Joe Raedle

It’s been a mixed Q2 Earnings Season for the restaurant industry, with strong sales performance in May overshadowed by a softer finish to the quarter as we’ve seen a negative change in consumer habits and weaker traffic trends. Meanwhile, despite some sales leverage for brands due to aggressive menu price increases, margins have left much to be desired, impacted by wage and commodity inflation. However, many restaurants rallied on these mediocre results, which can be chalked up to high short interest and stronger misses than expected or slight revenue beats.

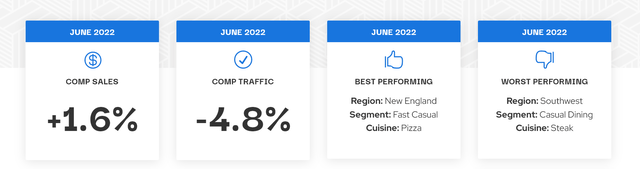

Shake Shack (NYSE:SHAK) has participated in the industry-wide recovery in share prices, bouncing more than 40% from its Q2 lows. However, while the Q2 report looked solid from a headline standpoint (ignoring the revenue miss), the report left much to be desired, especially if traffic continues to trend as it did in June, which was negative 4.8% for the industry (Black Box Intelligence). So, with SHAK stock now trading at more than 31x FY2022 EBITDA estimates after its recent rally, I don’t see any way to justify chasing the stock here above $53.50 per share.

Shake Shack Menu Offerings (Company Presentation)

Sales Performance & Development

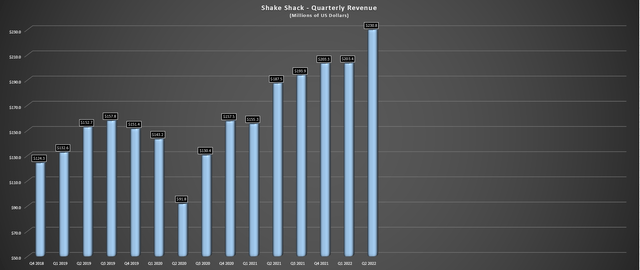

Shake Shack released its Q2 results earlier this month, reporting quarterly revenue of $230.8 million, a 23% increase from the year-ago period. This was helped by a significant increase in domestic-operated shacks (230 vs. 200) and a 10.1% increase in same-shack sales vs. Q2 2021. Notably, the increase in same-shack sales was not solely driven by menu price increases, which is where most restaurant brands have been driving sales, but Shake Shack reported 7.8% traffic growth. The traffic improvement was helped by a meaningful increase in urban sales, with NYC, Boston, and Washington reporting 25%+ same shack sales growth in the quarter.

Shake Shack – Quarterly Revenue (Company Filings, Author’s Chart)

However, while the sales performance was solid, Shake Shack did note that similar to the industry, sales began to level off in June, and it’s seeing some impact among its less affluent customers. This is consistent with what Dutch Bros (BROS) reported on its Q2 call, noting that it saw a 40% decline in traffic if household income was below 40%. The good news is that Shake Shack tends to over-index with higher-income consumers. Its attractiveness is that it appeals to those looking for a premium occasion with convenience at a price below that of casual dining.

Shake Shack Menu Offerings (Company Presentation)

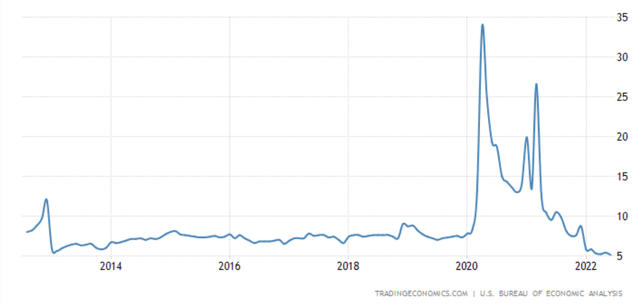

That said, if inflationary pressures continue to worsen (which is hurting personal savings rates and impacting discretionary budgets), we could see some trading down within the mid-income Shake Shack customer for those simply craving a burger but wanting to keep their check below $8.00. We could also see guests refuse to trade down but pull back on incidences or add-ons (shake, alcohol), attempting to manage their check a little to ensure they can still get the shack burger they crave. Either of these developments would harm sales/margins, and with personal savings rates sitting at multi-year lows, it would surprise me if we didn’t see one of these things occur.

US Personal Savings Rate (TradingEconomics.com, Bureau of Economic Analysis)

Meanwhile, from a development standpoint, another five company-operated shacks opened in the period, two being drive-thrus, and Shake Shack added eight licensed shacks. However, this was a sharp decline year-over-year, and the company has now guided down its outlook of 40-45 domestic restaurants to just 35-40 openings. It also cited elevated build costs, potentially impacting returns on new stores. Finally, even with continued investments in team member wages, staffing is still not yet optimal, suggesting further investments might be needed to support Shake Shack’s aggressive development goals.

Costs & Margins

Moving over to costs and margins, Shake Shack noted that while beef prices have moderated, it’s still expecting double-digit food paper costs in H2. The reason is that the slight improvement in beef costs is being offset by elevated dairy, chicken, and fries costs (potato inflation, fryer oil). This is not ideal when Shake Shack already reported elevated food and paper costs in Q2 despite being in a strong seasonal period, with these costs as a percentage of sales up 120 basis points vs. Q2 2018 despite significant menu price increases. Labor costs vs. pre-COVID-19 levels are even worse, increasing to 29.5% (+50 basis points year-over-year) and up 320 basis points vs. Q2 2018.

