kokkai/iStock Unreleased via Getty Images

This article is contributed by Jun Hao from our Superstocks Seekers team.

Overview

Sea Ltd (NYSE:SE) is an internet platform company that consists of three main business segments – Garena (digital entertainment), Shopee (e-commerce), and SeaMoney (digital financial services).

Well, well.

Sea has suffered yet another relentless 20% drawdown since our last coverage (do read it before you proceed), making it one of the heaviest punished stocks of the year, down 78% from its ATH back in Oct 2021.

We reckon that most of the headwinds have been priced in by the market – the possibility of a recession happening, Shopee’s “poor” unit economics and profitability, and the downward spiral of Garena’s growth. At today’s valuation, the market has written off all of Sea’s accomplishments and it seems like the consensus is that Sea’s management is not capable of coming out of the woods.

Is there truly no way out for Sea to sail out of this, as what the market is implying?

We have taken some time to review and reflect on Sea’s most recent Q1’22 earnings call, both good and bad.

So, let’s dive right into it.

Garena

(Source: Sea IR)

A quick background is that Free Fire (“FF”) is a self-developed Battle Royale game, and it currently makes up most of Garena’s bookings.

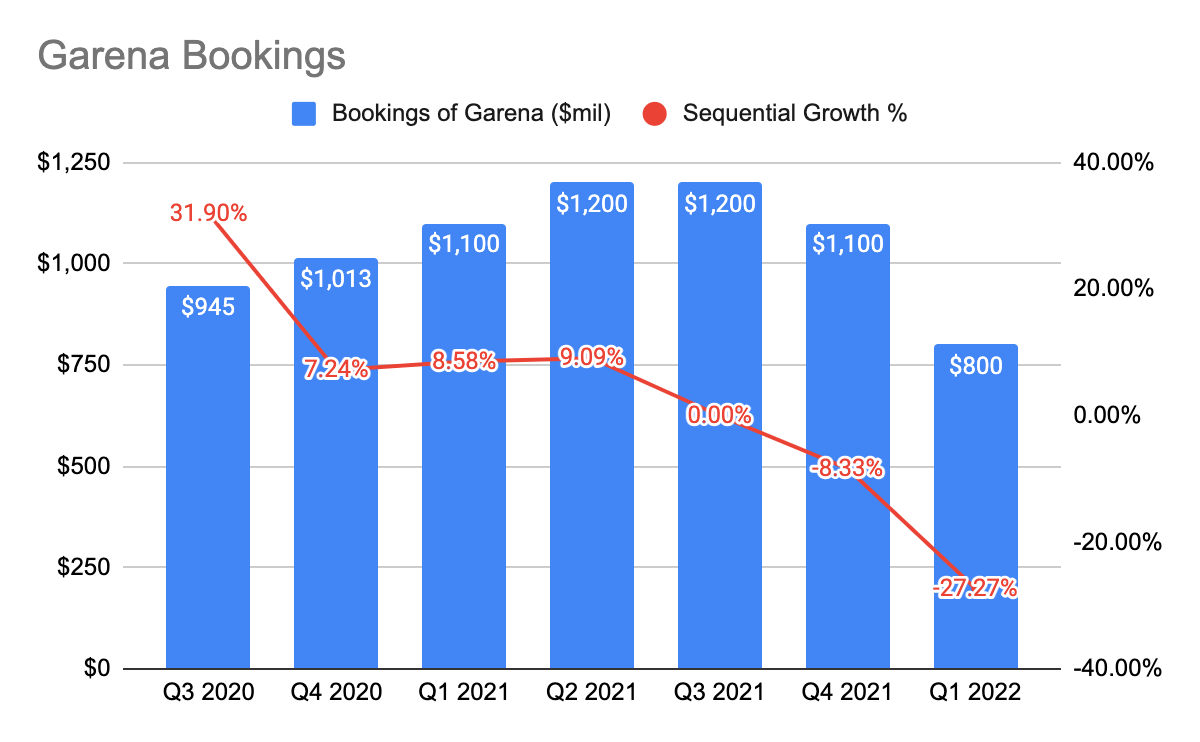

Garena’s result was no surprise as FF’s bookings fell 28% sequentially from Q4’21 to Q1’22. This is a result of the quicker than expected return to normalization as more people are heading outside and spending lesser time on mobile gaming.

(Source: Sea IR)

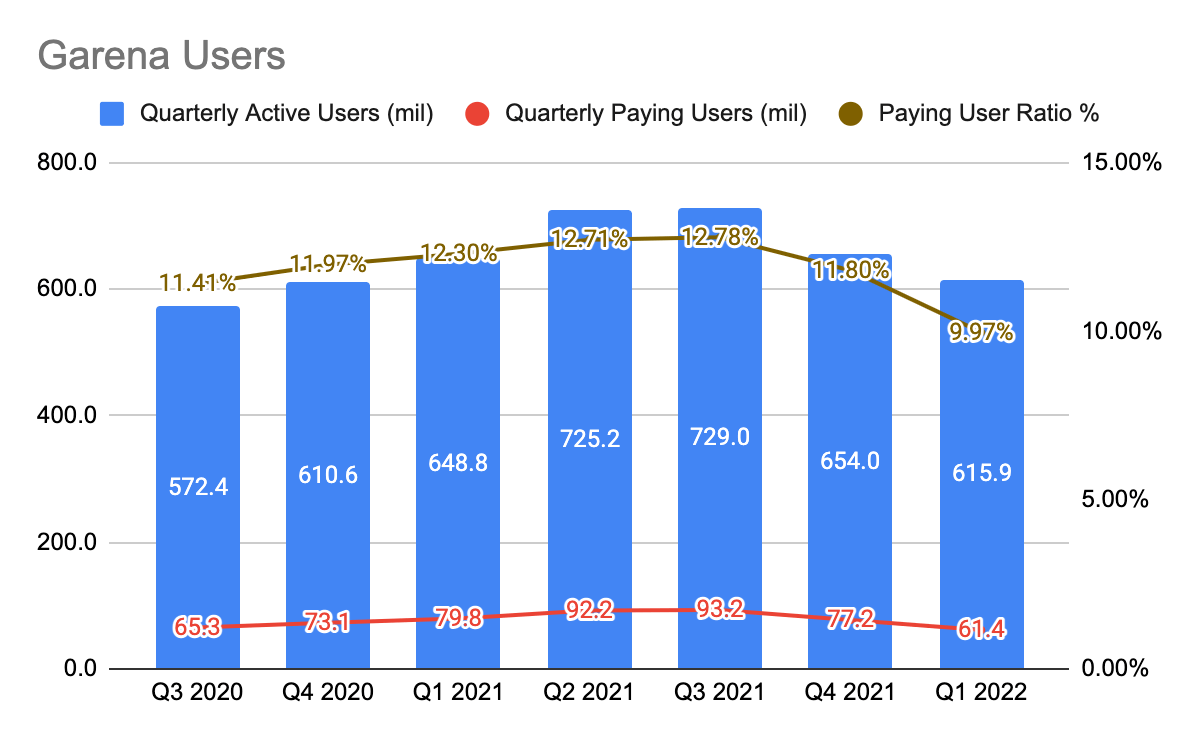

Its Quarterly Active Users (“QAU”) fell by 6% sequentially to 615.9 million users while the Quarterly Paying Users (“QPU”) fell by 26% to 61.4 million users. This led to a lower Paying User Ratio of 9.97% in Q1’22.

This means that not only are there fewer users playing games coming out of Covid but there are also fewer users spending money on the game. It is difficult to know the extent how which the easing of Covid restriction could further impact users’ playtime, and we may continue to experience further slowdown from FY23 and beyond.

