da-kuk

iShares MSCI EAFE Small-Cap ETF (NASDAQ:SCZ) is a fairly niche exchange-traded fund that invests in small-cap equities in developed markets across Europe, Australasia, and the Far East (excluding the United States and Canada). The expense ratio is 0.39%, and net assets under management were $9.6 billion, making the fund popular in spite of its niche focus.

While I would describe SCZ as “niche” in its focus, bear in mind that the fund has as many as 2,349 holdings as of October 31, 2022, as the fund does cast a wide net internationally.

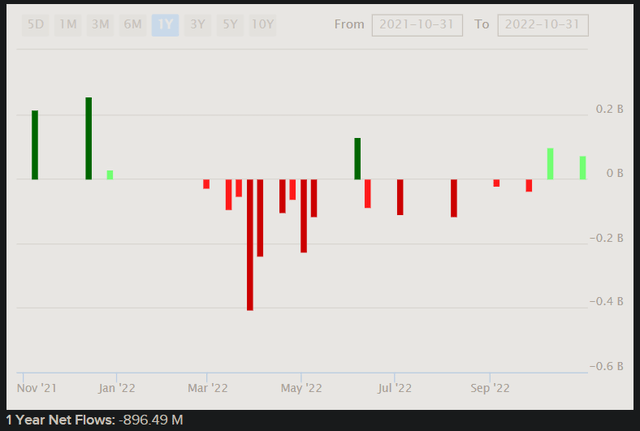

Net fund flows, as illustrated below, have been negative to the tune of about -$900 million over the past year for SCZ. It makes sense that with a rising U.S. dollar (making non-USD denominated equities cheaper) and slowing growth in the developed world has sent SCZ lower. Small-cap stocks are usually viewed as riskier, and indeed SCZ carries a higher long-term beta of about 1.17x.

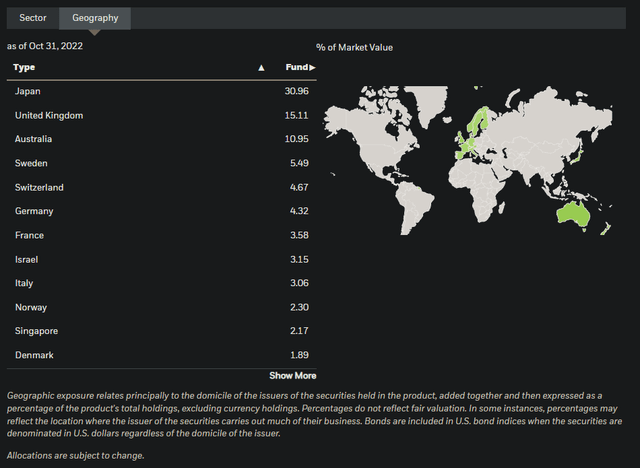

The fund’s benchmark is the MSCI EAFE Small Cap Index. As of September 30, 2022, the fund’s trailing and forward price/earnings ratios were 14.02x and 11.50x, respectively, with a prevailing price/book ratio of 1.15x. That indicates a forward earnings yield at the time of 8.7%, and a forward return on equity of about 10%. MSCI is less forgiving than other data providers when it comes to earnings, but a 10% return on equity is admittedly low. I am used to seeing closer to 15% internationally on average, and 20-30% (or even higher) across popular U.S. ETFs. This is in great part owing to SCZ’s heavy exposure to Japan (at 31% as of October 31, 2022).

Japan is a characteristically low-interest-rate, low-return economy. This is why the country has such a large net international investment position (about 63% of GDP as of 2021). Funds flow out of Japan into other countries, as domestic Japanese investors search for higher yields (whether through bonds, equities, or otherwise). SCZ’s large exposure to Japan is evidence of funds flowing in the opposite direction via SCZ, but there is risk in investing in “cheap” (low-return) countries/sectors. The risk is in the opportunity cost.

SCZ has performed poorly this year, with a year-to-date return of -29.21% at the time of writing (reported by iShares to October 31, 2022 on an NAV total return basis). That is a little worse than the S&P 500 U.S. equity index of about -20%. The Japanese yen has weakened considerably against the U.S. dollar this year too, dropping about -22%, so in fairness plenty of the downside has been owing to FX variance.

