janiecbros/E+ via Getty Images

We caught up with Schwazze (OTCQX:SHWZ) senior management last week to follow up on the recent Q4/21 earnings report and the company’s enviable position in the initial days of New Mexico rec sales.

Q4 results of $27M in revenues and $7.5M adjusted EBITDA came in largely as expected with revenues modestly below the low end of guidance but adjusted EBITDA in line with expectations. Growth for 2022 will be less than our prior expectations on integration timing and some delays with expansion projects. We reduce our estimates to reflect guidance (of an annualized run-rate of $220M to $260M in revenues and adjusted EBITDA of $70M to $82M by Q4/22) but never- the-less the company remains one of the top growth stories in the space without even factoring in additional state expansion or further M&A in Colorado and New Mexico. We note our belief that management is being conservative with guidance and believe there are meaningful sources of upside to our forecasts particularly in late Q2 and Q3 with existing operations. Additionally, we believe further expansion is forthcoming and that will be incremental to forecasts. Regardless, Schwazze remains one of our top picks in the space as a rare focused execution story in US cannabis.

Importantly, Schwazze’s anticipated growth should be considered a safer bet than that of many of the company’s high growth peers given the fact that execution is narrower in scope and not dependent on legislation or the integration of highly developed assets spread across the country. Furthermore, we believe management’s past proven track record in other traditionally competitive industries warrants credit. We are confident that continued execution and the reporting of future earnings results will highlight the scale of operations that have been developed at Schwazze and bring greater awareness for the company and further upside in the stock. Our rating remains Buy while we raise our price target to $3.20 from $2.75.

Safer High Growth Opportunity

We expect Schwazze to remain acquisitive in both Colorado and New Mexico in the near term. We also believe expansion into additional markets is possible with a likely focus being in nearby states such as Arizona, Nevada or eventually Texas.

Without additional deals, the company will be one of the fastest revenue growers in the space with a projected ’21-’23 revenue CAGR of >60% and projected annual adjusted EBITDA growth of nearly 80%. Anticipated revenue growth is one of the highest in US cannabis and of those with higher projected growth few also have existing scale ($108M in ’21 revenues) and are not reliant on legislation or transformative acquisition(s). While Schwazze is a consolidator that has grown through acquiring assets, the company is different in that it is not relying on any single transaction to fuel growth. Instead the company is executing on the integration of a series of smaller acquisitions which each offer similar characteristics to each other (primarily being smaller CO companies). This strategy should significantly reduce the risk of execution on integration and the achievement of broader goals. Furthermore, we are confident in management’s ability to execute with transactions and in integrating acquired assets and believe management’s capabilities in this area are a competitive advantage for Schwazze. Investor meetings highlighted this topic with much of the discussion focusing on the company’s pragmatic approach to expansion and the integration of assets. We note that Schwazze’s CEO & Chairman, Justin Dye, led Albertson’s through more than $40B in M&A and real estate transactions and oversaw rapid revenue growth for the company in his prior career.

Well Positioned in Newest Rec Market

Following last year’s acquisition of Green Leaf, Schwazze became one of the top operators in New Mexico. New Mexico opened for initial recreational sales on April 1st. While not the most populous state, we believe New Mexico presents a meaningful growth opportunity with the state expected to have ~$600M in annual sales within the next few years according to BDSA estimates while management is confident that it can be a $1B longer term. We believe early sales trends were strong in New Mexico and are confident that the established leadership position for Schwazze in the early days of New Mexico’s rec market will translate to significant and sustainable advantages including disproportionate retail demand, brand development opportunities and high margin wholesale sales.

For this year, we estimate New Mexico contributions to be $14M in revenues and $3M in adjusted EBITDA. Meaningful upside in price target

Following recent gains for the stock, Schwazze is valued at an EV/EBITDA multiple of 6.8x our 2022 forecast and 3.5x 2023. The 2022 multiple remains below that of the broader peer group (8.5x) and even similarly sized operators within our coverage. We believe execution will bring greater awareness amongst investors and translate to further outperforming stock returns.