(Source: Sea IR)

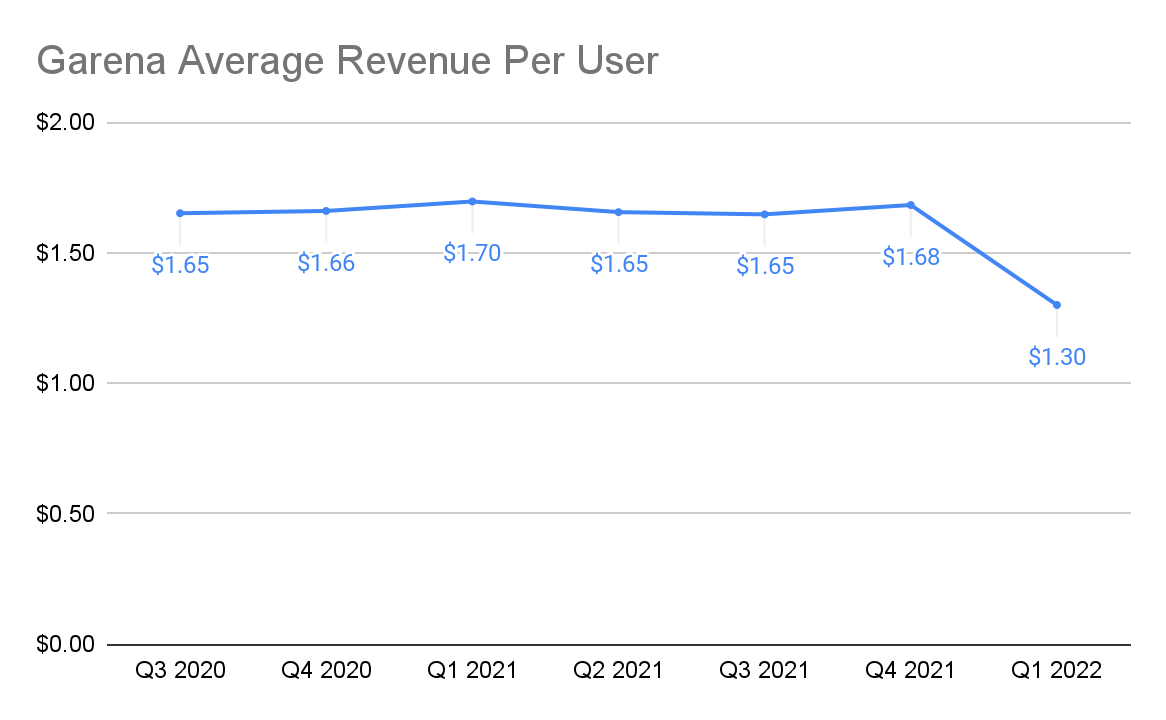

This resulted in an overall lower Average Revenue Per User (“ARPU”) as it fell from $1.68 in Q4’21 to $1.30 in the quarter, indicating a 29% sequential decline.

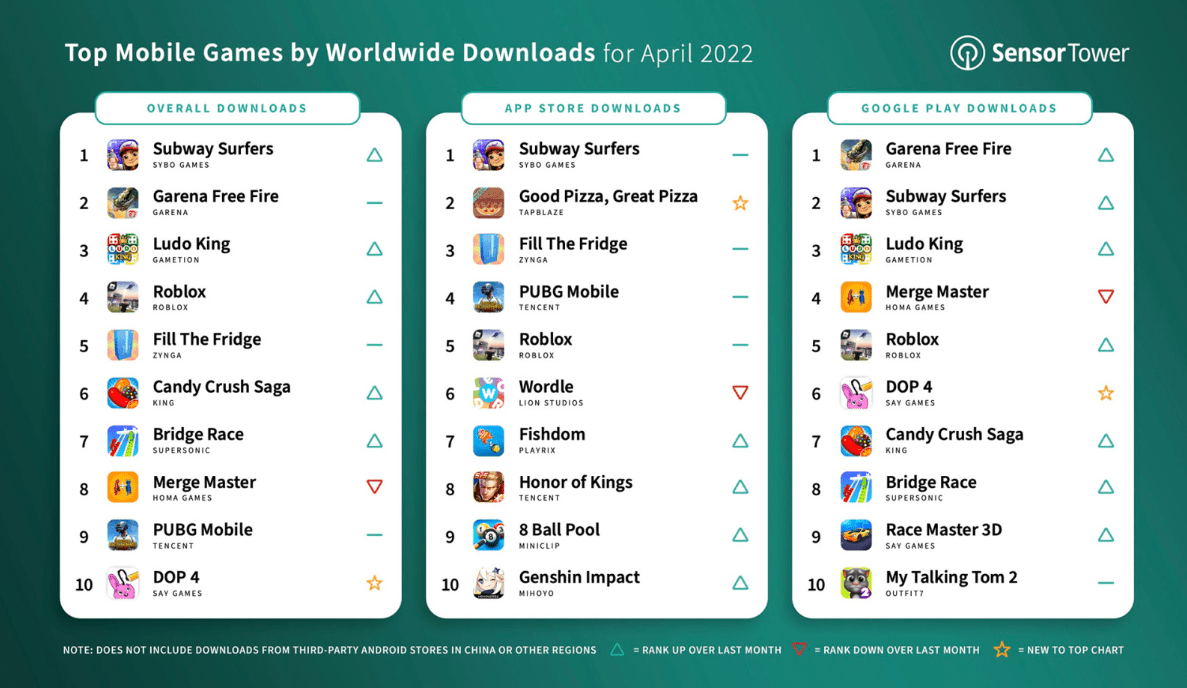

We like to, however, highlight that this isn’t Garena’s inability to monetize the platform, rather, users do not want to cope at home and are demanding a different experience like socializing with friends. In fact, if we look at the top mobile games worldwide in April 2022 study by SensorTower, FF still stands at number 2. It’s a broad-based slowdown in mobile gaming and not only pertaining to FF.

(Source: SensorTower) (Source: Sea IR)

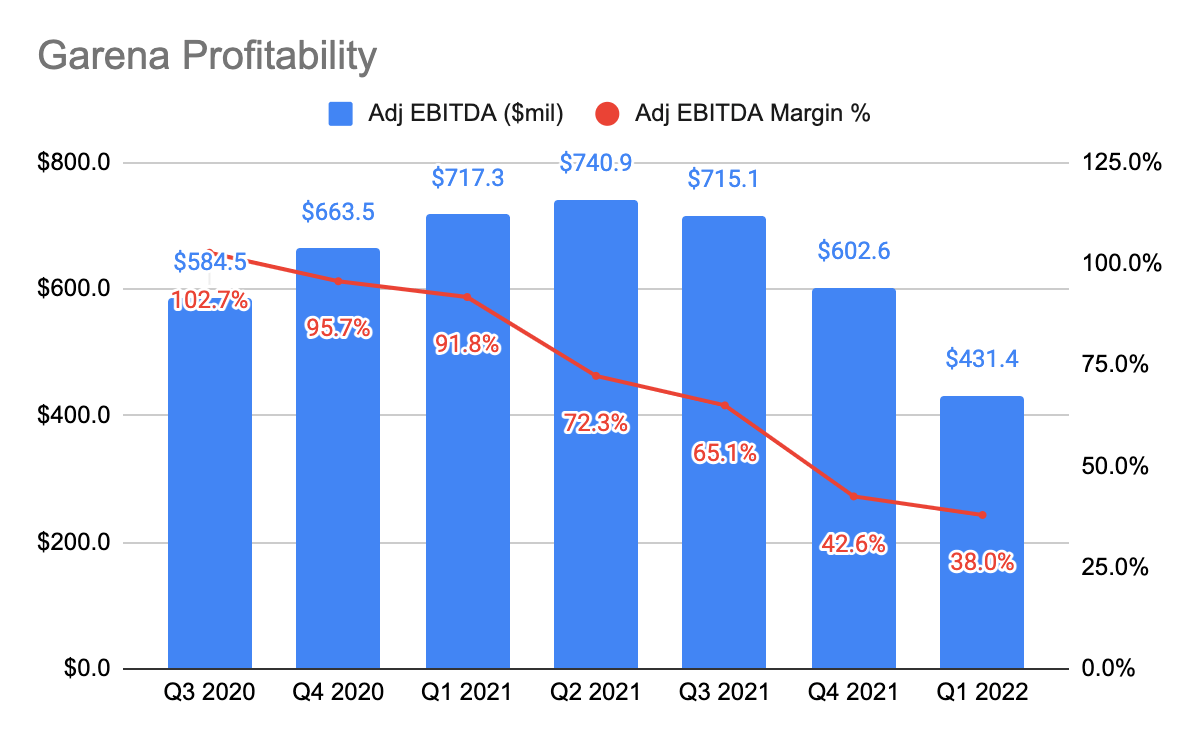

Its adjusted EBITDA then fell by 29% sequentially, and its adjusted EBITDA margin (% of bookings) is currently at 38%.