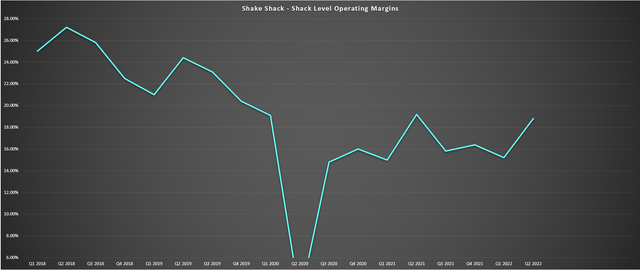

Shake Shack – Shack Level Operating Margins (Company Filings, Author’s Chart)

This margin erosion is evidenced by the chart above. While the tick-up in margins in Q2 2022 might excite some investors, especially with further menu price increases planned in Q4 to offset costs, additional pricing this year could be a mistake. The reason is that we’re already seeing an industry-wide traffic trend lower in June/July. Notably, this is before the latest round of price increases planned by most brands and ahead of a further deterioration in savings as consumers have now dealt with multiple months of elevated gas and grocery prices.

Besides, Black Box analysts noted that those with more moderate price increases could hold or strengthen their market position. Conversely, those companies raising prices above the industry average could see a lower intent to return and a decline in guest sentiment. So, while menu price increases might appear to be the solution for holding the line on consistently declining margins, they could reduce sales leverage and hurt the guest experience, with guests loving the taste, but not in love after walking away with an average check above $18.00. Let’s see if the risk of declining traffic is priced into the stock:

June Restaurant Industry Trends (Black Box Intelligence)

Valuation & Technical Picture

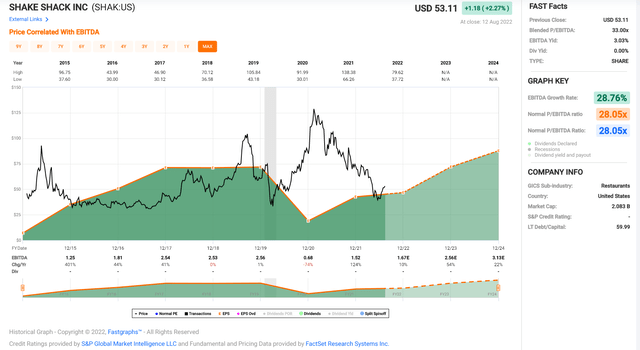

Based on ~39.2 million shares and a share price of $53.60, Shake Shack trades at a market cap of $2.10 billion, which leaves the stock trading at ~21.2x FY2023 EBITDA estimates. This may seem like a cheap valuation for Shake Shack, given that it has historically traded at ~28x EBITDA. However, this is an 18-month forward figure (FY2023 EBITDA estimates), and the industry is facing near unprecedented challenges (weaker demand, labor tightness, commodity/wage inflation). Besides, Shake Shack traded at this multiple with much higher margins vs. the ~17% shack level operating margins it’s reporting today, even with the benefit of significant menu price increases.

Shake Shack – Historical EBITDA Multiple & Forward Estimates (FASTGraphs.com)

Given the industry-wide challenges and the severe margin compression (Q2 2018: 28.2%, Q2 2022: 18.8%), I believe a more reasonable forward EBITDA multiple for the stock is 14, not 28. Under this assumption, and assuming Shake Shack meets estimates of ~$100 million ($2.55) in FY2023 fair value for the stock comes in at $35.70, not where it’s trading above $54.00 per share. So, from a valuation standpoint, I don’t see any value here, especially if traffic trends continue to worsen and we experience a hard landing for the economy, which could lead to further multiple compression for growth stocks.

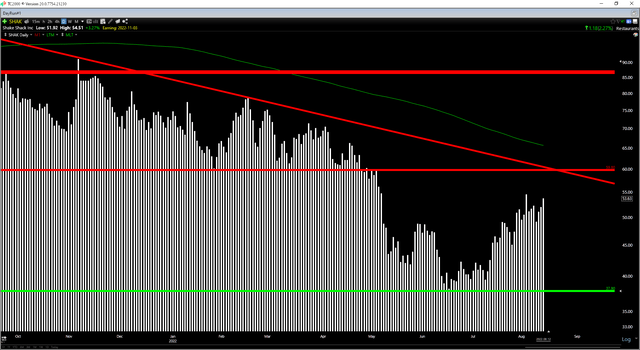

Moving to the technical picture, this confirms that SHAK is not in a low-risk buy zone, with the stock just 12% away from strong resistance at $59.80, and the stock has no strong support until $37.80. Based on $6.20 in potential upside to resistance and $15.80 in potential downside to support, SHAK trades at an unfavorable reward/risk ratio of 0.39 to 1.0. This suggests that there’s no way to justify chasing the stock above $54.00 from either a technical or fundamental standpoint. In fact, the stock might become an attractive short on any rallies to $60.00 before year-end, given its overvaluation.

SHAK Daily Chart (FASTGraphs.com)

Summary

Shake Shack might appear to be an exciting growth story with double-digit unit growth that’s also seeing continued growth in its licensed business. However, the margin outlook leaves a lot to be desired, and the strong margins in Q2 benefited from sales leverage in a strong seasonal period. However, with consumers getting hit from every angle with rising grocery, mortgage, and fuel costs and the added headwind of the negative wealth effect, I am less optimistic about the company’s outlook for transactions in H2, even with its promotions.

Assuming SHAK was pricing in a prolonged recession in the United States and trading at a single-digit EBITDA multiple, a strong argument could be made to look past the weaker environment, with the negativity already priced in. However, with SHAK trading at ~31x FY2022 EBITDA estimates and more than 150x FY2024 annual EPS estimates ($0.35), I don’t see any current negativity in the stock. For this reason, I continue to see the stock as an Avoid, and I would strongly consider shorting the stock if it heads above $60.00 before October to hedge long exposure.

Be the first to comment