kokkai

Investment Thesis

Sea Limited (NYSE:SE) is a Southeast Asia (“SEA”) conglomerate with 3 business units – (1) Garena, its gaming business, (2) Shopee, SEA’s e-commerce leader, and (3) SeaMoney, or SeaBank, the fintech arm of the company.

In the past two years, the company faced lots of scrutiny as investors believed Shopee had over-expanded back in Covid, which is also coined as the era of cheap money. Today, as the world comes out of Covid, and with inflation at an all-time high and the rising interest rates, Garena’s users have seen a sharp drop in active users, management has taken drastic measures to cut costs in Shopee, and for SeaMoney, investors are uncertain of its development and are not putting much weight into this business as it currently occupies only 9.5% of its total revenue. I reckon that much of the bear thesis has already been baked into the share price.

In this article, I aim to dive deeper into the company to provide readers with an overall more detailed analysis to highlight why its long-term fundamentals are still intact. While this is a widely covered company, I believe many investors do not have a full understanding of the business, and how they are well-positioned to navigate the headwinds present today. Its current valuation may be a great opportunity for long-term investors.

Garena

Overview And Investors’ Concerns Over Garena

Garena started as a pure gaming publishing company back in 2009 by CEO Forrest Li, and it worked closely with game developers such as gaming conglomerate Tencent (OTCPK:TCEHY). Some of the most popular games include League of Legends.

Then in 2017, Garena came up with its first self-developed game, Free Fire, a multiplayer battle royale mobile game, and it turned out to be a massive hit in Latin America (“LatAm”), particularly in Brazil, and also India. Unlike PUBG mobile, Free Fire was designed to cater to less developed countries with low-end mobile phones. While one could attribute this success to serendipity or a one-hit wonder, one cannot deny that the management had spotted an underserved market and executed it brilliantly.

Image Created From Sea Limited 10-Q Image Created From Sea Limited 10-Q

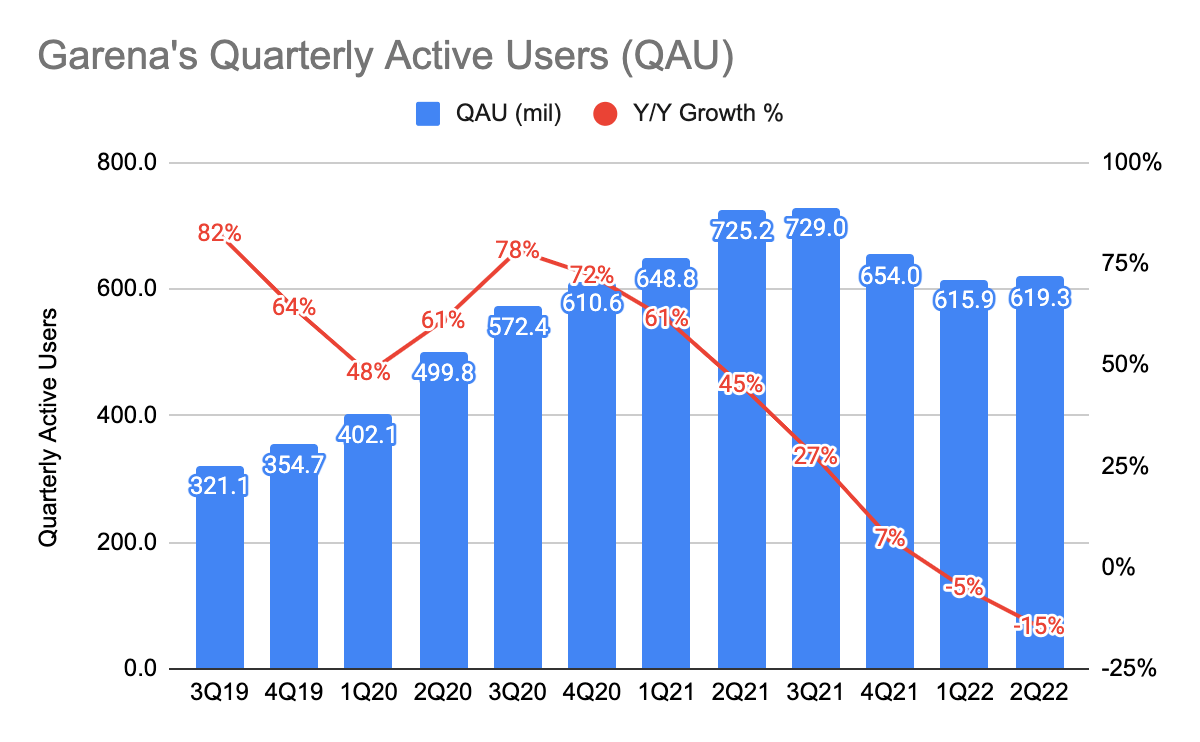

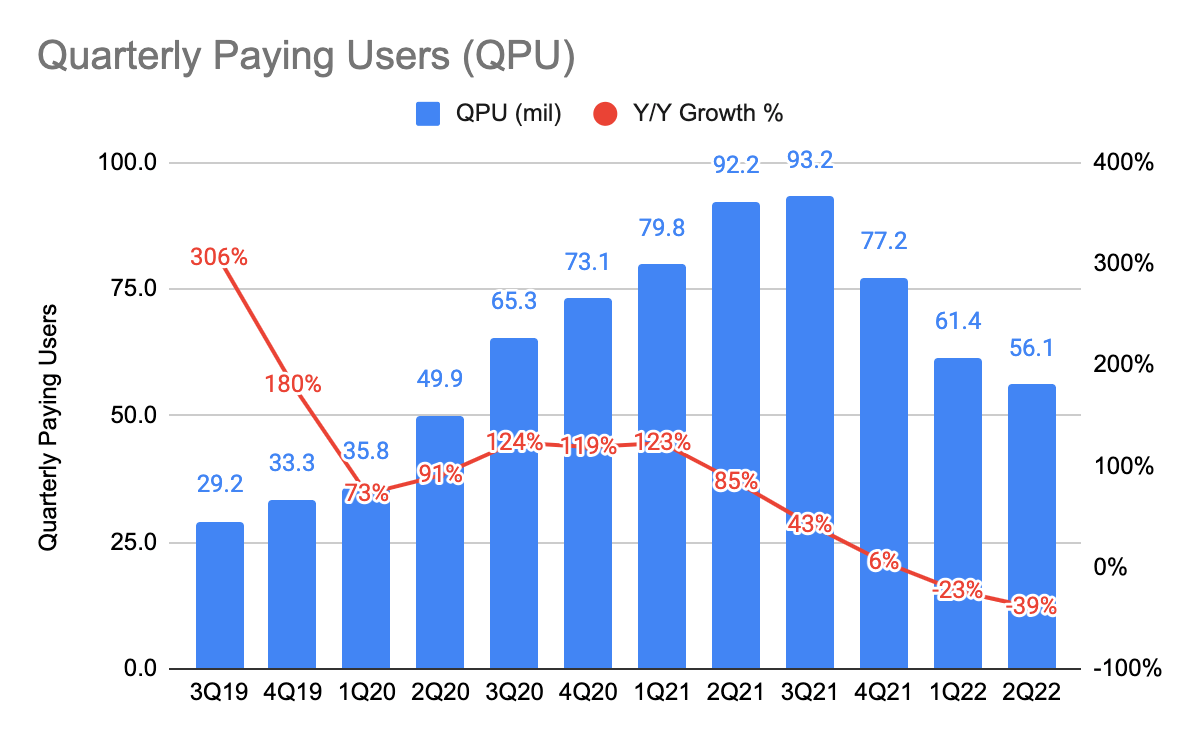

As the world went into lockdown, the broader gaming industry thrived as most countries were in lockdown and games were a huge beneficiary of it. Free Fire grew rapidly and constituted most of Garena’s revenue, and it was Sea Limited’s only cash cow. However, as Covid improved and restrictions eased, Garena experienced a sharp drop in its quarterly active users (“QAU”) and quarterly paying users (“QPU”) as users are spending less time and money on mobile games. This can be seen from its QAUs year-on-year (“Y/Y”) growth deceleration from 72.1% in 4Q20 to -14.6% in 2Q22, and QPU growth from 119% in 4Q20 to -39% in 2Q22.

Image Created From Sea Limited 10-Q

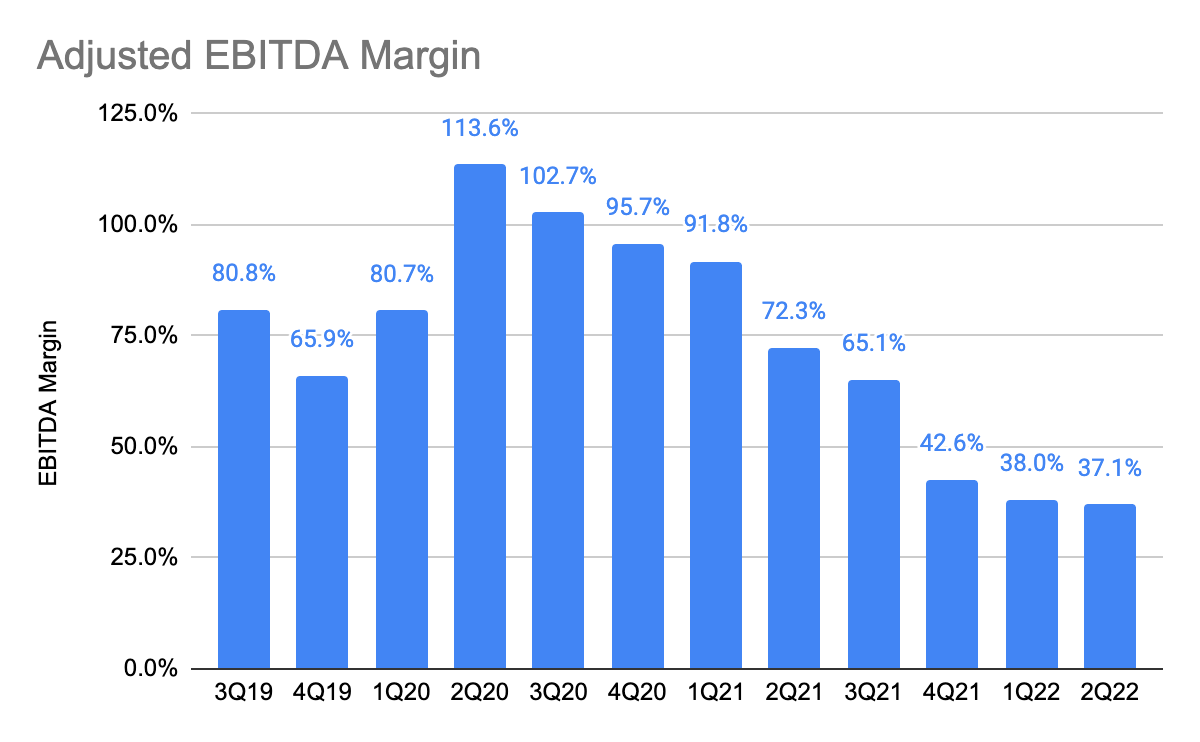

Free Fire has proven to be a huge concentration risk, all the more so that it was also funding Shopee’s expansion in LatAm. Its adjusted EBITDA margin fell from a peak of 113.6% in 2Q20 to 37.1% in 2Q22. This raises lots of doubts over its ability to continue to do so, and the risk of running out of cash is increasingly high. So what’s next?

