A switch Lari Bat/iStock via Getty Images

A bargain for several reasons

It is no secret that the market cap of Deutsche Telekom (OTCQX:DTEGF) (OTCQX:DTEGY) doesn’t adequately reflect its sum-of-the-parts. In addition to a huge European business, the Germans own almost half of T-Mobile (TMUS), which has a market cap of almost $180B, but their own company is worth less than half of that. What we can therefore get “for free” on top is roughly equivalent to Deutsche Telekom’s European businesses, which have been generating stable free cash flows of ~Euro 4B each and every year for some time.

Keeping this fact in mind, when we observe daily trading of the two stocks, there seems to be no rationality involved. Quite frequently, T-Mobile moves quite aggressively higher or lower, while Deutsche Telekom shows a modest move to the opposite side.

There are a few reasons for this situation, and they are no secrets either:

- Investors are afraid Deutsche Telekom will overspend to buy more T-Mobile shares (which the Germans are clearly committed to).

- Deutsche Telekom investors have seen little benefits of T-Mobile’s enormous successes, since the U.S. company hasn’t paid any dividends so far.

- Will Deutsche Telekom forward cash returns from the U.S. to its shareholders or will it use them to make dumb investments?

- T-Mobile’s massive share buybacks will provide a tailwind to its price, making the stock more attractive versus the German one.

- German investors are struggling to consider Deutsche Telekom as a successful company, given the traumatic experience of the IPO 25 years ago. The company spent 100 million German Marks to market the stock to the general public, and almost 2 million of the generally hyper-cautious Germans forgot their stock market phobia and bought into the IPO. One third of them bought a stock for the first time ever. Subsequently, the stock rose 600%, but when the Internet bubble burst, it lost over 90%. There are research papers showing that those that failed by investing in the Telekom debacle have passed their stock investing phobia on to their children.

- The Euro has lost a lot of value against the U.S. dollar, which makes already struggling European stocks look like even greater losers.

So let’s look deeper into each of these arguments.

Deutsche Telekom will own 51% of T-Mobile soon – without spending a dime

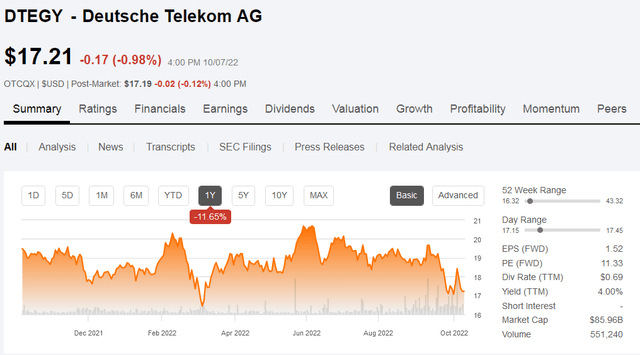

As I write this article, Deutsche Telekom and T-Mobile are trading for $17 and $137, respectively. While the latter is up 12% YoY, the former is down the same amount, thus perfectly illustrating the problem. (Both in USD terms.)

As stated on the last conference call, Deutsche Telekom now owns 48.4% of T-Mobile (~608m out of 1,256m shares) and absolutely wants to get to 51%, which means the Germans still need ~30m shares. While SoftBank (OTCPK:SFTBY) (OTCPK:SFTBF) has the right to receive 49 million newly issued shares from T-Mobile if the share price exceeds $150 on a 30-day VWAP-basis until the end of 2025 (total value ~$7.35B for a dilution of ~4%), thus diluting Deutsche Telekom’s interest, there is an agreement in place that the latter can buy those shares for $101 from Softbank (total value ~$5B). Moreover, Deutsche Telekom owns swaps that effectively give the right to buy T-Mobile shares for $142. Finally, T-Mobile has just announced a robust share buyback program for up to $14B, with up to $3B to be done within the remaining months of 2022 and the rest until September 2023.

This clearly means that no matter what Deutsche Telekom will soon own 51%:

- If T-Mobile won’t trade above $150, the buybacks will do the job, unless the average price paid per share skyrockets to somewhere around $230.

- If the stock moves above $150, Deutsche Telekom will need ~60m more shares to own 51%. However, there is a path to cross 50% ownership which doesn’t even require additional capital. Actually, if Deutsche Telekom buys those 49m shares from Softbank for ~$5B and sells them back to T-Mobile for north of $7.5B within the buyback program, it makes a clean ~$2.5B profit. In addition, T-Mobile shares outstanding come back down to the current level of 1,256m. Finally, the $2.5B profit can be used to buy additional TMUS shares on the open market and get very close to 50% at least, while the remaining buyback program will do the rest for Deutsche Telekom.

