JHVEPhoto

There is a saying that having a good neighbor is better than having a close relative far away. In America, I think we’re fortunate to have a friendly neighbor in Canada, whose businesses operate in a similar manner, and I especially like the quarterly dividend payments that they make, compared to semiannually from some British and annually for most other international stocks.

You wouldn’t work an entire year for an employer before getting paid, so why should owners have to settle for that?

This brings me to Bank of Nova Scotia (NYSE:BNS), which has gotten rather cheap as of late. As shown below, BNS has seen a double dip since the end of March, from the $74 level to just $47.55 at present. This has pushed the dividend yield to a historically high level, and in this article, I highlight why BNS doesn’t deserve to be this cheap.

Why BNS?

BNS, otherwise known as Scotiabank, has a long history dating back to the 19th century, making it one of the oldest banks in the world. It’s also the third largest Canadian bank by assets, and is the country’s most international bank, with around 40% of its revenue coming from international regions, primarily in Central and South America.

This geographical diversification has been a great thing for the bank during periods when some other Canadian banks struggled (such as during the oil crash of 2015), and it will likely be a key differentiator going forward.

Having said that, like many banks, Scotiabank hasn’t been immune to global market volatility. This is reflected by trading revenues within GBM (Global Banking and Markets) being down by $250 million YoY during the second quarter. Global Wealth Management was down by a modest 3% YoY, which isn’t bad considering the double-digit declines in equity and bond markets.

Nonetheless, Scotiabank was able to generate 4% YoY earnings growth due to strong personal, commercial, and corporate banking activity, which largely offset trading weakness. This is driven by low unemployment and strong consumer spending in Canada, with discretionary purchases nearly 20% compared to last year, a sign of economic resiliency. Moreover, BNS is seeing strong growth internationally, with International Banking up 30% on back of higher interest rates and inflation.

Looking forward, BNS should benefit from its digital transformation efforts, after investing in back-end systems and improving efficiency worldwide. Morningstar believes this will help BNS to achieve near 16-17% returns on equity sustainable over the long term. Furthermore, it’s expanding in Chile, which has a promising future with a young population and high digital adoption. Management also highlighted an important strategic move into buying a US dollar platform to help it facilitate dollar-denominated cross-border transactions during last month’s Barclays (BCS) Global Financial Services Conference:

The biggest growth opportunity we have is two specific things I’d call out. One is we want to buy a US dollar platform. So it’s not a large acquisition. We’ve talked about it a lot. It might be a few hundred million dollars. That’s going to be very impactful, because it’s going to provide us connectivity between the Caribbean wealth where we’ve had for a long time; the Pacific Alliance wealth where we continue to grow Chile and Mexico, we call it as two countries you should see more growth; and connect the Canadian Wealth Management where we made great progress. So once we fill that small gap that we have likely over the next six months or so, I think that business is well set to continue to grow.

And GBM, like I said, we’re a corporate lender. So, we love the corporate book very high quality. We don’t deal with leveraged lending and all those higher risk exposures, we have not done for at least 10 years and that’s by choice right what we’d like to do.

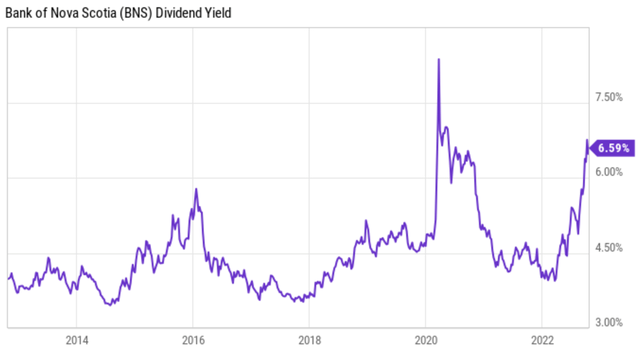

Meanwhile, BNS maintains a healthy A+ rated balance sheet with a common equity Tier 1 Capital ratio of 11.4%. It’s also paying a historically high dividend yield over the past 10+ years, as shown below, outside of the early pandemic timeframe. Its dividend is also well-protected by a reasonably low 46% payout ratio and comes with a 5-year CAGR of 6.1% (subject to currency fluctuations between CAD and USD).

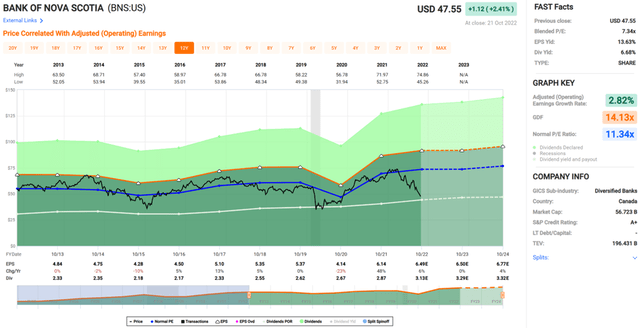

I find BNS to be rather cheap at the current price of $47.55 with a forward PE of just 7.1. As shown below, this sits way below its normal PE of 11.3 over the past decade. S&P Capital IQ has an average price target of $59, translating to potentially strong double-digit annual returns, especially when the dividend is included.

Investor Takeaway

Scotiabank is a high-quality bank that’s well-managed with a number of growth avenues. It trades at a cheap valuation relative to its long-term average, and offers a strong dividend yield that’s currently sitting at a historical high over the past decade plus. This makes it an attractive pick for long-term investors seeking both income and potentially high capital appreciation.

Be the first to comment