Morsa Images/DigitalVision via Getty Images

OPKO Health, Inc. (NASDAQ:OPK) is an Israeli healthcare company focusing on pharmaceuticals and diagnostic tests. The company is publicly traded on Israel’s TASE and NASDAQ, both under the symbol OPK. The company has international operations in South America and Europe, apart from its home country in Israel, where pharmaceutical research and development occurs. This is only one of two segments, the other being the Diagnostics segment, responsible for the clinical operations of Bio-Reference Laboratories and the company’s point-of-care operations. The healthcare sector, including research and diagnostics, is growing rapidly not only because of the recent global pandemic that highlighted the importance of an efficient industry but because of a growing population that is both aware and demanding better health services.

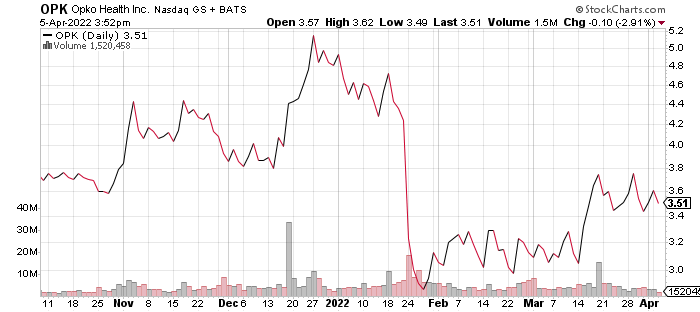

stockcharts.com

As the industry grows rapidly, we will look into what makes OPKO special from a financial perspective. The company has experienced challenges in the past, but things could take a positive turn in the next few years to come and present an excellent opportunity for prospective investors.

Company Risks & Industry

The company’s growth largely depends on how the global industry has been performing, what trends can be expected going into the future, and how OPKO plays into all of that. The company has cited supply chain difficulties as having adversely affected the supply of critical equipment and the cost of operations, all of which have resulted from the COVID-19 outbreak. Restrictions and regulations implemented in the countries where the company operates may further impact the company’s ability to meet its goals.

On the other hand, the same virus has also created a surge in demand for testing, which has positively impacted the company’s growth. This positive factor may not last long as improving treatments and vaccines could result in a decline in testing. This means that the company will need to focus less on revenue from COVID testing and more on the company’s core services.

That could come in the form of providing more products to market, such as in the United States, where the company has two approved pharmaceutical products and breaking into other markets that could add to the company’s revenue. Prior to the pandemic, the company had experienced some difficulty turning a profit, but attitudes have changed, and more funding is available for companies that can help the current and possible future crises.

The global Medical Devices market could experience a 5.4% compound annual growth rate from 2021 to 2028. This could see its total market value rise from approximately $432.23 billion, reported in 2020, to $658 billion by the end of the forecast period. At the height of the pandemic, the market saw a decline of about 3.7% in 2020, despite being the year in which demand should have resulted in higher revenue.

The market struggled to meet demands at first, but as evidenced in 2021’s figures, this was soon sorted out, and a resumption of growth is expected throughout the entire forecast period. Hopefully, the pandemic will see its end sooner rather than later, barring any serious variants that could arise. Still, many global health-related issues continue to persist and will need special attention. OPKO can count on increased investment in medical technology to help with those issues and ensure the company stays afloat for a while.

Financials

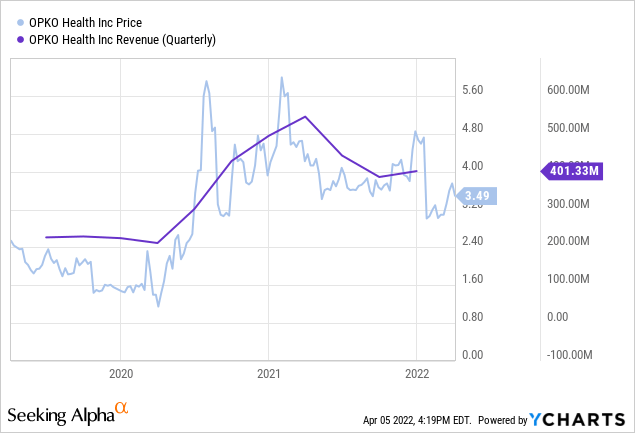

ycharts.com

OPKO registered a decline in quarterly revenue throughout 2021, having ended the first quarter with $545 million in revenue and finishing the year with quarterly revenue of $401 million. This was also down from the $494.6 million in revenue reported in the final quarter of 2020. Despite this decline, the fourth quarter figures represented a slight increase from the previous quarter, which saw $386 million in revenue. One major contributing factor to this was the gradual decline in demand for testing kits. This had a direct impact on the diagnostics segment, which saw its boom in popularity slowly wane as vaccines became a priority, reducing the number of tests needed.

Adding to this were costs associated with the GeneDx transaction, involving the purchase of the company’s subsidiary working in genomic testing and analysis, as well as non-recurring legal expenses. The GeneDx transaction will pay off in 2022, with an estimated purchase price of $623 million, helping the company raise capital for future investments.

However, the pharmaceuticals segment saw an increase in sales from $30.8 million in Q4’20 to $35.3 million in 2021. This growth was offset by an increase in operating costs for the segment, which rose from $36.6 million in the fourth quarter of 2020 to $43.4 million in the final quarter of 2021.

