bjdlzx

The Ukraine War, ESG concerns, and lack of oil investment have caused oil prices to skyrocket these past few months. Oil bulls have seen hefty profits, and many investors are eyeing oil investments, in the hopes of further profits. The United States Oil ETF (NYSEARCA:USO) is meant to track the price of WTI oil, through the use of oil futures, and is a reasonable short-term trading vehicle for oil bulls.

On the other hand, USO suffers from extremely low long-term expected shareholder returns, excessive costs, and a risky, complex investment strategy. USO’s investors would see hefty gains from further oil price increases, but would suffer losses otherwise, even if oil prices are flat. Under these conditions, I am wary of investing in USO. The Energy Select Sector SPDR ETF (XLE) invests in oil producers, would also see significant capital gains from further oil price increases, but does not suffer from USO’s many negatives. XLE seems like the broadly superior investment opportunity, in my opinion at least.

USO – Quick Overview

USO is meant to track the price of WTI oil, through investment in oil futures. These futures entitle the company to delivery of barrels of oil at a later date, usually months into the future. Prices for these futures are dependent on many factors, but current and expected oil prices are key, for obvious reasons. Other factors matter too, including storage and financing costs, contract details, and rebalancing procedures. USO’s target portfolio is as follows (actual portfolio is not materially different):

As can be seen above, USO invests in seven different futures contracts, with different delivery dates. Contract diversification is meant to protect the fund from negative issues arising in any specific contract, which do sometimes happen. If, say, the October 2022 futures contracts goes haywire, the fund only has 20% of its assets in said contract, which limits any potential fallout. Every month, the futures closest to maturity get sold, and the proceeds are used to buy futures with further-out maturities.

