wundervisuals/E+ via Getty Images

If we look at the stock price of SeaWorld Entertainment, Inc. (NYSE:SEAS) over the last five years, we can see an impressive increase of 311.78%. In 2013, the future did not look quite as bright after the Blackfish documentary’s release and the negative publicity surrounding the care of animals at SeaWorld parks drastically reduced visitation numbers.

Stock Price 5 year trend (SeekingAlpha.com)

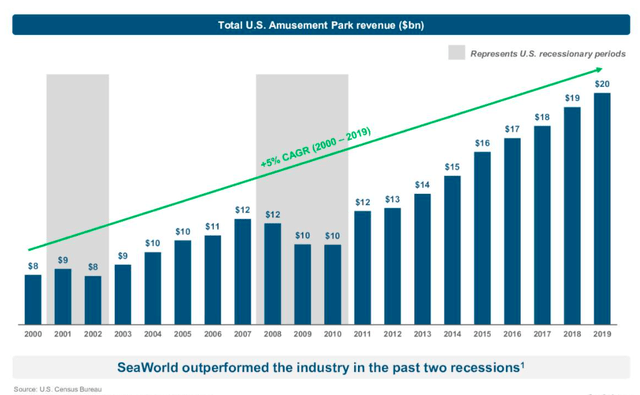

However, since 2017, activist investor and current chairman of the board, Scott Ross, has been a catalyst for significant changes; new management members, cost cutting, heavily investing in upgrading the parks, big data analytics, an advocate to move toward more thrill-based, less live animal animation offerings and making shareholder value a priority. Nonetheless, SEAS has yet to regain pre-COVID-19 numbers of international visitors and group-organized attendance levels. Investments are paying off if we look at the revenue results of this year’s first and second quarters. While attendance is much lower than in 2019, revenue has increased by increasing the in-park per capita spending. The business has shown resilience during previous economic downturns of 2001 and 2008 and revised its brand image at a critical time.

Although investors should be wary of the high long-term debt taken on by SEAS and the immense increase in costs this last quarter, I believe investors may want to take a bullish stance on this company with sturdy fundamentals and more upside potential once fully operational.

Introduction

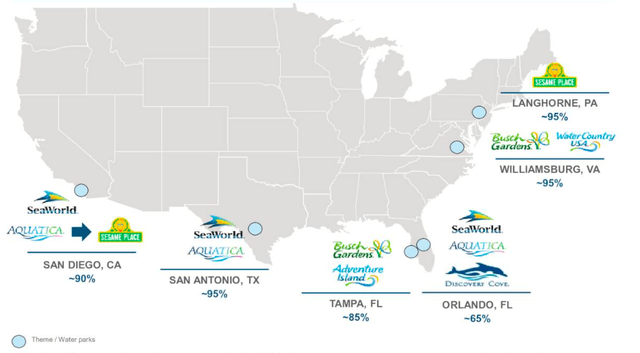

SEAS has a portfolio of twelve parks. The first park opened in 1964 in San Diego. Most customers, on average 85%, drive to the parks.

SEAS Twelve Parks (Investor Presentation 2022)

The company has gone through a much-needed brand change, from a park with animal entertainment to one that promotes the protection of animals. The second quarter results review with the management team included the number of animals helped, 350 for Q2 2022. The change also included cost cutting, investing over $785 million in rides, animal spaces and general park improvements, and a mobile application.

SeaWorld Mobile Application (Seaworld.com)

The mobile application has been downloaded 2.9 million times. The company is seeing an increase of 10% in food and drink purchases compared to direct sales. Roughly one in five parkgoers are engaging through the mobile application. Although the company has not confirmed fixed plans, SEAS is in the early stages of researching potential sites to develop hotels that would complement the parks.

COVID-19 is still impacting the number of international and group-organised visitors. The company has yet to reach its 2008 attendance numbers of 25 million people, 3 million more than what is seen today, with one less park.

Financials And Evaluation

The company shared robust second-quarter results, and top and bottom-line performance improved from the previous quarter. Revenue was in line with expectations at $504.8 million, an increase of 14.8% YoY. It has beat EPS for another consecutive quarter by $0.09 at $1.62. Although better than last quarter, net income was less than Q2 2022 at $116.6 million, a reduction of 8.7%. The reason for this was a 21.1% increase in costs. Attendance increased by 0.5 million guests YoY to 6.3 million. Attendance is lower than in 2019 as international guests have not yet returned to their usual numbers. Adjusted EBITDA hit an all-time high of $234.4 million, an increase of 7.1% YoY.

