Iuliia Korniievych /iStock via Getty Images

Note:

I have previously covered Seanergy Maritime Holdings (NASDAQ:SHIP), so investors should view this as an update to my earlier articles on the company.

On Friday, Greece-based dry bulk shipper Seanergy Maritime Holdings (“Seanergy”) surprised market participants with the decision to establish its own growth vehicle (emphasis added by author):

Seanergy Maritime Holdings Corp. announced today that it intends to effect a spin-off of the Company’s oldest Capesize vessel, the M/V Gloriuship, through a wholly-owned subsidiary. The newly formed subsidiary, United Maritime Corporation (“United”), will act as the holding company for the M/V Gloriuship. United has applied to have its common shares listed on the Nasdaq Capital Market and is expected to adopt a diversified business model, with investments across various maritime sectors. Seanergy is contributing the vessel-owning subsidiary of the M/V Gloriuship to United and intends to distribute all the common shares of United pro rata to the Company’s shareholders of record as of June 28, 2022, which coincides with the previously-announced record date for Seanergy’s cash dividend of $0.025 per share for the first quarter of 2022. The distribution of United common shares is expected to be made on or around July 5, 2022. United common shares are expected to commence trading on a standalone basis on the Nasdaq Capital Market on the first trading day after the date of distribution, under the ticker “USEA”.

Clearly, the company is looking to replicate the success of other recent Greek spin-offs like Imperial Petroleum (IMPP, IMPPP) and OceanPal (OP).

Particularly Imperial Petroleum’s ongoing capital raising efforts have been wildly successful. Since its spin-off from StealthGas (GASS) seven months ago, the company has raised an eye-catching $135 million by relentlessly diluting common equityholders at a fraction of net asset value (“NAV”) per share.

As a result, NAV per share has decreased from an initial $4.57 to an estimated $1.10 today. Assuming full exercise of outstanding in-the-money warrants, net asset value per share would be further reduced to approximately $0.88.

Other Greece- or Cyprus-based shipping companies like DryShips, Top Ships (TOPS), Globus Maritime (GLBS), Performance Shipping (PSHG) and Castor Maritime (CTRM) have employed similar capital raising schemes to grow their companies to the detriment of common shareholders.

United Maritime’s registration statement actually follows the blueprint of OceanPal, a small dry bulk shipper that was spun off from Diana Shipping (DSX) seven months ago.

Just like OceanPal, United Maritime will be controlled by its parent via super-voting Series B Preferred Shares.

And similar to OceanPal, the parent will be receiving dilution-protected Series C Convertible Preferred Shares:

Immediately prior to the Spin-Off, in exchange for the contribution of the United Maritime Predecessor and working capital to us, the Parent will receive all of our issued and outstanding Common Shares and 5,000 of our Series C Convertible Preferred Shares (the “Series C Preferred Shares”), which will have a cumulative preferred dividend accruing at the rate of 6.5% per annum which may be paid in cash or, at our election, in kind, and will contain a liquidation preference equal to their stated value of $1,000 per share and will be convertible into common shares at the holder’s option commencing upon the first anniversary of the original issue date, at a conversion price equal to the lesser of $9.00 and the 10-trading-day trailing VWAP of our common shares, subject to certain anti-dilution and other customary adjustments.

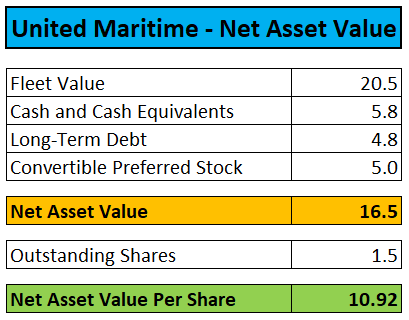

After accounting for $5 million in working capital provided by Seanergy and $4.8 million in vessel debt as well as the newly issued $5.0 million in Series C Convertible Preferred Shares, United Maritime’s initial net asset value per share calculates to approximately $10.92:

Compass Maritime, Company SEC Filings

Seanergy shareholders will receive one United Maritime common share for every 118 shares of Seanergy’s common stock owned. On a NAV basis, the spin off represents a one-time dividend of $0.0925.

Judging by the momentum rallies experienced by both OceanPal and Imperial Petroleum and particularly given the tiny share count of just 1.5 million common shares, I firmly expect United Maritime to be picked up by the momentum crowd right out of the gate which might result in very substantial windfall profits for Seanergy Maritime’s common shareholders.

For example, OceanPal commenced trading on November 30, 2021. Shares opened at $3.56 and continued to spiral higher before peaking at an all-time high of $12.09 later in the session which represented approximately 2.5x NAV at that time.

Assuming United Maritime to exhibit a similar trading pattern and investors being successful in timing their exit, the one-time benefit could be closer to $0.20 per Seanergy Maritime common share.

According to management, Seanergy will replace the Gloriusship with a younger vessel which is likely to be the Mineral Haiku, a 2010-built Capesize carrier which the company reportedly acquired for $34 million six weeks ago.

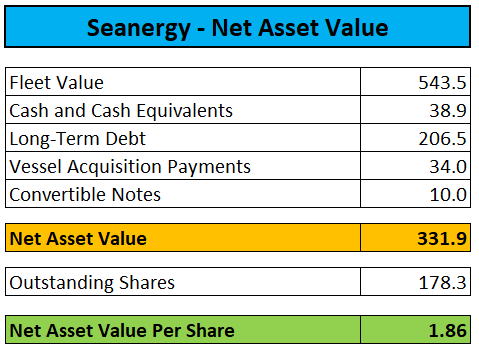

The spin-off will result in Seanergy Maritime’s net asset value per share decreasing slightly to approximately $1.86:

Compass Maritime, Company SEC Filings

Even with increased recession risks, I remain positive on dry bulk shippers for at least the next couple of quarters as I would expect coal and increased iron ore shipments to China to provide ongoing support for charter rates.

At an almost 50% discount to NAV, Seanergy is the cheapest, dividend-paying dry bulk stock at this point.

Bottom Line

To be perfectly honest, I am not happy with management’s decision to fleece unsophisticated retail investors by establishing its own growth vehicle but apparently Imperial Petroleum’s overwhelming success has made the move irresistible.

That said, with the dilution party now happening at the subsidiary level, it is increasingly unlikely that management will employ the same tactics at parent Seanergy Maritime again.

Given the large discount to NAV, decent dividend yield, still robust near- and medium-term business prospects and potentially substantial windfall profits for common shareholders from the proposed United Maritime spin-off, I am reiterating my “strong buy” recommendation for Seanergy Maritime.

Keep in mind that it will be imperative for Seanergy Maritime common shareholders to sell the United Maritime spin-off shares before anticipated dilution commences.

Be the first to comment