ipuwadol/iStock via Getty Images

Investment Thesis

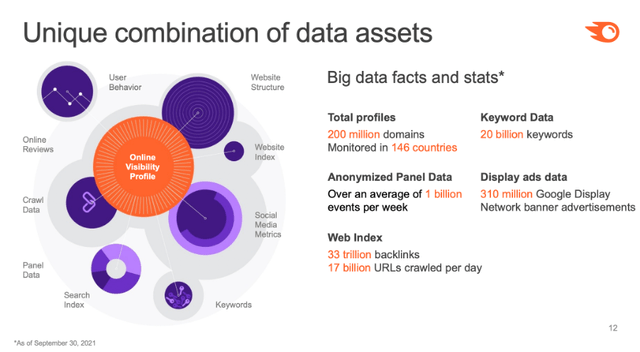

Semrush (NYSE:SEMR) is a SaaS company that operates a leading online visibility management platform, helping businesses make sense of all the data available to them in order to effectively reach customers online. This platform helps businesses to identify and reach the right audience for their content, in the right context, through the right channels – whether that is via social media, search, digital media, or more.

Semrush May 2022 Investor Presentation

In my previous article, I outlined in detail why I believed Semrush to be a great investment; in short, my investment thesis revolves around Semrush’s ability to land and expand with its customers. It has a sticky platform, and once a company gets their marketing set up on Semrush, they have no incentive to switch. Furthermore, the amount of data available to companies is only going to increase, making businesses like Semrush all the more important. It also offers an open, transparent, and independent approach to digital marketing, differentiating it from the walled gardens of Google (GOOGL) (GOOG) and Meta Platforms (META).

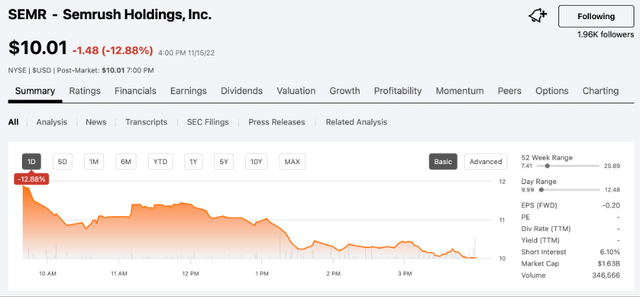

The company just released its Q3 results, and shares initially reacted by falling ~2%, however they quickly cratered to end the day ~13% lower despite many growth stocks making great gains on the same day.

So, was this earnings report as bad as this stock movement implies? Or is there more behind these numbers? Let’s take a look.

Semrush’s Q3 Earnings Overview

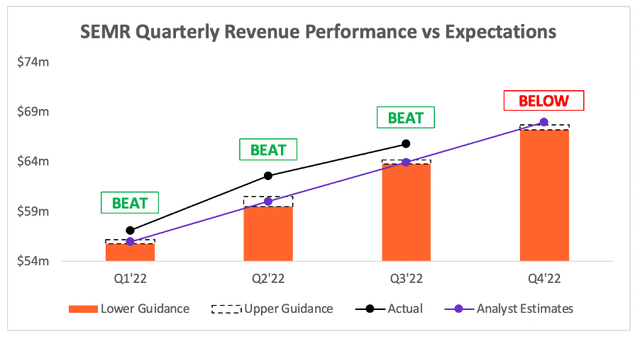

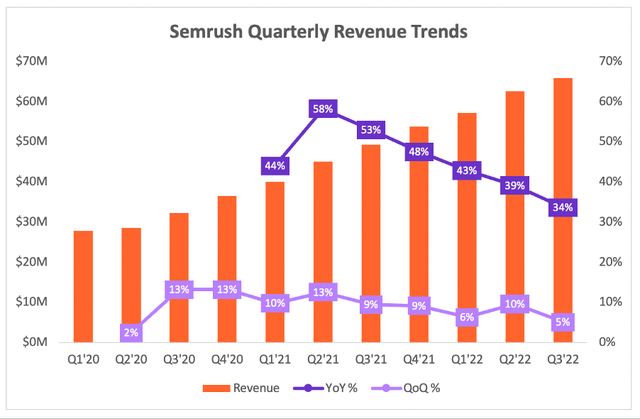

Starting from the top, Semrush’s Q3 revenue grew 34% YoY to $65.8m, coming in ahead of management’s $63.8-$64.2m guidance whilst also beating analysts’ estimates of $64.0m. Despite the difficult macroeconomic environment, it’s great for investors to see Semrush still delivering strong growth and continuing to beat analysts’ estimates.