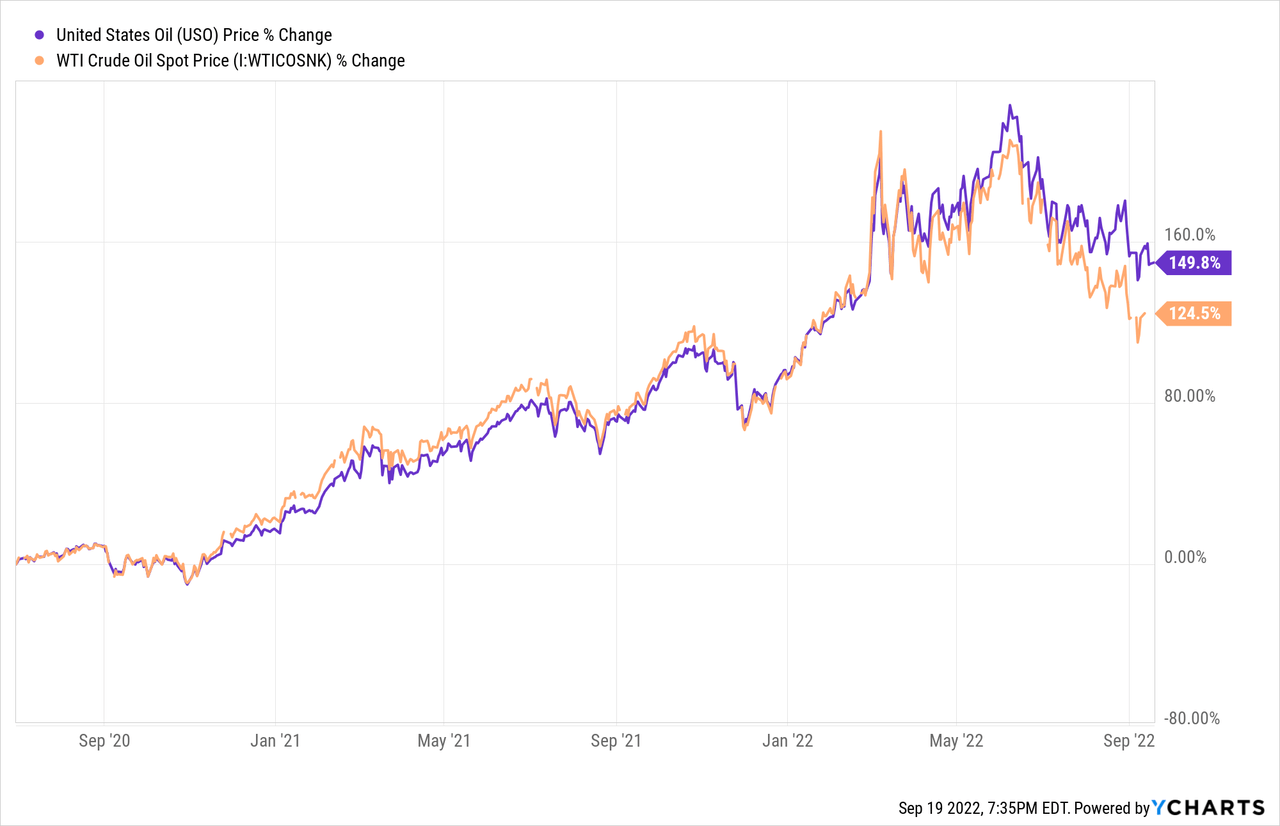

USO’s strategy has worked reasonably well these past two years or so, with the fund generally tracking the price of WTI oil for said time period. There were hiccups before that, due to rebalancing issues, but these have already been effectively addressed, and are very unlikely to be an issue moving forward.

USO – Benefits and Advantages

USO’s most significant benefit and advantage is the fact that the fund faithfully tracks the price of WTI oil, disregarding issues of valuation, investor sentiment, costs, operations, etc. Oil price goes up, USO price goes up, under the vast majority of plausible scenarios, with extremely few exceptions. Oil futures are explicitly structured to ensure that this is the case, and it almost always is the case.

Other investments and funds, including XLE are not straight oil plays, and their performance is dependent on many more factors.

XLE is an equity fund, investing in oil producers, and so performance is strongly dependent on the actual financial performance of said oil producers, and on investor sentiment. Oil price goes up, oil producer revenues and earnings go up, investor demand for oil producers goes up, XLE price goes up. This process is longer, more complex, and more prone to failure. Oil producers can sometimes fail to take advantage of rising revenues and earnings, as occurred during the last oil bull market, in which producers plowed billions in unprofitable shale plays. Investor demand for oil producers can refuse to budge even in the face of skyrocketing oil prices, for many reasons, including negative sentiment, ESG concerns, and just plain irrationality. These issues make XLE an inferior short-term trading vehicle, but complicate matters for longer-term investors too.

