Viktor_Gladkov

Canadian banks are known for their risk-averse nature, and that’s why the large ones have storied dividend track records that their U.S. counterparts simply cannot match. Starting yields matter a great deal and is highly influential on the eventual total returns of a stock. As such, I find these names to be attractive considering their recent drop.

This brings me to Bank of Nova Scotia (NYSE:BNS), otherwise known as Scotiabank, which is now trading well below its 52-week high of $75 achieved as recently as spring of this year. In this article, I highlight what makes BNS an attractive high income and growth stock for value investors, so let’s get started.

Why BNS?

Scotiabank is the 3rd-largest Canadian bank by assets and was founded in the 19th century, making it one of the oldest banks in the world. It’s also Canada’s most international bank, with around 40% of its revenue coming from international regions, primarily in Central and South America.

This exposure to faster-growing emerging markets provides the potential for a better runway compared to slower growth in its home market. This geographical diversification has been a great thing for the bank during periods when some other Canadian banks struggled (such as during the oil crash of 2015), and it will likely be a key differentiator going forward.

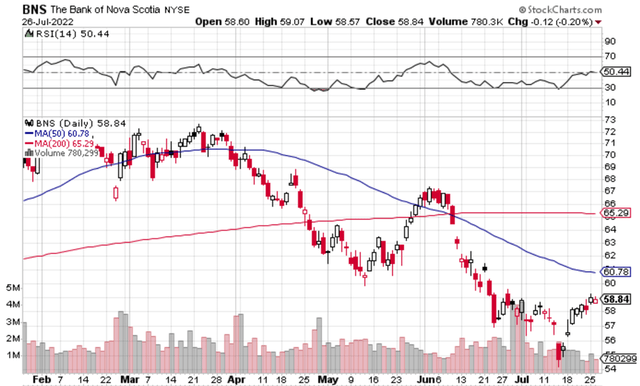

Scotiabank has seen a meaningful downturn in its stock price in recent months. As shown below, it’s now trading well below its recent highs, as well as its 200- and 50- day moving averages.

BNS Stock (StockCharts)

Meanwhile, BNS is demonstrating robust growth, with net income growing by 12% YoY to C$2.75 billion in the fiscal second quarter, while also generating a solid 16.2% return on equity, sitting 140 basis points higher than the prior year period. This contributed to faster bottom line growth with EPS rising by an impressive 15% YoY.

This strength was driven largely by earnings in the Canadian market growing by 27%, due to robust mortgage and commercial loan growth. Also encouraging, its global wealth management was able to grow earnings by 9%, driven by higher brokerage revenues, mutual fund fees, and net interest income supported by strong long and deposit growth.

Looking forward, management seeks to improve efficiency by streamlining back-end systems. BNS is well-positioned to grow through its leading digital position by leveraging its Tangerine subsidiary’s digital banking platform. Its Scotia Smart Investor digital hybrid advice platform was also launched earlier this year, and has seen solid traction with 38K accounts opened and client balances in excess of C$1.4 billion. These efforts support the potential for strong returns on equity, as noted by Morningstar on its recent analyst report:

After numerous acquisitions, we think the bank has made substantial progress on rationalizing its many back-end systems and improving efficiency bank-wide. The bank’s original goal was to have an efficiency ratio of 50% by the end of 2021; however, this was delayed given the less positive economic backdrop caused by COVID-19, and we think it will likely be another year or two before the bank hits this goal.

We like the bank’s digital efforts. While all banks in Canada are engaged in similar ongoing investments, Scotiabank has been spending a lot on within its technology and communication expenses. We think these efforts will ultimately pay off in the form of improved operating efficiency, customer engagement, and internal sales coordination. This leads us to believe that returns on tangible equity near 16%-17% are maintainable over the longer term for the bank.

Meanwhile, BNS sports a healthy common equity tier 1 capital ratio of 11.6%, and recently raised its quarterly dividend by 3% to C$1.03. Notably, Scotiabank has paid an uninterrupted dividend since 1940, at which time it was forced by the Canadian government to cut due to World War II. I see the dividend as being rather safe, as it comes with a low 44.6% payout ratio.

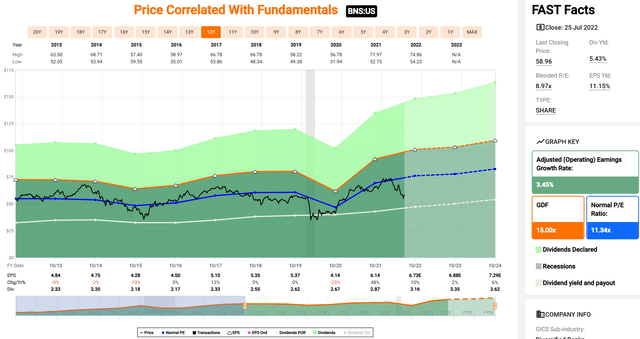

Lastly, I see value in the current share price of $58.84 with a forward PE of just 8.9, sitting below its normal PE of 11.3 over the past decade. Sell side analysts have an average price target of $68, translating to a potential 21% total return including dividends.

BNS Valuation (FAST Graphs)

Investor Takeaway

Scotiabank is a large, diversified bank with a long track record of success. Its business lines are performing well, and its growing digital presence and focus on efficiencies could add a further boost. It’s currently trading at a discount to its recent highs and sports an attractive dividend yield. I believe the current share price presents an attractive buying opportunity for long-term investors.

Be the first to comment