If anything, this highlights the need for the company to assess better which aspects of its company are weighing it down and know where to invest for greater growth. OPKO showed signs of this with the sale of GeneDx. If the company can reduce operating income while finding ways to increase revenue in a post-pandemic world, it will be buoyed by a growing economy and increased funding to solve global health challenges.

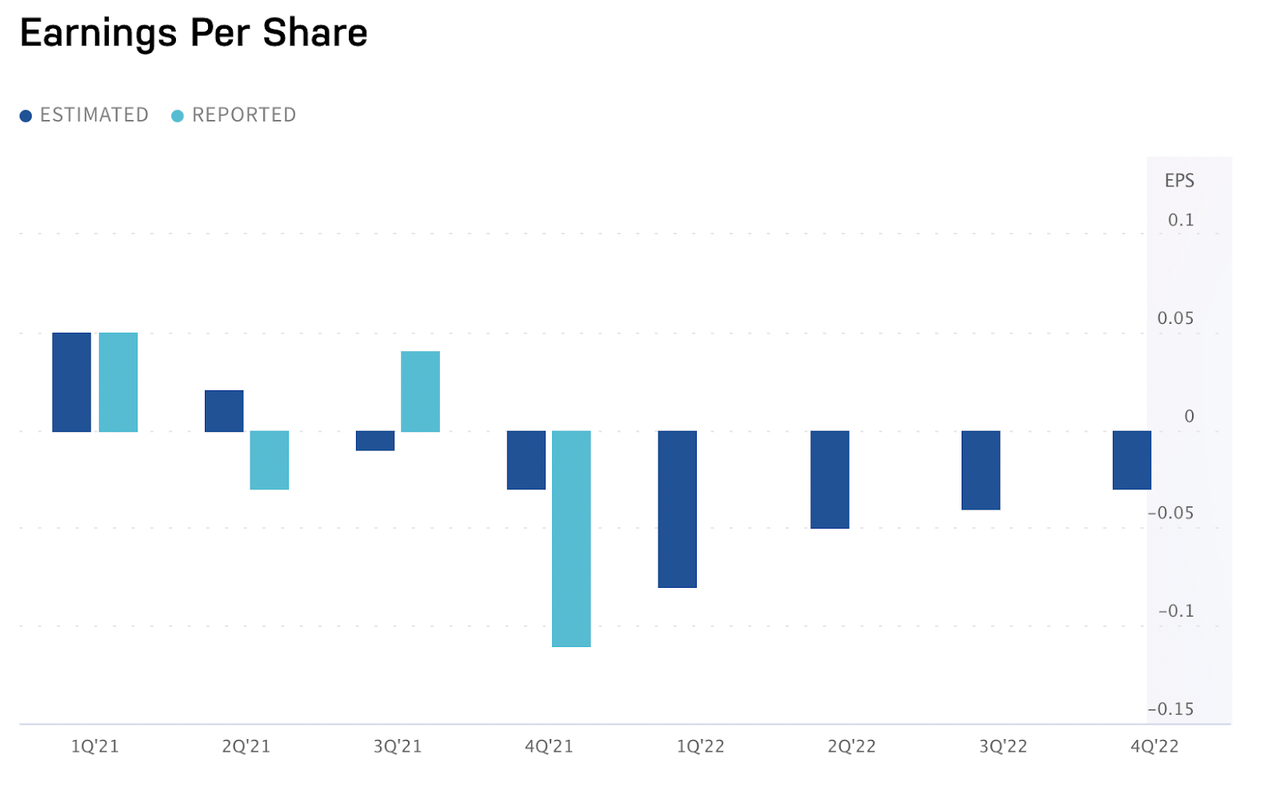

nasdaq.com

Reflecting the decline in form, earnings per share fell to losses per share by the second quarter of the year, which saw a -250% surprise. The final quarter ended at $-0.11 per share, much worse than the estimated $-0.03. There was a pleasant surprise in the third quarter, owing to fewer expenses during the quarter, in between the other two quarters. Even as things start to take a positive turn, OPKO is not expected to see EPS growth until 2023, when the company is expected to recover from costs associated with continued investments and developments.

Future Outlook

There is a lot of work to be done before OPKO becomes profitable. The company currently has a market value of approximately $2.4 billion and is expected to slowly crawl out of its current position by 2023.

Rayaldee stands out as being the most promising of the company’s businesses. The business was launched in Germany under VFMCRP, or Vifor Fresenius Medical Care Renal Pharma, further adding to the company’s international portfolio. Apart from expanding its ventures beyond the United States, Rayaldee’s work could reduce COVID-19 symptoms, according to current topline data. If this is true, it will be much easier to market the business to other countries, such as the 11 European countries where Rayaldee is expected to launch. This will keep the company relevant during the pandemic while it continues to make the necessary adaptations for future success.

OPKO has also announced regulatory approvals in Canada, Europe, Japan, and Australia for the treatment of hormone deficiency through its NGENKA injection. This will further bolster the company’s revenue from different markets. As novel challenges present themselves, even as the global economy recovers from the pandemic, one aspect that will not go away any time soon is the fluctuations in currency rates that could negatively impact the business.

At the same time, the more OPKO invests in research and development, the more relevant and valuable the company will become. If the company handles losses while it provides markets and those in need with essential solutions, then the payoff will be much larger in the long run. This makes OPKO an excellent long-term prospect for bullish investors looking to get ahead of the curve.

Be the first to comment