Unfortunately, it wasn’t all good news. Management’s Q4 revenue guidance of $67.25-$67.75m implied YoY revenue growth of ~26%, which came in lower than analysts’ estimates of $68.0m. On the plus side, CFO Evgeny Fetisov noted that this is a conservative estimate in the Q3 earnings call:

Looking ahead to guidance, although the fourth quarter is typically a strong quarter for Semrush, we believe it is prudent to be slightly more cautious given the more challenging economic environment which we believe impacts the demand for our products.

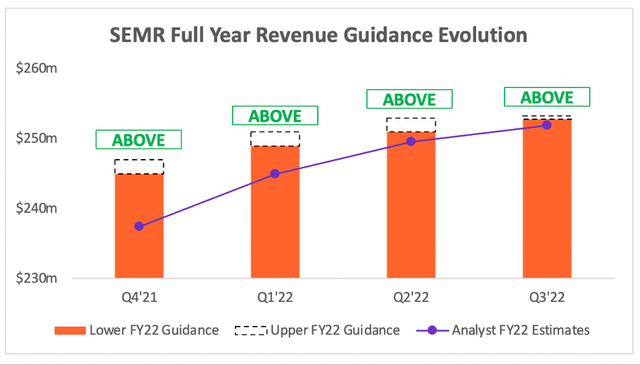

Perhaps investors had gotten too used to Semrush’s consistently pleasing guidance. This can be seen in the below evolution of management’s full year revenue outlook, which has constantly come in above analysts’ estimates.

Even in the latest quarter, management’s FY22 revenue guidance of $252.8-$253.3m came in ahead of analysts’ estimates of $251.9m. This guidance from management implies that Semrush will see revenue growth of 34-35% in FY22, which is especially strong considering the number of headwinds this business has faced.

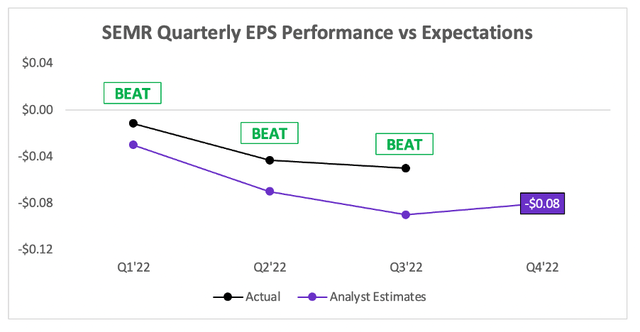

Moving onto the bottom line, and Semrush beat analysts’ estimates on earnings, delivering EPS of -$0.05 compared to expectations of -$0.09.

This was always going to be an unusual year for Semrush in terms of earnings. The company previously had many employees based in Russia, but following the invasion of Ukraine, Semrush took the decision to relocate its Russian employees. In total, this will cost Semrush $10-$11m in one-off relocation expenses this year, but management’s decision to do this will certainly be a bonus for long-term investors.

All in all, these were pretty strong headline numbers, with the only weaker aspect being management’s Q4 guidance. This isn’t a surprise, given that many businesses are currently seeing macroeconomic weakness as we head into the end of a fairly brutal 2022 for investors.

A Whole Host of Headwinds

There are plenty of headwinds faced by companies these days, but I’ll start with one that’s quite specific to Semrush – Russia. As per the company’s 2021 annual report, 691 of Semrush’s 1,173 full-time employees were based in Russia, although sales in that region are not significant.

The company has done a great job of rapidly relocating such a substantial number of workers, but this comes with other pains: relocation costs, higher salaries as Semrush hires employees in more expensive geographies, and the overall disruption that comes with relocating such a large portion of a workforce.

These headwinds come on top of all the other headwinds that have been seen throughout the global economy, so the fact that Semrush still expects to grow revenue by 34-35% this year despite all of these difficulties should give investors confidence; this is strong execution in an extremely tough environment, so just imagine how well Semrush could perform once these headwinds fade?

Unfortunately, it would seem that Mr Market still associates Semrush with Russia. Reports of a ‘Russian-made’ missile landing in Poland yesterday (which it now seems was a stray Ukrainian air defence rocket) appeared to disproportionately impact Semrush shares; down only ~2% prior to the news, Semrush shares ended the day down almost 13%.

Key Trends Are Heading the Wrong Way

It’s probably no surprise that, given all the headwinds in 2022 compared to the tailwinds in 2021, Semrush has seen some difficult YoY comparisons.

