Aslan Alphan/E+ via Getty Images

SERA Prognostics – Overview

Sera Prognostics (SERA, or the Company), a Salt Lake City, Utah diagnostics company trading on the NASDAQ, sells PreTRM®, a test that provides physicians an assessment of the individualized risk of premature delivery in a pregnancy. A determination of high-risk enables physicians to increase their monitoring and proactive interventions in those women with higher risk.

The test is based on a proprietary predictive algorithm of the serum level of two proteins, insulin-like growth factor-binding protein 4 (IBP4) and sex hormone-binding globulin (SHBG), coupled with clinical variables consisting of a woman’s height and weight. The initial algorithm output was reported from the Proteomic Assessment of Preterm Risk (PAPR) study, a study of serum from 5,501 patients published in February 2016.

The Company ran a second clinical validation study, A MulTicenteR AssEssmEnt of a SponTaneOus Preterm Birth Predictor (TREETOP). The TREETOP study enrolled 5,011 pregnant women from 18 sites across the United States from 2016 to 2019.

TREETOP Study Report

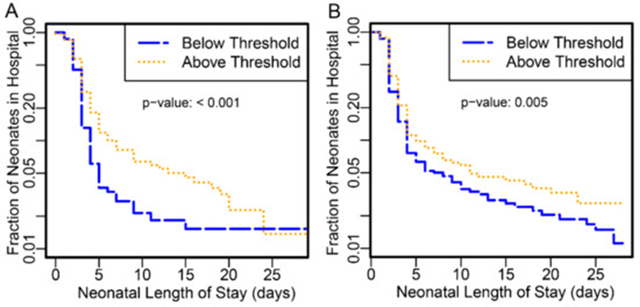

Figure 1: Kaplan–Meier curve of neonatal length of stay in days for all neonates, stratified into higher- (gold) and lower-risk (blue) groups as defined by the SERA algorithm. (A) Data from the PAPR study. (B) Data from the TREETOP study. Source – TREETOP publication.

With the biomarkers discovered and validated in PAPR the Company ran an intervention study to determine whether risk stratification and interventions in the higher PreTRM®-risk pregnancies had an impact on the preterm birth rate, on neonatal length of stay and on the costs associated with the preterm birth. The Company worked with the Intermountain Health System, based on Salt Lake City, UT, to determine if the PreTRM® test could reduce the likelihood of a spontaneous preterm birth (sPTB) and associated costs. The PREVENT-PTB study enrolled 1,191 women. The study was not powered to analyze a decrease in preterm births, but, importantly, showed a substantial decrease in the number of days preterm infants spent in the neonatal intensive care unit (NICU), despite the study being stopped well short of its original enrollment goal because of funding shortfalls.

PREVENT-PTM Study Report

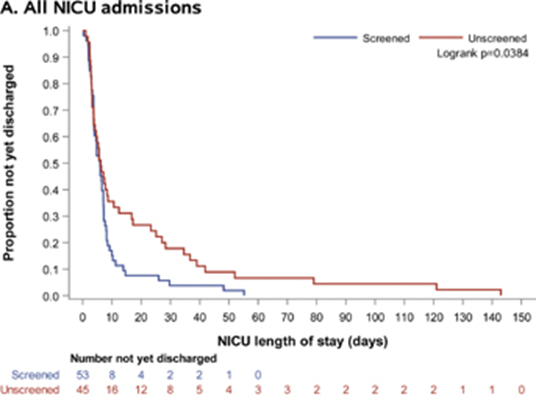

Figure 2: Kaplan–Meier survival curves comparing length of neonatal intensive care unit stay (days) among screened (red line) and unscreened (blue line) groups. Source: PREVENT-PTM Study Report.,

The NICU length of stay (LOS) was not the initial primary endpoint, but was recognized as an important pre-specified endpoint of clinical and economic importance among infants admitted for sPTB. The study demonstrated a difference between the control and study groups, with a LOS in screened patients median of 6.8 days, and a LOS in unscreened patients a median of 45.5 days. This is an 85% reduction between the screened and unscreened patients.