Our $3.20 Price Target reflects an EV/EBITDA multiple of 10.3x our 2022 estimate and 5.2x 2023.

We revise our estimates

- Revenues: Q1/22 from $40M to $30M; 2022E from $238M to $184M; 2023E remains at $296M

- Adjusted EBITDA: Q1/22 from $10.6M to $6M; 2022E from $78.7M to $55.9M; 2023E remains $110M

|

2020 |

2021 |

2022 |

2023 |

|||||||||

|

2020 Dec-20 |

2021 Dec-21 |

Q1 ’22E Mar-22 |

Q2 ’22E Jun-22 |

Q3 ’22E Sep-22 |

Q4 ’22E Dec-22 |

2022 Dec-22 |

Q1 ’23E Mar-23 |

Q2 ’23E Jun-23 |

Q3 ’23E Sep-23 |

Q4 ’23E Dec-23 |

2023 Dec-23 |

|

|

Revenues |

24 .0 |

108 .4 |

30 .0 |

44 .0 |

50 .0 |

60 .0 |

184 .0 |

62 .0 |

78 .0 |

80 .0 |

76 .0 |

296 .0 |

|

COGS |

17.2 |

59.1 |

16.2 |

22.9 |

25.5 |

29.9 |

94.5 |

33.2 |

40.2 |

40.8 |

37.8 |

152.0 |

|

Gross Profit |

6.8 |

49.4 |

13.8 |

21.1 |

24.5 |

30.1 |

89.5 |

28.8 |

37.8 |

39.2 |

38.2 |

144.0 |

|

SG&A |

4.5 |

16.6 |

5.4 |

6.0 |

6.0 |

6.0 |

23.4 |

6.0 |

5.5 |

6.0 |

6.0 |

23.5 |

|

Professional |

8.5 |

5.3 |

0.9 |

1.0 |

1.0 |

1.0 |

3.9 |

0.9 |

1.0 |

1.0 |

1.0 |

3.9 |

|

Salaries |

8.4 |

11.9 |

3.5 |

3.6 |

3.6 |

3.6 |

14.3 |

3.5 |

3.6 |

3.6 |

3.6 |

14.3 |

|

Stock Based Comp |

8.2 |

5.0 |

1.0 |

1.0 |

1.0 |

1.0 |

4.0 |

1.0 |

1.0 |

1.0 |

1.0 |

4.0 |

|

Opex |

29.7 |

38.9 |

10.8 |

11.6 |

11.6 |

11.6 |

45.6 |

11.4 |

11.1 |

11.6 |

11.6 |

45.7 |

|

Income from operations |

(22.9) |

10.4 |

3.0 |

9.5 |

12.9 |

18.5 |

43.9 |

17.4 |

26.7 |

27.6 |

26.6 |

98.3 |

|

Interest Expense |

0.0 |

(7.0) |

(2.0) |

(2.0) |

(2.0) |

(2.0) |

(8.0) |

(2.0) |

(2.0) |

(2.0) |

(2.0) |

(8.0) |

|

Total Other Expense |

2.6 |

8.5 |

(2.0) |

(2.0) |

(2.0) |

(2.0) |

(8.0) |

(2.0) |

(2.0) |

(2.0) |

(2.0) |

(8.0) |

|

Pre-tax Income |

(20.3) |

18.9 |

5.0 |

11.5 |

14.9 |

20.5 |

51.9 |

19.4 |

28.7 |

29.6 |

28.6 |

106.3 |

|

Taxes |

(0.8) |

4.4 |

0.4 |

0.4 |

0.5 |

0.5 |

1.8 |

0.4 |

0.4 |

0.5 |

0.5 |

1.8 |

|

NCI |

||||||||||||

|

Net Income |

(19.6) |

14.5 |

4.6 |

11.1 |

14.4 |

20.0 |

50.1 |

19.0 |

28.3 |

29.1 |

28.1 |

104.5 |

|

EPS |

(0.5) |

0.3 |

0.1 |

0.3 |

0.3 |

0.5 |

1.1 |

0.4 |

0.6 |

0.6 |

0.6 |

2.3 |

|

Shares |

41.1 |

46.0 |

43.6 |

43.8 |

44.0 |

44.2 |

43.9 |

44.4 |

44.7 |

44.9 |

45.1 |

44.8 |

|

Adjusted EBITDA |

( 9 .9 ) |

32 .2 |

6 .0 |

12 .5 |

15 .9 |

21 .5 |

55 .9 |

20 .4 |

29 .7 |

30 .6 |

29 .6 |

110 .3 |

|

% Revenues |

||||||||||||

|

Gross Margin |

28% |

46% |

46% |

48% |

49% |

50% |

49% |

47% |

49% |

49% |

50% |

49% |

|

Opex |

124% |

36% |

36% |

26% |

23% |

19% |

25% |

18% |

14% |