The company has been successful in increasing in-park per capita spending. There has been a 32.8% increase since 2019. The company has strategically worked on its pricing, improving its product quality and the mix. There are new and enhanced venues, events, and more in-park offerings.

Financially the company is in a solid position to invest in new opportunities and return capital to its shareholders. It has a positive cash flow of $162.9 million. Its leverage is under a ratio of 2.7, and there is available liquidity of $531.1 million, including $160.8 million in cash and equivalents and $370.3 million on credit. Over the last quarter, it has repurchased 7.1 million common stock shares worth $390.1 million. SEAS repurchased 1.5 million shares in Q1 and has just approved a $250 million share repurchase program. It spent $21.4 million this quarter on expansion and investment projects.

We can take confidence in the company’s past performance during recession moments. It outperformed the amusement park industry trends during 2008 and 2002, as seen below in the graph.

Revenue Growth versus recessions (SeaWorld Investor Presentation)

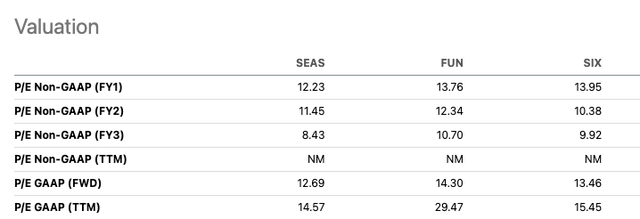

This week Deutsche Bank has given SEAS a Buy recommendation. Various Wall Street analysts are also recommending the stock as a Buy at 4.3. The reason for this is the belief that consumers will continue to spend on outdoor leisure for the rest of the year, and SeaWorld parks have the capacity and seasonal attractions to bring in more consumers, such as the upcoming ever popular Halloween events. If we compare SEAS to its theme park alternatives, Cedar Fair L.P (FUN) and Six Flags Entertainment Corporation (SIX), the 12-month trailing price-to-earnings ratio is much lower at 14.57 compared to its peers. It indicates that the stock may be undervalued. It also has a one-year price target estimate of $72.80 on Yahoo Finance, showing a lot more upside potential.

Relative Valuation amongst Industry Peers (SeekingAlpha.com)

Risks

The company needs to become more efficient in light of the impact of inflation, exceedingly higher wages and operational expenses. This past quarter, costs increased by 21.1% to $33.2 million. Inflation has affected operational fees, especially labour-related costs and operational costs, and chemicals required for maintenance. The company is prone to cyclical supply chain and temporary expenses such as energy and utilities, shipping, food and wage and employee-related costs. The company believes that a lot of the expenses this quarter are quick and unusual and has spoken about better strategies to deal with prices, including a better mix of fixed and part-time staff.

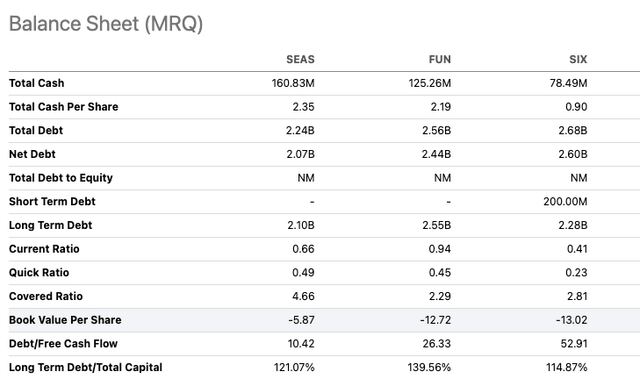

Another risk is SEAS’s high long-term debt of $2.1 billion. The table below shows that it is in a better position than its direct peers. Nevertheless, as an investor, it is essential to know that the company’s liabilities are more significant than its assets. The long-term debt to total capital is very high at 121.07%. It may become an issue if the company cannot generate enough cash to pay back interest and creditors. Looking at SIX and FUN, we can see a similar trend in the industry which may be related to the nature of the business.

Relative Valuation Balance Sheet (SeekingAlpha)

Final Thoughts

SeaWorld has significantly invested in its twelve parks to increase the quality and number of offerings, and management believes that 2 to 3 million additional visitors per year is a realistic possibility. Although attendance is lower than in 2019, revenues have increased significantly with a better price, and quality offerings in-park, in addition to more and enhanced offerings. The parks have the possibility of hosting 30 million people, that’s 8 million more than today. SEAS’ international attendance is still below 50% of pre-COVID-19. Furthermore, group attendance should improve with school field trips, church groups and other company events. On top of that, the ever-popular Halloween events bring in many visitors. Thus, there is a lot more upside potential for this sturdy stock, and why I believe investors may want to take a bullish stance on this company.

Be the first to comment