Spencer Platt/Getty Images News

It looks like the very, very long Sears Holdings (OTCPK:SHLDQ) Ch.11 bankruptcy case may actually be headed to a conclusion after 3 ½ years. On April 6, Judge Drain appointed three mediators to help settle the litigation brought by Sears Holdings against Eddie Lampert, ESL, and others. While the stated focus is on that specific litigation, I think any settlement will be all-inclusive regarding other issues and pending litigation. Sears Holdings shareholders are still not expected to get any recovery and it is still very unlikely that holders of 2lien notes will get anything.

Mediation

Judge Drain is retiring on June 30. The Sears Holdings bankruptcy case and other associated cases have not yet been assigned to a new judge. Under the new local rules, the case will not automatically be assigned to the new White Plains bankruptcy judge. All future bankruptcy cases over $100 million filed in the Southern District of New York will be randomly assigned. So even if you file for Ch.11 in White Plains, you could get a judge in Manhattan – no more “shopping” for a specific judge.

One would expect that Eddie Lampert’s lawyers would immediately file a motion for dismissal of the case against him when a new judge is assigned to the case. In addition, I expect that Judge Drain would prefer not to have this case dropped into the lap of another judge and he would rather have it mostly settled by the time he leaves the bench at the end of June.

The order (docket 270 of the adversarial proceeding Sears Holdings v Lampert No.19-08250) to appoint three mediators was signed on April 6. The three mediators include Judge Chapman, retired Judge Peck, and special mediator Jed Melnick. All are very highly respected. The discussions start within three days and the “Mediation shall conclude no later than May 23, 2022, unless expressly authorized by further order of this Court on notice to the Mediation Parties”. Mediation parties are allowed to make public their own proposals, but they can’t make public proposals by other parties. They also can’t make public the responses by other parties to their proposals according to the order.

The details of the litigation (adversarial docket 01; 110 pages) against Lampert have been covered in prior articles, but basically Sears Holdings is asserting that Lampert and others, such as Bruce Berkowitz, engaged in five “constructive fraudulent transfers”. These transfers were related to Lands’ End (LE), Seritage (SRG) and other assets. No specific dollar amount was mentioned in their “Prayer for Relief”, but the implied total amount is billions of dollars.

Still Too Broke to Exit Ch.11

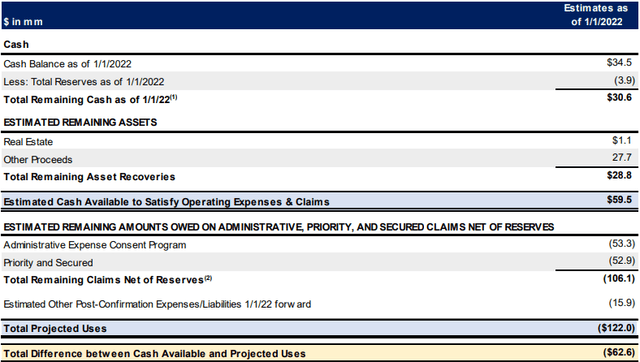

In order for the Ch.11 reorganization plan (docket 5293) that was confirmed by the court in October 2019 to become effective, certain priority and other administrative claims must be paid or the claim holders agree to accept less than their full claim. The latest estimated cash shortage was $62.6 million as of January 1, 2022 (docket 10240). In March, they paid a 4th installment of just over $17 million to certain claims holders. Those holding claims of less than $20,000 were paid in full under the March payment. The cash used reduced their cash balance, but it also reduced the claim amount by the same amount.

Recovery Analysis

Recovery Analysis (restructuring.ra.kroll.com/sears/Home-DocketInfo)

According to Sears Holdings in their status report, “The $62.6mm difference between estimated cash available and projected uses is expected to be covered by proceeds from future preference actions and ESL litigation.” The problem is that their status report from October 2021 (docket 9979) did not show a projection of any additional recoveries from preference actions. It, therefore, seems all the needed money must come from the litigation against Lambert/ESL et al. (Note: Based on various filings, it looks like ESL Partners is liquidating.) They need at least $62.6 million from Lampert et al. The $62.6 million may also be low because there are significant legal fees associated with this mediation process.