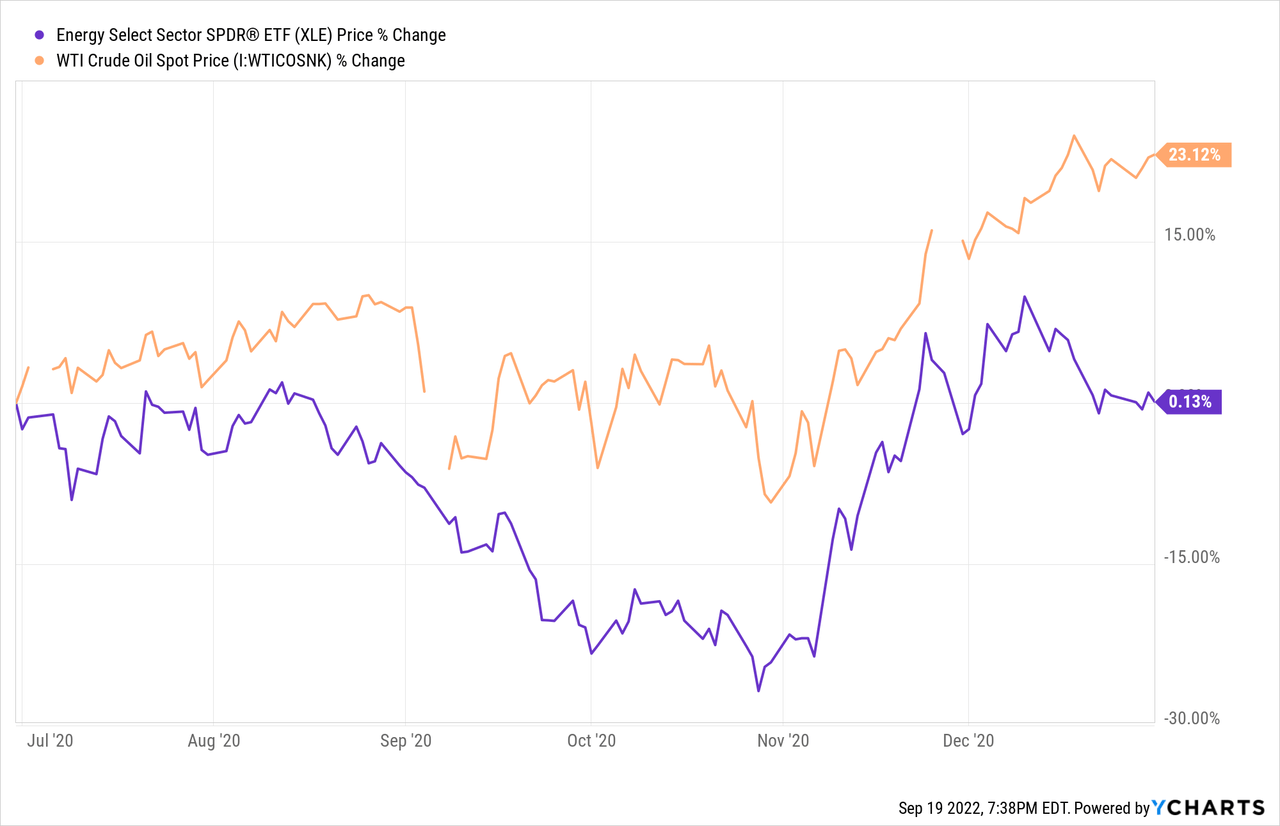

These are relatively common occurrences as well. For instance, XLE saw very few gains in the second half of 2020, during which oil prices started to recover from their pandemic-lows. It is not immediately clear to me why this was the case, but the pandemic remained in flux, so cautious, somewhat bearish investor sentiment made some amount of sense.