New Game Development; Investments In Game Studios

Back in Jan 2020, Garena acquired Phoenix Labs, the creator of a highly popular game, Dauntless. This acquisition allows Garena to tap into Phoenix Lab’s pool of talents, and this highlights the management’s efforts to transition into a game developer. More excitingly, they are working together to develop a mobile version of Dauntless. However, it has yet to be launched.

In the past earnings call, management has also hinted several times about developing new games, but despite investors’ efforts, they were unable to find out additional information. Investors were increasingly concerned over its ability to self-develop new games, and thus, reaccelerate its growth rates, and this begs the question of whether this is the start of its downfall. Fortunately, this is not the case.

Phoenix Lab’s Fae Farm

Recently, I found out that Phoenix Labs was working on a new game, called Fae Farm, a Co-Op RPG game that is set to be launched on Nintendo Switch in spring 2023. Its YouTube trailer has received positive feedback from the users as they were highly impressed and excited about the game. In addition, Phoenix Labs has also hinted that they are working on close to 10 projects, ranging from early R&D to full production.

In July 2022, Garena also invested in Vic Game Studio, a Korean-based game studio. They have been working on a new game, called Black Clover Mobile, and it is expected to be launched in 2022. Black Clover is a highly popular anime that has been running for 4 seasons now, and there are multiple teasers released on YouTube. It is not surprising to see why this is a highly anticipated game.

All of these points towards Garena making concrete moves in its goal to transition into a full-fletch game development company, and this may very well dispel investors’ concern over Garena’s inability to self-develop new games and to reaccelerate its growth rates in the future.

Shopee

Overview Of Shopee’s Success

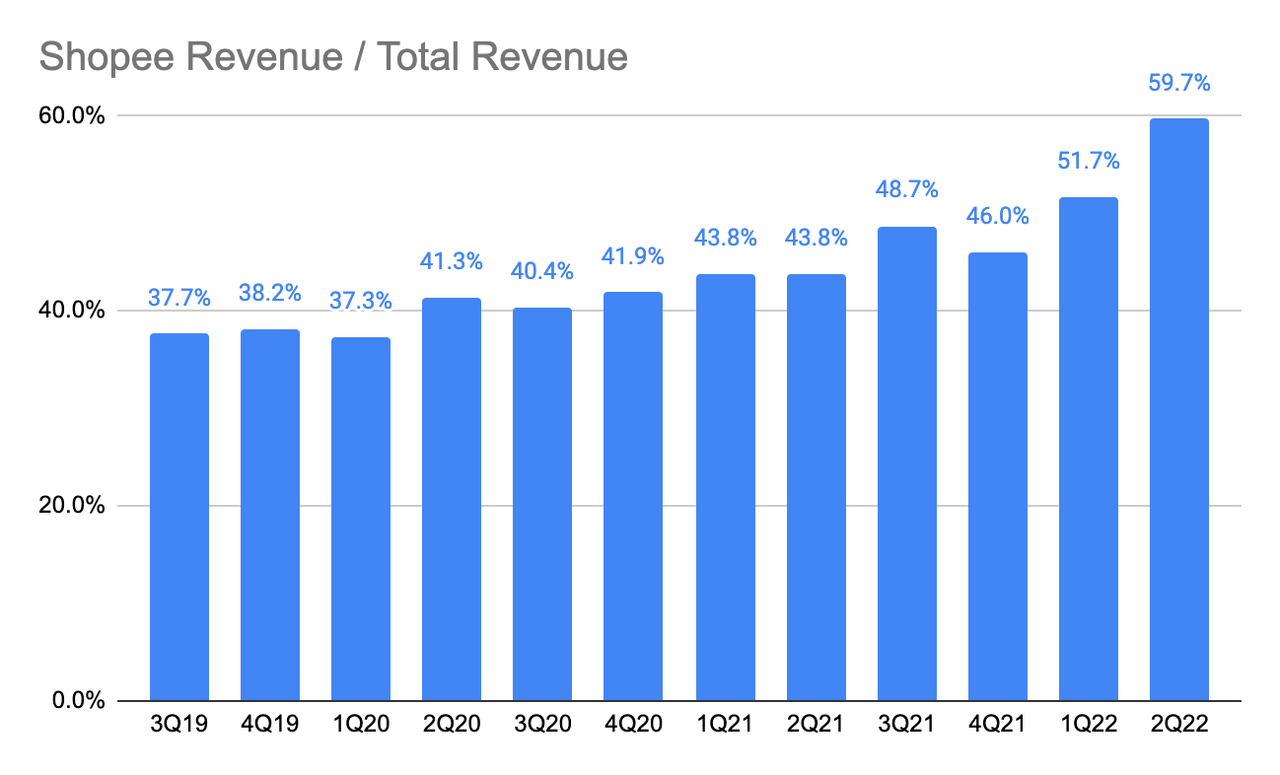

Image Created From Sea Limited 10-Q

Back in 2015, Shopee entered Southeast Asia (“SEA”) as a small and unknown player, against the likes of well-established peers such as Alibaba’s (BABA) Lazada and Goto’s Tokopedia [IDX:GOTO]. Fast forward to today, Shopee managed to overtake its peers, taking the market by surprise. Today, Shopee has grown to become the crown jewel of the company, making up 59.7% of its total revenue. This success can be attributed to Garena as the management reinvested Garena’s profits to fund Shopee’s expansion in SEA. Although, there were multiple factors that contributed to its success.

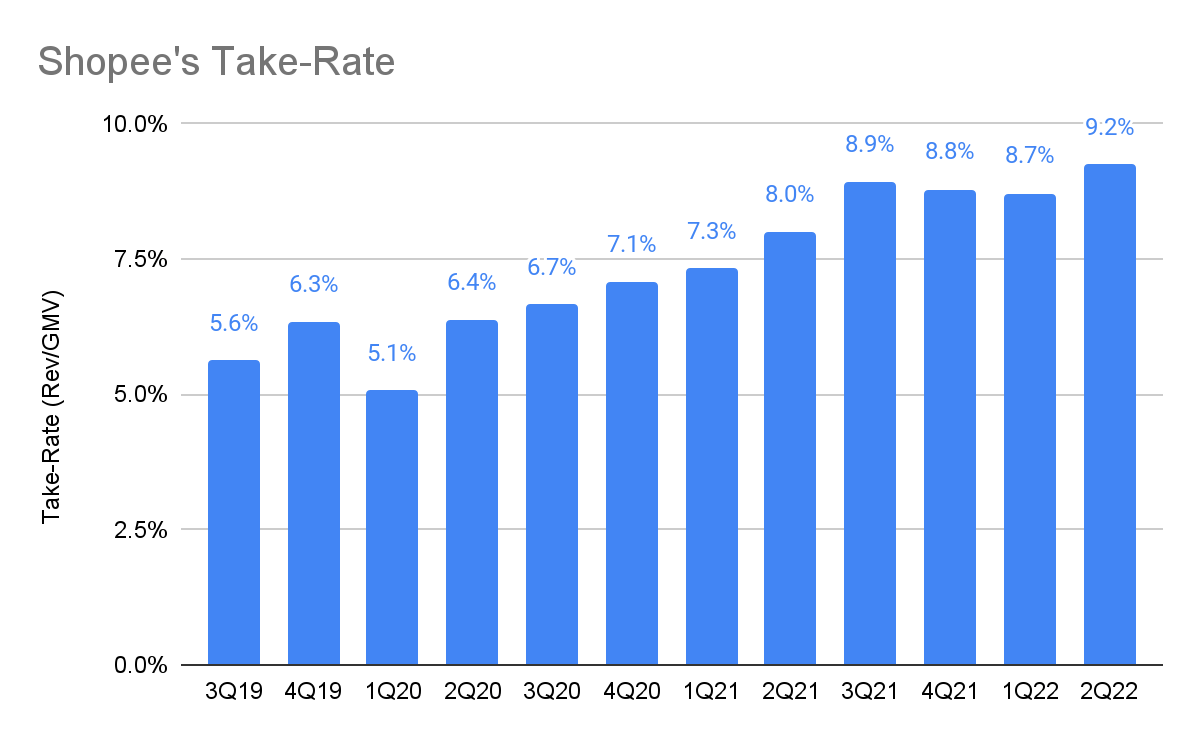

The main contributing factors include (1) its mobile-first approach by coming up with a mobile app as there was an increasing mobile penetration rate in emerging markets such as Indonesia and Thailand, (2) hyper-local strategy by having 7 separate apps in each market in SEA, and they also hire local staffs that best understand the users in each market to better serve them, (3) gamifying the shopping experience through in-app games, leading an increase in time-spent-in-app and app stickiness, (4) focusing on high-frequency and high margins product categories like fashion and beauty, and (5) management’s decision to forgo short-term profits for long-term profitability by maintaining a low take-rate with the aim to drive higher sales volume.

