simon2579/E+ via Getty Images

Many years ago, my now ex-wife did me the favour of chronicling my many odious personal habits and other terrible traits in excruciating detail. “Laziness” was ranked in the top five, and I’m reminded of that laziness this morning. When it comes to investing, my preference would be to simply buy a stock and forget about it for a year or two, as it slowly grinds toward my target price, or doesn’t. I’d rather not have to revisit a name after a short time, but when the price moves dramatically and quickly, that’s what I feel I’m obliged to do. In spite of the fact that my performance on Clearwater Analytics Holdings, Inc. (NYSE:CWAN) gives me a chance to brag (which reminds me that bragging is terrible trait number six), I’d rather be left alone to start my weekend a few days early. I hope you appreciate what I’m doing for you by writing about this company again so soon. You’re welcome. Anyway, soon after writing my bullish piece on it just under two months ago, shares of Clearwater took off and are now up about 26% against a gain of ~3% for the S&P 500. The “problem” is that a stock that’s trading at $21.50 is, by definition, more risky than one trading around $17. This highlights one of the challenges of communicating over this medium. If I write a bullish piece, and you only come to the party today, you might reasonably conclude that I’m still bullish, when, as the song says, “it ain’t necessarily so.”

The company has released financial statements since I last looked at the business, so I thought I’d review those. I also need to comment on the stock as a thing distinct from the underlying business for the reasons cited above. Finally, I sold some puts on this name, and I’m absolutely itching to write about those. Although I’ve earned less on the put options than I have on the stock, I’m of the view that these returns came at much lower risk, so they highlight the potential that short put options have to generate superior risk-adjusted returns.

I get it. My writing can be tough to take sometimes. I’m going to lie and say that I don’t want to brag, but there is sometimes wisdom here, and the results aren’t terrible. That said, mining for nuggets of insight amongst a slag heap of bad jokes and excessive self-congratulation can be a bit much. For those people who want the investment thesis without all the “Doyle mojo”, I provide a summary of my thoughts in the “thesis statement” portion of the article. No need to thank me, but gifts are appreciated. The company has just posted great financial results, and sales are up nicely. In addition, the capital structure remains rock-solid in my estimation, with cash and equivalents representing just over 300% of total liabilities. The problem is that the market is paying even more for $1 of future sales than it did when I last reviewed this business. Sales have risen, but the amount we’re expected to pay for $1 of future sales is up by about 25%. That’s a bit rich in my estimation, so I’ll be selling my small stake here, and adding another $850 to the whiskey acquisition fund. At the same time, though, I’m taking no action with the puts I wrote two months ago. The value of these has ground down as the shares have climbed higher and time value has eroded. To repeat what I typed above, the risk-adjusted returns from these are superior in my estimation. There you have the thesis statement. If you read on from this point, that’s on you. I’m not responsible for any nausea or other ill effects my writing induces if you choose to subject yourself to the rest of this.

Financial Update

In my previous missive on this relatively “below the radar” business, I introduced readers to the business, highlighting the fact that they have a 100% recurring revenue model. Sales are generated from the 1,000+ customers who rely on Clearwater to simplify their investment accounting operations. If you’re interested in reading more about the nature of the business, or the unique share structure that gives 27 times more voting power to a small group of institutional investors relative to common shares, I recommend you check out my earlier work on this name. I guarantee that it’s a real page turner, especially the “Insider Activity” section.

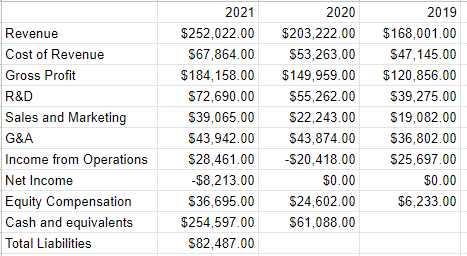

The company just released financial statements, and they were quite good in my estimation. For instance, revenue grew by 24% relative to the previous year and is up just over 50% relative to 2019. Additionally, gross profit is also up nicely, by 22.8% and 52% respectively. I really like the fact that income from operations turned back to positive in 2021 from a $20.4 million loss in 2020. Please note that income from operations in 2021 was about 10.75% higher than it was in 2019. Finally, the balance sheet remains very strong in my estimation, with cash and equivalents representing about 308% of total liabilities.