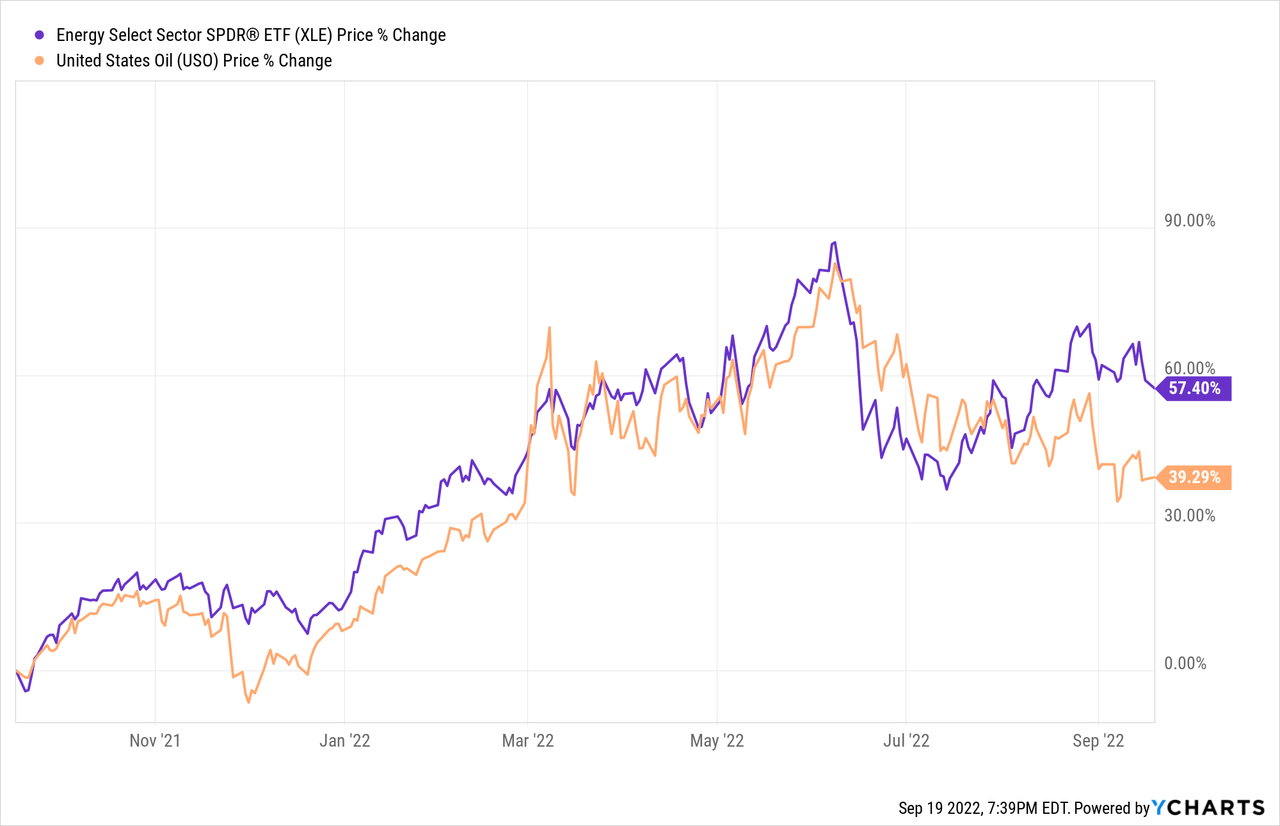

USO does more faithfully track oil prices when compared to XLE. As such, USO is the more appropriate investment vehicle for short-term traders, wishing to speculate on oil prices. USO closely tracking oil prices is also something of a benefit for more long-term investors, but less consequential. XLE will generally trade alongside oil prices, so oil bulls can still choose to invest in XLE, and will almost certainly profit from rising oil prices.

USO – Drawbacks and Disadvantages

Low Long-Term Expected Shareholder Returns

USO’s most significant drawback and disadvantage is the fund’s low long-term expected shareholder returns.

USO exclusively invests in oil futures, which entitle investors to physical delivery of oil, but which do not entitle investors to dividends, earnings, or residual cash-flows. Oil futures are only profitable if oil prices increase, and are unprofitable otherwise, with few exceptions. Oil prices are cyclical, and consistent, long-term price increases are rare. As such, investors should expect very low / zero profits from these contracts long-term.

XLE, on the other hand, invests in the shares of major oil producers. These shares entitle investors to their fair share of the earnings, cash-flows, and dividends of said producers, and these are currently quite hefty. XLE currently sports an earnings yield of 7.4%, and a cash-flow yield of 13.9%. Let’s split the difference, and say it averages down to 10%. XLE’s investors are entitled to said 10% regardless of future oil price movements. Even if oil prices remain flat from here on out, XLE’s investors are entitled to that 10%. If oil prices remain flat from here on out, USO’s investors are entitled to approximately nothing.

