FG Trade/E+ via Getty Images

These days, there are numerous ways to invest in the medical industry. Perhaps one of the most interesting, to me at least, is to buy into companies that focus on the operation of medical facilities. One player in this market that investors should be aware of is Select Medical Holdings (NYSE:SEM). Over the past few years, management has done well to consistently grow the enterprise. This is true of not only its top line, but also its bottom line. Cash flows for the company are also robust and shares are trading cheap on both an absolute basis and relative to similar firms. In all, so long as management can keep leverage in check, the business seems to offer attractive prospects for long-term, value-oriented investors.

Taking care of your portfolio

One great thing about the medical space is that it offers an opportunity that not all industries do. That is to do good and doing well at the same time. You get to buy into companies that are taking care of people and, if fortunes play out well, your portfolio gets taken care of as well. And these days, very few companies are doing as much good as Select Medical Holdings. You see, at present, the company serves as one of the largest operators of critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and occupational health centers in the US. The business has operations in 46 states, as well as the District of Columbia. This is accomplished through the operation of 104 critical illness recovery hospitals in 28 states, 30 rehabilitation hospitals in 12 states, and 1,881 outpatient rehabilitation clinics across 38 states as well as the District of Columbia. On top of this, the company also has 518 occupational health centers spread across 41 states. And it provides contract services at employer worksites.

Operationally, Select Medical Holdings has four different segments. The largest of these is the Critical Illness Recovery Hospital segment through which the company employs medical professionals and other staff to offer specialized care for patients suffering from complex medical conditions like infectious diseases, heart failure, and more. This particular segment made up 36% of the company’s overall revenue during the firm’s 2021 fiscal year. And of this revenue, 49% came from Medicare reimbursements. The next segment the company has is the Rehabilitation Hospital segment. According to management, this set of operations focuses on specialized inpatient care, primarily focused around highly acute patients and patients with debilitating injuries and rehabilitation needs. This also includes critical illness recovery care. During the company’s 2021 fiscal year, this segment made up 14% of the company’s overall revenue.

Next in line, we have the Outpatient Rehabilitation segment. This set of operations is focused on providing physical, occupational, and speech rehabilitation programs and services to its clients. People treated here include those suffering work-related injuries, concussions, or recently rehabilitated from cancer, and more. This segment made up 17% of the company’s overall revenue in 2021. The last segment the company has is called Concentra. Through this, the business acts as the largest provider of occupational health services in the country. Through this segment, the company delivers occupational medicine, consumer health, physical therapy, and wellness services to its clients. It also offers, in some of its locations, urgent care services. 28% of the company’s overall revenue came from this segment last year, with 56% of this stemming from workers’ compensation payments.

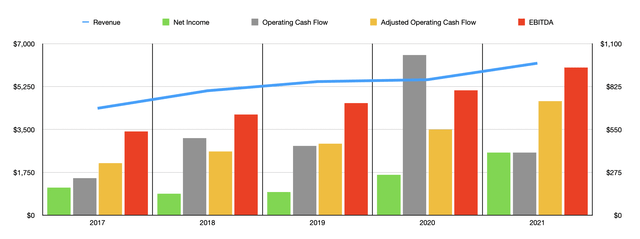

Over the past few years, management has done well to grow the company’s revenue. Each year over the past five years, revenue at the business has expanded, climbing from $4.37 billion in 2017 to $6.21 billion last year. At first glance, some investors may worry about this since surely the COVID-19 pandemic may have had an impact on overall sales. Having said that, this seems unlikely based on management’s current guidance. Despite the pandemic seemingly dying down, revenue in 2022 is forecasted to grow to between $6.25 billion and $6.40 billion. At the midpoint, this implies a year-over-year growth rate of 1.9%. That’s not particularly strong growth, but it’s better than a decline.

As revenue has risen, profitability has risen as well. After seeing net income drop from $177.2 million in 2017, it began a consistent ascent, climbing from $137.8 million in 2018 to $402.2 million in 2021. Naturally, there are other profitability metrics that we should pay attention to as well. One of these is operating cash flow. Unlike net income, however, net profits for the company have been all over the map, ranging from a low point of $238.1 million in 2017 to a high point of $1.03 billion in 2020. In 2021, this figure came in at just $401.2 million. If, however, we adjust for changes in working capital, then the trajectory is much more consistent, climbing from $335 million in 2017 to $731.2 million last year. A similar path could be seen when looking at EBITDA. According to management, this metric grew from $538 million in 2017 to $947.4 million in 2021.

Although management has provided the aforementioned revenue guidance, they have not offered any guidance when it comes to profits or cash flows. The reason behind this relates to the fact that the company does often rely on agency clinical staffing and the recent surge in labor costs have created some uncertainty there. The fact that management mentioned this at all leads me to believe that profits and cash flows might be lower in 2022 than in 2021. Or at least the margins might. But until we have further guidance from the company, this is a purely speculative statement on my part.

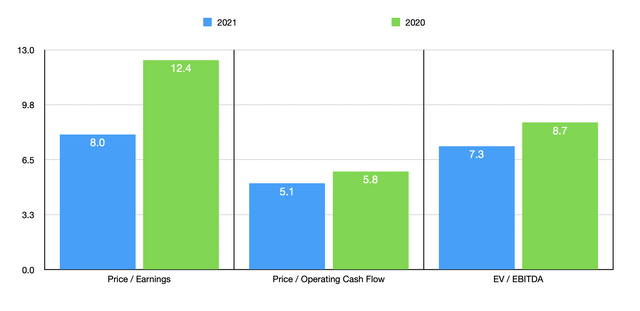

Taking the data that we do have, we can price the business. Using the data provided for its 2021 fiscal year, we can see that the company is currently trading at a price-to-earnings multiple of 8. Even if we assume that financial performance worsens and reverts to what the company achieved in 2020, then the reading would still come in at a respectably low 12.4. The price to adjusted operating cash flow multiple of the company is 5.1, with that number rising to 5.8 if 2022 results more closely mirror what we saw in 2020. Meanwhile, the EV to EBITDA multiple of the company should be 7.3. This compares to the 8.7 that we get if we rely on 2020 figures.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 0.7 to a high of 32. Only one of the five companies was cheaper than Select Medical Holdings. On a price to adjusted operating cash flow basis, the range was from 6 to 80.3. In this case, our prospect was the cheapest of the group. And finally, looking at the picture through the lens of the EV to EBITDA multiple would give us a range of 5.2 to 15.8. In this case, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Select Medical Holdings | 8.0 | 5.1 | 7.3 |

| Sonida Senior Living (SNDA) | 0.7 | 80.3 | 5.2 |

| Universal Health Services (UHS) | 12.2 | 13.7 | 7.9 |

| HCA Healthcare (HCA) | 11.8 | 9.2 | 7.8 |

| Tenet Healthcare (THC) | 10.3 | 6.0 | 6.4 |

| Acadia Healthcare (ACHC) | 32.0 | 16.3 | 15.8 |

Takeaway

Taking all of the data that we have today, it appears to me as though Select Medical Holdings is a quality company that is trading at an attractive price. Management has done well to expand the business in recent years and the overall fundamental condition of the company looks robust. Margins may come under pressure this current fiscal year, but not every year can be a victory for the business. On top of this, leverage for the company is not outrageous, with a net leverage ratio of 3.7. So long as management can keep this under control, the company should end up being an attractive long-term opportunity for value-oriented investors.

Be the first to comment