Sundry Photography/iStock Editorial via Getty Images

We downgrade Seagate (NASDAQ:STX) to a hold after our earlier buy rating in April. Since we recommend the stock, the demand environment for the company continues to worsen. STX is the “go-to” vendor for large-capacity data storage devices. The company has extensive experience manufacturing large-capacity Hard Disk Drives (HDD) and has increased its laser focus on enterprise and cloud customers.

Our downgrade on STX is based on the belief that the enterprise and cloud demand will decline in the coming quarters, specifically in the back half of the year (4Q22). We believe STX is deeply exposed to and reliant upon cloud data center markets, and upcoming demand headwinds will take their toll on it. We recommend investors wait for better demand dynamics before buying the stock.

STX‘s good days are behind

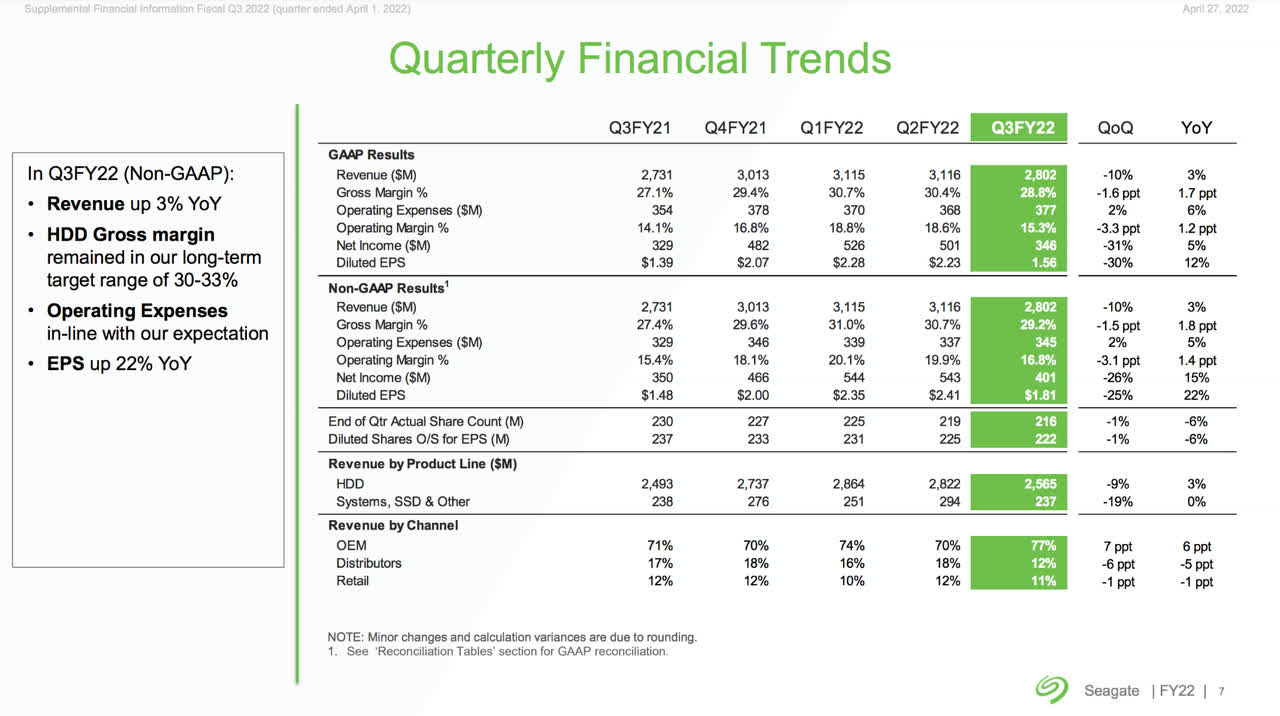

The storage component business, in general, can be divided into Hard Disk Drives (HDDs) and Solid-State Drives (SSDs). The former, HDDs, drive STX’s business. HDDs are devices that store data on spinning disks. Data continues to grow relentlessly, and enterprises and consumers need to store it somewhere for later use. Seagate devices are economical ways to store large amounts of data. The following slide shows STX’s revenue by product line ($M).