Investors’ Concern Over Shopee’s Declining Growth Rates

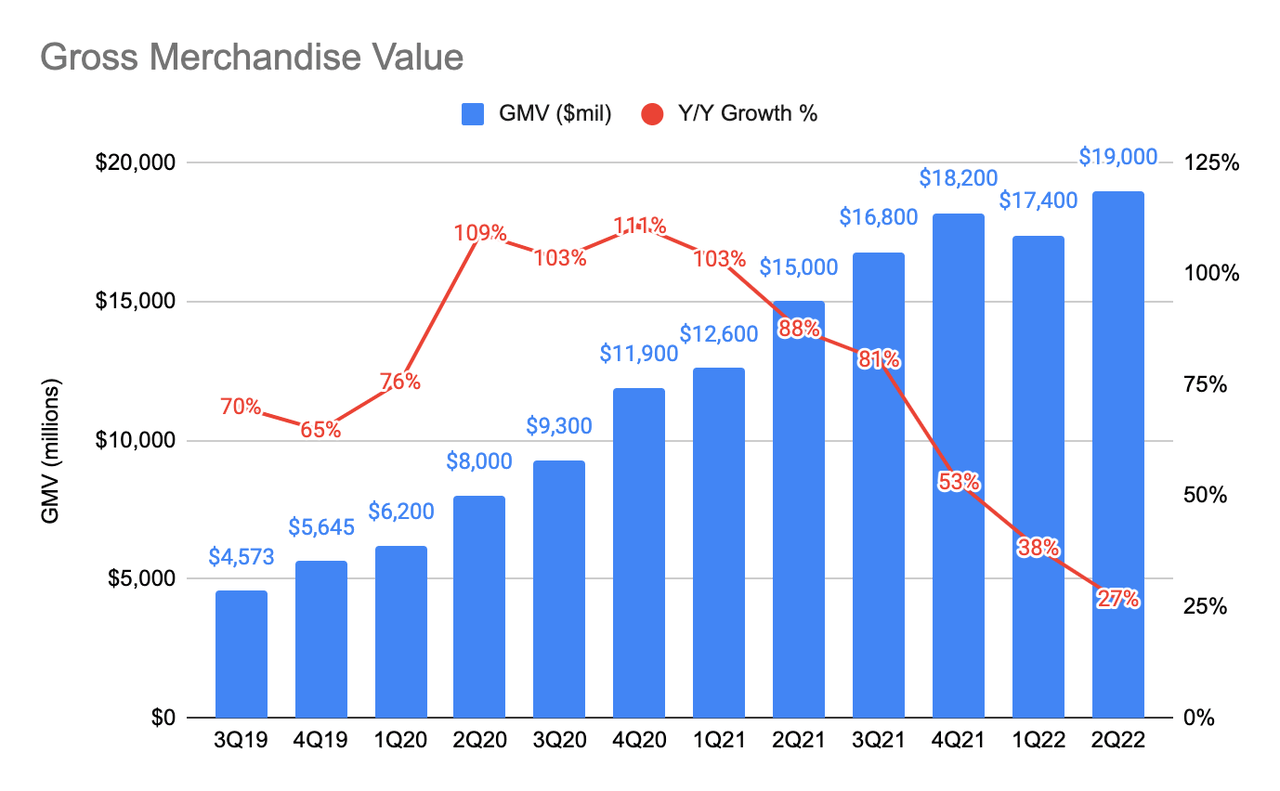

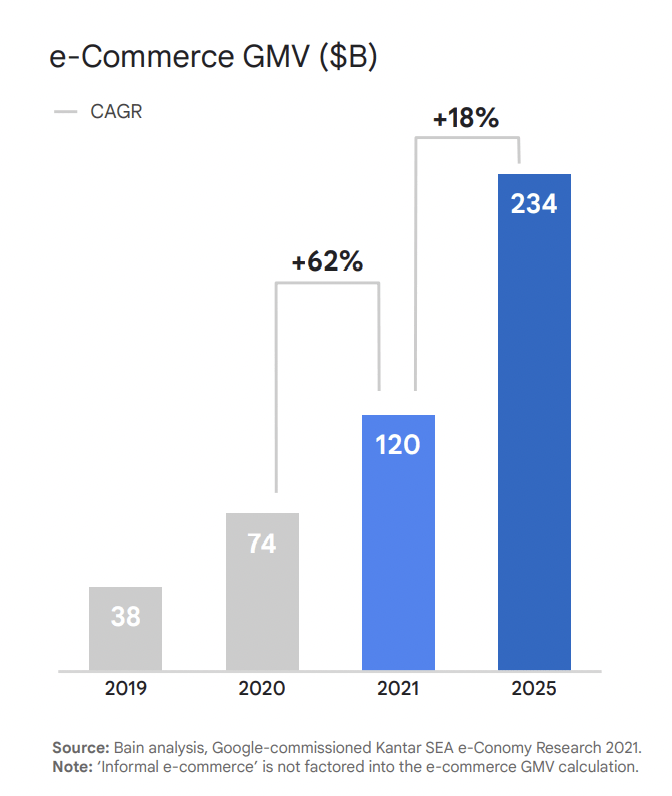

Image Created From Sea Limited 10-Q Google-Bain-Temasek 2021 Report

Combining those strategies with the Covid tailwind, Shopee went on to win a majority of the market share in SEA. To expand its runway, Shopee’s management also identified new markets to enter, primarily in Latin America (i.e. Brazil, Mexico, Colombia, Argentina, and Chile) and Poland. But as growth normalizes coming out of Covid, and with the rising inflation, and Shopee’s market leadership in SEA (estimated 35% to 40% using GMV / Total e-Commerce GMV), its GMV growth rates have declined from 111% in 4Q20 to 27% in 2Q22. More recently, the management announced its decision to exit all LatAm markets except for Brazil as achieving profitability is key.

Better Positioned Among Peers To Reach Profitability

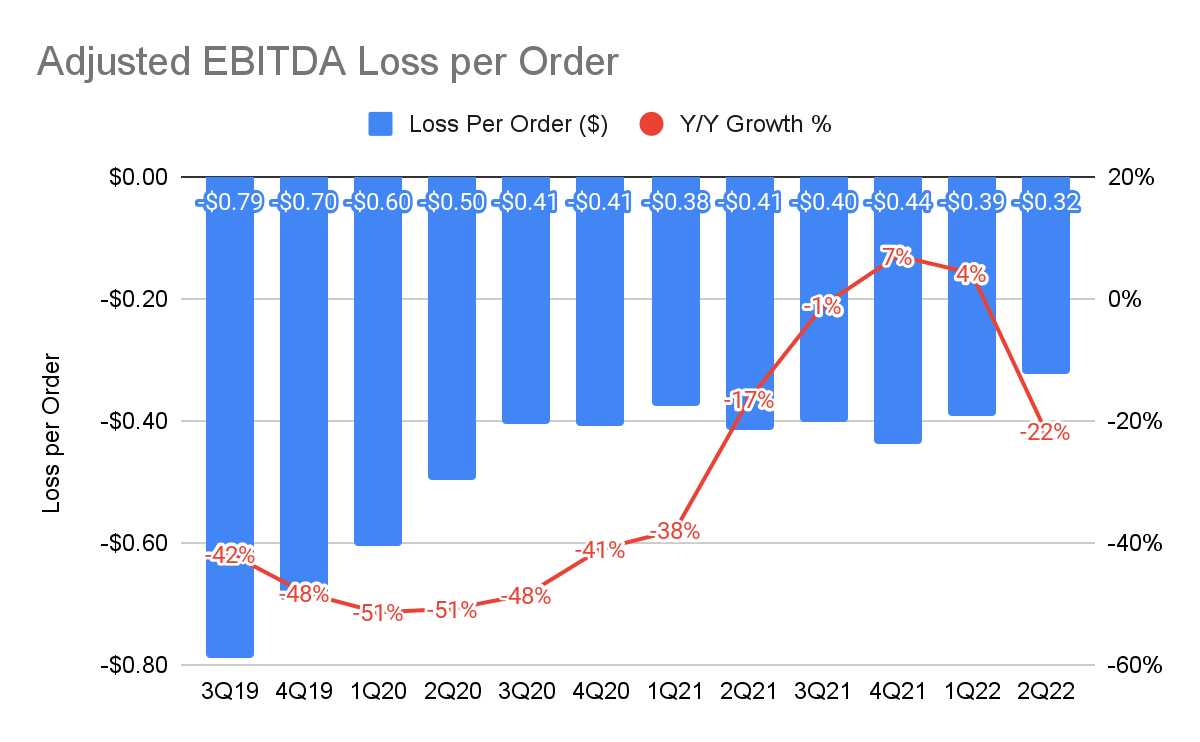

Image Created From Sea Limited 10-Q Image Created From Sea Limited 10-Q

Since 3Q19 or the pre-Covid period, its adjusted EBITDA loss per order has been improving, indicating its improvement in profitability. This was driven primarily by the increase in take rates and sales efficiency. However, as Shopee entered more markets, the loss per order typically fluctuate between $0.38 and $0.44 from 3Q20, and it was not until 2Q22 that there was a 22% Y/Y improvement to $0.32 due to Shopee cutting costs through laying off employees, exiting existing markets, and tuning down its S&M expenses to prioritize profitability.

More specifically, Shopee’s loss per order in SEA and Taiwan, or Asia, has improved by 75% quarter-on-quarter (“Q/Q”) in 2Q22 and 73% Q/Q in 1Q22. And they are expected to break even in Asia by the end of FY22. This is possible only because Shopee had attained market leadership in SEA and it chose to maintain a low take-rate in its earlier days. Today, they can monetize the platform by increasing the commission rate charged to sellers, charging users for shipping fees, and driving the sellers’ adoption of advertisement tools on the platform, raising the overall take rate. By commanding large consumer mindshare and its ability to drive higher sales volume for sellers than any other platform, sellers are unlikely to leave even as Shopee raised its commission. This is further backed by SensorTower as Shopee remains the number 1 overall shopping app in SEA and Google Trends shows Shopee is leading Tokopedia and Lazada by a mile. Its market leadership has certainly made them better positioned than its peers to attain profitability.

On the other hand, Shopee Brazil’s loss per order has slowed down to 7% Q/Q in 2Q22 from 24% Q/Q in 1Q22, and if you consider that other newer markets in LatAm are generating heavier losses, and with Garena’s declining profitability, this makes sense why they have decided to exit those markets. This also means that we are likely to see a further decline in growth rates in subsequent quarters.

Here are 2 case studies done on Amazon (AMZN) and MercadoLibre (MELI) by Fred Liu of Hayden Capital, highlighting how both companies have experienced similar drawdowns and bear markets, and have emerged stronger afterward. While investors may be punching the bag for management’s decision to cut costs aggressively, my views are well-aligned in that achieving profitability is key and Shopee’s market leadership in SEA is a key competitive advantage.

SeaBank/SeaMoney

Overview

This is the business segment that I believe can increasingly make up a bigger portion of the overall company, but at the same time, most investors are not putting much weight into the business. This is so for various reasons – (1) SeaMoney’s revenue makes up only 9.5% of total revenue, which is not significant yet, (2) management does not disclose much information on SeaBank through their earning calls, and (3) investors are not aware that SeaBank has its own separate financial statements in Indonesia and Philippines.