While we certainly expect this result, it was still an overall disappointing performance from the gaming unit with profitability, users, and monetization all sank as it reflects the transition to the post-pandemic period.

(Source: ActivePlayer) (Source: ActivePlayer)

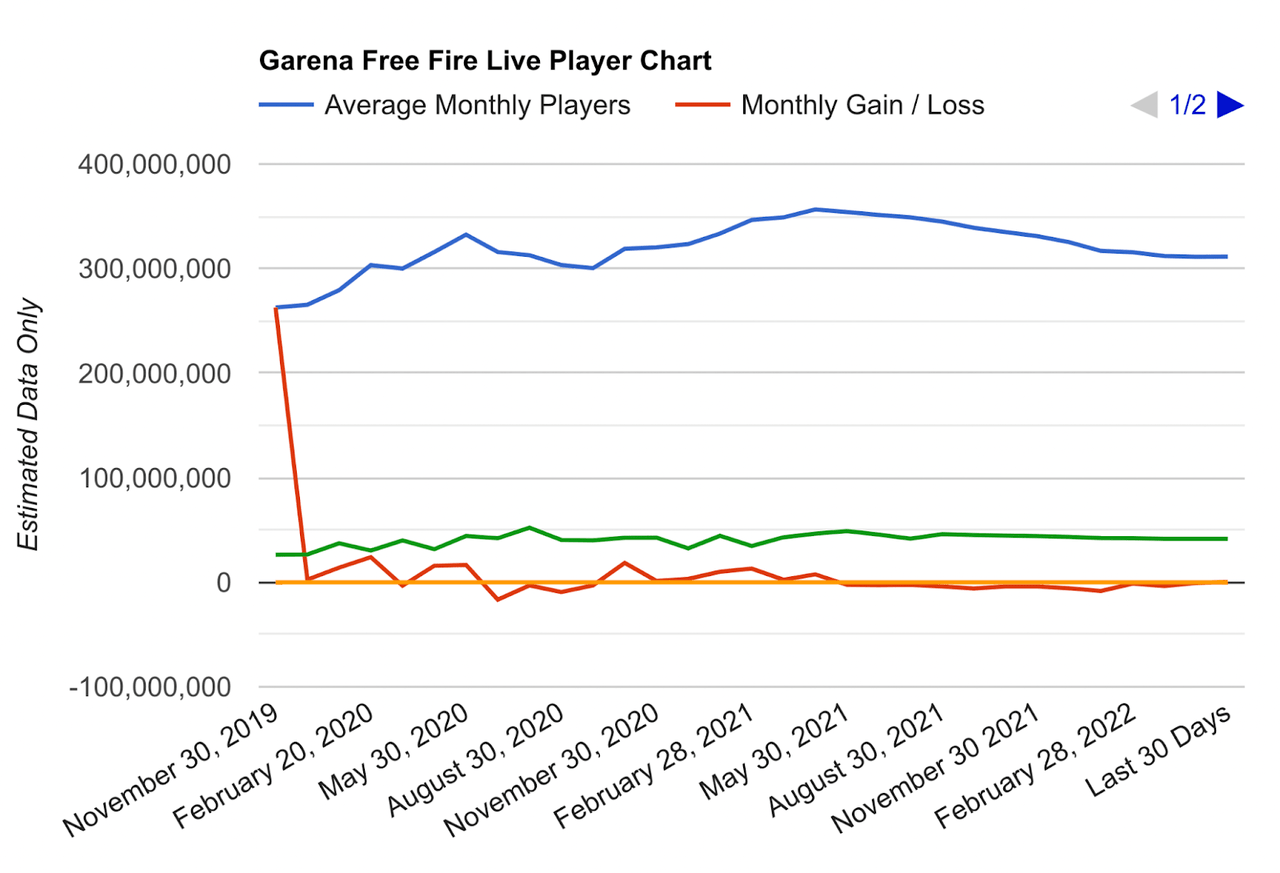

However, the management did start to see stabilizing monthly user trend for Free Fire (“FF”) at the end of Q1’22.

Referencing ActivePlayer.io, the Average Monthly Users (“AMU”) for FF in the last 30 days stands at 311 million compared to 312 million in Mar’22. We will be tracking the trend very closely to access whether the AMU stabilizes.

Regardless of that, the importance of diversifying its gaming portfolio is all the more crucial than ever. Garena cannot simply rely on FF.

It was pleasant to hear that there are already new games being launched or are in beta-launch but not under Garena’s name. This means that it will be nearly impossible for us to track how their new games are faring since we do not what these games are.

And when it comes to human capital allocation, this is what COO YanJun Wang has to say during the Q1’22 earnings call:

…we have about half of our team focused on new games at different stages, while the rest is still continue to focus on putting more content and also game modes and UGC tools into Free Fire and Free Fire MAX.

If most of the employees were to be allocated to FF which is experiencing declining growth, we will be concerned. But this is not the case today.

Previously, Shopee was able to grow quickly because its growth was funded by the cash cow Garena. However, with its profits declining, do also keep in mind that Shopee no longer depends heavily on it for growth. With Sea’s management working to re-accelerate Garena’s growth, this takes the pressure off Garena and knowing that Shopee can be self-sustaining soon is a huge plus.

This brings us to our next segment: Shopee.

Shopee

This is the crown jewel of Sea. As opposed to Garena, Shopee had a great quarter.

(Source: Sea IR)

