Michael M. Santiago/Getty Images News

Over this year, investors experienced a mind-blowing decrease in stock prices. The bear’s curse touched every automaker irrespective of its moat, size, and business model. The highly innovative Arrival (ARVL) plummeted by over 90% since it went public, and the most traditional Ford (F) decreased by 45% year-to-date. To understand which shares are dead and which ones will revive, I have started analyzing automobile companies one at a time. Today, I would like to talk about Rivian (NASDAQ:RIVN) and its four shaky pillars: demand, production, profitability, and cash generation.

In November 2021, Rivian went public via an IPO, distinguishing itself from an array of other start-up listings via SPAC. Investors discouraged by falling SPAC valuations praised such a step with a generous $83 billion valuation. The presence of such credible names as Amazon (AMZN) and Ford among early-bird shareholders further supported Wall Street’s interest.

Since then, the share price has decreased by 74%. Despite the already battered valuation, I still believe that the stock will decline further. Rivian did not manage to use its first-mover advantage and capture a share in the unchartered market. Recent manufacturing issues set Rivian back in terms of scale and profitability. Its high-cash reserves are melting at dangerous speeds and will not be sufficient to finance Rivian before it reaches a positive cash generation. I believe the current valuation does not factor in all the challenges the company faces.

Demand

Rivian’s IPO took place when it was unclear how fast traditional auto producers would fire up their electric engines. The US EV market was dominated by Tesla Model 3 and Model Y, and no electric pickups were available. Rivian’s position as the only producer of electric pickup trucks and SUVs lured Wall Street. A 100,000 order backlog from Amazon for electric trucks amplified investors’ confidence in the stock’s success. Since then, several challenges have appeared: enter F-150 Lightning, General Motors’s (GM) electric Hummer and Tesla’s (TSLA) Cybertruck, reportedly coming in 2023.

Initial pre-orders for F-150 Lightning achieved 44,000 within 48 hours. Demand was so high that Ford stopped accepting orders. The existing 200,000 bookings cover production capacity over the next three years (15,000 vehicles to be produced in 2022, 55,000 in 2023, and 80,000 in 2024). Ford cannot expand its productions quicker due to remaining supply-chain issues.

To be clear, F-150, “a working horse”, is not a direct competitor to Rivian’s R1T and R1S (click on the links if you want to see these beasts), which are positioned as premium vehicles for adventurous trips. You can also observe the difference in the prices: F-150 starts from $40,000, while the basic version of R1T can be bought for $79,500. Let alone an option to add a built-in kitchen as in the picture on the top for five grand. However, F-150 potentially competes with Rivian for EV consumers as 75% of its orders come from non-Ford owners.

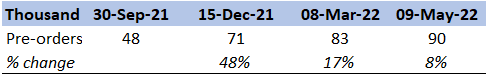

Demand for R1T also exceeded the production capacity, and the waiting times are over one year. But the backlog of orders cannot justify the stock’s rich valuation. Rivian’s IPO sparked broad media coverage promoting the R1 model across the general public. The initial demand jumped by about 50% over almost three months and reached 71,000 pre-orders in mid-December 2021. However, demand growth slowed down over the following months and increased only by 8% from March to May. This is some concerning dynamic. Furthermore, I believe the pre-order backlog will start decreasing in the second year-half. Let me show you why.

Author’s estimate, Rivian’s data

Demand growth is recorded on a net basis. It means that the backlog figures are adjusted for the churn (orders are non-binding) and fulfilled orders (produced vehicles). As of 9 May, Rivian produced only 5 thousand vehicle, but it has accelerated its roll-out to 250-350 units per week (three times higher than at the beginning of the year). Overall, Rivian targets to produce 25,000 cars this year and 50 thousand the following year. Assuming the current demand trends will prevail over the next quarters, the backlog may start decreasing soon due to increasing vehicle production. I firmly believe it will be a negative catalyst for the share price. The perception of Rivian as a growth stock can be essentially spoiled. Although the order backlog remains sufficient for the next year and is supported by 100 thousand van orders from Amazon, it remains below Ford levels despite similar production capacity. Let’s keep this point in mind. We will need it when we look at the valuation.