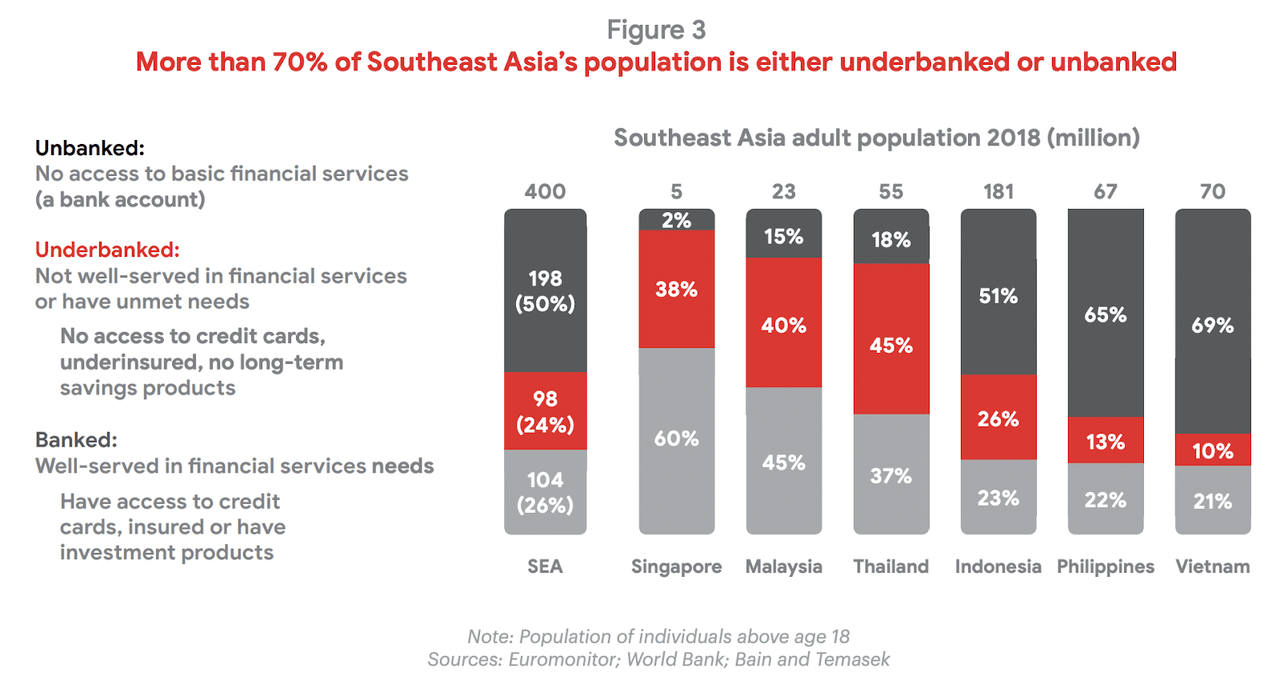

Google-Bain-Temasek 2019 Digital Finance Service Report

The management saw a tremendous opportunity to serve the unbanked and underbanked populations in SEA. This move makes perfect sense due to the strong synergy with Shopee as SeaBank is able to tap into the massive user base on Shopee’s platform to drive adoption and reduce customer acquisition costs. In Dec 2020, SeaBank won its first digital banking license, followed by 2 acquisitions in Indonesia and the Philippines, and more recently, they won a license in Malaysia.

Introduction To SeaBank

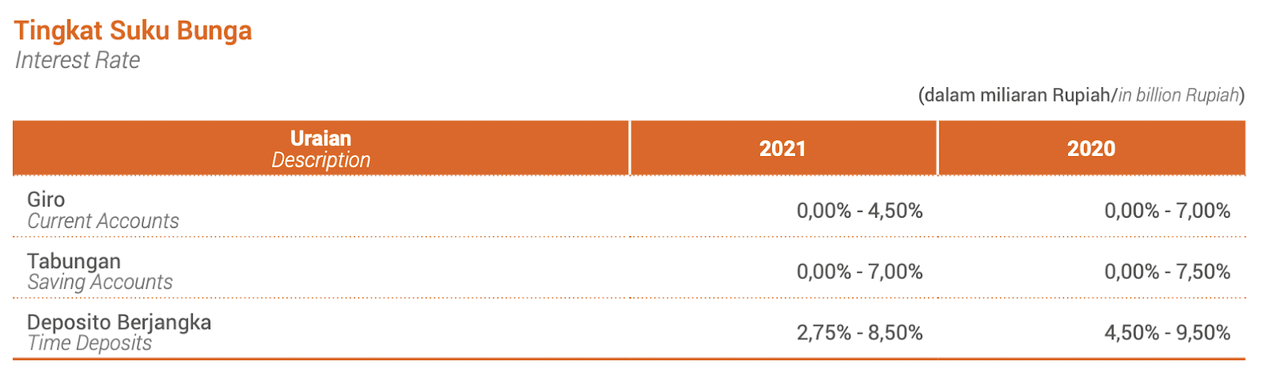

SeaBank Indonesia FY21 10-K

SeaBank has a few core product offerings, namely savings accounts, current accounts, and time deposits, and they are offered at varying interest rates. SeaBank collect deposits from consumers and pays them roughly 7% interest rate, while peers like GoTo’s Bank Jago are offering a 3% to 4% interest.

Unlike SeaBank which is aggressive in customer acquisition, Bank Jago aims to attract users by providing a better customer experience through its product called pockets. Users can create as many pockets (or accounts) for different purposes, such as savings, spending, emergencies, etc. And like Shopee, Bank Jago can tap into the user base in GoTo’s Gojek and Tokopedia platforms to drive adoption.

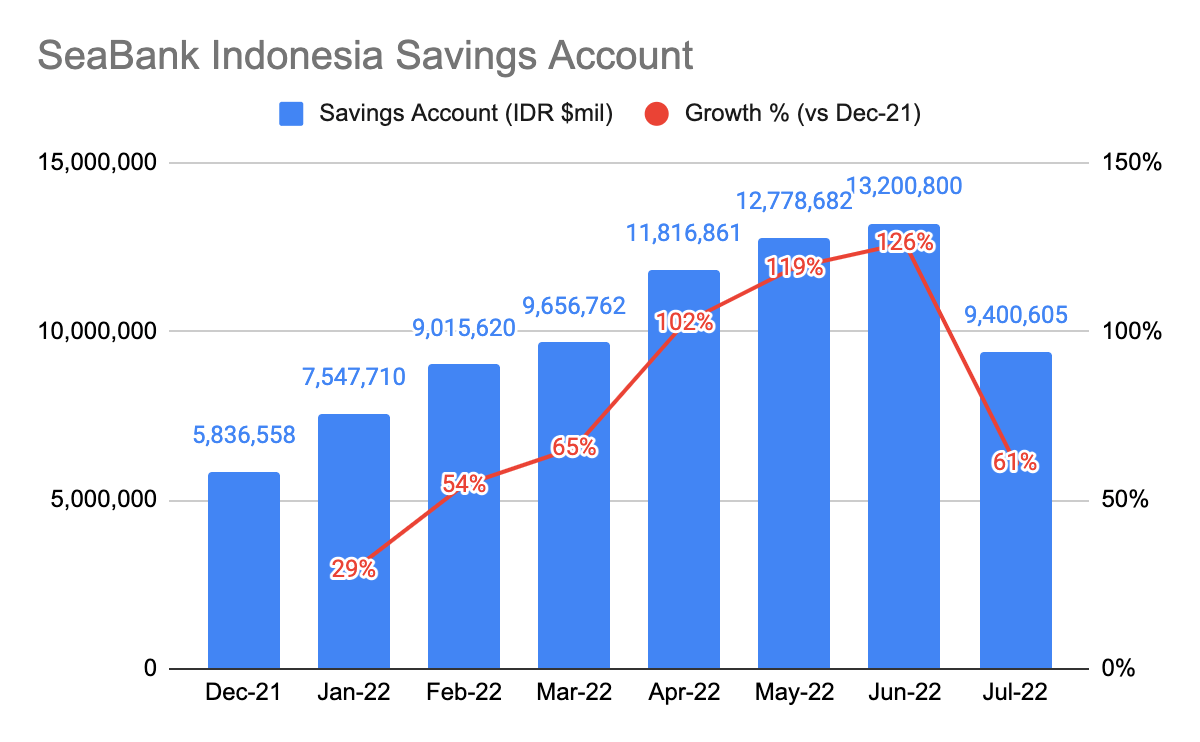

Author’s Image

Taking those deposits, SeaBank puts them in Shopee’s Buy Now Pay Later (“BNPL”) and SLoans which are loans offered to their users, to generate even higher interest rates. This is effectively a self-financing model in which consumers are funding SeaBank’s operation, and loans are one of the most profitable businesses of a digital bank.

When it comes to loans, banks need time to train their algorithms for credit underwriting purposes. The more data it collects, the lower it can reduce the risk of non-performing loans, and thus, digital banks can easily scale their lending. But, in the case of SeaBank, it takes far lesser time to scale its lending due to synergy with Shopee as Shopee can utilize its users’ data for digital lending. This is the same for GoTo’s Bank Jago, as well as Bukalapak’s (OTCPK:BKPTY) [IDX:BUKA] Bank Allo. However, I believe Bank Jago has an edge over SeaBank and other peers as it can tap into its partnerships with multi-financial companies (“MFC”) and peer-to-peer (“P2P”) lenders to underwrite credits more effectively. For SeaBank to transition from loaning to consumers to merchants, it requires far more data as the risk of NPL is generally higher.

Another point to note is that SeaBank is entitled to 100% of the profits earned, while peers are not as they do not have full ownership of the banks. GoTo owns 22% of Bank Jago and Bukalapak owns 11.49% of Bank Allo.

Financials

Accelerating Customers Deposits

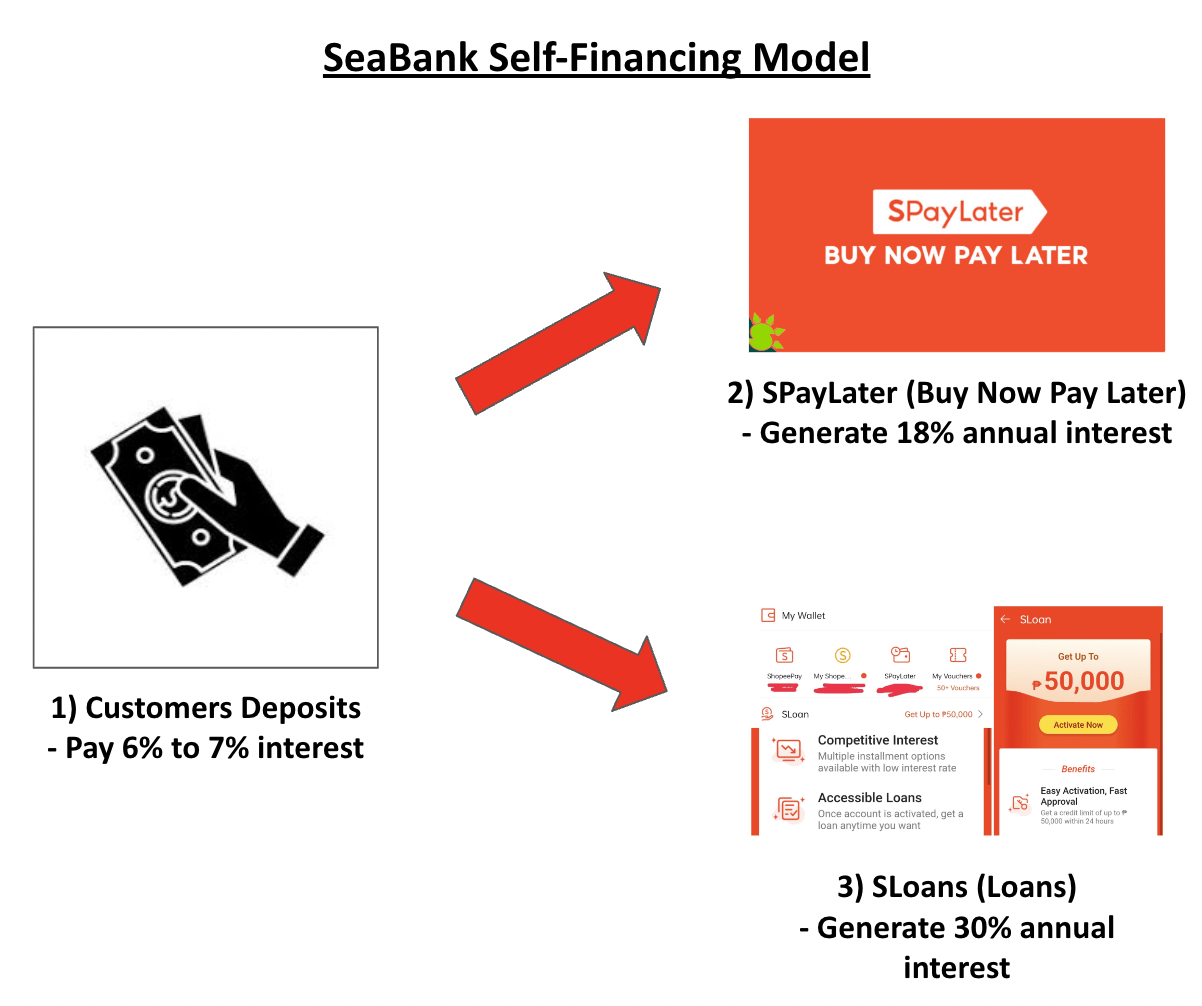

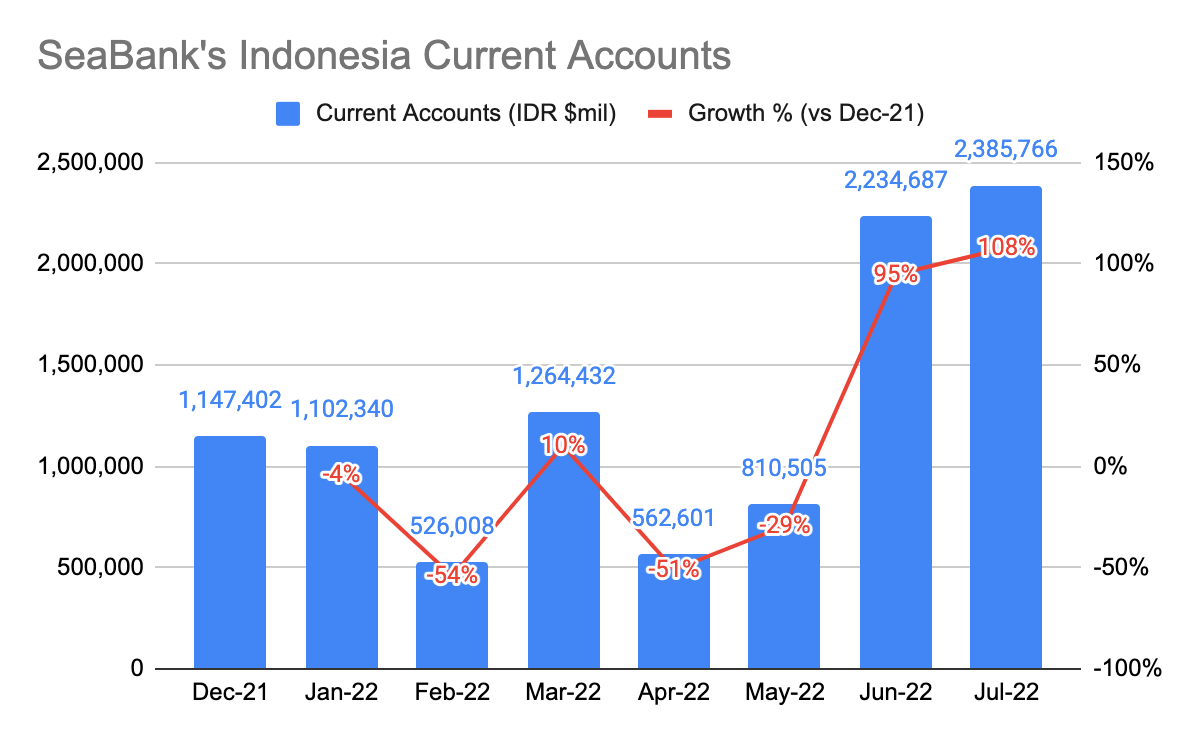

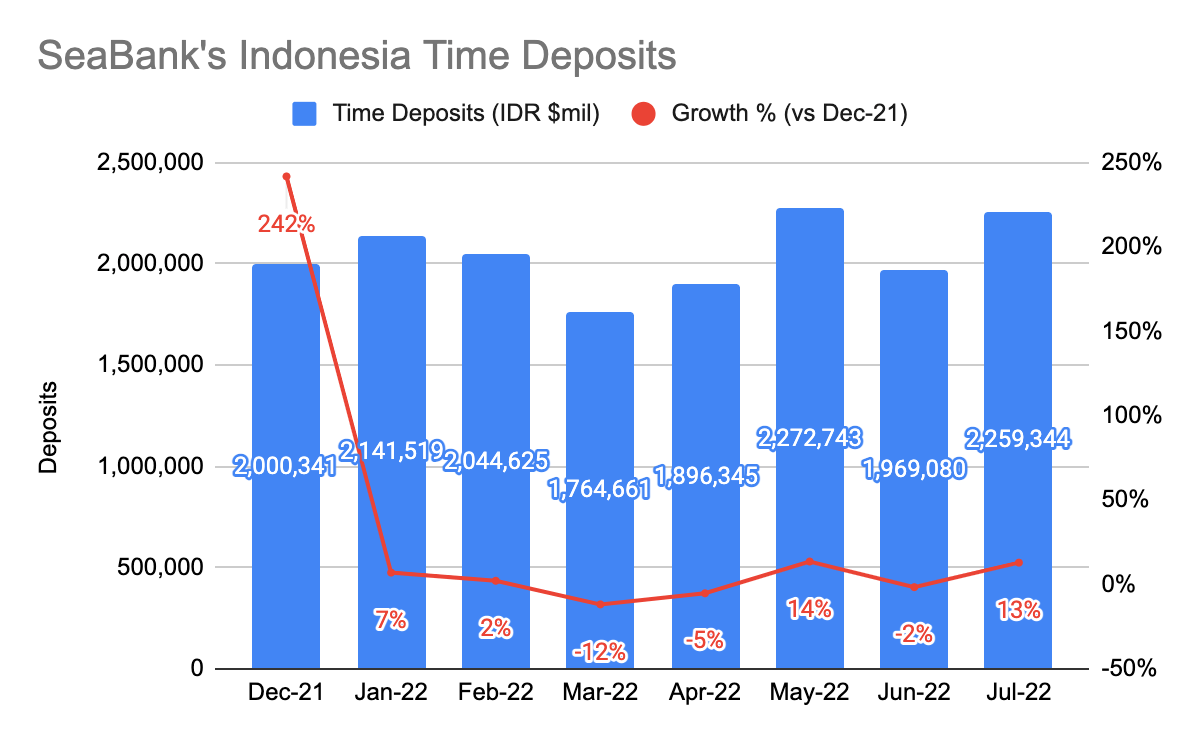

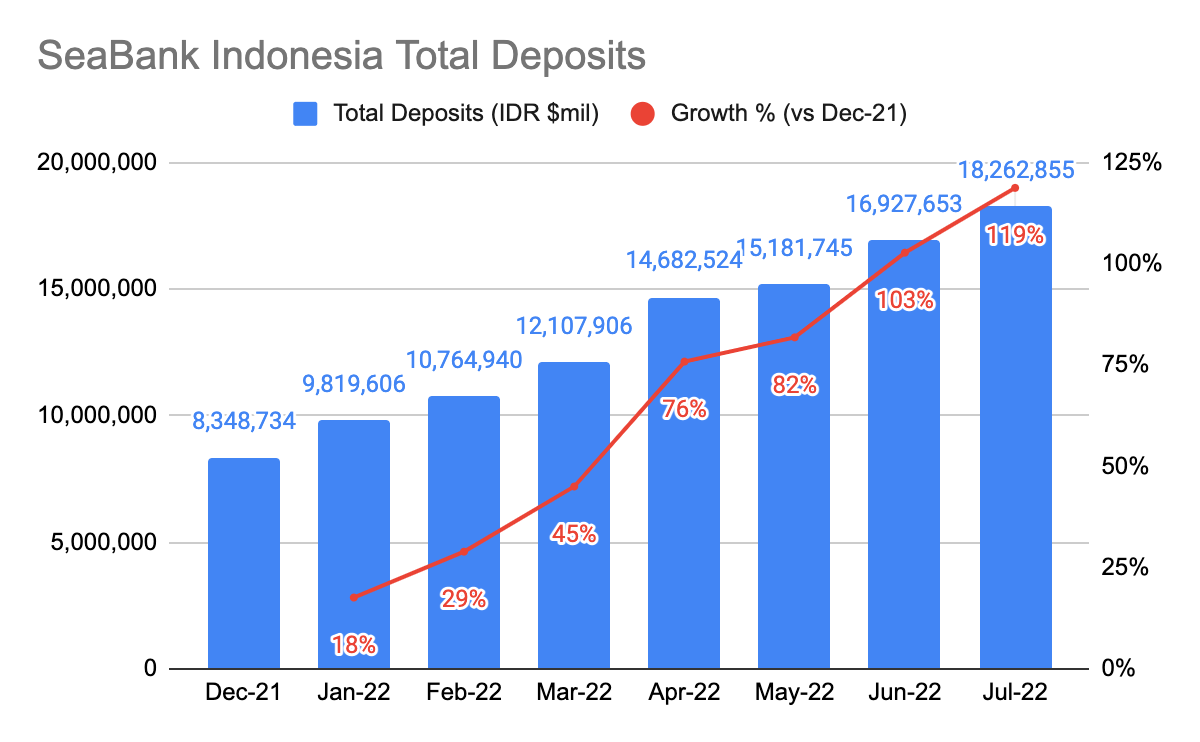

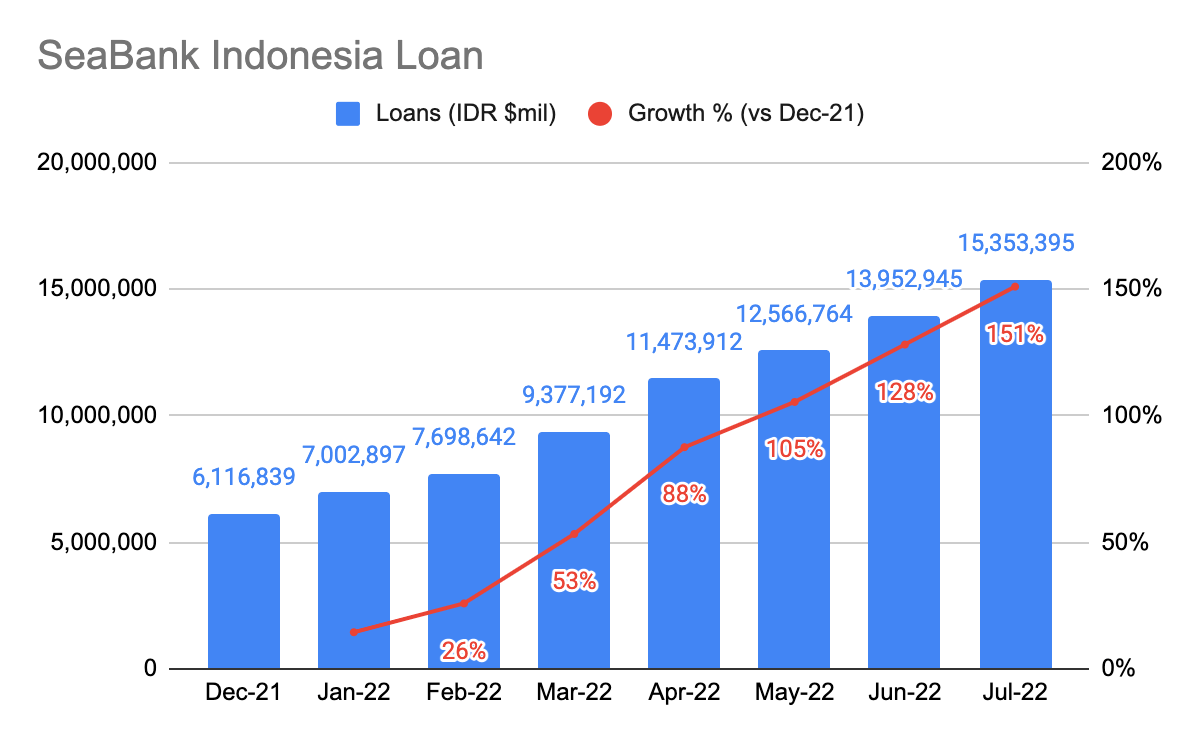

Image Created From SeaBank Indonesia 10-K and Monthly Financial Statements Image Created From SeaBank Indonesia 10-K and Monthly Financial Statements Image Created From SeaBank Indonesia 10-K and Monthly Financial Statements Image Created From SeaBank Indonesia 10-K and Monthly Financial Statements

I will only be including financials from SeaBank Indonesia as SeaBank Philippines does not disclose its monthly financial statements.

SeaBank Indonesia has been accelerating its deposits as its savings account, current accounts, and time deposits grew 61% Y/Y, 108% Y/Y, and 13% Y/Y, in July 2022, respectively. Collectively, the total customer deposits grew 119% Y/Y in July 2022, and it managed to double its deposits just 7 months into FY22. For comparison sake, its closest peer, Bank Jago’s total deposits grew 95% Y/Y to IDR7,154,113 million.