Seagate

Over the last few years, the cloud providers (AWS, Azure, GCP, etc.) drove the business for the company. Enterprises are using the public cloud to store some of the on-prem data in the cloud. A lot of data is natively created in the cloud. This data needs to be stored for reuse later. The cloud providers store the data in devices created by Seagate.

At the Bank of America Global Technology Conference last week, the company stated that “company revenue is growing, and the mass capacity is what will create the future opportunity for this business.” STX has placed all its bets on the price-sensitive large capacity market. STX is heavily exposed to cloud storage and will suffer because of the impending demand decline.

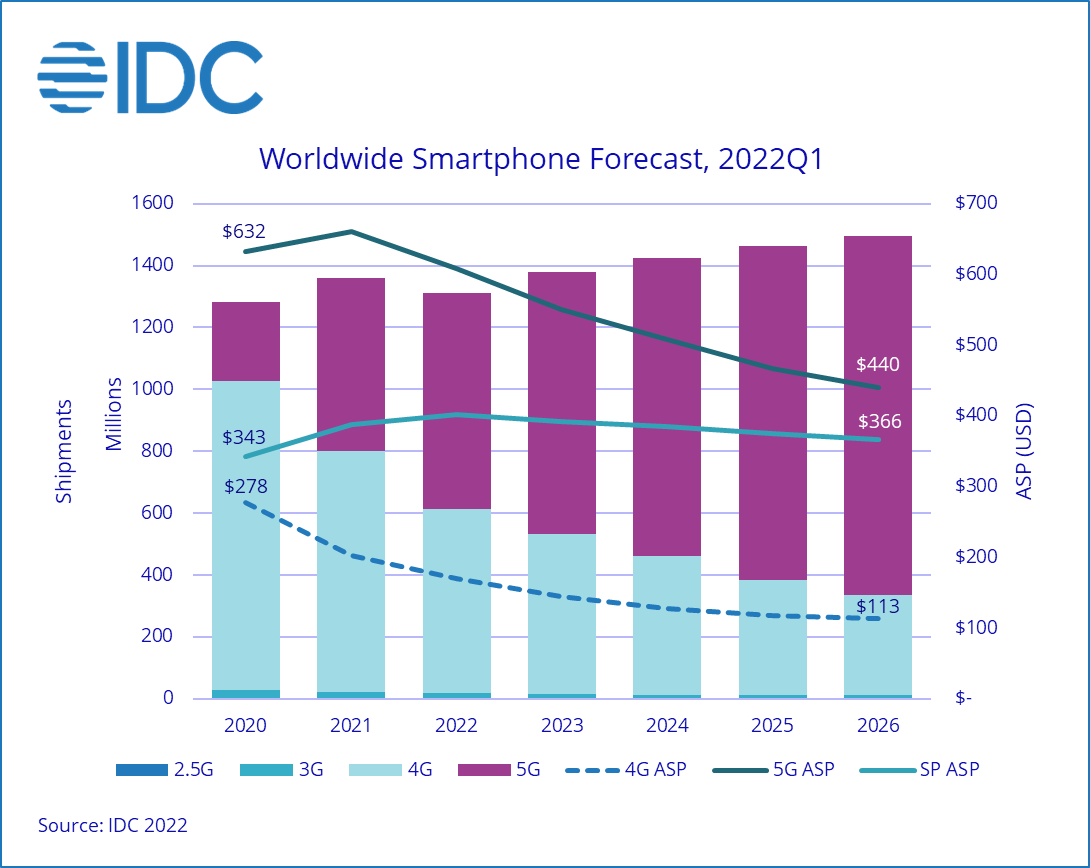

Consumer spending is contracting, and in turn, cloud demand will decline

We believe cloud demand will decline because consumer spending is being cut on PCs and smartphones. Consumer demand surged during the COVID pandemic, as illustrated in the case of smartphones in the IDC graph. We believe that consumer spending is now retracting to pre-COVID levels. We already see declines in worldwide smartphone shipments. According to IDC, worldwide shipments have declined 8.9% year-over-year in 1Q22. The same goes for PCs. Chen Junsheng, chairman of Acer, which competes as the fourth largest PC supplier, reported that the entire PC market has turned over, and the “supply exceeds demand.” With PC and smartphone demand dropping, we believe cloud CAPEX will be cut. In addition, many enterprises will be more prudent in deploying new applications until the demand normalizes. The impending spending weakness and persistent inflationary pressures will reduce CAPEX by enterprises and cloud customers.