15% |

15% |

15% |

|

Operating Income |

-95% |

10% |

10% |

22% |

26% |

31% |

24% |

28% |

34% |

35% |

35% |

33% |

|

Net Income |

-82% |

13% |

15% |

25% |

29% |

33% |

27% |

31% |

36% |

36% |

37% |

35% |

|

Adjusted EBITDA |

30% |

20% |

28% |

32% |

36% |

30% |

33% |

38% |

38% |

39% |

37% |

|

|

Growth Rates |

||||||||||||

|

Revenues |

||||||||||||

|

Y/Y |

352% |

55% |

43% |

57% |

126% |

70% |

107% |

77% |

60% |

27% |

61% |

|

|

Q/Q |

13% |

47% |

14% |

20% |

3% |

26% |

3% |

-5% |

||||

AnalystCertification

The research analyst responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers and were prepared in an independent manner, including with respect to Bradley Woods & Co. Ltd.; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in this report.

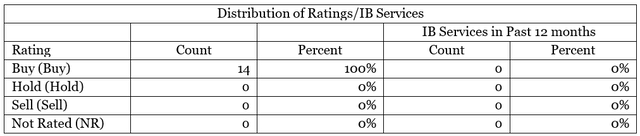

Meaning of Ratings

Bradley Woods & Co. Ltd.’s rating system of Buy, Hold, Sell, Not Rated reflects the analyst’s best judgment of risk- adjusted assessment of a security’s 24-month performance.

Buy: A Buy recommendation is assigned to stocks with low risk and approximately 10% expected return or stocks with high risk and approximately 25% expected return. The analyst recommends investors add to their position.

Hold: A Hold recommendation is assigned to stocks with low risk and less than 10% upside or less than 15% downside or to stock with high risk and less than 25% upside or less than 15% downside.

Sell: A Sell recommendation is assigned to stocks with an expected negative return of approximately 15%. The analyst recommends investors reduce their position.

Not Rated: A Not Rated recommendation makes no specific Buy, Hold or Sell recommendation.

Compensation or Securities Ownership

The analyst(s) responsible for covering the securities in this report receives compensation based upon, among other factors, the overall profitability of Bradley Woods & Co. Ltd. including profits derived from investment banking revenue and securities trading and market making revenue. Unless noted in the Company Specific Disclosures section above, the analyst(s) that prepared the research report did not receive any compensation from the Company or any other companies mentioned in this report in the previous 12 months, or in connection with the preparation of this report. Unless noted in the Company Specific Disclosures section above, neither the analyst(s) responsible for covering the securities in this report, nor members of the analyst(s’) household, has a financial interest in the Company, but in the future may from time to time engage in transactions with respect to the Company or other companies mentioned in the report.

