ozgurcankaya/E+ via Getty Images

Introduction

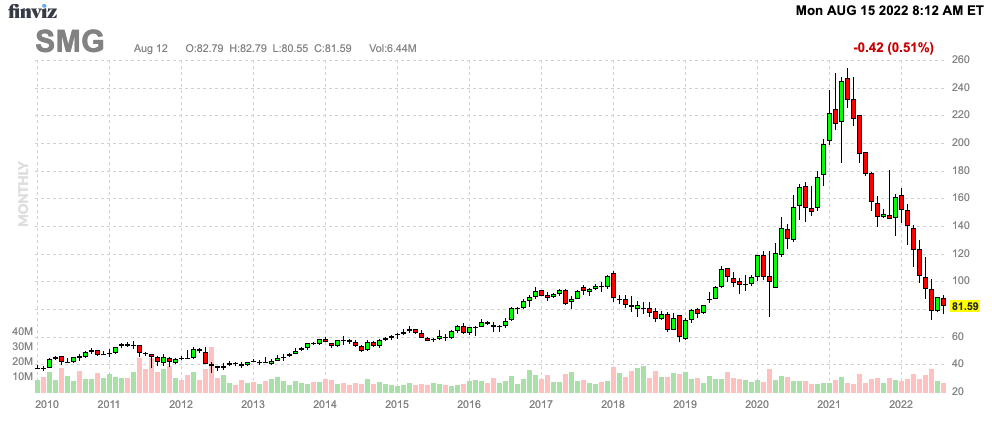

I’ve had some very good trades and investment ideas in the past few years. However, I’ve also had some bad ones. Scotts Miracle-Gro (NYSE:SMG) is one of the bad ones. In 2021, I wrote a bullish article. Since then, the stock is down roughly 50%. It’s down 30% since my most recent article in April. I’m not saying this to roast myself but because we’re dealing with an interesting development here. First of all, I do not believe that my assessment of the company’s value was wrong. SMG does bring a lot of value to the table as I will explain in this article. However, the market doesn’t trust the company as it is simply not reporting the growth rates that the market expected the company to be capable of. Given the valuation, the company characteristics, and market distrust, I believe that the company isn’t just a value play, but also a real takeover target.

In this article, I will share my thoughts on recent developments and discuss the value SMG brings to the table.

So, let’s dive into it!

There’s Value, But No Trust

With a market cap of $4.5 billion, SMG is a rather large player in the agricultural input industry. The company is officially operating in the basic materials sector, because of its core business.

The company produces and sells a wide variety of products for lawn and garden care and has exclusive deals with companies like Monsanto to sell consumer Roundup-branded products.

According to the company:

[…] we are the leading manufacturer and marketer of branded consumer lawn and garden products in North America. Our key consumer lawn and garden brands include Scotts® and Turf Builder® lawn fertilizer and grass seed products; Miracle-Gro® soil, plant food and insecticide, LiquaFeed® plant food and Osmocote®1 gardening and landscape products; and Ortho®, Home Defense® and Tomcat® branded insect control, weed control and rodent control products.

We are the exclusive agent of the Monsanto Company, a subsidiary of Bayer AG (“Monsanto”), for the marketing and distribution of certain of Monsanto’s consumer Roundup®2 branded products within the United States and certain other specified countries.

In other words, I would almost put the company in the consumer staples sector given that it sells anti-cyclical consumer products.

Moreover, the company has a Hawthorne segment, which makes the company the leading manufacturer, marketer, and distributor of lighting, nutrients, growing media, growing environments, and related hardware products for indoor and hydroponic gardening.

What this means is that the company is a heavyweight in the marijuana industry. In this case, the company is a supplier of the supplies mentioned above, which gives the company a good position in a highly competitive relationship between growers.

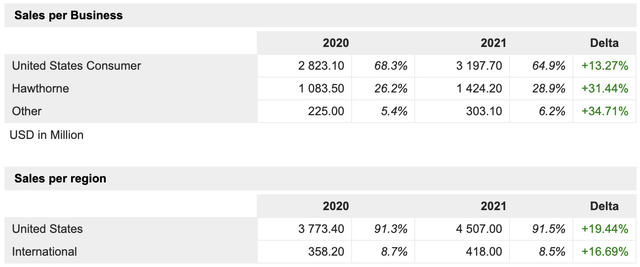

On a full-year basis, the company generates 65% of its sales in the US consumer segment, followed by 29% in its Hawthorne segment.

Moreover, the two consumer giants Lowe’s (LOW) and Home Depot (HD) accounted for 39% of fiscal 2021 net sales. While this comes with the risks of losing a major customer, it does provide stability as “shelf space” in these two megastores provides top-tier consumer exposure. Besides that, I do not expect that either LOW or HD will drop SMG as a supplier.

With that said, the company has reported steady growth, which is expected to continue.