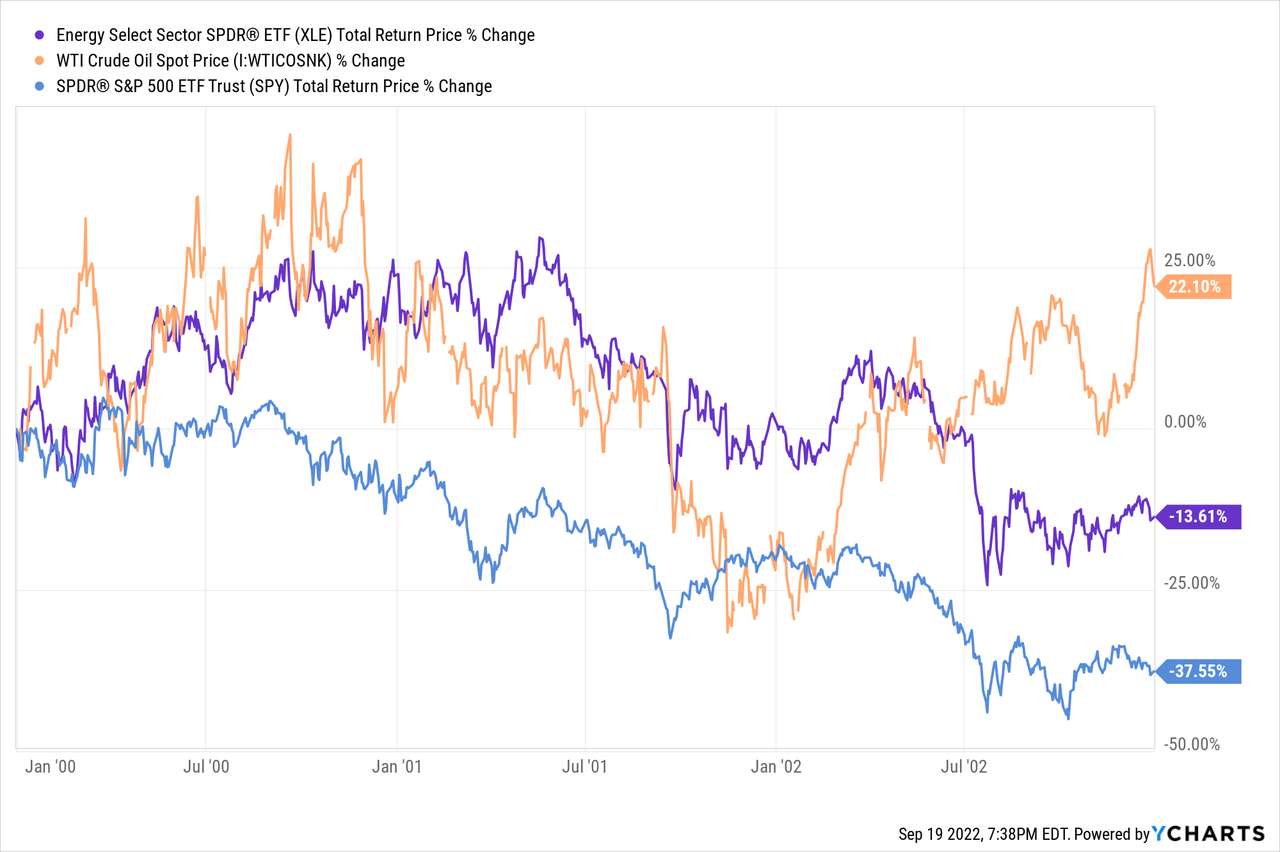

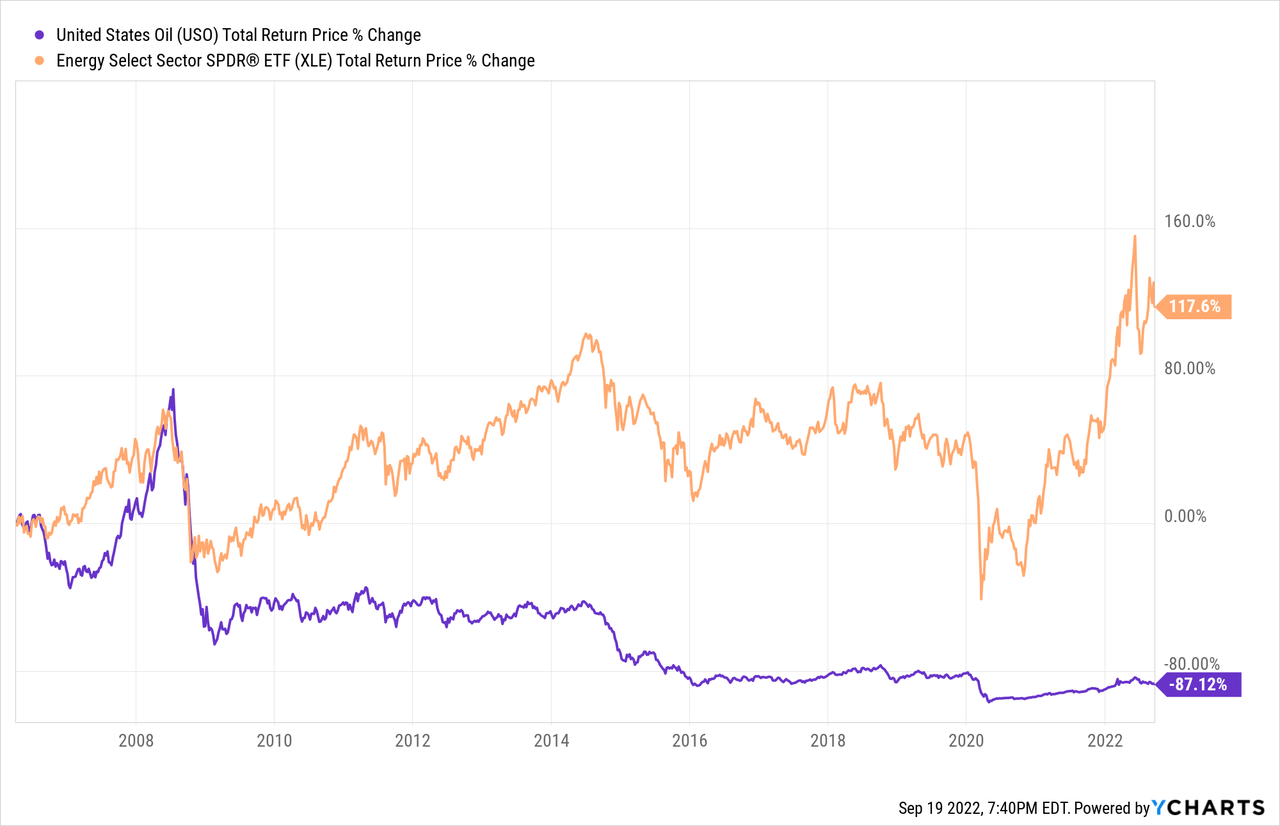

Due to the above, XLE’s long-term total shareholder returns will almost certainly be stronger than USO’s. This has been the case since inception, as expected.

High Costs and Expenses

USO is a relatively expensive fund, with a 0.81% expense ratio, quite a bit higher than XLE’s 0.10%. Higher expenses directly reduce a fund’s returns, and are a negative for investors. Reducing expenses are one of the only surefire ways for investors to boost (reduce by less) their returns, and should be a top priority for most investors. In this particular case, minimizing expenses means choosing XLE over USO.

USO’s investment strategy is also quite costly, and these costs are not reflected in the fund’s expense ratio. Buying futures is costly, the fund has to buy new futures every month. Costs add up. Importantly, the fund finances its purchases, of long-dated futures, through asset sales, of short-dated futures. There are operational costs associated with these transactions, and they are sometimes done at unfavorable prices. USO’s investment strategy will almost certainly be expensive to implement, directly reducing shareholder returns.

In the short-term, USO’s expenses are a small negative, and are unlikely to prevent the fund from seeing gains if oil prices increase.