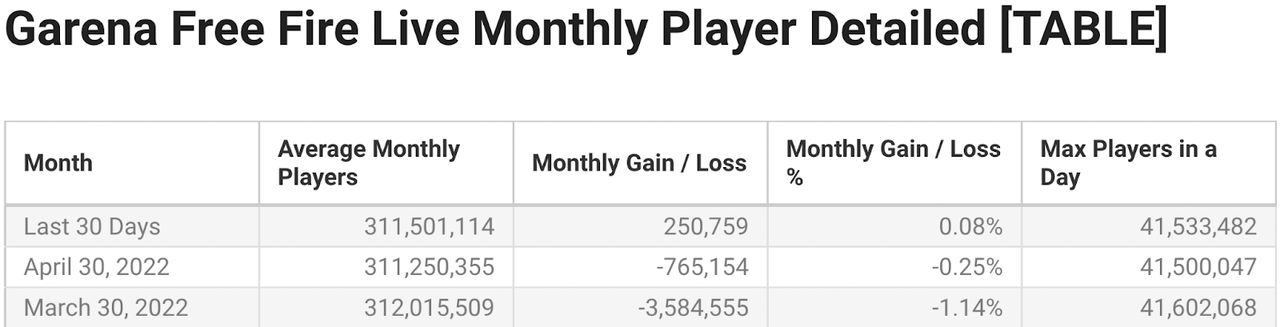

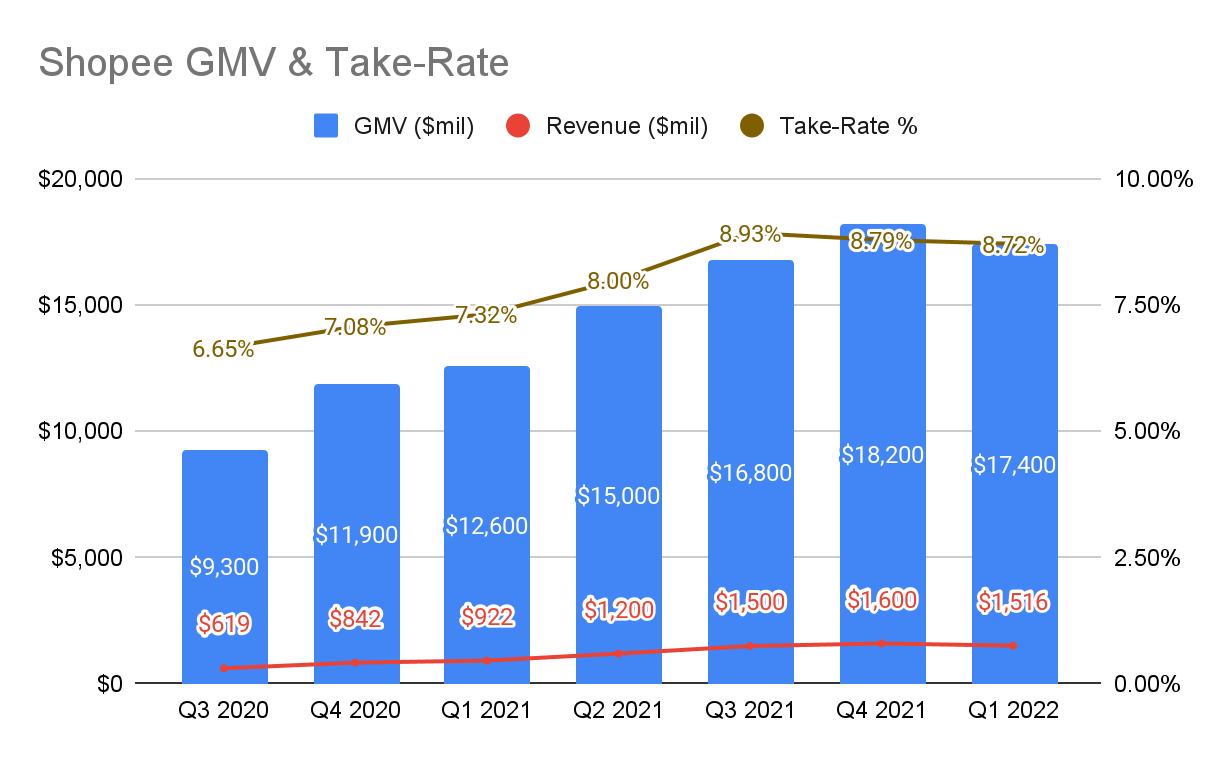

What we see is that its GMV has declined by 4.44% sequentially during the quarter.

At first glance, this may not seem good. However, readers need to recognize that a year ago, the e-commerce unit was riding on the Covid tailwind when they experienced heightened demand. This has accelerated the Gross Merchandise Value (“GMV”) growth from Q4’20 to Q1’21, especially so when Q4 is a seasonally better quarter as consumers tend to shop more towards the holiday season. Similarly, from Q4’21 to Q1’22, this sequential decline can be attributed to the reasons above, and together with the recent rising inflation, this might have led to lesser demand from consumers.

We should not be expecting this growth to continue in FY22 as e-commerce traffic normalizes with Covid restrictions gradually lifted.

In Singapore where we reside, the people we have spoken to have also reduced their spending on e-commerce platforms due to the rising inflation, or/and the fact that there aren’t many subsidies (i.e., vouchers) provided as before. This goes to show that Shopee has pulled back on its sales & marketing spending. However, some people continue to shop due to the convenience of online commerce.

When we take into account these factors, this wasn’t such a bad quarter for Shopee.

In addition, there are now 36,000 brand partners on Shopee Mall. They now account for 15% of its GMV from 12% a year ago, and Shopee also charges a higher take-rate to these partners.

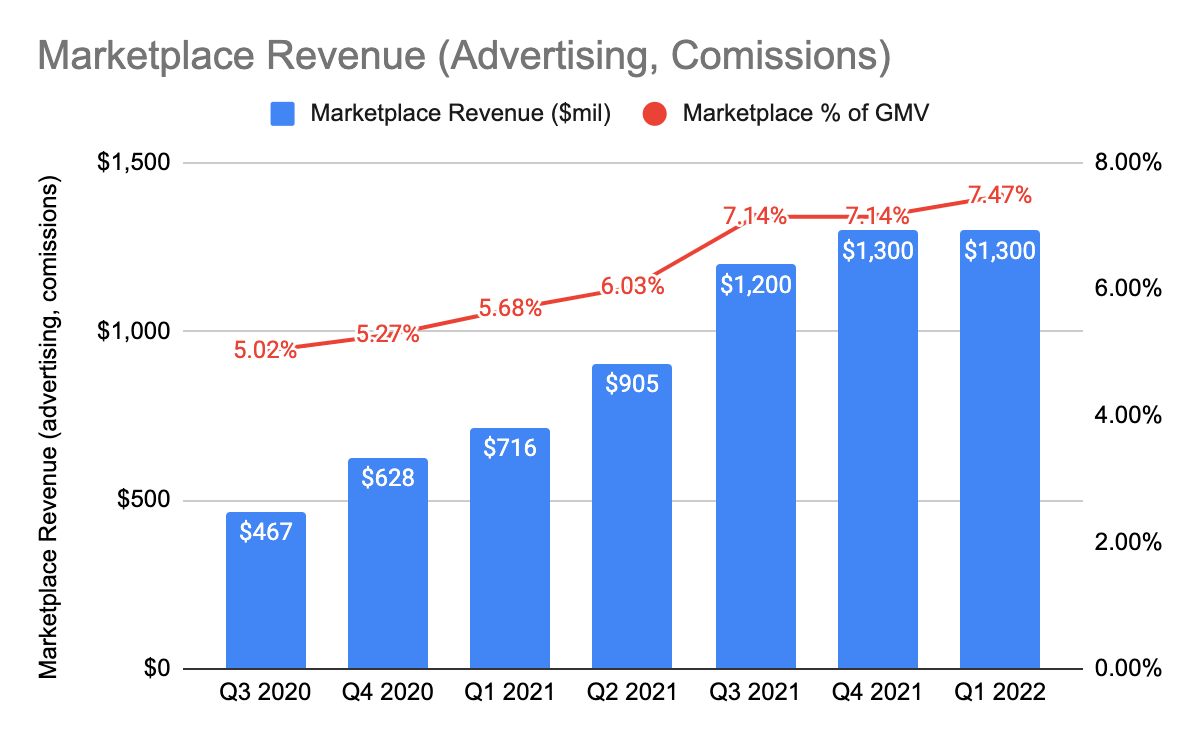

Its current take rate stands at 8.72%, which came slightly lower than in Q4’21, although we did anticipate this to be higher. This is because as the reliance on Garena’s funding slowly diminishes and raising capital in the current market can be detrimental, it is critical that Shopee can be self-sustainable and that would require it to be profitable.

In the early days, Shopee has always maintained a low take-rate to acquire as many merchants and consumers to drive order volume. So even if the fee was to increase over time, merchants are likely to stay given the higher sales volume they are generating over other competitors’ platforms.

This makes Shopee a defensible business and allows it to extract pricing power.

(Source: Sea IR)

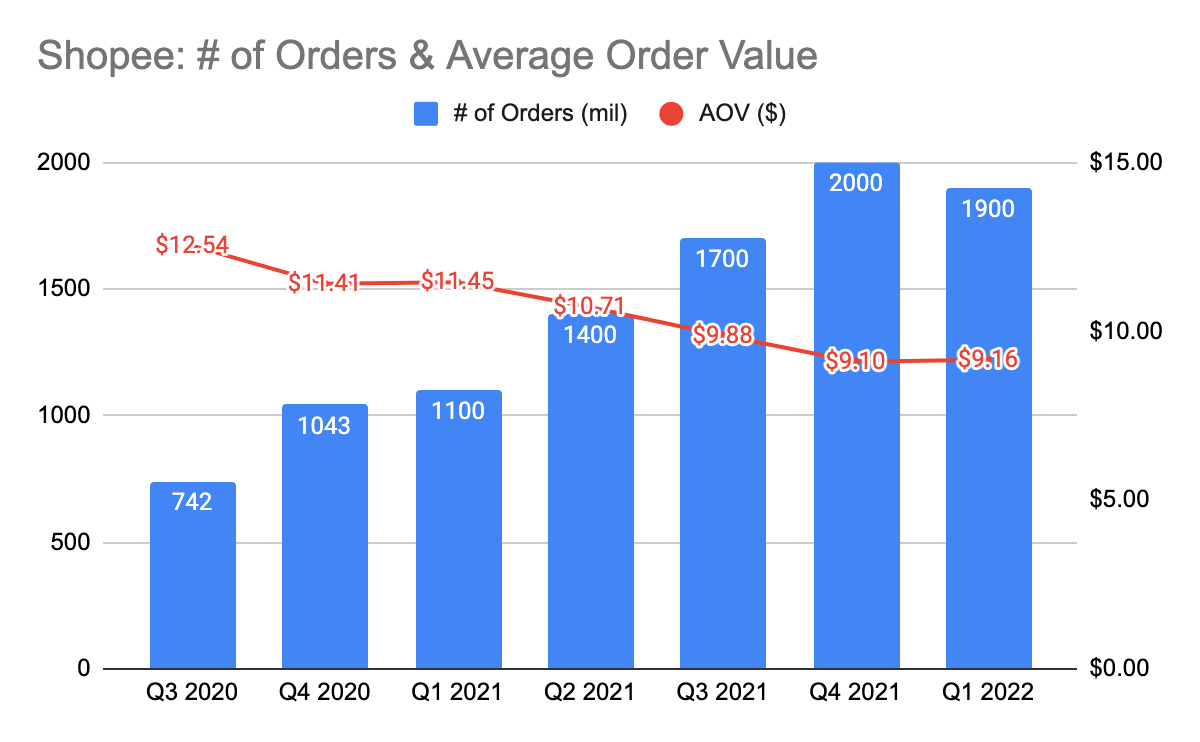

Shopee’s total number of orders is relatively flat over Q4’21 at 1.9 billion with the Average Order Value (“AOV”) improving slightly to $9.16. It also continues to take market share away as Alibaba’s (BABA) Lazada order grew 32% YoY while Shopee grew 72% YoY.

This indicates to us that users are spending more money on the platform, and Shopee is flexing its dominance in the SEA region.

It is worth re-iterating that the overall decreasing trend in AOV is largely due to its entry into new markets like LatAm. Like SEA in its early days, it has executed the same playbook in LatAm. They introduced heavy subsidies (i.e., free shipping, vouchers) and low take-rates to encourage merchants to come on board and users to transact on the platform. As users’ trust in the platform develops over time, they will slowly move to higher-ticket items and spend more, which is what we are seeing in this quarter.

(Source: Sea IR)

It was also a huge plus to see that its marketplace revenue % of total GMV has risen to 7.47%. This is also a high-margin revenue.

We believe more merchants are seeing positive ROI from their ads spent. This goes to show that they are increasingly appreciative of the value Shopee is bringing to them, and they are investing more in tools to generate more sales. Ultimately, this makes the relationship with merchants even stickier.

(Source: Sea IR)

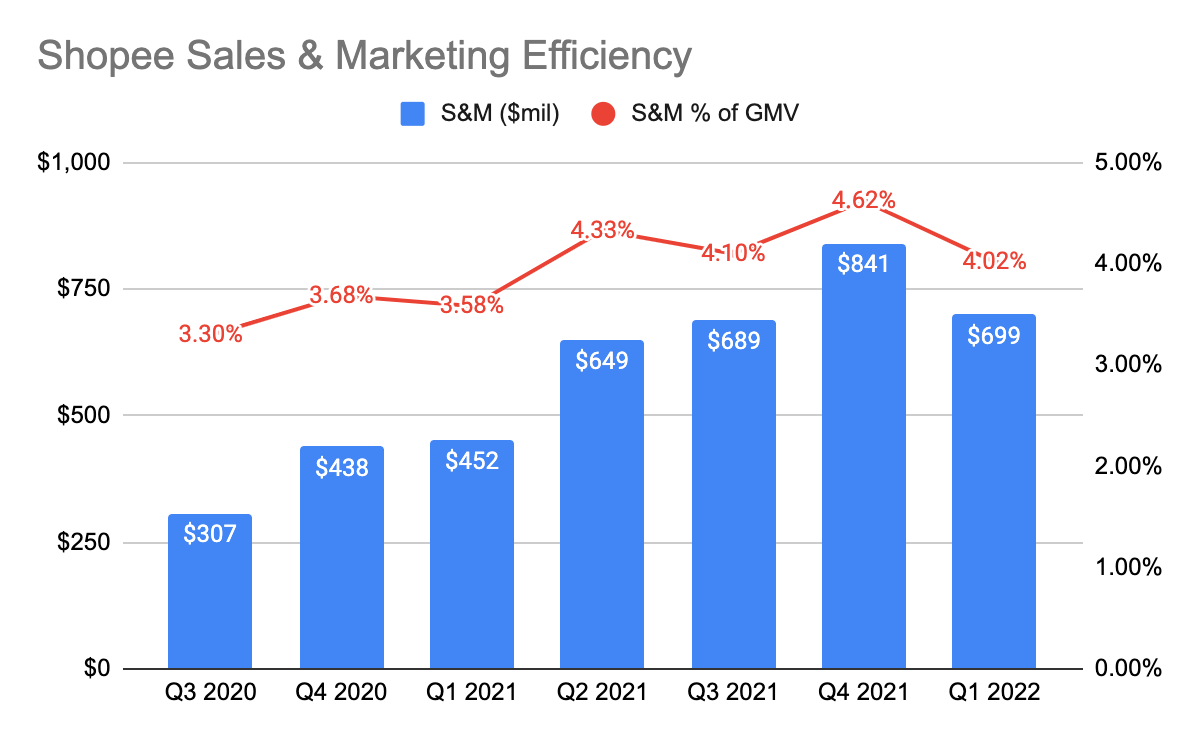

Shopee’s reduced spending is also reflected in its sales & marketing (“S&M”) expenses as it has come down from Q4’21. As a result, its S&M efficiency has improved to 4.02%. This signifies more prudent spending from the management team in a period in which profitability is key. We expect this to normalize as well moving forward.

(Source: Sea IR)

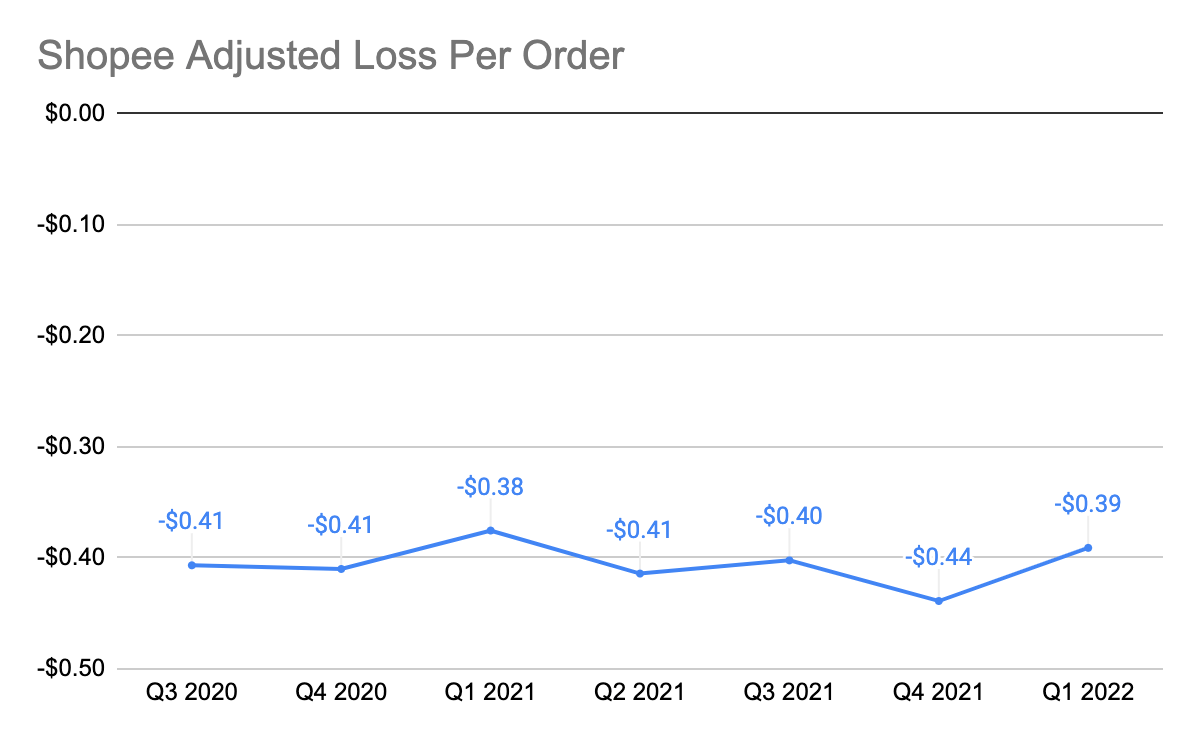

On a unit economics (“UE”) basis, its group’s adjusted loss per order has improved to $0.39. Specifically, in SEA & Taiwan, its loss per order has improved significantly from $0.15 in Q4’21 to $0.04 (+73% Q/Q) in Q1’22. And in Brazil, it has improved from less than $2 in Q4’21 to $1.52 (+24% Q/Q) in Q1’22.

