Sundry Photography

Thesis

ServiceNow, Inc. (NYSE:NOW) is slated to deliver its Q3 earnings release on October 26 (Wednesday), with CEO Bill McDermott and team under pressure to deliver. We highlighted in our post-Q2 update that we had anticipated NOW’s May lows to hold robustly.

However, the market decided to force a decisive breakdown in September after the CPI report suggested that the Fed needs to be more aggressive in its rate hikes. As a result, we believe the market has justifiably further de-rated high P/E stocks like NOW to reflect the Fed’s more hawkish posture.

Moreover, ServiceNow’s sizeable ex-US exposure could also contribute to further weakness as the world moves closer to a global recession. The dollar index has also strengthened markedly since its Q2 card, further lifting the forex headwinds impacting ServiceNow’s Q3 operating performance. Consequently, we believe the market needs to de-risk ServiceNow’s execution risks for FY23, with ServiceNow’s Q3 earnings on tap.

Our analysis suggests that NOW is at a critical juncture after losing its treasured May lows. Also, the market forced another rapid selloff that took out a crucial low from May 2020. As a result, the market has digested more than two years of gains as it sought to normalize its overvaluation from its 2021 highs.

We remain constructive over NOW at its current valuations, even though its price action has weakened considerably from August. Hence, investors looking to add at the current levels should heed our caution that we have yet to glean a bullish reversal at the current levels. Therefore, the downside risks of a steeper fall are seemingly higher than back in August if the market rejects its buying momentum at the current levels.

Despite its battering, its NTM normalized P/E of 44x could still be a significant headwind if the market anticipates a worse-than-expected global recession. Therefore, investors are encouraged to layer in over time to reduce allocation/timing risks due to NOW’s growth premium.

Accordingly, we reiterate our Buy rating on NOW.

ServiceNow’s Valuations Are At 5Y Lows

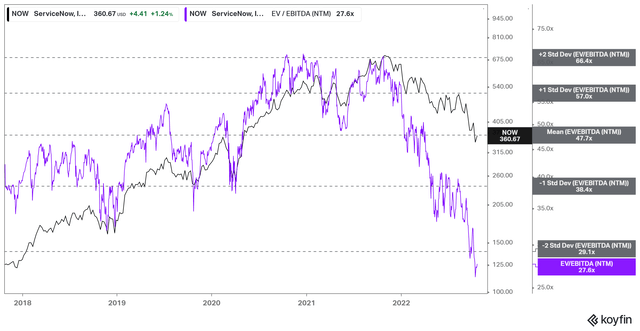

NOW NTM EBITDA multiples valuation trend (koyfin)

As seen above, NOW last traded at a NTM EBITDA multiple of 27.6x after falling below the two standard deviation zone under its 5Y mean.

Hence, NOW is valued at a lower EBITDA multiple than its COVID lows. Notwithstanding, we assess that the market could be positioning for significant revisions in ServiceNow’s guidance after sending it down nearly 36% from its August highs, significantly underperforming the market.

A recent commentary by UBS (UBS) suggests that the potential for a revision in guidance cannot be ignored, as it articulated:

[Our] checks ahead of the company’s Q3 results came back “mixed”, and perhaps a shade worse than his last round three months ago, with more partners than not missing their Q3 ServiceNow practice targets. – The Fly

Furthermore, despite the recent battering, NOW still trades at a premium against its peers. Its NTM EBITDA multiple of 27.6x is above its peers’ median of 22.9x (according to S&P Cap IQ data). In addition, its NTM P/E of 44x is markedly above the S&P 500 application software industry’s forward P/E of 24.9x. As such, we assess that the market needs to de-risk ServiceNow’s more aggressive growth estimates as we head closer to a potential global recession.

Is NOW Stock A Buy, Sell, Or Hold?

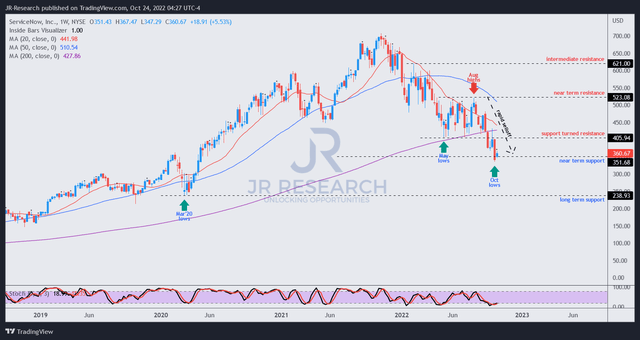

NOW price chart (weekly) (TradingView)

With NOW having lost its May lows, we believe the stage had already been set for ServiceNow to report a Q3 report card with a lowered guidance for FY23.

Coupled with valuations at 5Y lows, the market has likely anticipated significant headwinds in FY23 for its global business. Despite that, we postulate that its near- and medium-term downside is likely reflected in already if ServiceNow doesn’t drop a bombshell on its forward guidance.

We parse that NOW’s price action suggests it has lost its May lows and 200-week moving average (purple line). It’s a decisive win for the bears, as it turned the 200-week moving average into a resistance (for now) that buyers need to overcome decisively for NOW to recover its medium-term bullish bias.

Hence, we urge investors to watch NOW’s price action closely on whether it could retake its critical support level. Therefore, the initiative remains with the sellers for now. A bombshell guidance could see NOW lose its October lows decisively, with a steep selloff toward the gap between its near- and long-term support. That should also improve its valuations markedly, digesting more of its COVID gains significantly.

As such, investors are encouraged to move tactically with NOW heading into its earnings, keeping spare ammo to capitalize on downside volatility.

We reiterate our Buy rating on NOW.

Be the first to comment