Therefore, we can safely conclude that at the end of 2023 at the latest, Deutsche Telekom will own 51% of T-Mobile without spending one dime of its own money.

Deutsche Telekom investors will soon get real cash from T-Mobile

Until 9/2023, T-Mobile will repurchase $14B of its own stock and, as mentioned in the 8K linked earlier, Deutsche Telekom won’t sell into this buyback. This decision is probably best explained by the discussion above: The first portion of the buyback program is designed to get the Germans above 51% no matter what.

But one year from now the majority owner can and will likely sell into the subsequent buyback programs. Nobody is seriously doubting T-Mobile’s enormous future cash generation and their stated intention to return $60B to shareholders over the next few years. The Germans will receive at least 51% of the $46B remaining after the first $14B. In theory, over $23B will end up in Deutsche Telekom’s pockets (less capital gains taxes). When compared to the roughly $3B of dividends the company has paid out in each of the last few years, that’s a massive inflow. Even if – for taxes or because of other reasons – the inflow will be much less than $23B, there can be little doubt Deutsche Telekom will be able to increase its dividend and basically by as much at it wants.

My personal conviction is that once the dividend moves up, the stock will follow suit. Dividend investors have always hated the stingy payouts over the past few years (there was even a dividend reduction in the first year of the pandemic and the dividend has still not reached again the pre-pandemic level), but these had a simple reason: The company could not pay more than what it made in Europe. There was no cash flowing from the U.S. Since the European free cash flow was already fully paid out, no further increases were possible unless there was some help from T-Mobile.

In 2023 this help will come.

Deutsche Telekom has been a smart investor so far

So far, under Tim Höttges’ leadership, Deutsche Telekom has not been a dumb investor. It has refrained from large, value destructive transactions in Europe, while participating in several value enhancing smaller sales (e.g. Romania, Netherlands) or purchases (e.g. Austria), which have improved its market position and scale. The Sprint merger is clearly turning out to be a winner. So, while I get the general skepticism towards telecoms when it comes to capital allocation, Tim Höttges and his team seem to be one of the exceptions.

Why Deutsche Telekom should outperform T-Mobile

If T-Mobile repurchases $15B worth of stock every year, it needs to purchase ~$60m every trading day. At $150/share, that comes down to about 400,000 shares or less than 8% of the average daily trading volume. While not negligible, I doubt this will drive the stock in any significant way.

Moreover, the positive news is now out, the market understands the story and it will be tough for T-Mobile to surprise investors positively. Chances are that the market will soon start to look further into the future and ask for the drivers which could possibly take the stock higher from here.

The positive push from the Sprint merger is largely gone. The nice growth of FWA has settled in – but there is a physical limit to FWA growth (which the market is aware of). If T-Mobile crams its lines with the huge data consumption of mobile broadband customers, its user growth will be over soon.

On the other side of the Atlantic, when it comes to Deutsche Telekom, the market is full of doubts. But a couple of simple dividend increases can do the job. If the company additionally starts to repurchase its own stock using the proceeds from its sales into the TMUS buyback – and I expect this to happen if the discount to its most important asset persists – investors will be euphoric.

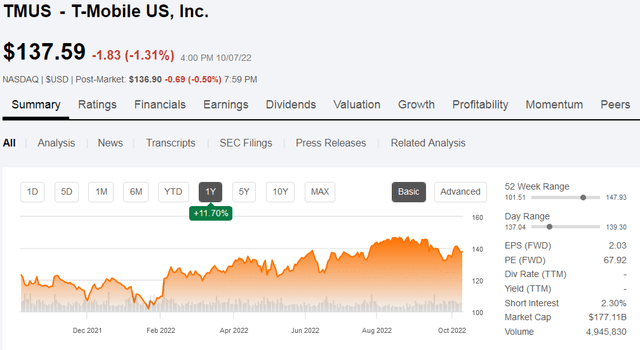

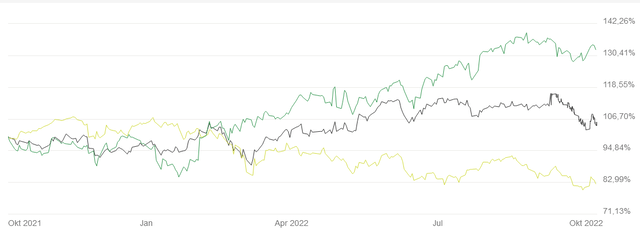

StockCharts allows us to gauge the extent of the irrationality:

The outperformance of TMUS versus DTEGY continues to increase.