Current accounts and savings account (“CASA”) constitutes a larger portion of SeaBank’s total deposits primarily because it is a cheaper source of financing due to the lower interest rates they are paying as compared to time deposits. SeaBank aims to offer attractive interest rates to entice users to put more and retain their money in these accounts.

Growing Loans

Image Created From SeaBank Indonesia 10-K and Monthly Financial Statements

Its loans on the other hand are growing at 151% Y/Y, which is a great sign as SeaBank has a strong self-financing model and we like to ideally see this growing quickly too. And these are loans that have to be paid back within a year.

Profitability

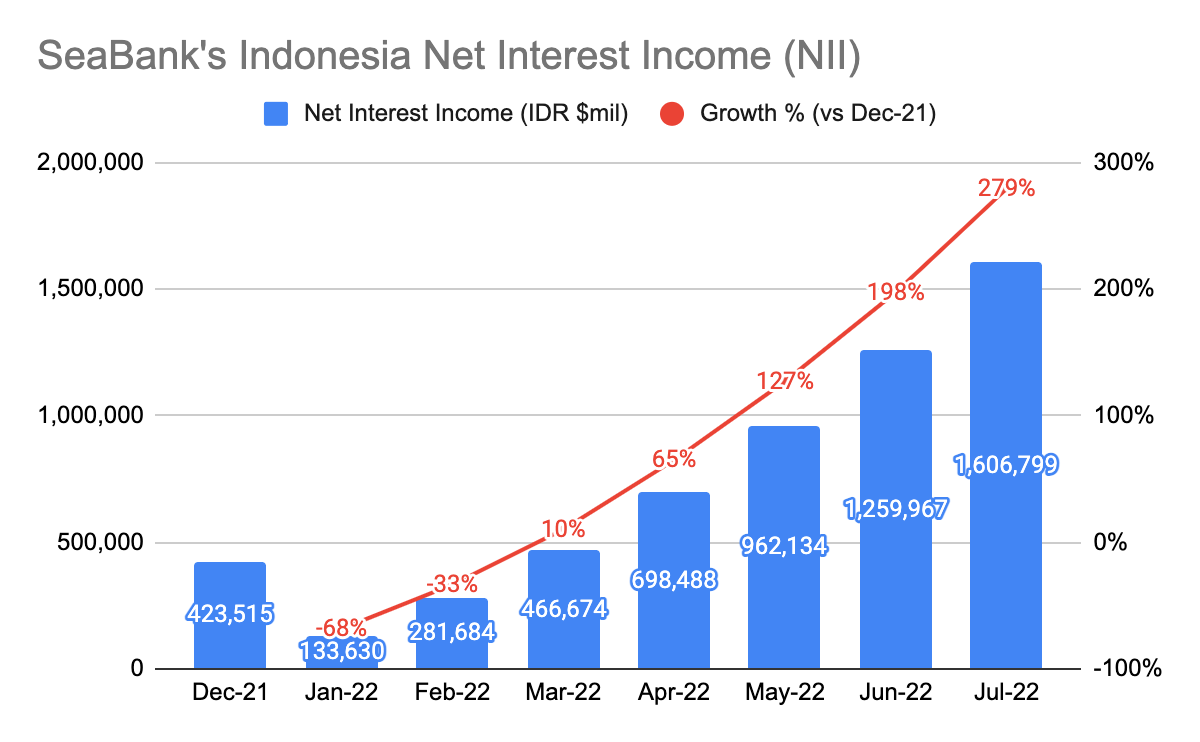

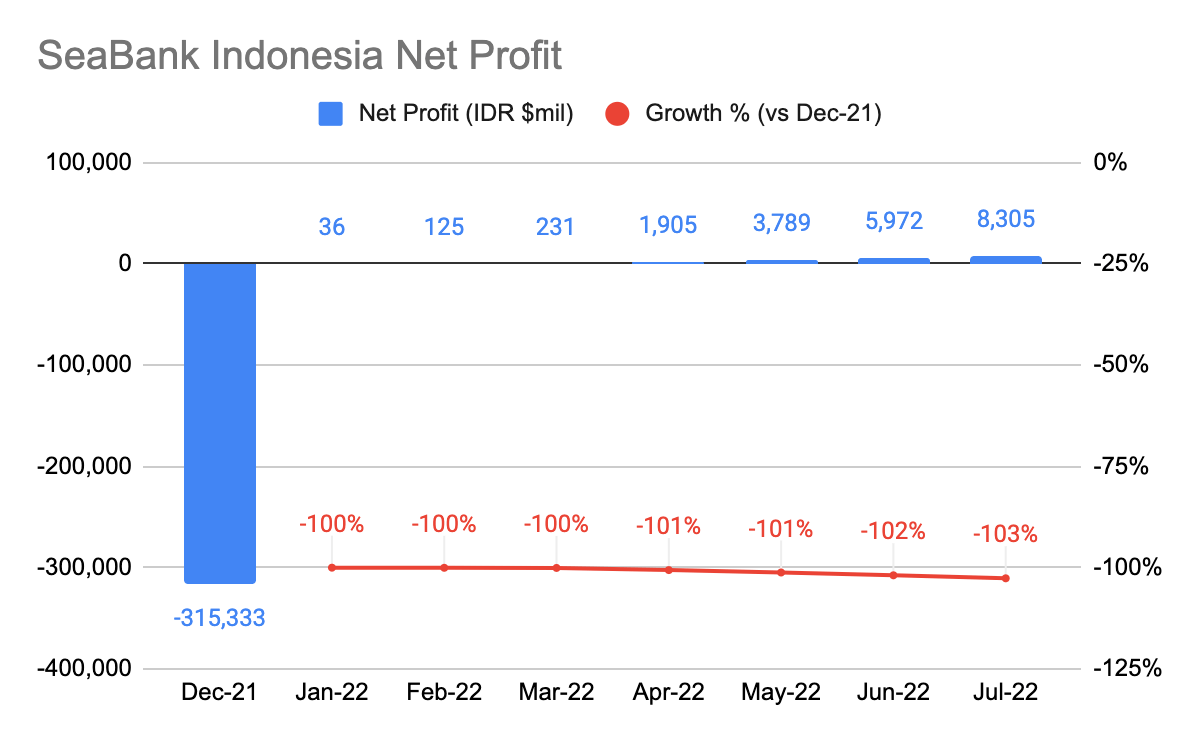

Image Created From SeaBank Indonesia 10-K and Monthly Financial Statements Image Created From SeaBank Indonesia 10-K and Monthly Financial Statements

The net interest income (“NII”) is calculated by taking the difference between interest expense (i.e. 7% interest offered to consumers) and interest income (i.e. interest generated from BNPL and SLoans). Its NII grew at a staggering 279% Y/Y, driven by both growths in customer deposits and loans. And as a result, they managed to book a net profit from Jan 2022 onwards.