This is a vast improvement from the previous quarter.

With that, Shopee is expected to be adjusted EBITDA positive (after allocation of HQ cost) by the end of next year. In a market that is driven by extreme fear and noise, it is easy to be distracted and to give in to the consensus on Shopee’s “poor” UE and S&M efficiency. However, given the data we are seeing here, this isn’t true at all.

Just recently, Shopee Brazil also announced an increase in commission for individual sellers, from R$3 to R$5 for each item sold. This is effectively a 66% rise in revenue, signaling that Sea’s management is serious about heading into profitability.

Alternative Data

As part of our due diligence process, we continue to use alternative data sources to track the overall health of Shopee.

Here’s what we are tracking:

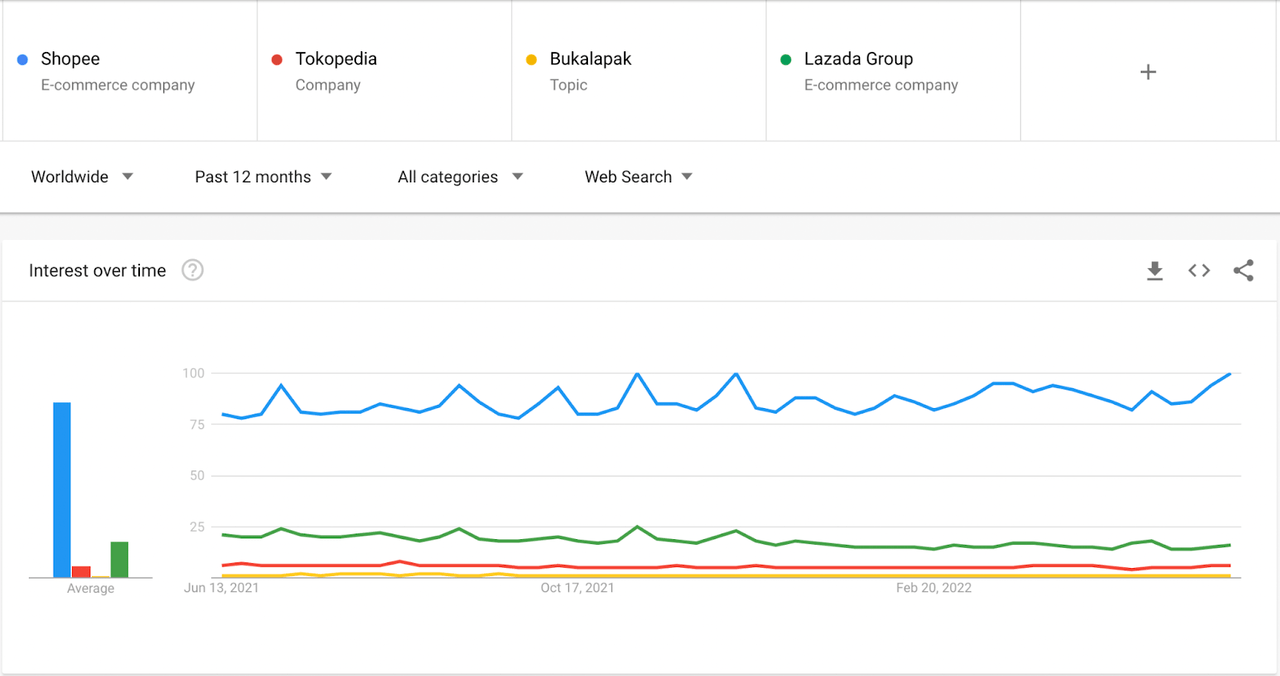

(Source: Google Trend)

On Google trends – Shopee continues to rise on top of peers like Bukalapak, Lazada (parent company is Alibaba) (NYSE: BABA), and Tokopedia in SEA.

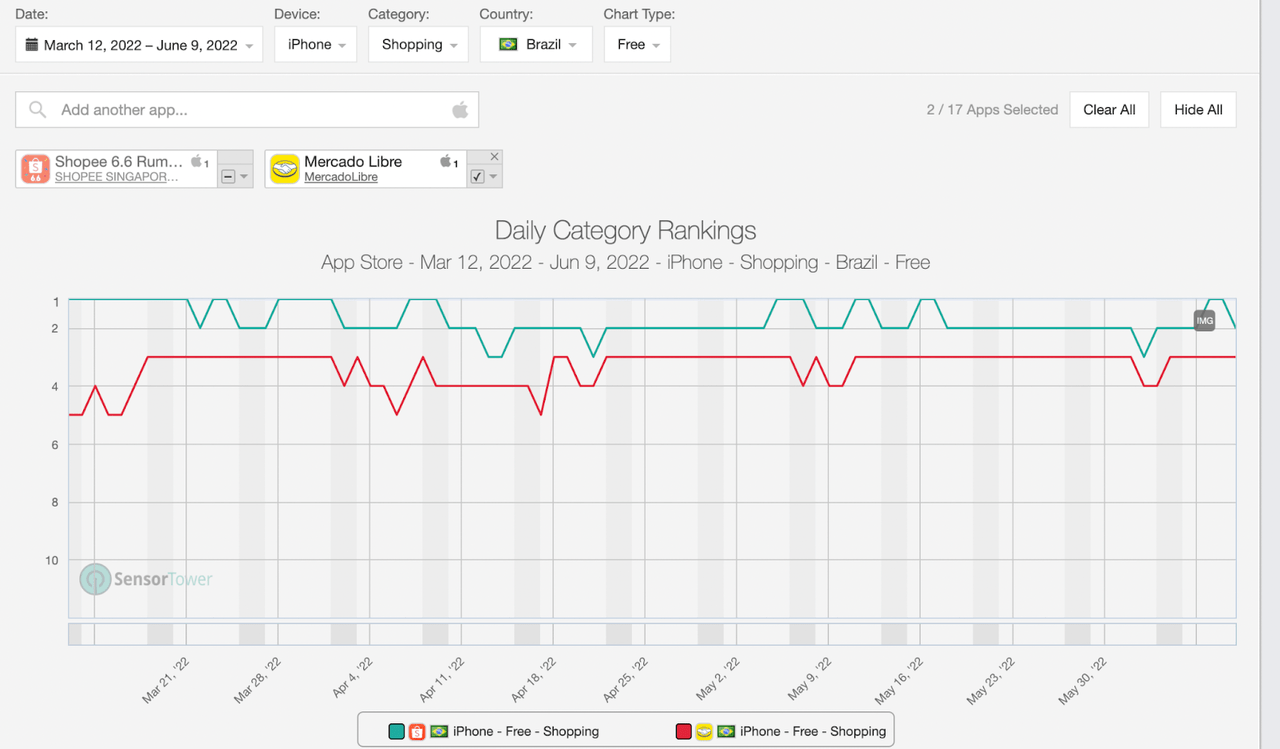

(Source: SensorTower)

On SensorTower, Shopee continues to rank #1 or #2 (overtook by SheIn), ahead of MercadoLibre (NASDAQ:MELI). Except for Chile, Shopee is ranked #3 as it was overtaken by SheIn and Falabella, a multi-chain department store, although still ahead of MELI.

This further corresponds to our analysis that Shopee continues to take market share away from Lazada and it is executing well across its regions.

Now let’s look at the potentially next growth engine of Sea Ltd: SeaMoney.