Before proceeding with the production analysis, I would like to consider one more risk on the demand side. Some meteorologists, such as JPMorgan Chase CEO Jamie Dimon, call it “that hurricane down the road” some economists prefer the term “recession”, and I will call it an “economic downturn”. Let me briefly illustrate what can happen with the car demand if consumers decide to save some money for hard times.

It is relatively easy for a consumer to postpone the decision to buy a car. Automakers sell roughly 15-17 million vehicles annually in the USA. Considering 127 million households in the USA, an average family buys a car every 7.5 years. Hence, if the decision is postponed only by one year, the car market decreases to 15 million cars (12% decline). As R1 models are premium cars, the negative effect from demand contraction can be even stronger for Rivian. In case of an economic downturn, the Elon Mask’s mantra “Our issue is not demand, it is production” may become irrelevant for Rivian.

Production

According to Rivian, supply chain issues hampered its vehicle roll-out and led to the 2022 downward guidance revision from the initial 50 thousand vehicles to 25 thousand. Indeed, supply chain issues played an important role in production delays. However, I suspect that the reason may lie in Rivian’s manufacturing inefficiencies. Plus, I am confident that Rivian will be short of a 2026 consensus revenue estimate. Let me show you how I have come to such conclusions.

Rivian manufactured 2,500 cars in the first quarter and increased the vehicle roll-out by three times compared with the beginning of the year. Despite some supply-side shortcomings, Rivian is expected to produce over 4,000 cars in the second quarter (310 vehicles per week times 13 weeks). It leads to 6,500-7,000 cars in the first half-year and means that production acceleration is required in the second half-year to meet the 25,000 annual production target. Assuming the current roll-out, Rivian will be able to produce only 8,500 at maximum in the second half-year (out of 18,000 required). Potentially, the factory in Normal will be needed to operate in two shifts to achieve it. Analysts tried to address the issue at the recent earnings call but received only a very vague answer:

Question:

And based on the fact that it looks like you will be adding a second shift midyear, does that imply that you are assuming all the supply constraints should get resolved by midyear, by June, as you add the second shift there?

Answer:

Yes. Our production lines are capable of producing at a significantly higher rate than what our supply chain is able to support today, as you said. But the guidance we provided fully encapsulates our expectations and confidence around the supply chain.

Indeed, the idle time a vehicle spent waiting on the component to arrive leads to significant inefficiencies across the factory floor. It leads to operating bottlenecks and longer working hours. In one of my previous articles – “A recession would make Proterra (PTRA) a buy” – I described how many extra hours are needed to compensate for logistics delays. Still, it is surprising that a factory with 150,000 production capacity may need a second shift to produce 25,000 vehicles. If this is the case, it will suggest to me that there are significant manufacturing issues: halted production lines, the wrong calibration of manufacturing tools, a high scrap rate, improper inventory building, and so on. From an accounting point of view, this means very high Capex (especially maintenance Capex) for expensive production units that cannot be used to their full efficiency. This, of course, has an impact on the free cash flows and further intensifies the cash burn problem.

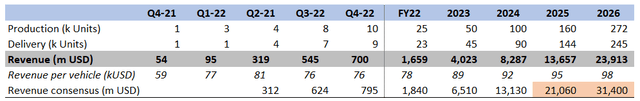

In my long-term projections, I assume 50,000 vehicles to be produced in 2023, in line with the management’s projections. A set-up of the second factory in 2025 in Georgia will lead to an accelerated vehicle roll-out over 2025-26. The Georgia factory is expected to produce the 2nd generation of electric cars with up to 200,000 vehicle capacity. Initially, it was planned to open the factory in 2024, but it was postponed to 2025.

