SL_Photography

Introduction

My main focus at our Conservative Income Portfolio service is to find preferred stocks, baby bonds and traditional bonds that are undervalued relative to similar securities using hard cold facts and not subjective opinion. Buying these undervalued securities greatly increases your odds of beating the market in terms of receiving a higher yield and having more upside price potential.

When one finds a relatively undervalued preferred stock, that means that there are also some relatively overvalued preferred stocks that are very similar in nature. That leads to opportunities to swap out of your overvalued security and into an undervalued security. That is the opportunity that we have here – to buy the best preferred stock of Pebblebrook Hotel Trust (NYSE:PEB) and sell your Hersha Hospitality (NYSE:HT) preferred stocks which are all overvalued.

Market volatility is moving preferred stock prices around quite a bit and each week new opportunities arise to improve your portfolio. In a couple of weeks, there could even be a better bargain in Hotel REIT preferred stocks than PEB preferreds and it will make sense to swap again and further improve your portfolio. In this market, an active investor can really outperform a buy and hold investor.

Pebblebrook Hotel Trust

Company Website

Pebblebrook, like all hotel REITs, owns hotels and has management companies operating these hotels: management companies like Marriott and Hyatt and many other less well known names. PEB is internally managed.

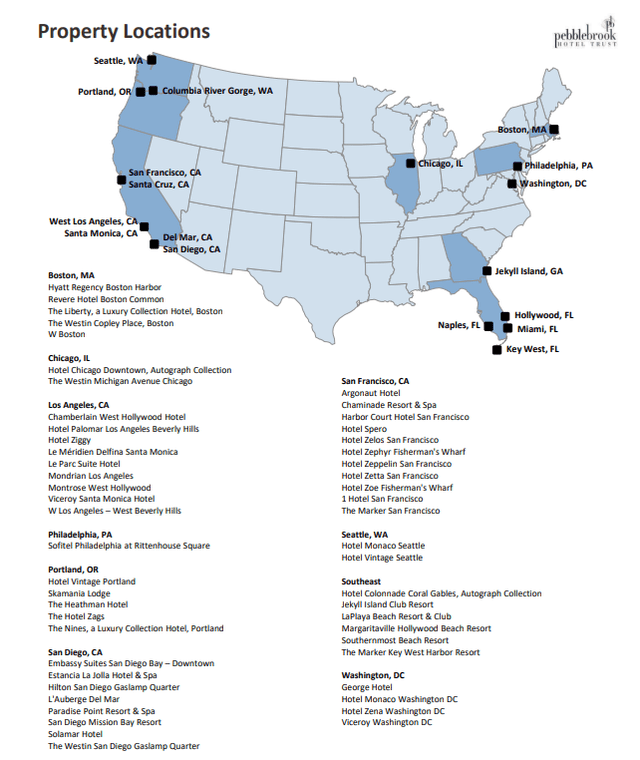

PEB’s focus is on coastal locations with high barriers to entry as well as a few resort properties.

Their hotels are primarily located in what PEB calls “gateway” cities – cities that receive a lot of international traffic as well as U.S. travelers. These cities have historically had very strong real estate markets and have little in the way of undeveloped land making it more difficult for competitors to enter their markets.

PEB offers 4 preferred stocks that are trading in the teens, PEB preferred “E” (NYSE:PEB.PE), PEB preferred “F” (PEB.PF), PEB preferred “G” (PEB.PG) and PEB preferred “H” (PEB.PH). These are all cumulative preferred stocks whose dividends are classified as Section 199A dividends and thus 20% of your dividends are tax free. I will discuss more of the details of these preferred stocks later in the section comparing PEB preferred stocks to HT preferred stocks.

Hersha Hospitality

Investor Presentation

Like PEB, Hersha Hospitality is an internally managed REIT that owns hotels. HT is extremely similar to PEB in that it also owns hotels in “gateway” cities and also operates resorts. In fact, its hotels are also in Boston, Philadelphia, California, and Washington DC with resorts in Florida. So PEB and HT basically have identical business models with hotels in many of the same places.

HT has 3 preferred stocks that can be purchased. Hersha Hospitality Preferred “C” (PEB.PC), HT Preferred “D” (HT.PD) and HT Preferred “E” (NYSE:HT.PE).

The primary difference between PEB and HT are their balance sheets, with HT having more debt/leverage than PEB which has a superior balance sheet. In fact, HT suspended their preferred stock dividends during part of 2020 although they are now whole and paying their preferred stock dividends.

PEB Preferred Stocks Versus HT Preferred Stocks

Author

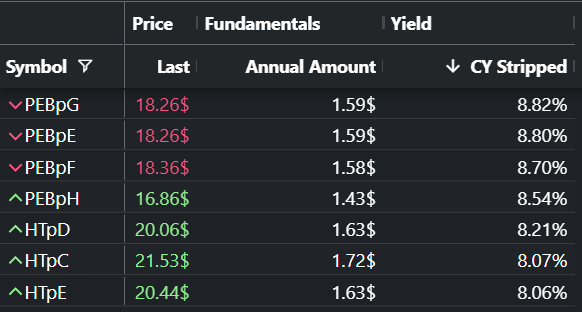

The above chart shows the current price, annual dividend and current stripped yield for each of the HT and PEB preferred stocks. The most important metric is certainly current yield where the PEB preferred stocks trade with an approximate 8.7% yield versus the HT preferred stocks which trade at around an 8.1% yield. Additionally, PEB preferred stocks trade in the mid to high teens while HT preferred stocks trade in the low $20s. This gives PEB preferred stocks the potential for larger capital gains should all of these preferred stocks trade back to $25 where they once traded. Even PEB.PH, the most discounted from par, traded as high as $26 about 14 months ago before the Fed started raising rates. HT.PE has never traded that high so the pricing between HT.PE and PEB.PH is historically greatly in favor of PEB.PH.