For the first months of 2022 I actually owned T-Mobile, but now I have fully switched to Deutsche Telekom. The reason is simple: Since Deutsche Telekom’s European business is doing surprisingly well and the segment’s guidance was raised (in H1/22 adj. EBITDA grew 4.4% organically YoY, FCF was up 21% YoY), I don’t see why it should drastically underperform its most important asset.

Consensus expects Deutsche Telekom’s European assets to deliver an average FCF of Euro 4B over the next few years. Put a 13x multiple on that and the ex-TMUS segment is worth Euro 52B. (At the current exchange rate that is a bit more in USD.) In addition, there are almost $90B worth of TMUS stock. That makes roughly $140B, whereas the company trades for just $86B. Even after factoring in a conglomerate discount of 10%, the discrepancy is still huge.

Seeing is believing

Finally, Deutsche Telekom is likely to rake in, over the next three years, about Euro 12B of FCF in Europe and some ~Euro 30B of cash returns from T-Mobile, which in total makes almost 50% of its market cap. Such a huge cash inflow will have consequences. While the U.S. business is valued roughly according to its expected FCF generation, this is not the case for the German owner: T-Mobile trades for ~10x consensus FCF(2025), while Deutsche Telekom trades for just 6.7x its proportionate share of FCF(2025e).

As I said, the key difference versus past years is that from now onwards there will be cash flowing across the Atlantic and Deutsche Telekom shareholders will finally get their hands on some of it. Seeing is believing.

A dividend of Euro 0.91 (consensus 2025e) would be easy to finance and would just cost a little more than the projected European FCF in 2025. Therefore, I personally expect a higher dividend in 2025 of at least Euro 1. And with such a dividend, the stock should not trade below Euro 25, bringing the total return from today to ~50%. I think this is a safe bet and not too shabby for risk-averse investors in the current environment.

Deutsche Telekom is down with Europe, but actually depends a lot on the U.S.

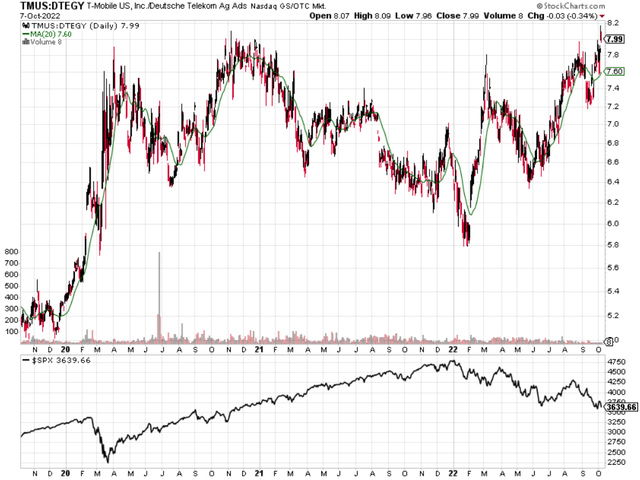

The following chart compares Deutsche Telekom in Euro against the EURO STOXX 50 in yellow and the EUR/USD exchange rate in green.

As can be clearly seen, the EURO STOXX is down with the Euro, given reduced attractiveness of European stocks after the beginning of the Ukraine invasion. In contrast, Deutsche Telekom has outperformed the index and is up modestly versus one year ago.

This is due to its large exposure to U.S. assets, but if we compare it to TMUS in Euros (in green), we can still see that the weak home market (EURO STOXX in yellow) weighs on it:

For U.S. investors this means that through Deutsche Telekom they can gain exposure to U.S. assets which are irrationally punished because included in a European stock.

If the Euro recovers, these U.S. assets will be worth less in Euro terms, but the stock will still do great as it will shrug off the general pessimism versus Europe and rise together with the Euro in U.S. dollar terms.

If the Euro weakens further, Deutsche Telekom should – at least over time – reflect the ownership of its U.S. assets and large dollar inflows, which would be worth more in Euro terms, helping the stock to continue its outperformance over the EURO STOXX.

But even for European investors the stock is interesting since it is somewhat hedged: Its future dollar denominated cash inflows should be worth more now as the Euro is down. If the Euro falls further, it will be a good feeling to indirectly own assets across the Atlantic. If the Euro recovers, all ships will rise in Europe, including Deutsche Telekom, whose European assets should at that point enjoy a higher valuation.

Be the first to comment