IDC

“Other” business cannot sustain growth

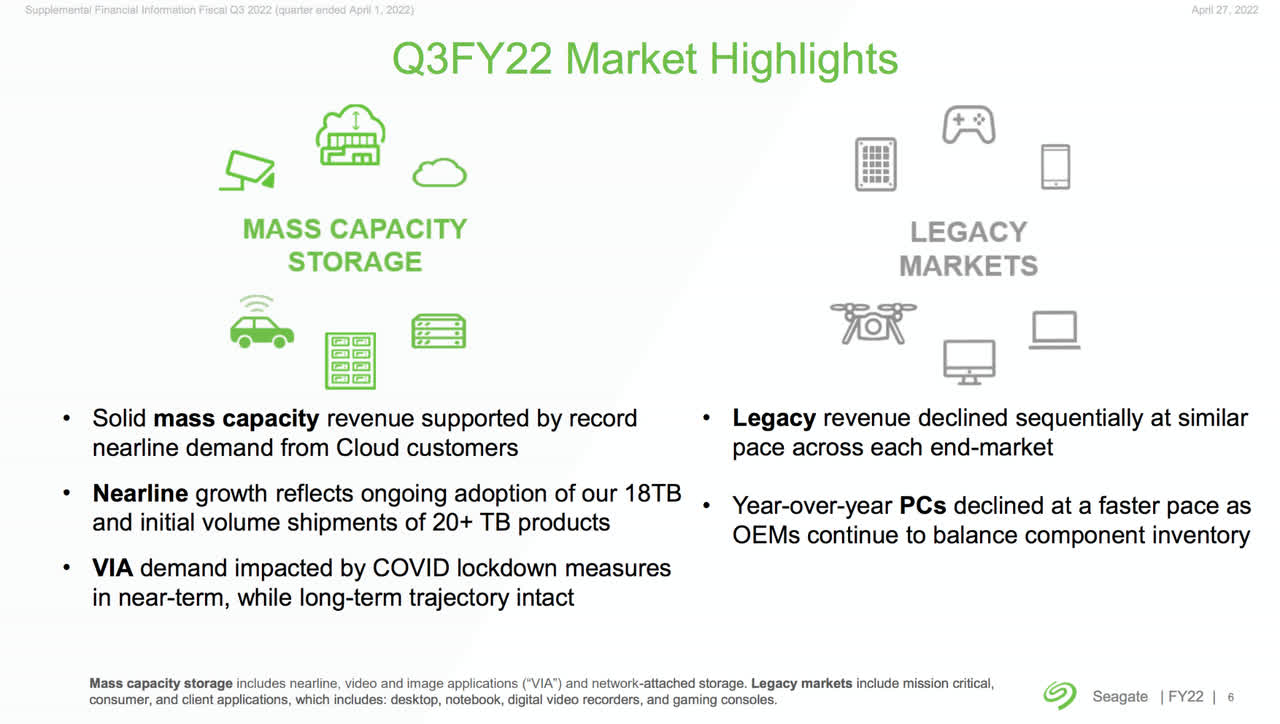

“Other” segments of STX are not strong enough to meaningfully sustain the company’s growth through the coming storm. STX operates in two sectors: mass capacity storage and legacy markets, as shown in the slide. The mass capacity storage sector is the stronger side of STX’s business and is “supported by record nearline demand from cloud customers.” We believe cloud demand will decline and do not believe the company’s legacy markets will be able to compensate for the cloud customers. Legacy markets have been declining for a while now. Gianluca Romano, Seagate’s Executive VP & CFO, said that legacy business used to be 80% of the company’s revenue and is now less than 35% of their HDD revenue. He described the company’s legacy market, saying, “it’s declining and will continue to decline.” We are not optimistic about STX’s prospects without its mass capacity revenue.

Seagate

Valuation

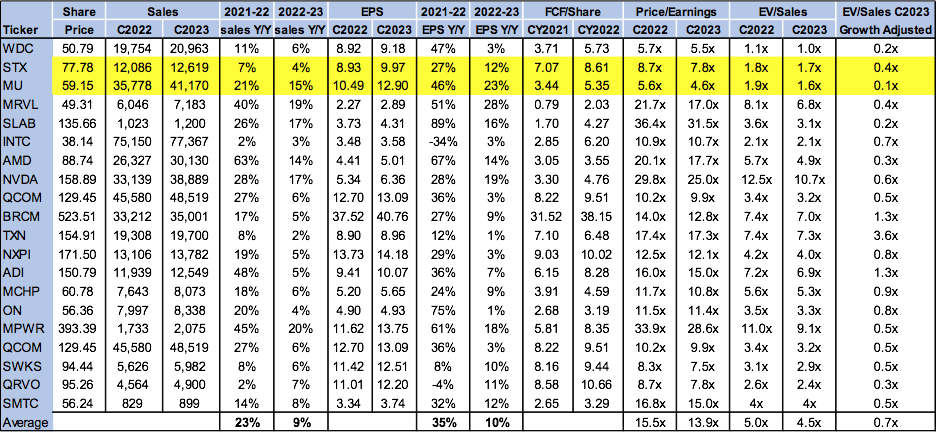

STX is trading at around $78. The stock is cheap. On the P/E basis, STX is trading at 7.8x C2023 EPS of about $10 compared to the semiconductor peer group average of 13.9x. The stock is trading at 1.7x EV/C2023 sales versus the peer group average of 4.5x. We believe the company