SeaMoney

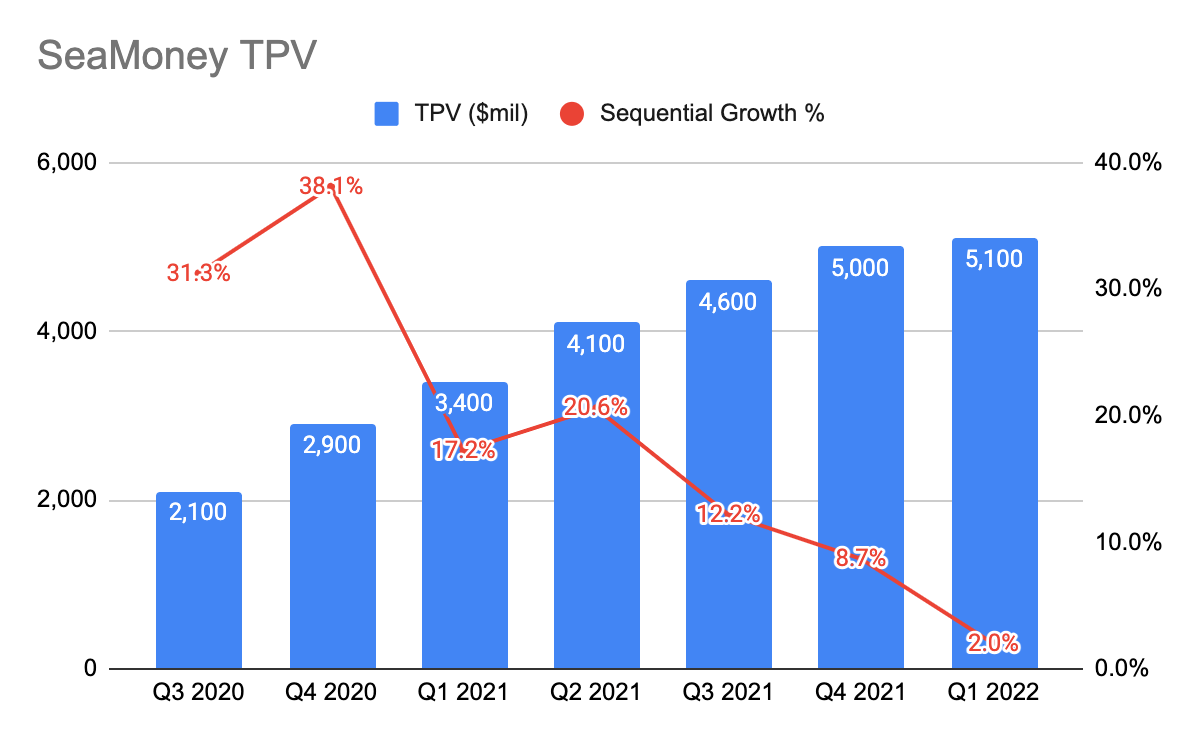

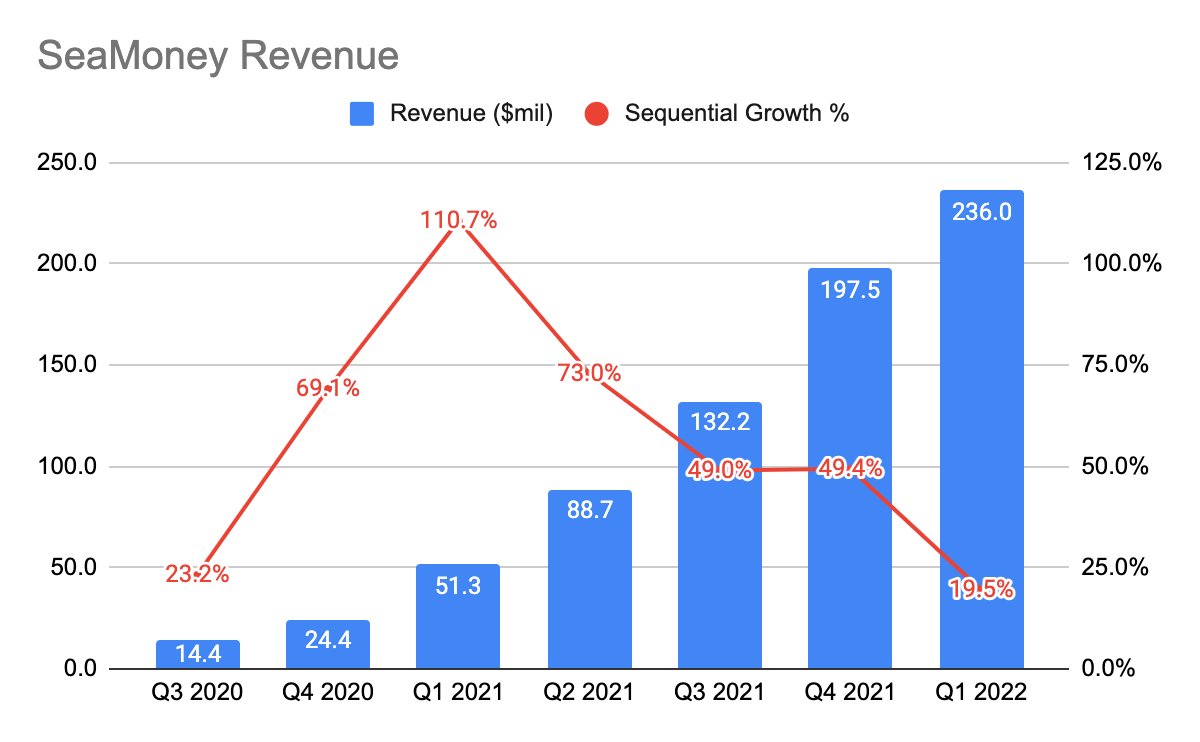

(Source: Sea IR) (Source: Sea IR)

SeaMoney’s explosive growth back in FY20 and FY21 was because they were growing off a very small base and is also riding on a Covid tailwind alongside Shopee. However, its sequential growth has started to decline since Q1’21. And this quarter, they only grew by a mere 2%.

This does raise concern that SeaMoney’s adoption is losing momentum.

Its revenue did better as it grew by 19.5% to $236 million, mainly due to its record-high take-rate of 4.6%. However, instead of relying on take-rates, we do prefer to see its TPV growing so that its revenue growth is sustainable in the long run.

(Source: Sea IR)

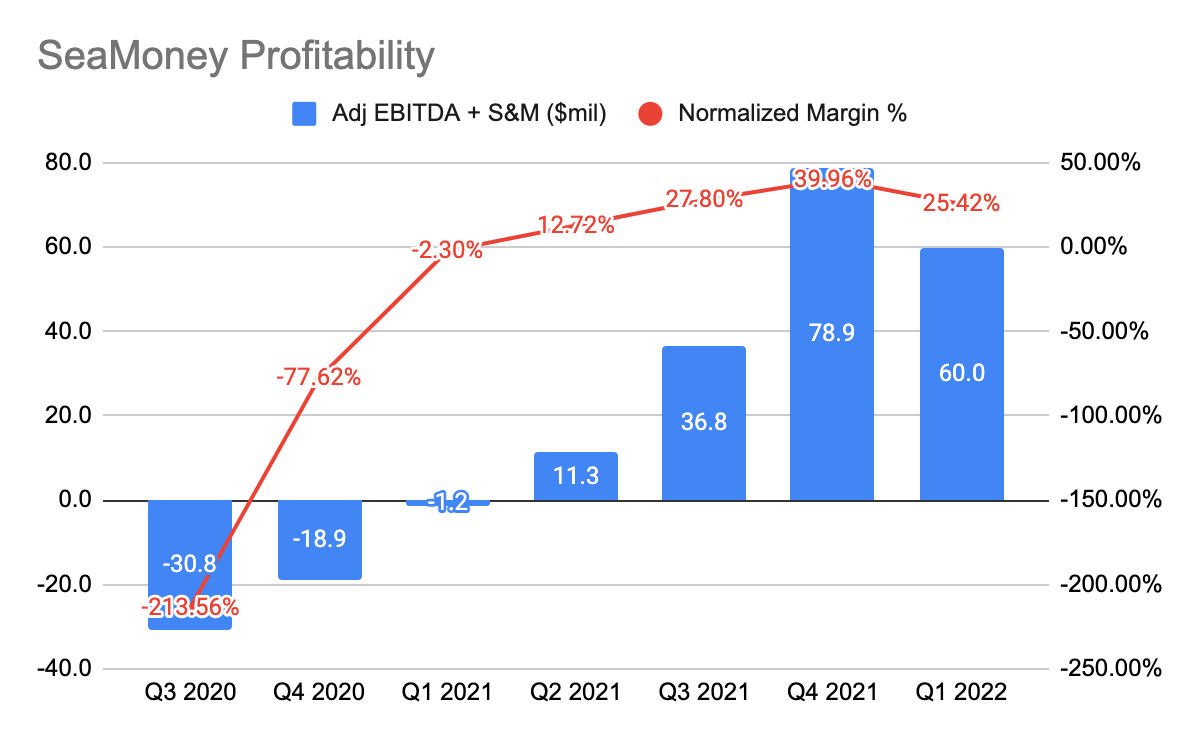

Similar to how we did for Shopee, we added back the S&M back to the adjusted EBITDA, and this gave us roughly $60 million in normalized EBITDA, which translates to 26% in normalized EBITDA margin.

