Just_Super/iStock via Getty Images

Wolves no longer need to hide their rapacity behind sheep’s clothing. They are accepted everywhere. ― Marty Rubin

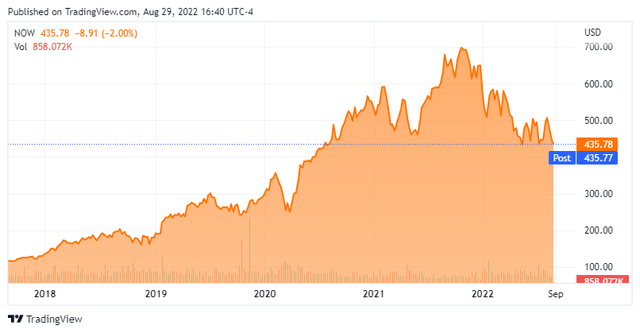

Today, we take our first look at ‘cloud‘ play ServiceNow (NYSE:NOW). The stock is trading roughly at the same levels as it was two years ago, even as the company continues deliver solid revenue and earnings growth. Are the shares priced yet at a valuation where they can ‘sizzle‘ again in the coming quarters or will the stock more likely to be range bound? An analysis follows below.

Company Overview:

July Company Presentation

ServiceNow is located in Santa Clara, California and operates as an enterprise cloud computing solutions. The company offers numerous capabilities to help clients automate various workflows via a cloud based platform on a SaaS basis.

July Company Presentation

The company was founded nearly 20 years ago and has grown into a current market cap of approximately $88B and trades around $435 a share.

July Company Presentation

The company gets nearly two thirds of its revenue from North America, with the rest coming from overseas and you can see the breakdown of revenues by workflows below.

July Company Presentation

Second Quarter Results:

The company posted second quarter numbers on July 27th. The company delivered $1.62 per share of non-GAAP earnings for the quarter, beating expectation by more than a nickel per share. Revenues rose 30% on a year-over-year basis to $1.82 billion, beating the consensus by some $60 million.

July Company Presentation

Subscription revenues rose 25% from 2Q2021 to nearly $1.66 billion. The company was impacted by a strong dollar. Without currency impacts, subscription growth would have been up over 29%. Current remaining performance obligations or cRPO stood at $5.75 billion at the end of the quarter. This represents 21% growth, 27% on a constant currency basis.

July Company Presentation

The company continues to diversify their customer base and now have over 1,450 customers that bill at least $1 million annually. The company’s renewal rate remains a best in class 99%.

July Company Presentation

It was a solid quarter, through and through. However, it should be noted that management did take down forward guidance a tad. This can be seen in the graphics below.

July Company Presentation July Company Presentation

Analyst Commentary & Balance Sheet:

Since second quarter results came out, more than 20 analyst firms including Oppenheimer, Citigroup and Jefferies have reissued Buy or Outperform ratings on the stock. It should be noted that more than half of these ratings contained slight downward price target revisions to reflect ServiceNow’s leadership taking down forward guidance a bit. Price targets proffered range from $495 to $650 a share. Guggenheim seems to be the lone pessimist on the stock, as it initiated the shares as a Hold with a $510 price target three weeks ago.

Approximately two percent of the shares are currently held short. Insiders, on the other hand, have been frequent sellers. Numerous officers have made what appears to be a few hundred transactions so far in 2022, spread across every month of this year totaling tens of millions of dollars. There has been no insider buying in the shares for at least two years. My guess is many insiders have automated selling programs in place.

The company ended the second quarter with just over $3.8 billion in cash and marketable securities against just under $1.5 billion in long-term debt.

Verdict:

The current analyst consensus has ServiceNow earning some $7.30 a share in FY2022 as revenues rise nearly 24% to $7.3 billion. They see similar sales growth in FY2023 with profits rising to $9.25 a share.

July Company Presentation

The company is delivering consistent revenue and earnings growth. The stock is certainly cheaper from a valuation perspective than it was two years ago when the shares were trading as a similar level. However, this equity is still trading at nearly 60 times this year’s expected earnings and approximately 12 times sales. With a forward P/E ratio approximately 2.5 times its anticipated growth rate, NOW still is too expensive for my taste. This is especially so in an environment with rising interest rates and slowing global growth.

ServiceNow appears to be a very well run company, but that is more than reflected in the current share price in our opinion.

A just law is crafted with thoughtful communication and factual debate, a corrupt one is forged to limit such things. ― C.A.A. Savastano

Be the first to comment