will face demand headwinds in its cloud markets. While the stock is cheap, we do not expect it to fare well in the next few quarters due to slowing demand. The following table illustrates the semiconductor peer group valuation.

Techstockpros

Word on Wall Street

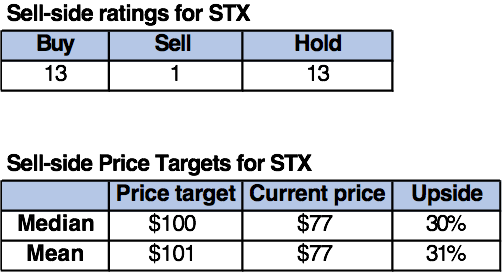

Market consensus is mostly neutral/hold on the stock. Of the 27 analysts, 13 are buy-rated, another 13 are hold-rated, and one analyst is sell-rated. Despite the stock being cheap, analysts seem conflicted on what to do with the stock. Sell-side price targets for STX remain optimistic. STX is trading at $77. The sell-side median price target is $100, and the mean is $101, for an upside of 30-31%. The following chart indicates STX sell-side ratings and price targets.

Techstockpros and Refinitiv

What to do with the stock

Despite STX being cheap on a valuation basis, we recommend investors wait for a better entry point. In the near term, we expect the stock to be under pressure with the impending demand downturn. We expect the demand to slow down in all segments of its business: enterprise, cloud, and consumer. Therefore, we believe STX stock will go lower than current trading levels. We await a better demand environment before we can recommend the stock again.

Be the first to comment