The substantial decrease in the number of NICU days, despite the small trial size, allowed SERA to garner substantial investor interest and raise substantial additional capital. Included in the new book of investors was Anthem (now Elevance Health (ELV), who owned ~10% of SERA at the time of the July 2021 IPO). Elevance entered a commercial agreement with SERA to purchase a minimum number of tests over multiple years (details were redacted in the agreement filed with the SEC). Elevance and SERA also partnered to initiate a 6,500 patient post-marketing study throughout the Elevance network of hospitals. The PRIME Study is currently enrolling patients in 13 sites around the country, and is expected to enroll 2,800 patients by the end of 2022. Management has stated that they intend to provide an interim data readout on those 2,800 patients around mid-2023.

Elevance and SERA worked with HealthCore, the Elevance analytics subsidiary, to predict the economic effects of adjusting the monitoring and proactive interventions based on Sera’s PreTRM screening test by analyzing more than 40,000 commercially insured pregnancies. The model published in the journal ClinicoEconomics and Outcomes Research predicts a reduction in the number of NICU days by 20%, and a gross cost savings was calculated to be $1,608 per pregnant patient, not including the assumed cost of $745 for running the test. (Source: SERA Corporate Presentation, CEOR publication)

The Company IPO’d in July 2021 at stock price of $16. Prior to the IPO, the Company did a $100 million private placement. The Company currently has a small sales force working to sell the PreTRM® test focusing on health systems including self-insured employers, integrated delivery networks (like Kaiser Permanente), and managed Medicaid groups. In Q1 2022 revenue from tests was only $38,000, which caused some analyst angst. The Company has guided to have $500,000 of revenue for the full year 2022.

ldmicro.com

As of March 31, 2022, the Company had approximately $130 million in cash and cash equivalents, and the Company had approximately 31 million common shares outstanding. There are another 11 million warrant and option shares outstanding. The options have a weighted average exercise price of $4.30.

The company burned $9.5 million in cash in operating activities in Q1 2022 but had fluctuations in liabilities and receivables. Adjusting for depreciation and stock option expensing, the net operating loss was approximately $11 million.

Assuming an $11 million cash operating loss in Q2 2022, the cash balance at the end of Q2 2022 is likely around $119 million – which is about $3.83 in cash, excluding the warrants and options, which are currently mostly out of the money.

Management Team

The CEO (Greg Critchfield), CFO (Jay Moyes), CSO (Jay Boniface) and General Counsel (Benjamin Jackson) were all at Myriad Genetics (MYGN), which launched one of the most successful CLIA laboratory diagnostics in history targeting the BRCA gene in women as a risk factor for breast cancer. Greg Critchfield lead Myriad Genetics from July 1998 through March 2010. During that time they completed the development of their breast cancer test, launched their test through the CLIA lab pathway, then developed a on-site kit that required FDA 510(K) clearance. Stockholders were rewarded with as much as 17X, depending on their ability to perfectly time their sale.

Yahoo Finance

Source: Yahoo Finance

The CEO (joined SERA as a Director in Aug 2010 after leaving MYGN and took over as CEO in Nov 2011) and the CFO (joined SERA in March 2020, last full-time position was MYGN in Nov 2007) were on the Director lifestyle-path after a long, successful run at MYGN. They both have claimed that they have taken a pause on retirement to make SERA successful.

Discussions with management lead me to believe that they are cognizant and cautious about spending, which is the key to retaining value in the event of a Lose scenario.

The Opportunity – A Path to Becoming a New Standard of Care

There are approximately 3.6 million births in the US per year. Of those, approximately 10% were born preterm. According to the March of Dimes, the costs of preterm birth in the US was over $25 billion in 2016. The highest propensity was in African Americans at 14.2%, and the lowest propensity was in the Asian/Pacific Islander population at 8.8%.