Before we come to revenue estimates, let me walk you through pricing assumptions. The recent 17% price increase will affect pricing only for cars delivered in 2023. Therefore, 2022 prices will be roughly in line with the prices observed in the first quarter. Some changed pricing may come from a higher weight of trucks in the revenue mix. But no truck prices have been disclosed so far, and it is not easy to estimate them. On the one side, Ford’s electric van (E-Transit) is a bit more expensive than its pickup (F-150). On the other side, Rivian has an exclusive order with Amazon and is not allowed to sell its trucks to other customers for several years. I believe Amazon can benefit greatly from such exclusive terms, and its early-stage support for Rivian can be rewarded by attractive pricing.

Based on my analysis, I get ~245,000 deliveries in 2026 and an average price of about $100,000 per vehicle. It results in $24 billion in revenue, 1/3 below revenue consensus. Hence, the current stock price does not factor in future earnings correctly.

Author’s estimate, Rivian’s data

Profitability

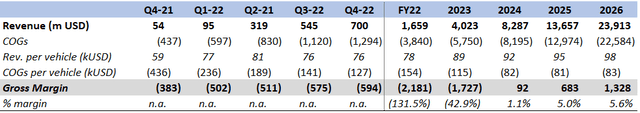

When I looked at the 2022 first-quarter numbers, I was shocked by the scale of losses. On gross margin, Rivian lost $500 million, meaning that it cost $240,000 (!) to produce a vehicle. Such high charges are driven by very low output numbers. Currently, the factory stays basically empty, but the fixed costs still need to be paid in full.

Profitability is expected to increase; however, the path to solid margins may take a lot of time. By the year-end, only ~20% of the factory is expected to be utilized. Such a low utilization will not allow to achieve profits. Based on communicated expectations of $4.5 billion negative EBITDA over an entire year, I expect ~$2.5 billion negative gross margin in 2022.

Rivian did not communicate when it expects to achieve positive gross margins. But I estimated it based on a comparison with Ford, which anticipates positive margins from electric vehicles closer to 2026. Ford’s issues are driven by the fact that they adapted combustion engine vehicles to electric batteries. They did not build electric vehicles from scratch as Rivian did. On top of it, R1 models are positioned in the premium segment with a potential for higher gross margins. Therefore, I expect low-single-digit margins already by 2024, followed by some profitability increases in 2025. 2026 margin can be negatively affected by the ramp-up of the new factory in Georgia; hence, I see 2026 margins at similar levels.

Author’s estimate, Rivian’s data

Cash Generation

Based on cash flow projections, I believe Rivian will need to raise additional cash in 2025. Otherwise, its plans to produce the 2nd generation vehicles are endangered. Or, as Elon Musk would put it:

Unless something changes significantly with Rivian and Lucid (LCID), they will both go bankrupt. They are tracking toward bankruptcy.

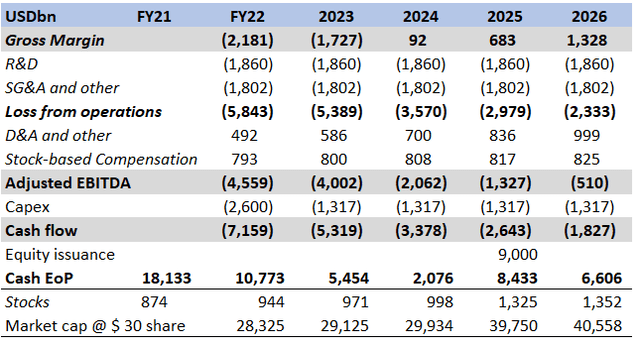

Rivian secured plenty of cash at the IPO and had an ~$18 billion cash buffer at the end of 2021. Unfortunately, the 2022 negative cash flow will decrease the cash position by $7.2 billion due to highly negative EBITDA and vast Capex spending. As the section above explains, I expect a positive Gross Margin in 2024. But even conservatively assumed flat R&D and SG&A expenses result in positive EBITDA not earlier than in 2026. High Capex for the factory in Georgia puts extra pressure on the cash flow generation. Factory roll-out requires about $5 billion, out of which $1.5 billion are to be subsidized. As management underlined in the earnings call:

We have a high level of flexibility regarding the cadence of our growth investments.

