation of Shell

I used a DCF model to estimate the intrinsic value of Shell. For the estimation, I utilized free cash flow ($22.9 B) and WACC of 10% as the discount rate. For the base case, I assumed free cash flow growth of 1% (consensus EPS growth estimate as shown on Seeking Alpha) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed free cash flow growth of 2% and 3%, respectively, for the next 5 years and zero growth afterwards. Given the strong commodity price and under-investment during the past two years and their strategic investment, I expect them to achieve these growth rates.

The estimation revealed that the current stock price presents 15-20% upside. Also, their current P/E (FWD) is at 5.05x, which is near its lowest point in the past decade. Given the continuing strong oil price and successful energy transition prospects, I expect Shell to achieve this upside.

|

Price Target |

Upside |

|

|

Base Case |

$54.81 |

11% |

|

Bullish Case |

$56.99 |

15% |

|

Very Bullish Case |

$59.18 |

20% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 10%

- Free Cash Flow Growth Rate: 1% (Base Case), 2% (Bullish Case), 3% (Very Bullish Case)

- Current Free Cash Flow: $22.9 B

- Current Stock Price: $49.05 (07/09/2022)

- Tax rate: 25%

Risk

Oil is one of the most volatile assets. Prices obviously depend on fundamentals like supply and demand, but also on geopolitics, environment, and government policy changes. Therefore, oil price can suddenly start dropping (or rising) any day without advance warning or a fundamentally sound reason. Recently, the fear of recession caused by high inflation and Federal Reserve monetary tightening caused nearly a 10% drop in crude oil price overnight. Therefore, Shell’s cash flow can fluctuate dramatically on a quarterly basis.

While I believe in their strategic investment (hydrogen, solar, and wind), there is no guarantee that energy transition will proceed smoothly. Hydrogen as a fuel source has all the critical characteristics to be a successful business, but the hydrogen manufacturing process is not fully mature yet. Also, solar and wind platforms need to refine their business models and resolve energy storage challenges. Otherwise, even if it produces enough energy, Shell won’t be as profitable as a traditional oil company.

Conclusion

Fossil fuels have been the backbone of the world’s energy for a long time, but now the world is moving towards new energy sources. Shell is making great strides on several different fronts to transform itself from a traditional oil and gas giant to an integrated energy company. I expect them to manage the transformation, capturing the value of fossil fuels now but prepared to supply clean energy in the future. Overall, I expect 15-20% upside from here.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment