JHVEPhoto

PepsiCo, Inc. (NASDAQ:PEP) is a leading global beverage and convenient food company that does about +$80.0B in annual sales, with many of their individual brands generating over $1.0B in annual retail sales on their own. Some brands included within their product portfolio include Lay’s, Doritos, Gatorade, Pepsi-Cola, and Quaker, to name a few.

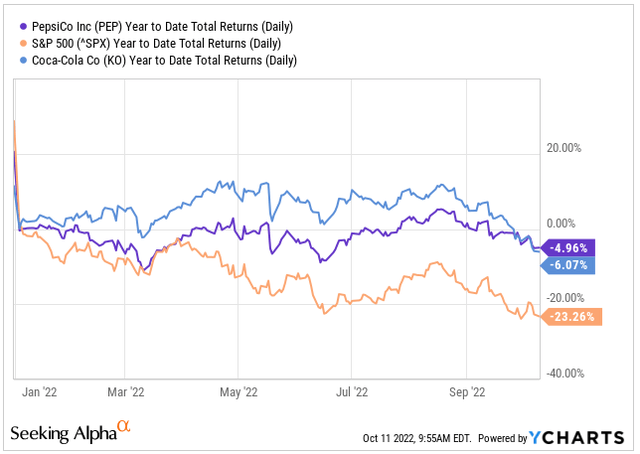

Over the past one year, PEP has been one of the few places to hide from the recent market volatility. YTD, shares are down just under 5%. This vastly outperforms the over 20% decline that has been suffered in the broader S&P 500. And after trailing Coca-Cola (KO) through the first half of the year, shares in PEP are now slightly outperforming their close competitor.

YCharts – YTD Total Returns of PEP Compared To S&P 500 and Coca-Cola

For existing shareholders, PEP continues to be a viable core portfolio holding that provides a defensive hedge against broader market volatility. An investment in the stock also comes with a dividend payout that has grown for 50 consecutive years at an impressive 5-YR compound rate of over 7%. While shares may not present enough upside in relation to alternative sectors in the market, PEP remains a quality hold for those seeking to minimize their exposure to market volatility.

Q3FY22 Earnings Recap

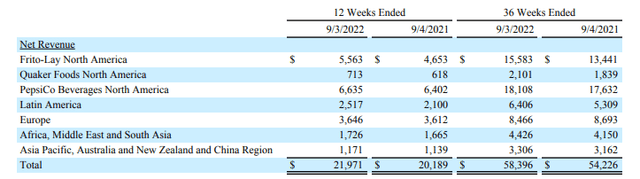

PEP operates in seven reportable segments, their two largest being Frito-Lay North America (“FLNA”) and PepsiCo Beverages North America (“PBNA”). In the most recent 12-week quarter ended September 3, 2022, the two segments accounted for approximately 55% of total net revenues, which is consistent with last year.

Q3FY22 Form 10-Q- Breakout Of Quarterly Net Revenues By Segment

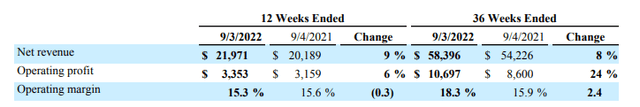

Overall, total net revenues for the quarter came in at +$22.0B, which was up 8.8% from last year and just over +$1.0B better than expected. Operating profit also increased by 6%, driven primarily by net revenue growth and productivity savings. Margins, on the other, hand were down 30 basis points (“bps”) due to the impact of higher mark-to-market losses.

Q3FY22 Form 10-Q – Comparative Operating Summary

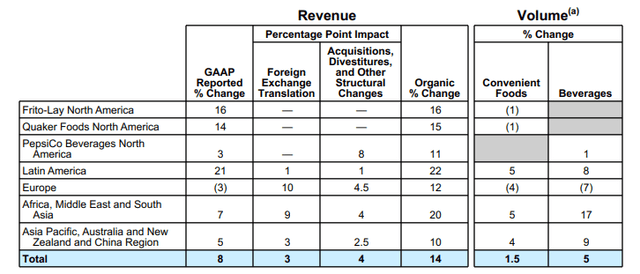

Organic revenues, which is a metric that adjusts for foreign-exchange translations and acquisitions/divestitures, was up 16% and represents the fourth consecutive quarter of double-digit organic revenue growth following growth of 13% in the second quarter.

Q3FY22 Earnings Release – Revenue And Volume Summary By Segment

PEP also reported continued strength in their global beverages and convenient foods businesses, delivering 12% and 20% organic growth, respectively. Results were particularly strong in their FLNA segment, which exhibited 20% organic growth and logged continued market share gains from the second quarter.

From an international perspective, strength continues to be led by Latin America due to effective net pricing and consistent volume growth in their beverage units, with high-single-digit growth in Mexico and double-digit growth in Argentina.

The strong top-line results resulted in operating and free cash flows of about +$6.3B and +$4.0B, respectively. Though this is down from last year due to unfavorable working capital comparisons and higher net cash tax payments, it still represents a significant source of ongoing liquidity for the company, which would be on top of a sizeable balance of cash and equivalents, which stood at about +$6.7B at the end of the current period, and availability on their revolving credit facilities. Altogether, these fund sources are more than enough to cover their reoccurring obligations, one of which is their dividend payout, which remains well covered by existing cash flows.

Looking ahead, management once again raised guidance. Full-year organic revenues, for example, are now expected to be up 12%, which would be up from the 10% it had projected at their last earnings release and 6% prior to that. In addition, EPS growth is expected to be 10% when excluding currency impacts. This would be up from earlier estimates of 8%.

Post-Earnings Insights

PEP operates in the recession-resistant industry of snacks and beverages and maintains leading positions in branded snacks, sports drinks, and non-carbonated beverages in the U.S. While they face some challenges in their more mature carbonated soft drink markets due to shifting consumer habits, they still maintain the number two domestic market position. And while carbonated soft drinks represent a large share of PEP’s business, they account for less than 25% of total revenues.

Savory snacks, on the other hand, continue to be a strength for the business. While volumes are down, consumers continue to be drawn to the convenience of the relatively low-cost snacks. This is resulting in robust sales growth driven by prices that are up about 17% from last year.

Under pressure to continue passing on rising input costs, PEP continues to exceed expectations, even with consumer food inflation at 40-year highs. The willingness of consumers to continue absorbing the price hikes is indicative of the resiliency of many of their household brands, such as Doritos, Fritos, Lay’s, and Ruffles.

Their diversified portfolio of products is also a hedge against a turn in consumer behavior. For those seeking a healthier and lower-cost option, for example, PEP’s Quaker Food segment offers time-tested favorites, such as pasta, oats, and ready-to-eat cereal. Though this segment represents a smaller share of total revenues, its share may trend higher in subsequent periods as consumers gravitate towards more affordable cravings.

For existing shareholders, PEP remains an adequate hedge against broader market volatility. Immediately following their release, for example, shares were just 2.5% changed in pre-market trading. This is in stark contrast to names in other sectors that have posted double-digit increases or decreases following their releases. In the current market, stability is worth a premium.

And in this regard, PEP does trade at a higher pricing multiple, about 24x at present. This is not only higher than KO but also the broader S&P, which currently trades at 18x. Though new investors may find more lucrative opportunities elsewhere, PEP is a quality long-term portfolio holding that should continue posting resilient results through just about any operating environment.

Be the first to comment