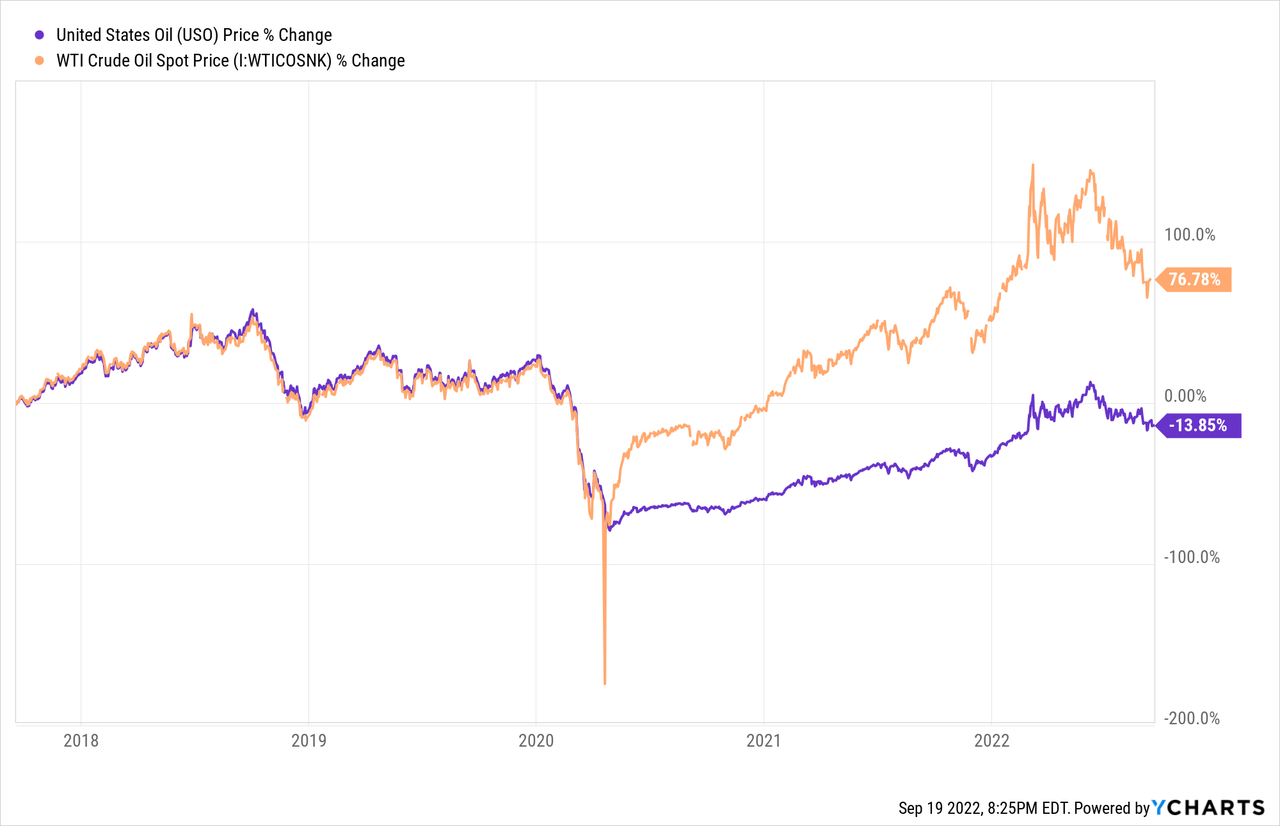

In the long-term, USO’s expenses will almost certainly result in negative returns regardless of oil price movements: expenses will eat your gains, and more. This has been the case for the fund for most long-time periods, including since inception. More recently, oil prices have climbed by over 75% these past five years, but USO is down almost 14% during the same. That 90% differential is partly due to costs associated with implementing the fund’s investment strategy.

Complex Holdings and Strategy

USO’s holdings are complex financial derivatives with lots of moving parts, specific characteristics and functioning. Details matter. USO’s strategy itself is also somewhat complicated, and specific details, including when the fund buys futures and which specific futures it buys, matter. Complexity increases risks, and exposes the fund and its shareholders to the possibility of significant underperformance for, well, complicated, difficult-to-foresee reasons.

Currently, I see no significant issues with USO’s holdings or strategies, but that is only to be expected. Significant, glaring issues are easy to notice, and are quickly fixed, but that does not preclude the possibility of subtler, less noticeable problems with the fund’s strategy or holdings.