I assume that only 70% of Capex will be spent over the next three years, and only part of 200,000 new production lines will be launched in 2025. Still, even such conservative assumptions lead to negative cash in 2025 if there is no raise in equity.

In addition, I believe that equity will be diluted by stock-based compensation to attract key employees. Stock-based compensation, in essence, is a salary paid to the employees by shareholders. It would be similar if Rivian would issue stocks every year and pay raised cash to its employees. The booking of stock-based compensation is a very complex matter. Therefore I applied a simplistic model that provides a reasonable estimate. I divide compensation expense by the recent share price of 30 dollars and get the number of stocks to be issued. Then I add new stocks to the outstanding shares and update the market capitalization assuming a flat share price.

Under these assumptions, Rivian’s market capitalization increases to $41 billion (compared with the current $28 billion capitalization), assuming no change in share price. This is closer to Ford’s $48 billion market capitalization. Let me show you why I consider Ford’s valuation a good benchmark for Rivian.

Author’s estimate, Rivian’s data

Valuation

During the era of zero interest rates, EV start-ups received astronomic valuations because investors believed the future belonged to them. The recent developments showed that traditional carmakers are solid fighters, and it will not be easy for start-ups to drive them off the scene (let us recall massive Ford’s backlog of 200,000 vehicles for the F-150 alone). Therefore, it was not easy to decide how to value Rivian.

I believe it would be optimal to benchmark Rivian against Ford, an established car juggernaut that is undergoing EV transformation. I have recently written an article – Ford: EV Transformation Kills Business Profitability And Dividend Yield – and I am confident that Ford’s share price is very close to its fair value. Ford’s EV/EBIT ratio is in line with the pre-pandemic levels. The dividend yield is lower than historical values but is insufficient to justify that Ford’s valuation is elevated. Based on my analysis, Ford can generate ~$17 billion in EBITDA per year.

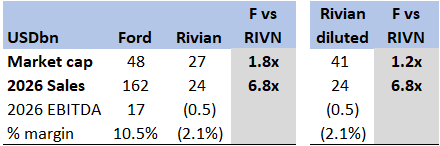

Comparing Rivian with Ford, we see that Ford’s market capitalization is two times higher than Rivian, while its future sales are seven times higher. Plus, Ford’s EBITDA significantly exceeds break-even levels by Rivian. Certainly, Rivian can increase its revenue, as well as its EBITDA, beyond 2026, while Ford’s potential is limited mainly due to its large base. But the future growth comes at a price of shareholding dilution. If we fully consider it, then the market capitalizations will be much closer to each other.

Based on this, I believe that Rivian remains largely overpriced. I agree that its multiples can be higher than Ford’s due to Rivian’s long-term growth potential but not to the current extent. I will not be surprised if Rivian’s stock decreases by 50% from the current levels.

Author’s estimate, Rivian’s data

View Of Rivian Through A Bullish Lens

Bulls might say that the slow vehicle roll-out is driven by supply-chain issues rather than manufacturing ones. The anticipated recession will make semiconductors abundant and allow Rivian to increase production. It would enable Rivian to achieve profitability sooner and will make raise in capital unnecessary.

Some SA authors claim that Rivian’s valuation is low if we adjust it for cash. The logic is the following: Rivian has a ~$18 cash per share, resulting in a ~$9 share price adjusted for cash. It would lead to an adjusted 1.4x sales multiple based on 2023 sales. I consider such an approach flawed because it compares apples with oranges. If you take 2023 sales as a basis, you could potentially adjust equity for 2023 expected cash of $5.5 billion and not 2021 cash position of $18 billion. This would lead to a much higher multiple.

Conclusion

Based on my analysis, I believe Rivian is not a worthy investment at the current price. Its road to profitability has many roadblocks ahead, making the stock unattractive. In addition, high cash reserves are insufficient to finance the future development path. Elon Musk probably exaggerates when he speaks about Rivian’s bankruptcy, but the stock has a high downside potential. It is a clear SELL for me.

Be the first to comment