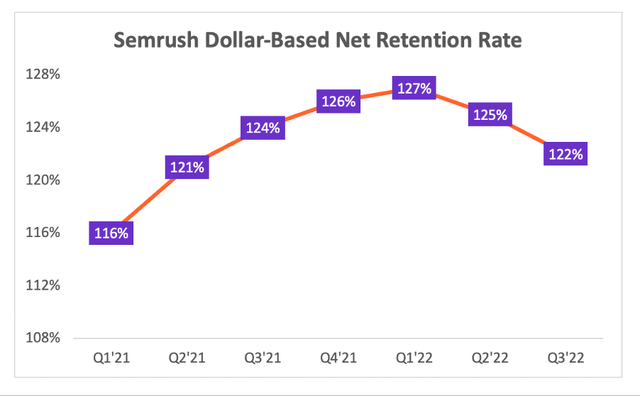

One of the most important factors to watch with Semrush is its dollar-based net retention rate. This tells us how successfully Semrush is executing on its land-and-expand approach, whereby it can extract more value out of existing customers by upselling them with additional products and services.

The company’s DBNRR for Q3 was 122%, which is still an impressive figure, however it’s clearly been trending downwards over the past couple of quarters. I’d expect this downward trend to continue into Q4’22 and Q1’23, as it comes up against difficult YoY comparisons whilst entering an equally difficult macroeconomic environment.

Management spoke about this on the call, but perhaps surprisingly, it was Semrush’s larger companies that saw more of a slowdown. As Semrush President Eugene Levin said:

In terms of macro, we see impact in larger accounts. But in terms of performance of our core base, we don’t see that much difference. So, I would say actually, and somewhat surprisingly, our small business segment is holding pretty well, which is — I think was counterintuitive for many app stores that we talked to.

…But small business segment, when we look at total number of expansions, is pretty — doing pretty well.

… So, it’s more of a softer environment. We don’t see people — drop in their subscriptions. But sometimes like I said if people had layoffs, they would buy less. So, that’s what contributes to lower expansion. When it comes to SMB segment where most of the transactions are self service, we don’t see that much difference. But, yes, on a higher end, total number like Evgeny said is growing really well. But some of those high subscription tiers, they are a little bit reluctant to buy more where previously they would be much more eager to do that.

In short, more hesitation among big customers, but business as usual for small customers – which is surprising, but also a positive to see that the smaller customers are showing strength!

All the tailwinds that Semrush saw in 2021 thanks to lockdowns and a booming economy have swiftly turned into numerous headwinds, making YoY comparisons extremely tough, as can be seen below by the continuously falling revenue growth rates.

The 5% QoQ growth was Semrush’s lowest sequential growth rate since Q2’20, back when the pandemic was in its early stages and the world had no idea what would happen to the economy.

I am expecting these growth rates to continue softening due to the tough global macroeconomic conditions – however, I think that Semrush itself has continued to execute successfully in the face of these headwinds, and I also think that the company is very well positioned to enjoy rapid growth once the economic conditions start to improve.

Also, let’s not forget that 34% YoY growth remains incredibly impressive right now, especially coming off the back of 53% YoY growth in Q3’21!

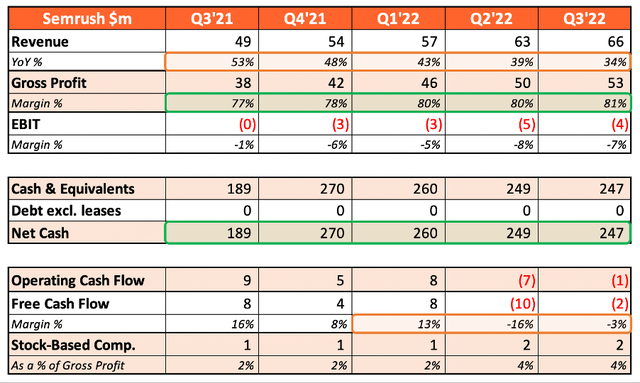

Quick Take: Semrush’s Core Financials

I want to quickly touch on Semrush’s financials, as its financial profile was one of the many reasons I chose to invest in this business.