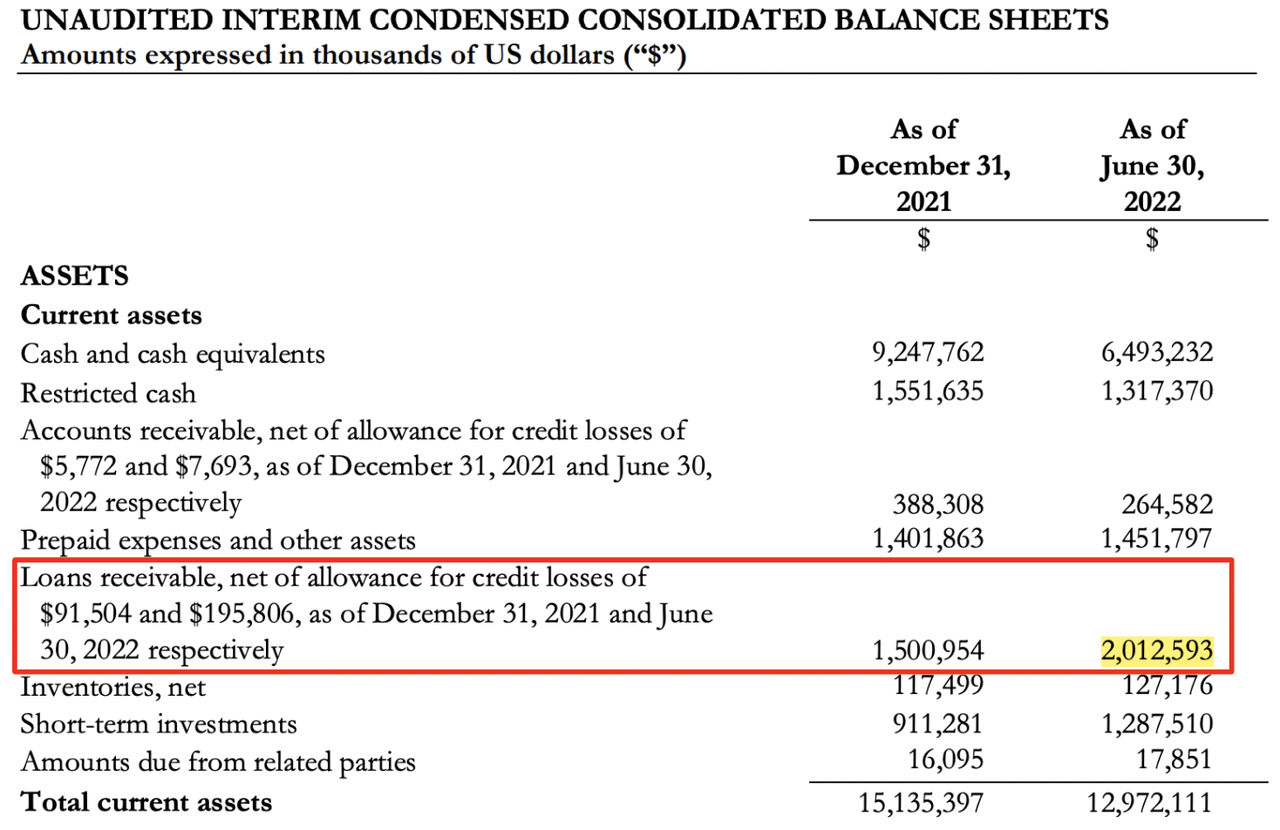

Sea Limited 2Q22 Quarterly Report

In the consolidated financial statement, its loan receivables have also been growing really quickly as just 6 months into FY22, its $2 billion loans have surpassed Dec 2021. We can safely assume that they are on track to reach $3 billion by the end of the year.

Balance Sheet

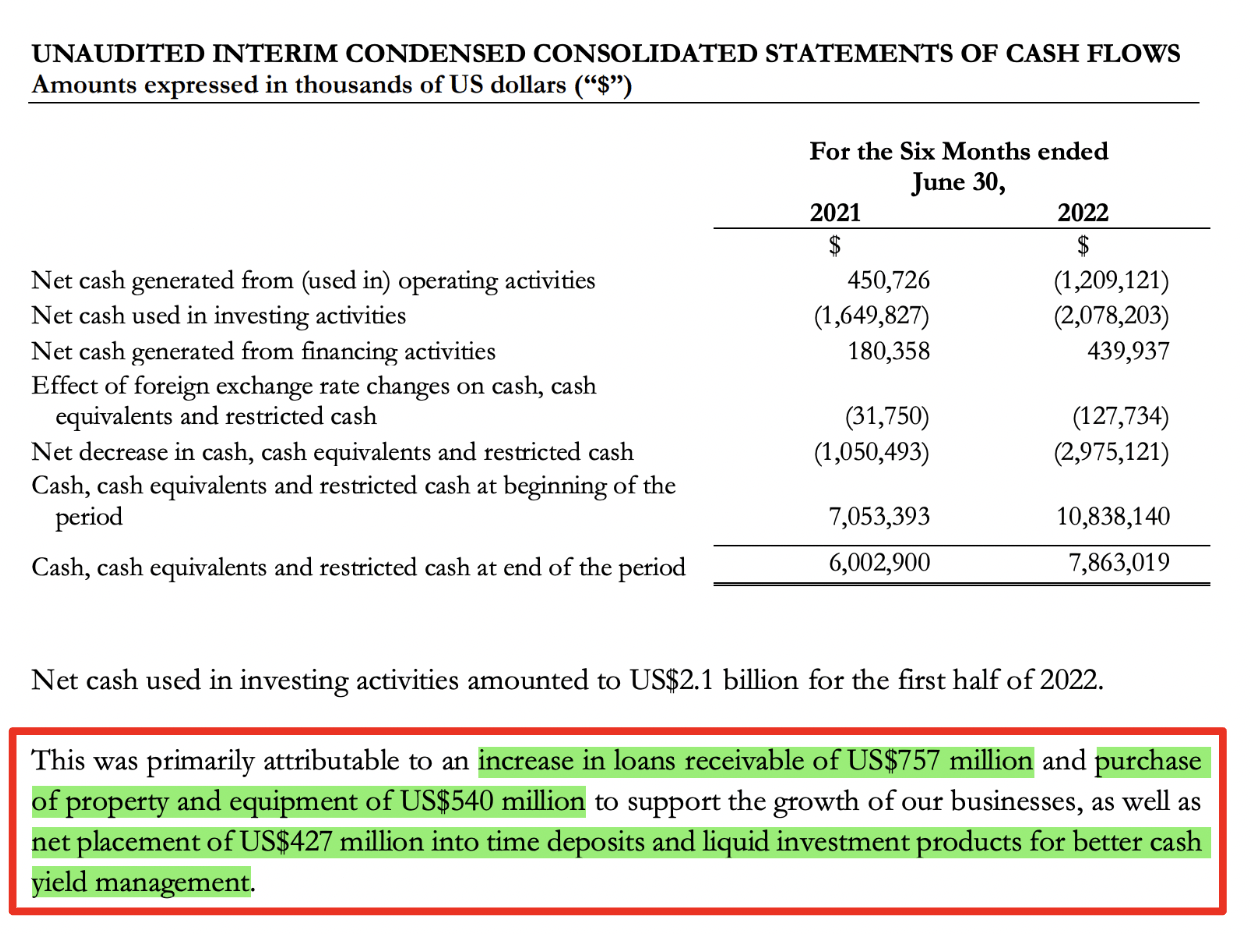

Sea Limited 2Q22 Quarterly Report

As of 2Q22, the company has total cash of $7.8 billion in its balance sheet, and this is down from $10.8 billion in 4Q21. The $757 million of loan receivables are money that SeaBank loans to its customers and these are expected to be paid back in less than a year. The $540 million in property and equipment could be attributed to building out its logistic infrastructure in Brazil, and the $427 million in time deposits and liquid investments, are likely assets that can be converted to cash when needed.

