Ildo Frazao/iStock via Getty Images

When the market dipped in early 2022, we were buying the dips. We posted several articles on our favorite opportunities, many of which had dropped by over 20% in just a few weeks and without any apparent reason.

But since then, the market has bounced back, and right now, the S&P 500 (SPY) is just 5% off from its all-time highs. That’s quite spectacular when you consider that we are still facing:

- The biggest war in Europe since WWII.

- A worldwide pandemic that just won’t go away.

- New lockdowns in China, causing more supply chain issues.

- Up to seven expected interest rate hikes.

- 40-year high inflation that’s likely to get worse as a result of recent events.

- An inverting yield curve that signals a likely recession in the near term.

Is now still a good time to buy the dips?

Or should we rather sell the rips?

Obviously, it depends on what you’re looking at, but generally speaking, I find it difficult to get excited about the broader stock market at these prices.

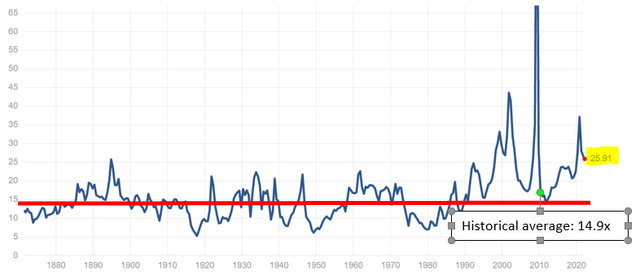

We are likely headed toward a recession. There’s a real risk of a bigger war. And then there’s the inflation that’s out-of-control, rising rates, the pandemic, etc., and despite all of that, the S&P 500 is priced at a huge premium to historic levels:

The stock market is historically expensive (S&P Multipl )

I’m not a market timer, but you don’t need to be one to understand that the risk-to-reward of an investment today likely isn’t that compelling.

The recovery could continue, but priced at near all-time-highs already, the future upside is likely limited.

Meanwhile, there’s a long list of potential events that could cause the market to quickly drop much lower.

The risk-to-reward simply isn’t that compelling right now, and therefore, if I had a lot of wealth in a US stock market index like the S&P 500, I would consider selling the rip in order to raise capital. Personally, I don’t hold any investment in the S&P 500, but I have used the bounce to unload a few individual positions that I thought had risen too far too fast.

To give you a few examples:

During the initial dip, I bought a lot more shares of LHV, the leading Estonian bank, when it dropped 20%+ in just a few days. It quickly recovered and even surpassed its previous level, which led me to trim my position.

LHV recovers rapidly from the sell-off (Google Finance)

Similarly, I added to my position in position IWG (OTCPK:IWGFF), which is WeWork’s (WE) largest competitor, when it dipped by 10%-plus in a single day. It recovered as if the war had never occurred:

IWG recovers rapidly from the sell-off (Google Finance)

These are just two examples among many others. If the bounce continues, I will likely pull even more capital out of such stocks.

But once you sell the rip, you are faced with another issue:

What do you do with that cash?

It’s tempting to just hold cash during times of uncertainty, but with inflation at 7%-plus, it’s not really an option. The cost is too significant.

Instead of holding cash, I’m reinvesting the proceeds mainly in income-producing real assets like farmland, grocery-anchored strip centers, industrial warehouses, energy pipelines, and apartment communities.

Apartment communities:

Apartment community (Mid-America Apartment)

Source: Mid-America Apartment (MAA)

Farmland:

Farmland (Gladstone Land)

Source: Gladstone Land (LAND)

Energy Pipelines:

Energy pipeline (Enbridge)

Source: Enbridge (ENB)

Today, it’s easier than ever before to invest in them through publicly-listed REITs (VNQ) and MLPs (AMLP) and I see them as a refuge in today’s environment because of four key reasons:

- Immune to the war: Unlike a lot of global companies that are directly affected by the war in Ukraine, most US-based real asset investments are immune to it. McDonald’s (MCD) might lose 10% of its revenue as it closes all its Russian locations, but the owner of an apartment community in Austin isn’t heavily affected as it keeps earning rent check after rent.

- Profit from inflation: Similarly, today, a lot of companies are suffering declining profitability due to the surging inflation. But real asset investments actually benefit from it because it leads to rising property values even as their debt used is slowly inflated away.

- Recession resistant: A lot of companies quickly feel the impact of a recession on their bottom line, but essential real assets are a lot more resilient. Whether we are going through a recession or not, people need a roof over their head, farmland to grow food, a grocery store to buy food, etc. Historically, REITs have enjoyed nearly 2x better downside protection during most recessions.

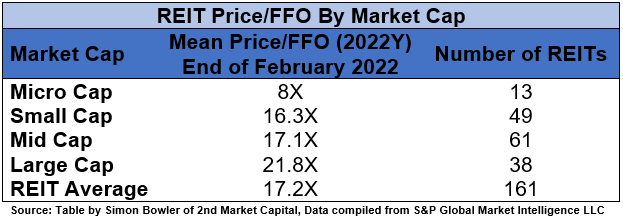

- Discounted Valuations: Today, most REITs are still barely recovering from the 2020 COVID sell-off, even despite substantial real estate appreciation since then. As a result, they are often undervalued relative to the value of the assets they own. Moreover, on a cash flow basis, they are also heavily discounted relative to other stocks. REITs are priced on average at 17x as compared to 25x for regular stocks:

REIT FFO Data by Market Cap (Simon Bowler from 2nd Market Capital)

Take the example of STAG Industrial (STAG). It’s the owner of a diversified portfolio of e-commerce warehouses and Amazon (AMZN) is its biggest tenant.

E-commerce warehouse (STAG Industrial)

Its portfolio is doing better than ever because the pandemic greatly accelerated the growth of e-commerce and also led a lot of companies to bring back portions of their supply chains to the US.

Rents are growing rapidly with new leases being signed at 15%-20% higher rates and the management guided for the rapid growth to continue because there simply isn’t enough new supply of industrial space to meet the growing demand.

In addition to organic growth, STAG is buying and developing new properties to boost its growth. Today, it only has a 20% LTV, which gives it significant buying power if it decided to even slightly increase its leverage.

Priced at 18x cash flow and offering a 3.5% dividend yield, I think that the company offers a great combination of yield, growth, value, and resilience in a highly uncertain world.

I would much rather own this type of investment than most other stocks at this time, and this is why I’m selling the rip in stocks and buying the dip in REITs.

Bottom Line

The S&P 500 is trading very close to its all-time-highs even despite all the uncertainty that we are facing.

I don’t suggest getting out of the market because I don’t believe that it’s possible to consistently profit from timing the market.

However, I think that now could be a good time to trim some positions (sell the rip) in order to accumulate discounted REITs and other real assets (buy the dip).

Be the first to comment