The PreTRM® test is designed and marketed for women carrying a single baby, who are otherwise not deemed to be high risk. Having a previous preterm birth, genetic red flags, twins, or triplets are factors that would cause a physician to increase the monitoring and/or proactive interventions to help keep the baby in the womb as long as possible. If a physician is provided with the assessment that a woman potentially has a high risk pregnancy, there are multiple interventions that could be done to attempt to prevent a preterm birth:

- Increase surveillance

- Additional cervical length measurements

- Progesterone injections

- Low-dose aspirin

- Antenatal steroid therapy

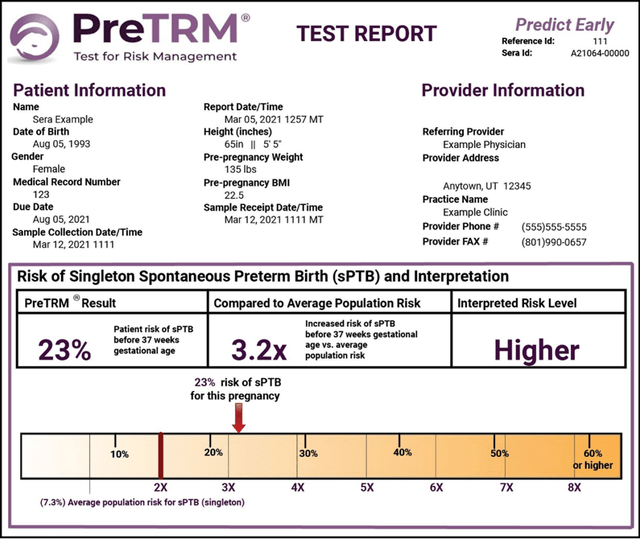

Below is a sample preterm birth risk assessment report that would be delivered to the physician.

SERA Prognistics 10-K

The PREVENT-PTM study showed a 70% reduction in the total NICU days for those patients who were screened, versus those that were not screened. In a discussion with management, they indicated that in the study, the notice of increased risk did not always translate into a physician using of one or more of the possible interventions. There was noise in the study, and the Company does not own the patient data so cannot do its own patient by patient analysis to understand the noise. Anecdotally, some patients who tested positive for the high risk screen rejected additional interventions, and added to the NICU days of the screened patients. Given the small size of the study, the focused geography of the enrolled patients, and the anecdotal noise, it is not surprising that the Company, and Elevance, are attempting to reproduce the study with a much larger sample size. If the PRIME study is able to reproduce the data with high statistical significance, then it is probable that the PreTRM® test becomes the standard of care. Additionally, the study should be able to provide further pharmacoeconomic data to determine the full value of providing the screening test.

The Company estimates that there are about 3 million potential patients that would qualify for PreTRM® testing, which is about 83% of US births. If PreTRM® becomes the standard of care, and the Company is then able to charge $500 per test, then the total addressable market in the US is $1.5 billion.

Ability to Decrease COGS

At present, the test involves gathering patient serum and running a processed sample through a mass spectrometer to obtain the protein levels required for PreTRM® assay. Serum collection and shipping requires a cold chain to maintain sample integrity. Sample preparation for mass spectrometry is a non-trivial task that requires labor input. The current COGS, as stated by the Company, is approximately $150 per sample.

As a first step, with higher sample volumes and the additional robotics to do the sample preparation process, the Company believes that hitting a $100 COGS is doable with the current process using a mass spectrometer.