Potential Litigation Financing Arrangement

Because Sears Holdings is running out of cash to pay lawyers, they have been considering to get some type of funding from an outside funder willing to give them needed cash in exchange for percent/fixed amount of any future settlement. Reading Akin Gump’s February fee motion (docket 10385), you see the following: “Review correspondence with potential funder”; “Review updates to litigation financing term sheet”; “Review legal research re funding”; “Revise draft litigation funding motion”. There has been no funding motion filed yet and they have only until April 25 to file a motion seeking approval of a “litigation financing arrangement” according to the mediation order.

If there is no settlement via mediation, it looks like Sears Holdings may get outside funding to continue their litigation. Of course, any settlement from future litigation using an outside funder means less recovery for those on the bottom of the recovery priority order because the funder will most likely get a big cut of the money. This ability for Sears to get additional cash is also a powerful bargaining tool against Lampert.

Impact on Investors

Most SHLDQ shareholders accept the reality that they are not getting any recovery under the Ch.11 reorganization plan, even if there is some litigation settlement because there is just too much priority debt and other claims that need to be paid before shareholders get anything.

Holders of 6.625%’18 2lien notes, however, are still hoping for some recovery. This is the reality. Judge Drain ruled that “claims pursuant to section 507b of the Bankruptcy Code is determined to be $0.00” (docket 4740). The Second Circuit ruled against their appeal in 2020. Their second appeal is still pending after oral arguments were heard last fall. A major problem for 2lien noteholders is the Circuit Court could just remand the case back to the bankruptcy court instructing the court to use the procedure requested to be used in the appeal for determining the value of their claim/collateral. This would not really settle the matter without another long delay. Another problem for current holders of 2lien notes is there does not seem to be any market makers for the notes because of the amended 15c2-11 No Action Letter dated December 16, 2021. The holders are stuck with the notes if they can’t directly find a buyer it seems.

While the appeal of the 2lien notes is not directly part of the mediation, it would be, in my opinion, irrational not to include some type of final agreement regarding the 2lien claim in a settlement. If there is a settlement without including the 2lien appeal and there is sufficient cash to pay various claims via mediation settlement, Sears Holdings may declare their Ch.11 reorganization plan effective without any finalization of the 2lien issue.

I am not sure if Eddie Lampert would risk that Sears Holdings would just file a motion to withdraw their Ch.11 without having an effective reorganization plan because he litigated against having the plan being declared effective without a 2lien final settlement. (Yes, this is an option if they are unable to have their Ch.11 reorganization plan become effective.) He needs the plan to become effective in order for him/Transform to have future use of the very large NOLs. Therefore, the risk reward favors letting the plan become effective with or without a 2lien settlement, in my opinion. He might gain something via the 2lien appeal, but that is a token amount compared to the value of the NOLs.

Therefore, at this point, all things considered, it seems that 2lien noteholders are really in bad position in their hope of getting any recovery. There are just too many negatives.

Conclusion

Sears Holdings bankruptcy case has been a downhill three-year process. Almost all stores have now closed after Lampert was allowed to buy them with the approval of Judge Drain. There have been many rulings that I consider very questionable, but part of the problem was there were no 2lien noteholders actively participating in the Ch.11 process.

At this point, Judge Drain wants an end to the case before he retires. His three mediators are experts who should, in my opinion, be able to resolve all the issues and get the Ch.11 reorganization plan on course to be declared effective.

Sears shareholders are so far under water, they should not expect any recovery with or without a settlement via mediation. I think 2lien noteholders will remain under the wheels of the bus even with some all-inclusive settlement. I rate all Sears Holdings securities a strong sell, but actually it is very difficult to even sell them at this point.

Be the first to comment