For compendium reports (a research report covering six or more subject companies) please see the latest published research to view company specific disclosures.

Other Important Disclosures

This report is provided for informational purposes only. It is not to be construed as an offer to buy or sell a solicitation of an offer to buy or sell any financial instruments or to particular trading strategy in any jurisdiction. The information and opinions in this report were prepared by registered employees of Bradley Woods & Co. Ltd. The information herein is believed by Bradley Woods & Co. Ltd. to be reliable and has been obtained from public sources believed to be reliable, but Bradley Woods & Co. Ltd. makes no representation as to the accuracy or completeness of such information.

Bradley Woods & Co. Ltd. is regulated by the United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers.

Opinions, estimates, and projections in this report constitute the current judgment of the author as of the date of this report. They do not necessarily reflect the opinions of Bradley Woods & Co. Ltd. and are subject to change without notice. In addition, opinions, estimates and projections in this report may differ from or be contrary to those expressed by other business areas or group of Bradley Woods & Co. Ltd. and its affiliates. Bradley Woods & Co. Ltd. has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Bradley Woods & Co. Ltd. does not provide individually tailored investment advice in research reports. This report has been prepared without regard to the particular investments and circumstances of the recipient. The securities discussed in this report may not suitable for all investors and investors must make their own investment decisions using their own independent advisors as they believe necessary and based upon their specific financial situations and investment objectives. Estimates of future performance are based on assumptions that may not be realized. Furthermore, past performance is not necessarily indicative of future performance. Investment involves risk. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Bradley Woods & Co. Ltd. salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed in this research. Bradley Woods & Co. Ltd. may seek to offer investment banking services to all companies under research coverage. Bradley Woods & Co. Ltd. and/or its affiliates expect to receive or intend to seek investment-banking related compensation from the company or companies mentioned in this report within the next three months.

This research report (the “Report”) is investment research, which has been prepared on an independent basis by Bradley Woods & Co. Ltd., a member of FINRA and SIPC, with offices at 805 Third Avenue, 18th Floor, New York, NY USA, 10022. Electronic research is simultaneously available to all clients. This research report is provided to Bradley Woods & Co. Ltd. clients and may not be redistributed, retransmitted, disclosed, copied, photocopied, or duplicated, in whole or in part, or in any form or manner, without the express written consent of Bradley Woods & Co. Ltd. Receipt and review of this research report constituted your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion or information contained in this report (including any investment recommendations, estimates, or target prices) without first obtaining express permission from Bradley Woods & Co. Ltd. In the event that this research report is sent to you by a party other than Bradley Woods & Co. Ltd., please note that the contents may have been altered from the original, or comments may have been added, which may not be the opinions of Bradley Woods & Co. Ltd. In such case, neither Bradley Woods & Co. Ltd., nor its affiliates or associated persons, are responsible for the altered research report.

This report and any recommendation contained herein speak only as of the date of this report and are subject to change without notice. Bradley Woods & Co. Ltd. and its affiliated companies and employees shall have no obligation to update or amend any information or opinion contained in this report, and the frequency of subsequent reports, if any, remain in the discretion of the author and Bradley Woods & Co. Ltd.

Bradley Woods & Co. Ltd. may effect transactions in the securities of companies discussed in this research report on a riskless principal or agency basis. Bradley Woods & Co. Ltd.’s affiliated entities may, at any time, hold a trading position (long or short) in the securities of the companies discussed in this report. Bradley Woods & Co. Ltd. and its affiliates may engage in such trading in a manner inconsistent with this research report. All intellectual property rights in the research report belong to Bradley Woods & Co. Ltd. Any and all matters related to this research report shall be governed by and construed in accordance with the laws of the State of New York.

This report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject Bradley Woods & Co. Ltd. and its affiliates to any registration or licensing requirements within such jurisdictions.

The Bradley Woods Form CRS, Client Relationship Summary, can be accessed here.

Be the first to comment