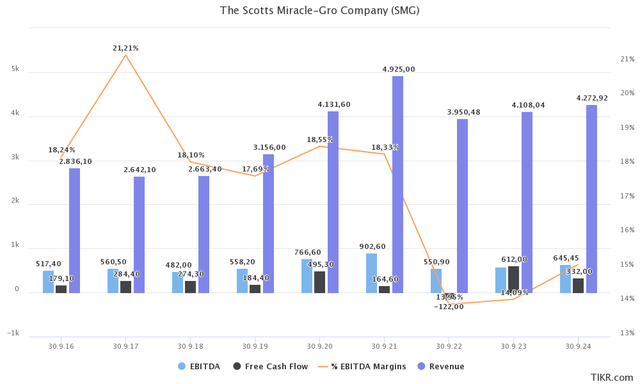

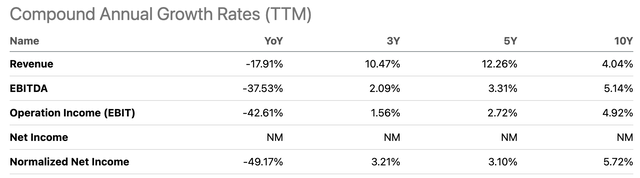

In FY2016, the company did $2.8 billion in sales. That number is expected to be $4.3 billion in 2024. That’s not organic as the company spent close to $900 million on acquisitions during this period. While the pandemic provided the company with a strong boost as people were sitting at home working on projects, revenue is now expected to grow moderately again.

Using Seeking Alpha’s data, we see that growth is moderate. Over the past 10 years, the average annual compounded revenue growth was 4%. EBITDA grew by 5.1% thanks to improving margins.

The issue is that both margins and growth have come down. The recently-released earnings are a good example of that.

In 3Q22 (fiscal quarter), the company did $1.19 billion in revenue. That’s $40 million lower than expected and 26.1% lower compared to the prior-year quarter.

As reported by Seeking Alpha:

The company lowered its full-year sales guidance in the U.S. Consumer segment due to lower-than-expected replenishment orders from retail partners. The company now expects sales to decline 8 to 9 percent. The company also expects further SG&A favorability and is now guiding full-year SG&A down 15 percent. As a result of these changes, the full-year adjusted EPS outlook is now expected to be $4.00 to $4.20 vs. consensus of $4.72.

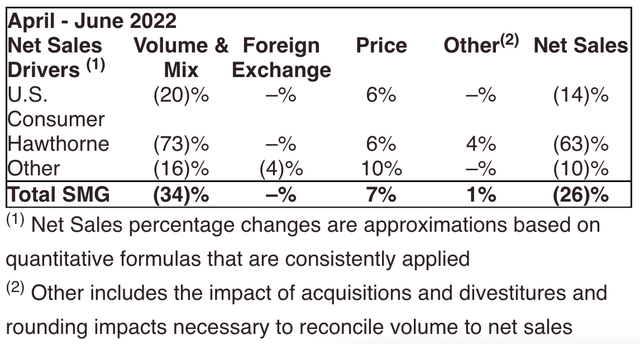

While consumer sales were down 14%, Hawthorne sales were down 63%, causing net income to fall from a $225.9 million profit to a $443.9 million loss. Note that Hawthorne saw 73% lower volumes as pricing offset some weakness.

According to Chairman and CEO Jim Hagedorn:

[…] especially with Hawthorne, we misread the market which drove investment decisions that I’d reverse if I could but I can’t. What I can do and will do is focus on the proactive steps we can take to get this business back to an acceptable level of profitability.

CEO Hagedorn had three takeaways that I want to include in this article.

First, the company asks shareholders to not give up as the company is aware of challenges and working on solutions.

First, is confidence that we understand the challenges in front of us and are moving with urgency. And while we’ve been forced to make dozens of tough decisions in a compressed time frame, including a headcount reduction of hundreds of people, we’re also protecting our competitive advantages and securing the leadership pipeline we need for the future.

This includes focusing on strong business fundamentals.

Second is a belief in the underlying and undeniable strength of our U.S. consumer franchise. It is critical for shareholders to look beyond the financial performance of this business in the second half of the year. The fundamentals are still there. The consumers remain engaged and the future remains bright.

And, finally, the company’s confidence that it can improve margins.

And third is an understanding of why we’re confident we can restore the business to our historical margins, generate significant cash flow and recapture the financial flexibility we need to drive growth and enhance value.

The company did invest too much into Hawthorne and probably at elevated prices. While I do not doubt that Hawthorne brings tremendous value to the table, the timing was off.

Moreover, and this is not related to the company’s own decisions, retailers are reducing inventory. Consumer sentiment has fallen off a cliff and prices have gone through the roof. That’s toxic for any consumer-focused company. Even if it’s about gardening-related products.

Because companies like Lowe’s and Home Depot are reducing inventory, SMG ended up with too much inventory, pressuring margins.