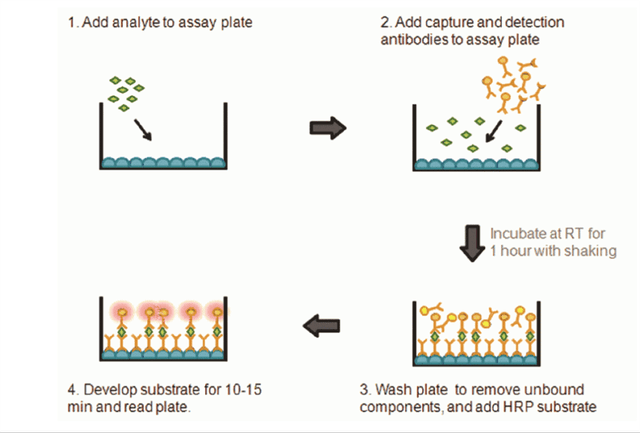

Those skilled the art of protein characterization and measurement know that the Company can take some additional research steps to dramatically reduce the COGS. A simple sandwich ELISA (enzyme-linked immunosorbent assay) would dramatically reduce the costs to run the assay. The Company would need to make two different antibodies to bind to two different areas of the protein Each gram of antibody will cost $200-500 once designed, but each test would require only micrograms of antibody, depending on the size of the testing well. One antibody would bind the protein to the substrate at the bottom of the well, and one antibody would bind the signaling marker to the other side of the protein to be scanned by a reader. This process is highly standardized in the industry and would allow the Company to fully automate the testing process and use 96 or 384 well plate.

TRG Biosciences

Source: Image from TRG Biosciences Website

SERA Valuation Scenarios

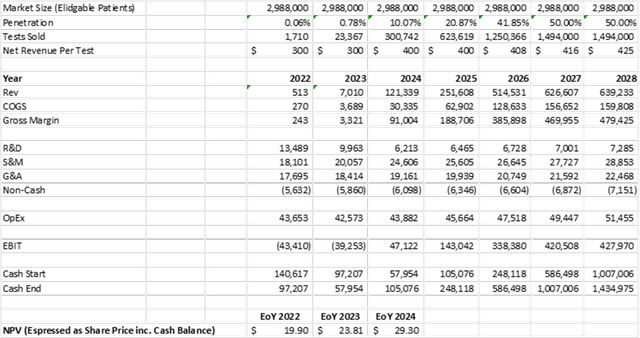

“Win” Scenario

Given that Elevance has invested in the Company and helped craft the PRIME study, one can assume that the success or failure of the PRIME study would determine the level of adoption of the PreTRM® test by Elevance’s insured network (~400,000 total births per year). That adoption level will then determine the success or failure of the SERA. If the PRIME study validates the cost savings from providing the assessment of preterm birth risk, then Elevance (as well as any other insurance company) would do the math and adopt the screening test as a standard of care. In that “Win” scenario, I would assume the following for the model:

-

- a 50% ultimate penetration, with 20% quarterly growth starting in 2024 (probably conservative given that Elevance would roll-out day one and insure approximately 400,000 births per year)

- a price point of $300 until data in 2023, then $400 once the data is able to validate the economics

- Modest increase in sales and marketing expenses upon positive interim PRIME data

- 50% COGS until 2024, 25% COGS from improved automation and increased scale using the current mass spectrometry methods

- Only modeling US market – the EU and Asia would require a different business model which is not currently detailed by the Company

These “Win” scenario assumptions generate a proforma NPV of $734 million, or $19.90 per share on a fully-diluted basis including cash at the of 2022. There are 41.8 million shares, warrants and options outstanding as of March 31, 2022.

Internal Analysis

Source: Internal Analysis

If the Company is able to reduce the COGS to $20 using a different protein measurement technology, then the proforma NPV of the Win scenario at the end of 2024 would be approximately $300 million higher, which is approximately $7 per share in incremental value.