It’s not all animated bluebirds and rivers of whiskey over at Clearwater, though. Nothing’s perfect, and this company is no exception. The R&D and sales and marketing expenses have grown by $34.25 million, which is very near the growth in gross profit for the year. I’ve seen more than a few SaaS companies like this one remain permanently unprofitable because they grew their expenses at the same rate as sales. I’m going to want to see expenses grow at a slower pace going forward. Since it remains early days, though, I can’t conclude that expenses will outpace revenue going forward. I’m willing to add to my position at the right price.

Clearwater Financial History (Clearwater Analytics Holdings, Inc. investor relations)

The Stock

In my previous missive on this name, I droned on about the insider buying activity. It was so compelling to me that I was willing to overlook the then rich valuation and buy a couple of hundred shares of this name. The shares have popped since, then, though, and I need to revisit this position. While I’m willing to overlook valuation to some degree, my patience isn’t infinite. The need to “buy cheap” is core to my being (this is one reason why my wardrobe has recently been described as “flood victim chic”), and so I need to revisit the shares.

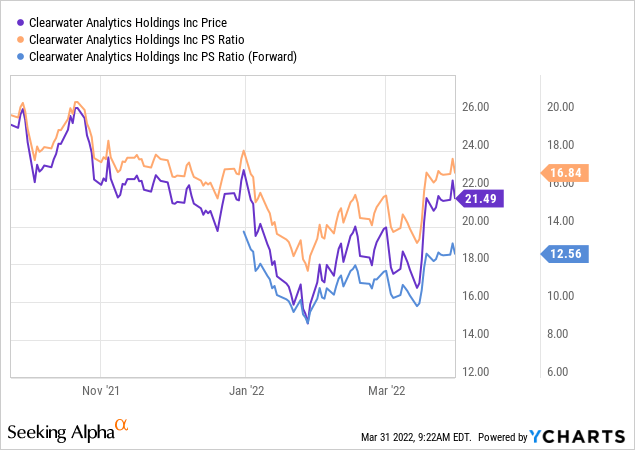

When I last looked at the company, I fretted about the fact that the price to sales was sitting around 13.5 and the price to forward sales was about 10.25 times. Shares are now about 24.5% more expensive, per the following:

I’m of the view that cheap wins over time. The company grew sales nicely from the year-ago period, and the people who know the business best have bought recently (at prices about 20% below the current market price). None of that makes up for the fact that shares are richly priced, though. The market is paying much more for $1 of future sales simply because there’s been some great growth here. While I’ll try not to penalize the company for growing expenses at a faster rate than sales as the evidence isn’t in yet, I’ll also not reward the company in the absence of evidence for future profitability. I’ve only got two hundred shares of this business, but I’ll be selling them this morning, and adding another $860 to the whiskey acquisition fund.

What Of Options?

In addition to buying a small stake in the business, I also sold 10 of the September puts with a strike of $12.50 for $50 each. These are currently bid at $0, as much of the time value has eroded, and the shares have marched higher. Just because I’m not comfortable holding the shares at current prices doesn’t mean I wouldn’t be happy to buy at $12.50, so I see no reason to do anything with these.

The fact that at this point, I’ve made about $4.30 per share in stocks, and made $.50 from selling relatively low-risk put options indicates something about the risk-reward of put options. I risked ~$1700 of capital to earn ~25%. At the same time, I earned “only” 4% by selling put options that were at the time about 26.5% out of the money. I made less money from the puts, but in my way of thinking, I made a much better risk-adjusted return from them so far. This is one of the reasons why I consider put options to be such powerful investments.

While I normally like to try to repeat success, I can’t in this instance. I’m willing to buy the shares at $12.50, obviously, but the bid on the September puts has vanished. One of the things that I think it’s critical for put sellers to remember is that we only ever sell puts on companies we’d want to buy at prices we’d want to pay. Thus, there’s no opportunity here at the moment, but I’ll be keeping an eye on the shares.

Conclusion

I may regret selling shares at current prices if the market continues to drive them higher based on the hope of future profits. Weighing the risk of potential future regret against the very real risk of capital loss proves no contest in my view. I’m of the view that no one ever went broke taking profits, so that’s what I’m going to do in this instance. Of course, I’m willing to buy the shares at an adjusted price of $12, so I’m maintaining my short put position. This demonstrates the risk-reducing potential of these instruments in my view. It’s too risky for me to hold the shares at current prices, but I’m quite comfortable maintaining my short put position.

If you’re just coming to this party, I think the best thing for you to do would be to wait until shares fall to a more reasonable level before buying. If you took my advice a few months ago, I think it would be wise to take at least some profits here on the stock, while letting the puts ride.

Be the first to comment