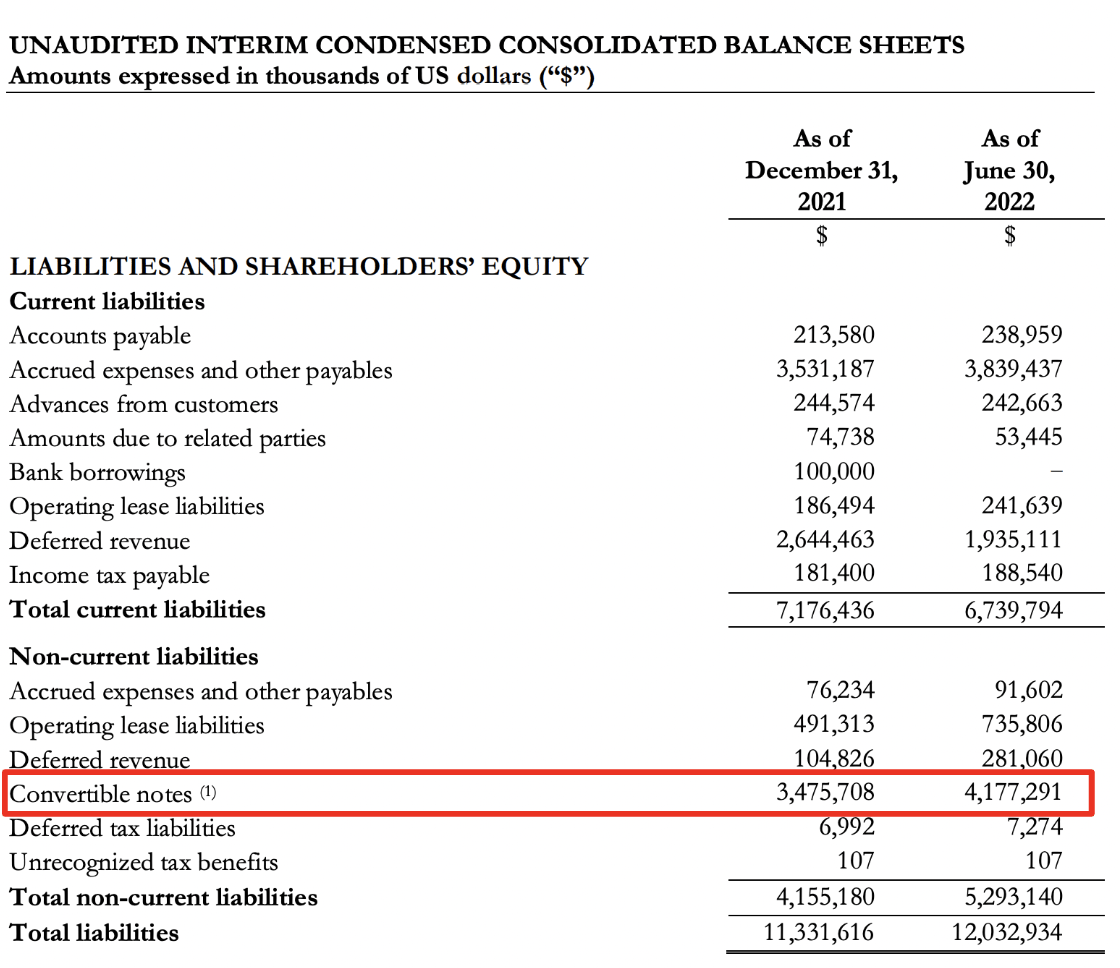

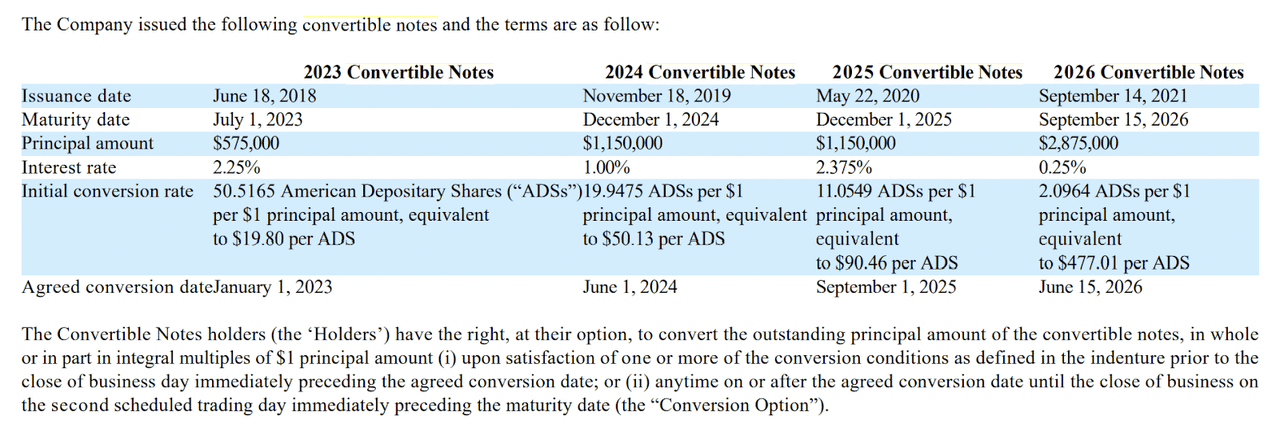

Sea Limited 2Q22 Quarterly Report

Sea Limited FY21 10-K

The more concerning issue is its $4.2 billion of convertible notes sitting on its balance sheet. There are various notes, with the earliest maturing on Jul 1, 2023. Its 2026 convertible note in particular has a conversion price of $477.01, which I believe is unlikely to be converted. The full principal is likely to be paid in cash, and this will result in a low cash balance after deducting the full amount from its current cash balance of $7.8 billion. Therefore, it’s critical for the company to attain self-sufficiency, and we certainly do not want to see the company raising external capital at the valuation today.

Risks

Garena

-

Execution risks: Inability to reaccelerate its growth rates.

-

Unpredictability nature of games: Games have unpredictable shelf-lives due to the challenging need to keep up with consumers’ trends, wants, and needs. In addition, new games may also take longer than expected to launch.

-

Macroeconomics: Rising inflation may reduce consumers’ spending, and Garena’s profits are likely to decline further.

Shopee

-

Macroeconomics: Shopee continues to be at risk of inflation due to lower consumer discretionary spending.

-

Execution and balance sheet risks: Shopee Brazil’s inability to attain profitability and the continued investments in logistics will eat into the company’s cash balance.

SeaBank

-

Competition: Competitors may compete by offering similar interests as SeaBank, hindering its ability to acquire customers.

-

Execution risks: Inability to expand from consumers loan to merchant loans and SeaBank’s ability to expand to other product offerings, such as mutual funds and insurance to provide more value propositions to its users.

Valuation

I am using a 12% discount rate in my valuation model.

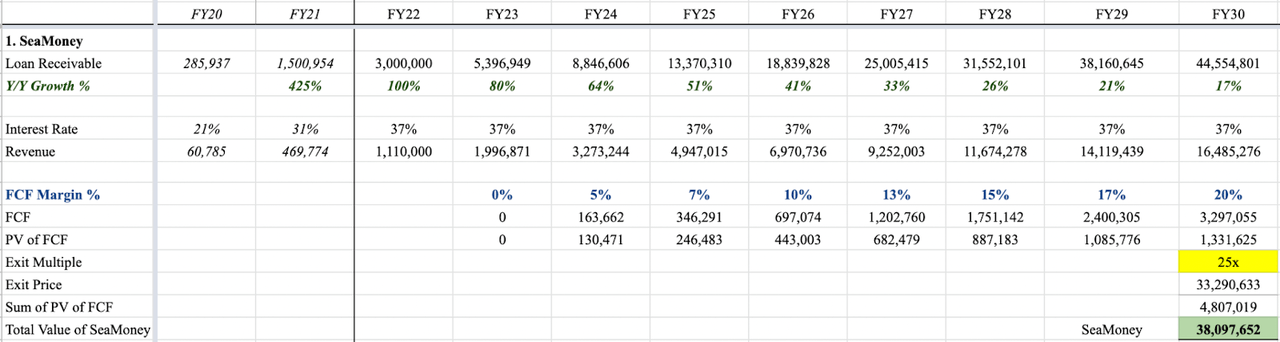

SeaMoney

Author’s Estimates

SeaMoney is on track to hit $3 billion in loan receivables by FY22, and with the management revenue guidance of $1.11 billion, this gives us an interest rate of 37%. I will be using the same interest rate throughout the forecast.

Management guided SeaMoney to be cash flow positive by FY23, and I’m estimating its FCF margin to be 20% by the end of FY30. This is achievable given its strong self-financing model and that digital banks are less capital-intensive than traditional banks. With FCF multiple of 25x, this gives us a total value of $38.1 billion by FY30.

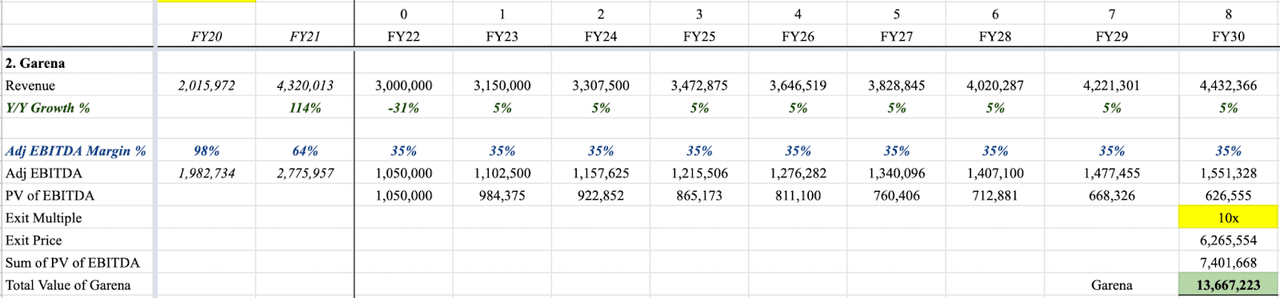

Garena

Author’s Estimates

Management guided for a $3 billion revenue by FY22, and I’m using its current adjusted EBITDA margin of 35%. Over here, I am taking into consideration that since Garena does not incur much capital expenditure, I will be using its adjusted EBITDA as a proxy for its FCF. A multiple of 10x gives us a total value of $13.7 billion by FY30.

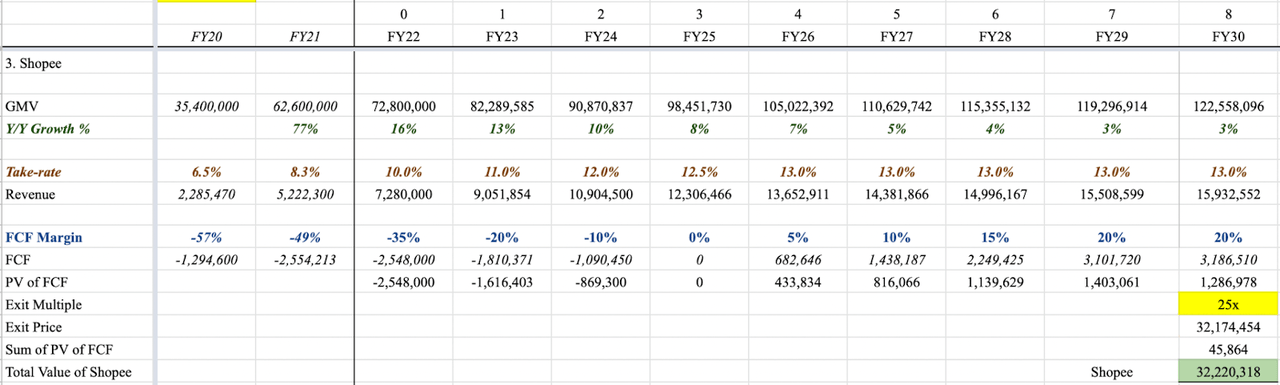

Shopee

Author’s Estimates

3Q and 4Q are seasonally stronger quarters for Shopee, therefore, we can annualize its 1H22 GMV to reach $78.8 billion. Since Shopee has a mature market share in SEA and has exited multiple markets, I’m expecting a low single digit’s growth by FY30. Take rates are to increase gradually to 13%. According to the management, Shopee is expected to be self-funding by FY25, and my estimated FCF margin by FY30 will be 20%. A multiple of 25x gives us a total value of $32.2 billion.

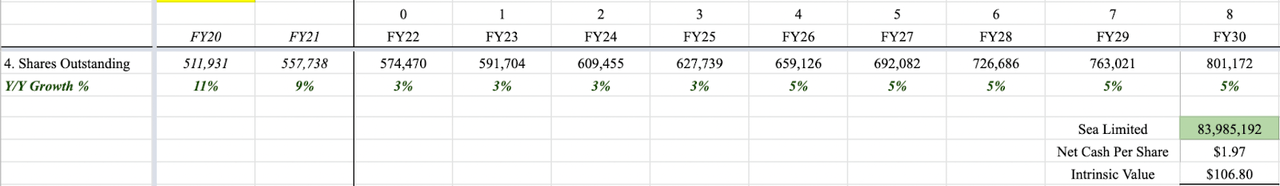

Combined Business

Author’s Estimates

I do not expect heavy dilution as the race to profitability tightens. Combining all segments gives us a total value of $83.9 billion for Sea Limited. After accounting for net cash per share, the intrinsic value is $106.80.

Conclusion

Sea Limited has been under scrutiny, and this is understandably so given the declining growth rates we’ve seen in its cash-cow Garena, and crown jewel Shopee, thus, raising doubts if Shopee can break even. And as SeaBank’s developments are not obvious to the public, it is no surprise to see why investors are not confident in SeaBank’s growth trajectory.

However, in this article, I managed to cover that (1) Garena is working on its self-developed games with Phoenix Labs, and likely Vic Game Studios in the future, (2) why Shopee is well-positioned to reach profitability and why its decision to cut cost is right, and (3) I’ve also touched on SeaBank’s strong self-financing model, SeaBank Indonesia accelerating growth in loans and deposits, and that it is already profitable. Unlike the consensus, I believe the fundamentals are not broken.

I’ve also tried my best to also come up with conservative and fair estimations of the company, of which my intrinsic value is $106.80. Note that these are purely based on my assumptions and are subject to errors, therefore, readers should conduct their own due diligence. For investors that are willing to look past the short-term macros, I believe the current valuation may be a great opportunity to consider.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment