simarts

Thesis

Credit Suisse Group AG (NYSE:CS) is by far the worst performing bank YTD, as the stock is down some 60% versus a loss of approximately 23% and 21% for the S&P 500 Futures (SPX) and the Financial Select Sector SPDR ETF (XLF), respectively. Given that Credit Suisse is a major international bank, with a relative valuation now close to the lows seen during the financial crisis, is this a dip buying opportunity?

Credit Suisse’s Problems

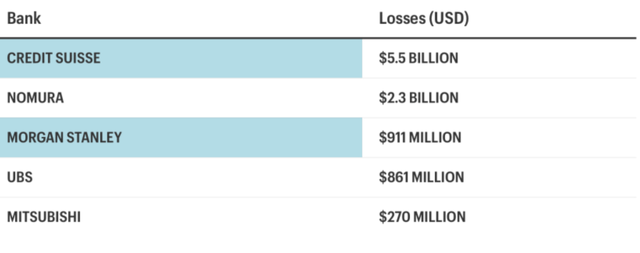

Credit Suisse’s problems with excessive risk taking came into focus about 18 months ago, when the implosion of Archegos Capital caused about $5.5 billion of losses for CS. As compared to Goldman Sachs (GS) and Deutsche Bank (DB), Credit Suisse’s risk management failed to move “first and fast.” Investors took note and concluded that there might be some structural problems with the CS culture of risk-taking/management.

Now, as valuations are falling across asset classes, it appears likely that some of Credit Suisse’s counterparties could be in trouble to meet margin calls, which would expose the bank to losses similarly to what happened following the Archegos blowup.

If accumulating losses on the balance sheet would force CS to raise equity, this would be highly dilutive for investors, given that the market capitalization of the bank has contracted to below $12 billion. Moreover, headwinds are compounded by a frozen market for investment banking transactions, as well as a slowing demand for private wealth management.

Reflecting on the above concerns, the market has become increasingly worried that Credit Suisse’s capital base might be insufficient to protect the bank’s liquidity and solvency. And, in the past few days, rumors circulated — especially on social media platforms — that Credit Suisse might be close to bankruptcy.

On Monday 3rd October, Credit Suisse Credit Default Swaps (a derivative that could be considered as a gauge of a company’s financial health) surged to an all-time high of 500 basis points, levels above the financial crisis. At the same time, CS share price plummeted to all time lows, to as low as $3.72/share.

Thoughts on Credit Suisse’s Solvency

Credit Suisse ended the June quarter 2022 with a common equity tier one ratio of 13.5%, indicating that the Swiss bank should have about SFr37bn of equity capital. Credit Suisse CET 1 ratio is in line with major European Banks, including Deutsche Bank, Barclays, BNP, UBS and HSBC, and about double the ratio that the bank posted before the financial crisis.

Accordingly, absent any accounting shenanigans, and absent any material shock to the bank’s balance sheet (which unfortunately cannot be ruled out at this point), Credit Suisse’s capital position should be fine.

Investors should consider, however, that a bank’s balance sheet can be highly complex and fast-changing. This is due greatly to the transparent nature of structured products, legal claims, and derivatives positions. Accordingly, understanding a Credit Suisse balance sheet exposure can be an impossible task even for the most experienced and skilled analysts.

Cheap Valuation

Credit Suisse stock is trading very cheap with a P/B of only x0.2, which is the lowest amongst the BB investment banks (Deutsche Bank’s P/B is close, though).

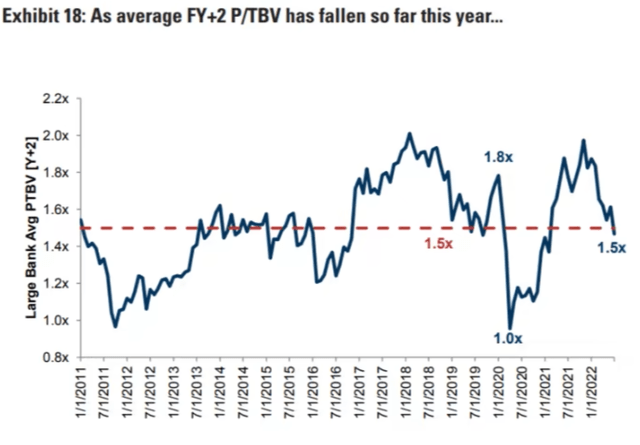

This is a very distressed valuation. According to research by Goldman Sachs, the cyclical low for bank stocks is usually around the x1 P/B multiple, and the historical average is somewhere around x1.5.

Can The Bank Recover?

Given Credit Suisse’s strong CET1 ratio as of June 30, I believe it is unlikely that the bank will default within the near-term future. But given the distressed market environment, I would not be surprised if my thesis is proven wrong.

But even if there is likely no imminent default for Credit Suisse, I doubt that the bank’s stock will recover anytime soon, if ever. Banking is all about confidence and trust. And Credit Suisse has lost it.

In my opinion, the latest negative news environment surrounding Credit Suisse — highlighting poor risk management, scandals, and speculation on an imminent default — will likely scar the bank’s reputation to such a degree that customer assets, employees, and investors will rush to find a different bank. And accordingly, it is in my opinion only a question of time until the bank shrinks itself to match its depressed x0.2 P/B multiple. (Note that this is exactly what happened to Deutsche Bank over the past decade.)

Be the first to comment