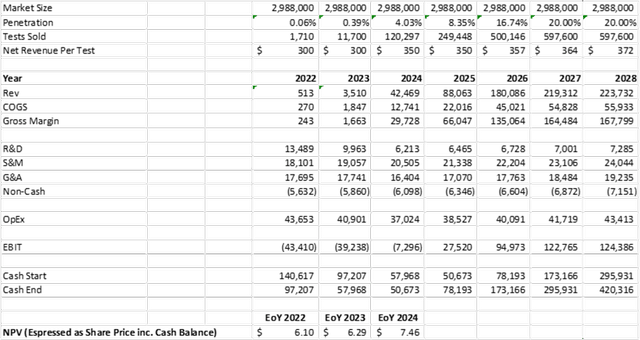

“Gray” Scenario

If the study is not 100% clear, the cause will likely be driven by patient/doctor compliance with appropriate interventions following notice of high-risk. In that case, there will still likely be a strong case for performing the test in certain patient demographics, or certain geographies. Elevance’s actuarial tables determined that a 20% reduction in NICU days would result in $1,600 of savings if all patients were given the test. The PRIME study is large enough to enable the Company and Elevance to dissect the data and determine where the test can be profitably used, in the event the results do not clear the 20% hurdle across the broad population. In the “Gray” scenario, I would assume the following for the model:

- a 20% ultimate penetration

- a price point of $300 until data in 2023, then $350 once the data is able to validate the economics

- no increase in sales and marketing expenses upon positive interim PRIME data

- decrease in ongoing research and development expenses

- 50% COGS until 2024, 30% COGS until 2025, 25% COGS thereafter from improved automation and increased scale

- Only modeling US market – the EU and Asia would require a different business model which is not currently detailed by the Company

These “Gray” scenario assumptions generate a proforma NPV of $158 million, or $6.10 on a fully-diluted basis including cash at the end of 2022.

Internal Analysis

Source: Internal Analysis

“Lose” Scenario

If the study is a failure, then the Company is likely dead. The Company would need to wind down operations and would become a reverse merger candidate or give the money back to investors (wouldn’t that be refreshingly crazy!). In the “Lose” scenario, I would assume the following for the model:

- No business past Q2 2023

- The Company winds down operations in the second half of 2023

- The Company becomes a reverse merger candidate and trades for unspent cash.

These “Lose” scenario assumptions generate an NPV of $0, but the company would still have approximately $72 million, or $2.35 in cash per common share, at the end of 2024. There are 30.8 million common shares. The outstanding warrants and options would be substantially below basis therefore not included in the calculation.

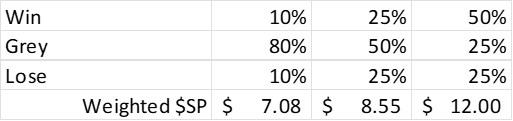

Overall, if one assigns probabilities to the different scenarios, one could calculate a range of stock prices that would make sense – all of which are above the current stock price.

Internal Analysis

Financing Risk

The Company raised a significant amount of cash before going public. There is a very low risk of the Company raising money while they are trading for less than cash, and likely they will not consider any additional funding until after they release their interim data analysis in mid-2023. In both my Win and Gray scenarios, the Company does not need to raise money. If the Company stock price rises to the “Win” level, then there is always the potential for the Company to put an ATM in place, or raise additional funds to fuel new products, new geographies, etc.

Analyst Coverage

According to TipRanks.com, SERA has an average target price of $15, with a range of $13 to $17. The most recent update came from Oppenheimer, who has a $17 price target on the stock. Oppenheimer has revenue expectations of 0.5 million in 2022, with a growth to $20 million in 2023.

Oppenheimer Report – July 15, 2022

The analyst’s base case assumptions include an uptake of the test by multiple national insurers following the interim data readout of PRIME in mid-2023, and a reduction in COGS from $150 to $100 in the near term.

Insider Activity

The Chief Scientific Officer has been selling 2,725 shares per week for many months. Many investors who see that a Chief Science Officer is selling stock, would run away. How could there be any value in a company, if the individual who should know the most about the science ,is selling stock.

The General Counsel purchased 8,000 shares back in June for $9,600.

No other member of management or the board have purchased shares this year. With the stock trading below cash, it is amazing that only the General Counsel, a late addition to the team, is the only one of the management team or the board who shows they believe. If everyone on the management team and the board would all buy $20,000 worth of stock, then it is my guess that the market would jump in with both feet.

Potential Risks

1) PRIME: While the data generated to date looks promising, the small numbers of preterm birth events in the PREVENT-PTM study make the study directional. Also, the study was performed in and around Salt Lake City, which is below the national average on preterm birth rate. The Company is rightly performing a larger study and recruiting patients from all over the country. The PRIME study serves as the pivotal study. Its outcome will determine is the Company’s success. A positive outcome relies on two factors. 1) The ability of SERA’s assay to provide an accurate assessment of risk. 2) With a positive high-risk assessment, the patient and physician need to agree and execute on a intervention plan to try to mitigate the risks, AND the interventions need work. If #1 and #2, then this could be the standard of care (the Win scenario). If #1 but mixed compliance/efficacy of #2, then this could be used in certain patient groups or geographies (the Gray scenario). If not #1, regardless of #2, there will not be a statistically significant different between screened and non-screened, and the test will be deemed useless (the Lose scenario).

2) CLIA Lab: The Company operates its laboratory under the Clinical Laboratory Improvement Amendment (CLIA). This allows the Company to sell its laboratory test without submitting the test to the FDA. This has the benefit of allowing the Company to sell its test after it has validated the test and the laboratory. This also limits the Company’s operating only one laboratory. In time, to expand geographically outside of the US, the Company will need to create test kits and submit those test kits to a regulatory authority for approval.

2) COGS: The Company currently has a cost of goods around $150 per test. With scale and automation, management says that they can reduce that cost to $100 per test. I believe that they should be able to use some improved protein characterization methods to improve the collection and testing process, resulting ultimately in a COGS of $20 per test. Using a different method with lower COGS could add a significantly to gross margin, and proforma NPV. In any case, varying possible COGS levels adds risk to the model.

4) Pipeline: The Company is working on a number of different neonatal tests, including preeclampsia, gestational diabetes, fetal growth restriction, and postpartum depression. Given that the stock price is below the cash value, it is clear that the market assigns no value to their pipeline. If anything, it could be seen as an extra cost and distraction. If the research expense for the other pipeline products is low, it is a net positive in the long term to be building the pipeline.

5) Valuation: Since the start of the pandemic, classical NPV valuation methodologies have been disconnected from public company market caps. This is especially true in the small cap space. In June 2022, 20% of biotech companies were trading for less than the cash on their balance sheet. This disconnect may persist for a long time. Therefore, the models used to generate the stock price estimates in this report should be seen as directional.

Conclusion

SERA has lost of 80% of its value since its IPO in 2021. I believe the Company has been caught in the general life science risk-off sell-off that started mid-2021 and accelerated in 1H 2022. Missing their Q1 2022 analyst revenue expectations and having the CSO set up a 10b5-1 selling plan has added to the early 2022 pressure on the stock.

SERA has the advantage of a strong balance sheet providing it multiple years of operational cash, and a significant inflection point within 12 months. The PRIME study is a repeat of a previously successful study with a larger patient enrollment target across a larger geographic area, and should have an interim data readout in mid-2022. The previous study was terminated too early because of financing timing reasons when they were a private company. Since that operational error, the Company used the dataset to raise a very large cross-over round and go public through an IPO.

If the PRIME study is positive, then it is likely that PreTRM® quickly becomes the standard of care within the Elevance insurance network, and perhaps across the industry. In this “Win” scenario, an NPV model suggests a stock price of over $30 is possible. If the PRIME study is a complete failure, then the Company should have just over $2.00 per share in cash. In the middle ground result, the Company will be able to use the data to determine which patient subgroups or geographies to target with the assay. This “Gray” scenario valuation points towards a stock price over $7.00.

Given the risk-reward balance in a Win or Gray scenario ,then this stock meets the criteria of our Life Science Opportunity Fund portfolio (over 5X potential upside with defined scientific risk and de minimus downside).

Be the first to comment