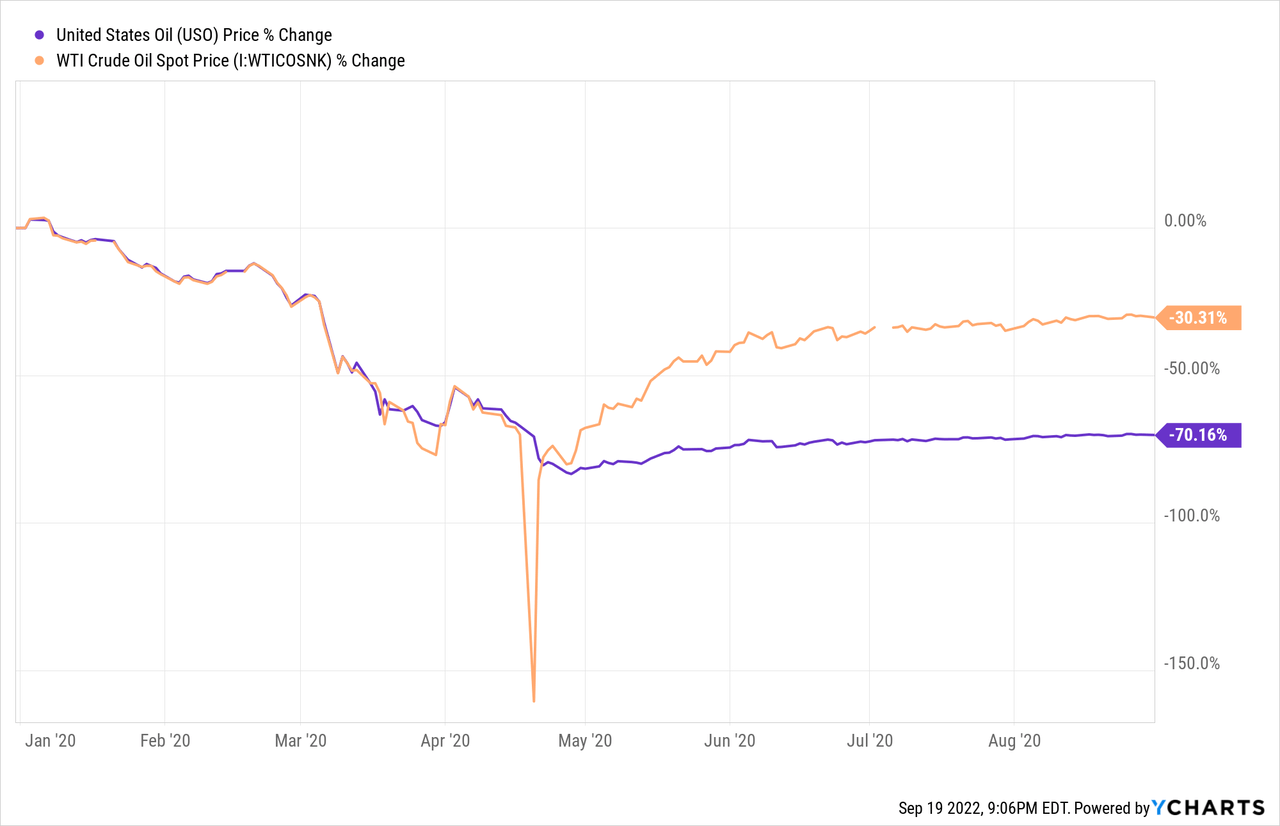

I’m aware that the above seems a bit speculative, but there is precedent here. USO’s strategy used to be different, with the fund focusing on futures contracts with one-month maturity. These contracts went haywire in mid-2020, as the coronavirus pandemic led to an unprecedented, chaotic energy market. At maturity, the fund sold its futures contracts for pennies, as oil prices had collapsed. It then used the proceeds to buy futures contracts with maturities farther out into the future, which were much more expensive, as investors assumed oil prices would recover in the future. The fund sold low and bought high, with disastrous results. USO was down 70% by August 2020, while WTI was only down 30%.

USO’s earlier strategy would have necessarily resulted in significant losses during a situation like the coronavirus pandemic, but this was not immediately clear to me, or to most investors. It could very well be the case that the fund’s current strategy is set to significantly underperform during a future scenario. There is a very real, very large risk here, and prospective losses are quite high.

Most funds, including XLE, do not suffer from the issues above. The fact that USO does is a negative for the fund and its shareholders.

Conclusion – Choose XLE Instead

USO faithfully tracks the price of WTI oil in the short term, but suffers from extremely low long-term expected shareholder returns, excessive costs, and a risky, complex investment strategy. In my opinion, although the fund is a reasonable short-term trading vehicle, its many negatives make it a subpar investment opportunity. XLE is a simpler, overall stronger fund, and a better choice for oil bulls.

Be the first to comment