Safety Comparison Between HT and PEB

- PEB currently has a market cap of $2,002 million while it has $3853 in liabilities plus preferred stock outstanding. Thus, PEB is leveraged at 1.9 times, liabilities being 1.9 times common equity. HT, on the other hand, has a market cap of $362 million and $1188 million in liabilities plus preferred stock outstanding. So HT is leveraged 3.3 times versus only 1.9 times for PEB.

- In terms of preferred stock coverage, PEB’s market cap covers the value of its preferred stock by 2.7 times. For HT, its market cap covers its outstanding preferred stock by just 1 times. The preferred stock of HT is a much bigger burden to HT than PEB’s preferred stock is to PEB. In fact, HT’s preferred stock is actually slightly more than its market capitalization. That is not a pretty picture.

- Lastly, some investors feel more comfortable with larger cap stocks. If one looks at the market capitalization of PEB versus HT, PEB is 5.5 times larger than HT.

- And as I mentioned earlier, given the higher leverage of HT as well as the fact that its preferred dividend outstanding is a very large relative burden for them, HT felt the need to suspend their preferred dividends for a while when business got bad during COVID. This was not the case for PEB.

Fair Value of HT and PEB Preferred Stocks

Having looked at other hotel REIT preferred stocks and what they yield and also considering the large price upside that PEB preferreds have over other similar preferred stocks, I would say that 8.3% is the current relative fair value yield for PEB preferreds with 8.2% being fair for PEB.PH because it has more long term upside potential. For a reference point, RLJ.PA currently carries a 7.85% current yield.

HT, on the other hand, is the most leveraged hotel REIT among hotel REITs that are currently paying dividends on their preferred stocks. Given where other hotel REIT preferred stocks are trading, 9.0% would seem to be a more appropriate yield for HT preferred stocks. That would mean that HT.PD and HT.PE should trade at more like $18.50 rather than the current $20.25. And HT.PC should trade at $19.50 rather than $21.50. That is where it was trading one month before this way overdone rally in HT preferred stocks occurred. I would recommend that anyone owning any of the HT preferred stocks take advantage of the recent large rally in their preferred stocks to sell their shares and move on to something of better value.

And while HT preferred stocks have had a huge rally over the last month, up a large $2.00, while most other hotel REITs have only rallied slightly, PEB preferred stocks have actually fallen about $0.60. So there has been a huge swing of $2.60 swing in favor of PEB preferred stocks versus HT preferred stocks over the last month. This disconnect provides a great opportunity for those who own HT preferred stocks to sell them and move up in safety, yield and capital gains potential to one of the PEB preferred stocks. The PEB preferred stocks have lagged the rally and are likely to catch up and outperform other hotel REIT preferred stocks. Historically, PEB preferreds have traded at higher prices than HT preferred stocks, so we have a really large mispricing here. I would expect that in the near term for PEB.PE to eventually trade at a higher price than HT.PE.

End of Year Tax Loss Selling

It is not unusual that this time of year people are selling some of their stocks that are down a lot to be able to use those losses for tax purposes. This can keep pressure on the prices of these shares. But come to late December and January, we often see these types of shares outperform and rally as this selling pressure abates, and those that sold for a tax loss, and waited 30 days, can now buy the shares back again.

Thus, I am focused over the next month to locate undervalued and very beaten down preferred stocks.

Summary

For more active investors, like myself, who are always looking to improve their portfolios to generate higher yields and capital gains, this market is providing many opportunities to do so. This is my primary focus in my personal investing and at our Conservative Income Portfolio service. There are some very large mispricings all over the place currently, and although the market has been poor, those who are opportunistic are finding this market quite attractive.

Currently, HT preferred stocks are quite overvalued relative to PEB preferred stocks as well as all other hotel REIT preferred stocks. While HT preferred stocks sell in the low $20’s with an 8.1% yield, PEB preferred stocks sell in the teens with an 8.7% yield despite PEB having a much better balance sheet. I would say that the HT preferred stocks are about $2.00 per share overpriced and should be sold here.

HT preferred stocks rallied over the last month by $2.00 per share while PEB preferred stocks fell around $0.60. That is a massive price swing in the preferred stock world. There is no fundamental reason for this as these 2 companies are operationally extremely similar. Personally, I like to find laggards that are lagging for no fundamental reason. With PEB preferred stocks we have that.

The end of tax loss selling could be particularly good for the PEB preferred stocks which have sold off more than other hotel REIT preferred stocks. I would not be surprised at all to see them rally over the coming weeks.

Be the first to comment