Total retail inventories of SMG products were down 12%. SMG expects that number to increase a bit more due to inventory management. However, the company sees strong demand for its products. While consumers are cutting back, it’s mainly on garden furniture, BBQ grills, and other products. Soil, fertilizers, and related continue to do well. Hence, SMG expects that retail inventory will be significantly lower going into spring, which is likely to fuel orders.

With that in mind, as bad as the quarter was, the market didn’t sell off to new lows. While SMG shares are down 50% year-to-date and roughly 67% below their all-time high, the stock is up 3.2% over the past four weeks.

FINVIZ

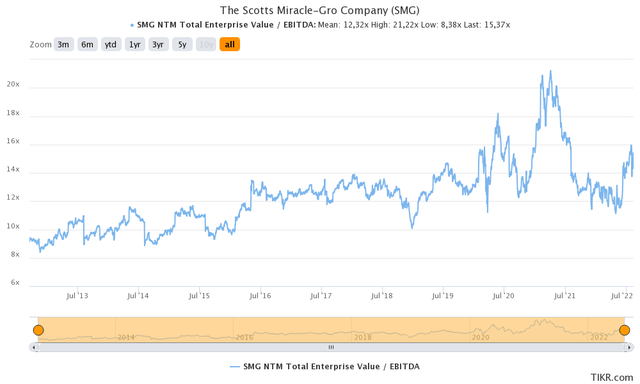

We’re at a point where the value is good. SMG is trading at 11.5x FY2023E EBITDA, which I believe will break $600 million. That’s based on a $6.9 billion enterprise value consisting of the $4.5 billion market cap, $2.3 billion in expected 2023 net debt, and roughly $100 million in pension-related liabilities.

The valuation is now higher compared to four months ago as sell-side analysts do not believe that the company can do $900 million in EBITDA. Now, the company is lucky if it can do $600 million in EBITDA as volumes are simply too bad.

Yet, even under these circumstances, that’s too cheap. Historically speaking, SMG has traded close to 13x NTM (next twelve months) EBITDA.

Moreover, the company is expected to do $612 million in free cash flow in 2023, which implies a 13.6% free cash flow yield. That’s a good deal, which not only protects the 3.2% dividend yield but also allows the company to repay debt.

That said, SMG’s debt load is high, but it’s sustainable. Next year’s $2.3 billion net debt load is roughly 4.0x EBITDA. Excluding cash, the company is currently sitting on $3.2 billion in long-term debt. $3.5 billion when including the part that’s maturing within 12 months.

$1.6 billion of this consists of Senior Notes due between 2026 and 2031 with yields between 4.0% and 5.25%.

Takeover Thoughts

Discussing a potential takeover is always tricky because my goal is not to make management look bad. However, there are reasons to believe that a takeover would make sense. First of all, Scotts Miracle-Gro has admitted that it made mistakes. I included some of the quotes in this article. Various market participants who I’ve talked to believe that management is not up to the task. Jim Hagedorn is the son of Horace Hagedorn, the man who originally founded Miracle-Gro back in 1951.

The former fighter pilot and Harvard Business School graduate has been on top of every development at SMG for decades. Certain people believe that it’s time to involve more outsiders with a “new” vision to reshape SMG.

While I do not have anything against the CEO, I believe that SMG has tremendous potential to be reshaped. It has top-tier products and a portfolio that services consumers and businesses in a time when efficient farming has never been more important.

If the company is able to maintain $4.3 billion in revenue with an EBITDA margin of 18.5%, the company could be looking at $800 million in EBITDA. And that excludes any expected sales growth beyond FY2024.

So, who could buy SMG?

That’s a tough question and I would not bet against the German Bayer company making a move. Bayer owns Monsanto, which has long-term contracts with SMG. Bayer is not only one of the world’s largest agricultural/chemical players, but the company is also increasingly focused on consumers. Buying SMG at a cheap price would make total sense.

Moreover, Bayer is highly engaged in making farming more sustainable. It recently launched ForGround, to connect farmers and companies. Buying all of SMG would give the company tremendous exposure in “future” farming in small spaces and indoor settings.

Takeaway

SMG is a very interesting company. I believe the company brings a lot of value to the table thanks to its business model including its consumer/commercial business segments, sales channels, and ability to benefit from secular growth.

The problem is that SMG has been unable to unlock that value. Management has admitted that it made mistakes and ongoing inventory adjustments at buyers are making things worse. Growth expectations have been adjusted and investors have left the ship.

While I believe that SMG has the potential to work its way out of this mess as the company is far from distressed and likely to benefit from inventory restocking going into next year, I believe that SMG is a potential takeover target. The valuation is attractive, especially when incorporating higher margins and growth markets.

So, either way, at these valuations, I wouldn’t be a seller. Even if I were underwater. The risk/reward has become attractive and even small business improvements should lead to significant share price improvements.

(Dis)agree? Let me know in the comments!

Be the first to comment