Now despite an increased revenue and lower S&M spent, it has a lower margin as compared to Q4’21. This is largely due to the upfront investments incurred in terms of hiring and R&D. According to Strike.Market, the job openings on LinkedIn have gradually increased in numbers and it has not winded down yet. On LinkedIn, you’ll see that they are hiring ahead of the curve for positions related to digital banking.

Multiple tech companies like Netflix, Coinbase, Carvana, and Amazon have either slowed down or halted their hirings due to the plight of the stock market and the emphasis on more prudent spending and profitability. This, however, does not seem to be the case for SeaMoney. Considering that SeaMoney is still unprofitable, this may raise concerns about whether Sea has enough cash to sustain its aggressive hiring.

We like to also bring back what COO YanJun Wang said during her Q2’19 earnings call, citing that “ digital financial services will be one of the largest opportunities in the digital economy of our region.”

Given that Sea has digital banking licenses in Malaysia, Indonesia, the Philippines, and most recently in Brazil, we strongly believe that it can be Sea’s third growth engine.

Concerns Over Cash On Hand

(Source: Sea IR)

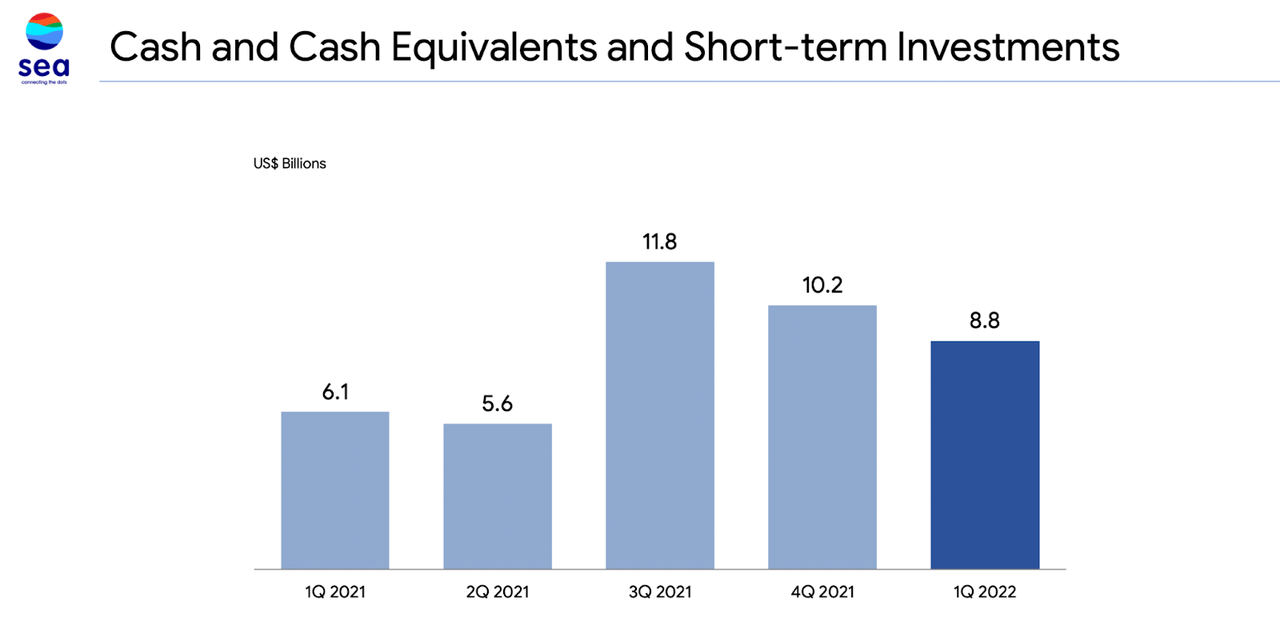

Investors have rightfully pointed out the concern over the Sea’s cash on hand.

This quarter, Sea’s cash burn was $1.4 billion, and assuming that this continues, they have roughly about 6 quarters ($8.8 bil / $1.4 bil) of cash runway left. Given that Shopee and SeaMoney are still unprofitable and still hiring aggressively, the need to raise cash in this current environment will be detrimental given that multiples are at their lowest. Ideally, we seek at least 2 years of cash runway. This is why we highly suspect that there is a huge improvement in Shopee UE in this quarter as the race to profitability tightens.

This has to be monitored very closely and making sure that both Shopee (i.e., adj positive by FY22) and SeaMoney (i.e., cash-flow positive by FY23) remain on track to profitability.

Concluding Thoughts

Since Sea’s share price has fallen off the cliff, the market has turned pessimistic citing that the thesis was broken and has completely written off the management’s track record of building SeaMoney, and Shopee from scratch to a market leader in SEA, fending off against well-established peers like Lazada.

To think that Sea managed to venture and create 2 new businesses from what’s known as only a gaming publisher back then may seem too far-fetched. Crazy ambitious if you asked us, but they have done it.

What’s even more impressive is that SEA consists of 7 highly differentiated & complex regions, and they have managed to excel in every single one of them. Not forgetting, e-commerce is a cutthroat industry. And now, they are building out their digital banks in these regions.

With CEO Forrest Li’s growth-mindedness, his willingness to take risks, and his core on generating shareholders’ value, Sea could not have been the company they are today.

This, in our opinion, is a vote of confidence.

At the same time, we do recognize that as Sea scales larger, the competitive landscape has increasingly become more challenging as they enter into new markets, and there are now multiple speed bumps. However, we remained optimistic that they can navigate these short-term headwinds, given that we have been both a long-term follower and shareholder of the company, and we are well aware of the management’s capability to execute.

Again, this is a management team with an established track record.

The progress made so far has been encouraging to us knowing that Sea’s management is not resting on its laurels. This is well-aligned with us as long-term shareholders.

(Source: eMarketer)

Regardless of the macro tailwinds, SEA’s e-commerce market share is still low in the high-single digits, and Shopee is already a market leader in a growing market. Not to mention, they are also in LatAm. Alternative data further supports that Shopee continues to execute well in LatAm and SEA. If we use the U.S. as a proxy, we can see that over the long term, the e-comm as % of total retail sales has always been on an increasing trend. We do expect SEA and LatAm to follow suit.

This makes Sea well-positioned to ride on the long-term secular tailwind.

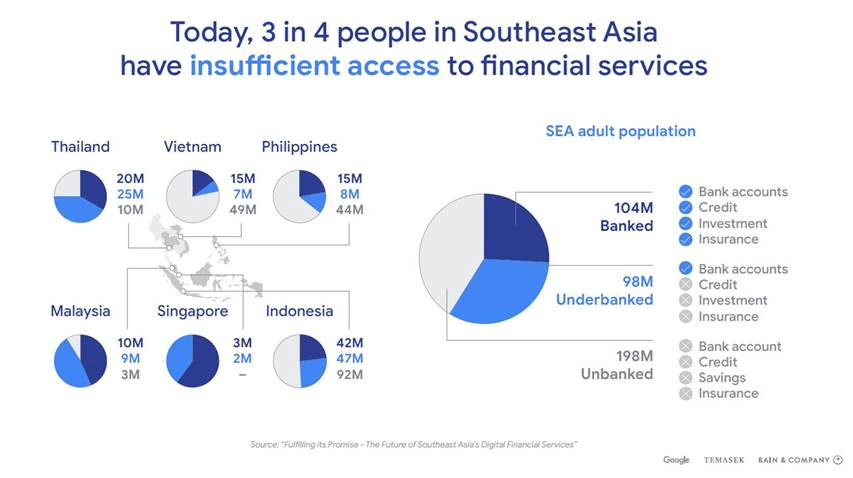

(Source: Google-Temasek-Bain & Company)

Moreover, if you were to consider the massive opportunities in SEA, with over 50% of the population being unbanked and underbanked, these short-term macros do not affect our long-term thesis of the company.

We implore investors to zoom out and look at the bigger picture.

Let us know what are your thoughts on the results in the comments section below!

Be the first to comment