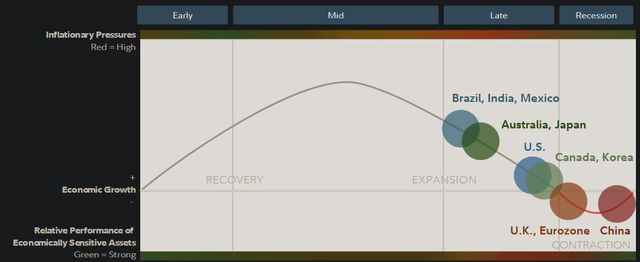

Nevertheless, the U.S. dollar has strengthened by all major currencies this year. With the United States likely heading toward a recessionary dip (whether it will be soon or difficult remains to be seen), riskier segments of the equity market (including small-cap equities) have sold off in line with their characteristically higher betas. As illustrated below, the U.S. and Canada are heading into a recessionary period, while the Eurozone is already likely in recession, as is China (although China is likely to bounce back sooner).

As markets are forward-looking, usually by 6-12 months. Modern recessions last perhaps 10 months, maybe longer (and maybe shorter, e.g., COVID-19 from early 2020). On balance, SCZ is likely to be an interesting cyclical buy from the start of a recession. SCZ does have European equity exposures, and hence from that perspective, it might be interesting to go long European small-caps right now. However, SCZ also has plenty of other exposures, of course including Japan, but also Australia (11% of the fund) which is behind even the U.S. in its present business cycle.

Therefore, SCZ’s positioning is mixed, and it might not be for another 6-12 months or so before SCZ is best positioned on balance for the long side.

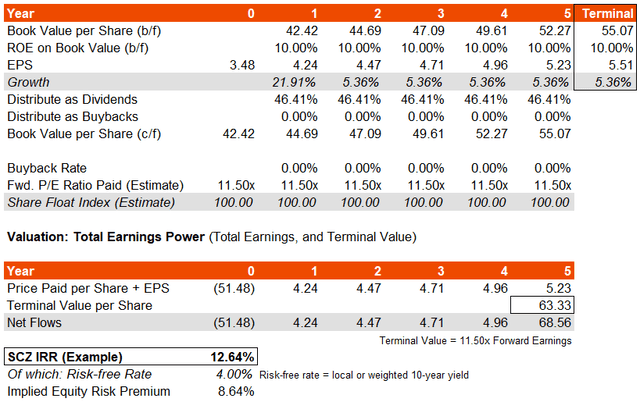

In terms of valuation, I have constructed a basic model below using MSCI’s data (for SCZ’s benchmark) using the index referenced earlier. Further, I have held most assumptions constant including a 10% return on equity. I have also taken an international U.S. investor’s perspective by using a local risk-free rate of 4% (about in line with the present 10-year yield). On this basis, the equity risk premium is well over 8%. Even adjusting for a higher average beta, the ERP is safely beyond what I would consider fair, indicating under-valuation.

The IRR is projected to be over 12%. My three- to five-year earnings growth assumption is implicitly 8.5-10.6%. As a frame of reference or comparison, Morningstar‘s earnings growth estimate for this same time period for SCZ is 9.96%, which means that my 10% return on equity estimate is probably fair. Assuming constant FX prices, the implied IRR is therefore strong. You could even argue that the earnings multiple for SCZ’s portfolio should expand from here.

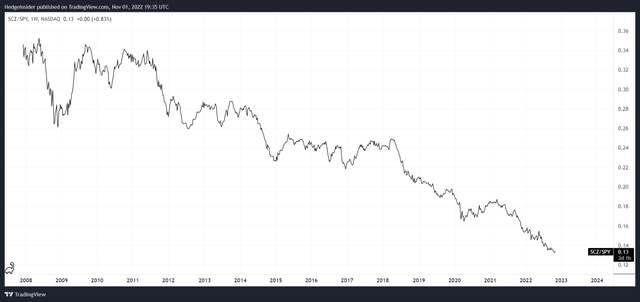

Having said that, the ratio between SCZ and popular S&P 500 U.S. equity index tracker SPY has dropped almost unidirectionally since SCZ’s inception in late 2007.

This is, in part, evidence of a stronger U.S. dollar as well as the United States’ preeminence in long-term equity out-performance. But even with the USD/JPY exchange rate probably being in an over-valued position at present, based on PPP models, and growth/current-account models, we should not need to rely on FX tailwinds (going forward) for returns. My rule of thumb is that the long-term performance of a fund is likely to converge between the forward earnings yield and the underlying portfolio return on equity; for SCZ, that would be very close to 10% in both cases.

In summary, SCZ is a decent international diversifier, and the expense ratio is not too high. However, I do not think that investing in this particular niche allocation strategy makes especial sense. The underlying return profile of circa 10% on a forward basis is good, but the long-term and clear under-performance versus U.S. markets is equally clear, and the fund is too diversified to present any material out-performance opportunity in the medium term. I would remain neutral on SCZ.

Be the first to comment