Scott Olson

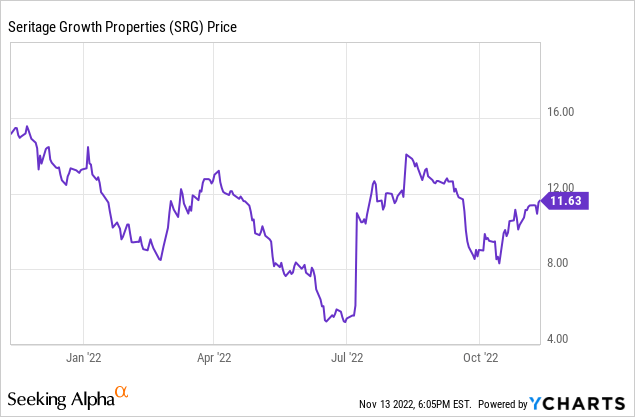

Seritage Growth Properties (NYSE:SRG) (SRG.PA) shares briefly rallied to $14 this summer as investors cheered its liquidation plan. However, Seritage stock has retreated in recent months due to fears that rising interest rates and the threat of recession will disrupt its asset sales.

Seritage did warn investors in late August that the shift in the macro environment made it unlikely that total shareholder distributions would reach the upper part of the $18.50 to $29 range the company provided in its original draft proxy statement in July. On the other hand, the board and management never revised its distribution range guidance. This suggests that the Sears real estate spinoff isn’t seeing evidence to justify lowering the projected range.

Last week, the company reported Q3 results that indicate the asset sale plan remains on track. That makes Seritage Growth Properties stock a great buy at its Friday closing price of $11.63.

Asset sales roll on

Just prior to filing its Q2 earnings report in early August, Seritage prepaid $100 million of its term loan, using most of the $163.4 million it generated from asset sales during Q2. This reduced the loan balance to $1.34 billion.

Despite the more difficult macro environment, Seritage’s asset sale pace accelerated in the third quarter. The company generated $235.2 million of gross proceeds from asset sales in the quarter ($213 million net of buying out a ground lease). This allowed it to make another $70 million repayment at the end of Q3.

Asset sale activity shows no signs of slowing. And with shareholders having approved the company’s “plan of sale” at last month’s annual meeting, Seritage now has full flexibility to proceed with its liquidation.

As of mid-October, Seritage had $400 million of assets under contract for sale. It also had accepted offers for $670 million of additional asset sales. This week’s earnings report revealed that Seritage generated another $176.4 million of proceeds from its disposition program in the first five weeks of the fourth quarter. That enabled a debt repayment of $110 million in late October, bringing the loan balance to $1.16 billion.

Meanwhile, the value of deals under contract increased to $546 million as of Nov. 4. Seritage also continues to negotiate binding terms for $299 million of potential asset sales. Lastly, the company is negotiating pricing for three JV stakes for which it has exercised put rights. It estimates that two of those JV stakes will sell for at least $65.7 million combined (see p. 9).

In short, there is no sign of a general freeze in deal-making. And while rising interest rates have impacted pricing, the shift in the macro environment hasn’t been devastating. Indeed, several of Seritage’s recent asset sales have come at impressive prices. Most notably, Seritage recently sold a 15-acre property at Southland Mall in the Miami area for $34 million. It also received $11.2 million for a 20-acre property in a low-income part of Sacramento and $10.75 million for a 15-acre property at a dying mall in Sarasota.

In this context, Seritage should have no trouble reducing its term loan balance to $800 million by next July. That would qualify it to extend the remainder until July 2025, removing near-term liquidity risk and enabling management to be “choosy” about when to sell other assets based on market conditions.

Cash burn improving

Importantly for shareholders, Seritage’s cash burn is slowing, mitigating the long-running risk that the company would fritter away its intrinsic value.

A year ago, Seritage reported total NOI (net operating income) of $10.6 million in the third quarter: $42.4 million annualized. That barely covered the company’s $8.8 million of quarterly G&A expense, let alone interest expense, which stood at $29 million per quarter or $116 million annually on a cash basis. Dividends on Seritage’s preferred stock cost an additional $4.9 million a year.

Since then, Seritage has prepaid $440 million of debt using the proceeds from its asset sales. That reduces annual interest expense by $30.8 million. Yet total NOI has increased modestly, reaching $12.2 million last quarter. This reflects lease commencements over the past year, along with the fact that many of the assets Seritage has sold were vacant and generating negative NOI. As Seritage closes on the asset sales currently under contract, interest expense and cash burn are poised to decline further in the next few quarters.

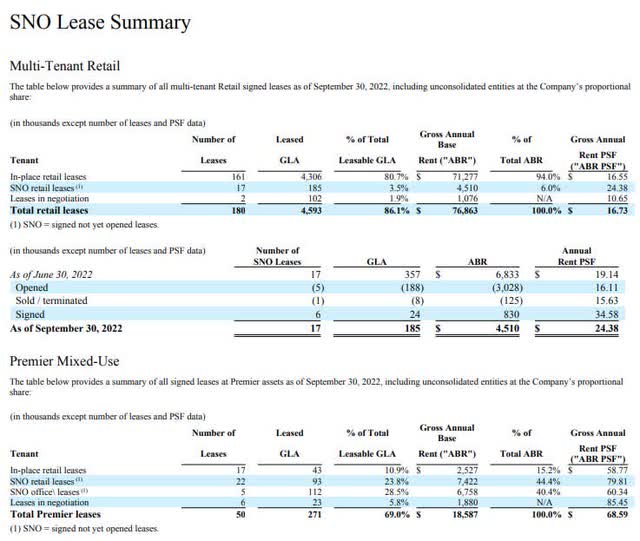

Seritage has signed leases for $18.7 million of annual base rent in its pipeline for future openings. Most of that rent should come on line by mid-2023, further reducing cash burn. Finally, G&A expense will likely moderate going forward, due to lower professional fees.

Source: Seritage Q3 2022 Supplemental, p. 10.

Today, cash burn stands at a rate of around $20 million per quarter (excluding development expenditures), down from $30 million for most of 2021. I expect quarterly cash burn to recede to well below $10 million per quarter by mid-2023, dramatically reducing the risk that a slower sale process would materially impair shareholder value.

Leasing activity is a mixed bag

The one slightly disappointing aspect of Seritage’s Q3 report was its leasing results. In its 38-property multitenant portfolio, the company signed six leases for 24,000 square feet at an average rent of over $34 per square foot. While the average rent looks good, Seritage has over 800,000 square feet of vacant space at its multitenant properties. At this leasing pace, the vacancy rate would remain elevated for a long time.

To some extent, this is not surprising. The most desirable parts of each property were naturally the first to rent. But most retail REITs have been reporting strong leasing demand despite the weakening macro environment. That makes Seritage’s multitenant leasing performance disappointing.

In its premier asset portfolio, Seritage recently completed leasing for the first phase of its San Diego project, filling the last 15,000 square feet during Q3 and early Q4. But on the flip side, leased occupancy at its Aventura property declined last quarter. Two leases for 11,000 square feet at an average rent of $112.52/square foot were terminated during the quarter, whereas just one new lease for 2,000 square feet at $72/square foot was signed. The property is only 59% leased, despite the first tenants being slated to open next month.

Still a clear path to around $20

Notwithstanding the volatile macro backdrop and mixed leasing results (and hand-wringing by various analysts and former bulls), Seritage is likely to make distributions of around $20/share as it liquidates.

As of Nov. 4, Seritage had $1.16 billion of debt, plus $70 million of preferred stock outstanding. Meanwhile, it had $134 million of cash on hand, which should easily cover cash burn and CapEx during the liquidation period (estimated at 18 to 30 months by the company).

Seritage’s remaining properties can be divided into four categories: premier assets, the multitenant retail portfolio, JV stakes, and residential/non-core properties.

Among the seven premier assets, one is reportedly under contract for sale for “north of $52 million“: a mostly vacant suburban site in Hicksville, New York. Multiple brokers estimate that Esplanade at Aventura could be worth $200 million. (If Seritage can make more progress on leasing, the price could go even higher.) Seritage’s JV stake in the San Diego property is worth well over $100 million now that it is fully leased. In total, I estimate that the premier assets will sell for at least $700 million, and potentially $900 million or more in a best-case scenario.

Image source: Seritage Growth Properties.

The multitenant retail portfolio generated $14.1 million of NOI last quarter: $56.4 million annualized. Seritage’s pipeline of signed leases will generate an additional $4.5 million of rent annually, roughly offsetting the NOI lost from selling three of its 38 multitenant properties in early Q4. There is additional upside from leasing the remaining vacant space and entitling new outparcels. At a 7%-8% blended cap rate, the remaining 35 properties would be worth roughly $700 million-$800 million.

Seritage’s JV stakes include four mostly or fully-leased properties, which I estimate to be worth $100 million. The other 11 JV stakes are probably worth between $100 million and $200 million combined.

Finally, Seritage has around 50 consolidated properties classified as residential or non-core. Most of these assets are vacant, but a number of them have leased outparcels or big-box tenants. In total, I anticipate that these properties will sell for around $500 million, give or take $100 million.

Summing these ranges implies that Seritage will likely generate between $2 billion and $2.6 billion of proceeds from selling its remaining assets (as of early November).

|

Property Type |

Valuation (low end) |

Valuation (high end) |

|

Premier |

$700 million |

$900 million |

|

Multitenant retail |

$700 million |

$800 million |

|

JV stakes |

$200 million |

$300 million |

|

Residential/non-core |

$400 million |

$600 million |

|

Total |

$2 billion |

$2.6 billion |

At the midpoint of that range, Seritage would have $1.07 billion to distribute after repaying its debt and redeeming its preferred shares: just over $19/share. Excess cash on hand (beyond what Seritage needs to cover future cash burn and CapEx) and insurance settlements to recoup more of the $35 million paid in a recent litigation settlement could add another $1, bringing the payout to approximately $20/share.

At the bottom of the valuation range, total distributions could come in as low as $14/share. That still represents upside of more than 20% from current levels. Moreover, it is fairly unlikely that proceeds from these four asset categories will all come in at the low ends of the ranges I project. (Conversely, distributions could reach $25 in a best-case scenario.)

In short, Seritage Growth Properties stock offers ample capital appreciation potential from current levels, with minimal downside risk short of a general implosion of the real estate market. And with asset sales proceeding at a steady clip, it shouldn’t take much more than a year for shareholders to realize the bulk of this upside potential.

Be the first to comment