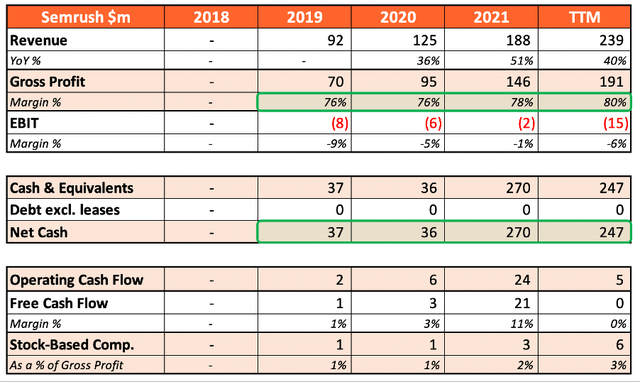

Starting with the trailing-twelve-month trends, and Semrush has continued to see strong revenue growth combined with improving gross profit margins, which reached 80%.

The company also has a substantial net cash position, with $247m in cash and zero debt; at the time of writing, this accounts for ~17% of Semrush’s market capitalization.

Semrush also has very minimal stock-based compensation, which is very rare for any technology company these days!

Moving down to the quarterly figures, and there are a couple of negative but unsurprising trends; in fact, they’ve both already been covered in this article. Revenue growth is clearly slowing down, but I think a lot of the drivers for this are outside of Semrush’s control.

The other negative are those EBIT and free cash flow margins, both of which have deteriorated over the past few quarters. Once again, we already know that this is partially driven by the costs incurred to relocate all Semrush’s Russia-based employees. Without these expenses, I think margins would have still contracted slightly as revenue growth slows, but nowhere near are sharply.

In truth, Semrush remains in extremely strong financial shape. It has loads of cash, and gross profit margins hit a whopping 81% in Q3; there’s certainly a lot here for long-term investors to be happy about.

SEMR Stock Valuation

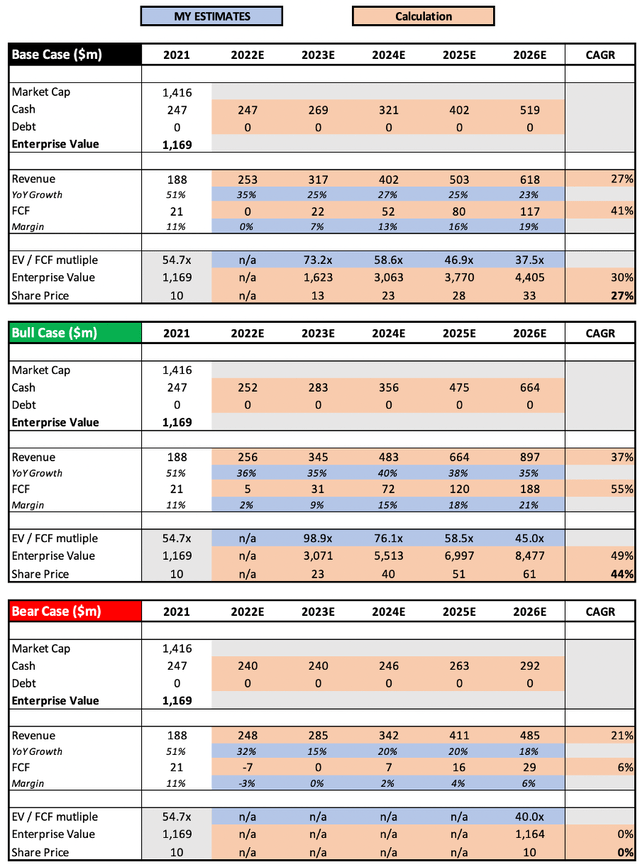

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Semrush is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have not made many substantial changes from my previous article, but I have tweaked a few items.

First, I have assumed that Semrush’s free cash flow margins will be weaker than expected due to the impact of employee relocations combined with the broader macroeconomic headwinds. I’ve also assumed that revenue growth in FY23 will now be hit slightly harder, and I have updated the FY22 revenue growth in my base case scenario to come in line with the top-end of management’s latest guidance.

Put all that together, and I can see shares of Semrush achieving a CAGR through to 2026 of 0%, 27%, and 44% in my bear, base, and bull case scenario.

Investment Thesis: On Track

Semrush is continuing to perform well in a desperately difficult environment, made even more tough for this business due to its previous ties with Russia. By Q4, it will have finished all relocations, and the ties will be well and truly cut, meaning management will be able to focus solely on growing the business and navigating through the macroeconomic headwinds.

I think Semrush remains a very strong company, and its ability to keep delivering impressive results is testament to this. The market appears to be heavily discounting Semrush right now, and I think the current risk / reward scenario is incredibly attractive.

Given all this, I will reiterate my previous ‘Strong Buy’ rating on Semrush shares.

Be the first to comment