Andrzej Rostek/iStock via Getty Images

Shares of growth factor signaling specialist Scholar Rock (NASDAQ:SRRK) have lost over 20% of their value during the past 3 years and are down 70% so far in 2022. In ROTY’s portfolio, I sold the remainder of my position in June 2021 for a 40% loss after a “sell the news” reaction followed promising Cohort 3 data for apitegromab in SMA.

While the company has certainly experienced its share of setbacks including 25% workforce reduction in May and key executive exits such as Chief Medical Officer leaving for “other career opportunities”, not to mention failure to see meaningful efficacy signal for SRK-181 in solid tumor indications as of yet, a recent revisit led me to believe the story is ripe to turn around.

In our Core Biotech portfolio we own PTC Therapeutics (PTCT), whose partner Roche is battling it out in the lucrative SMA market with Novartis’ gene therapy and Ionis’/Biogen’s Spinraza. To my eyes it’s clear that any one of these rare disease players would love to get their hands on apitegromab if promising long term improvements in on HFSME measure translate into a phase 3 win.

Let’s take a closer look to determine if readers interested in this name should enter a position in the near term.

Chart

Figure 1: SRRK weekly chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price skyrocket up to high of $60 in late 2020 after lead candidate apitegromab showed a positive effect in the mid-stage TOPAZ study in SMA. From there, shares corrected to $30 following data update and continued to slide to an ultimate low in the mid-single digits due to absence of news flow as well as lack of monotherapy signal for SRK-181 in the DRAGON study. In June, shares briefly rebounded back above the $10 level with promising data update from TOPAZ followed by oversubscribed secondary offering at $4.90/share. At the time, I thought it a bit dodgy that the company chose to access funding on the same morning as data instead of waiting for higher share price (then again, golden rule of biotech is raise funds when you can). Currently, shares are sitting on the $7 level which I think is ideal for a pilot purchase for readers interested in this name.

Overview

Founded in 2012 with headquarters in Massachusetts (~110 employees), Scholar Rock currently sports $400M market capitalization, enterprise value of close to ~$0 and Q2 cash position of $371M providing them operational runway into 2025.

However, keep in mind that June’s secondary offering consisted of 16.3M shares of common stock + pre-funded warrants to purchase 25.5M shares of common stock (along with warrants to purchase 10.46M shares of common stock). Per 10Q filing, there are roughly 27.7M pre-funded warrants outstanding, so let’s call that a $600M market capitalization fully diluted (which then puts resulting EV at closer to $200M).

In my original article from 2018, I pointed out value inherent in the company’s unique platform technology focused on targeting protein growth factors and their receptors, namely Transforming Growth Factor-Beta (TGFβ). I noted that while competing drug candidates target these protein growth factors, the problem is that they do so in a systemic manner (in the whole body) which leads to significant side effects. The company hoped to overcome this obstacle by pursuing a localized effect with highly selective candidates.

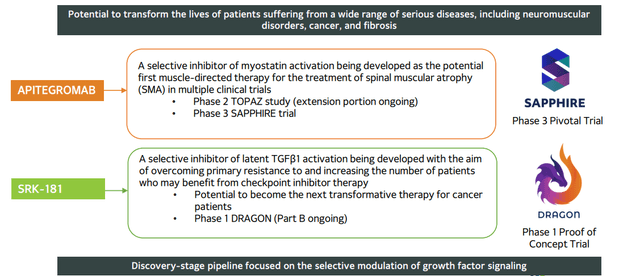

Figure 2: Pipeline

Prior, I noted that Scholar Rock is unique in that the company was able to ink a collaboration with Johnson & Johnson (Janssen) (JNJ) before even receiving its first round of financing. Through its aforementioned platform focused on targeting protein growth factors and their receptors, Scholar Rock hopes to overcome significant side effects experienced by competitor programs by instead pursuing a localized effect with highly selective candidates. I also pointed out that access to prior funding, including Series C financing with participation from several institutional investors of note (EcoR1 Capital, Cormorant Asset Management, ARCH Venture Partners, Polaris Partners, etc), was a significant green flag.

For lead candidate apitegromab, a selective inhibitor of the activation of myostatin, I stated that the program could be the first muscle-directed therapy to reverse or prevent further muscle atrophy for spinal muscular atrophy patients- importantly, it could see use as a monotherapy or in combination with standard of care. As for the market opportunity, I alluded to company estimates of 30,000 to 35,0000 SMA patients in the United States and Europe. Despite gene therapies being developed to address the underlying genetic defect in SMA, management continued to believe that addressing muscle atrophy directly would provide additional benefit to these patients. I also described SRK-015 as a ¨pipeline-in-a-product¨, as the next logical step after POC data would be to pursue development in such muscle wasting disorders as Duchenne Muscular Dystrophy, ALS (Amyotrophic Lateral Sclerosis), etc.

As if the above were not enough, I highlighted the hidden value in the firm´s preclinical TGFβ1 (with fibrosis and oncology applications) and BMP6 (preclinical animal models show increased iron bioavailability with applications in certain anemias) programs. For TGFβ1, I noted that high selectivity (no binding to TGFβ2 and TGFβ3) could help avoid cardiac toxicity associated with competitor programs. Referring to the above point about the company´s unique TGFβ1 program, the immuno-oncology setting appeared particularly attractive after preclinical studies showed selective inhibition of TGFβ1 results in increased immune system activity.

Fast forward to the TOPAZ data update call, here are a few of the highlights:

- Update consists of the 24-month extension results in patients with type 2 and type 3 SMA. There are now three approved therapies for SMA, all of which are intended to increase the survival of motor neurons. However, significant deficits remain and company believes a muscle-targeted therapy has the potential to positively impact these patients. Scholar Rock is focusing on types 2 and 3 SMA, representing two-thirds of the overall SMA population (30,000 to 35,000 patients in US + EU alone).

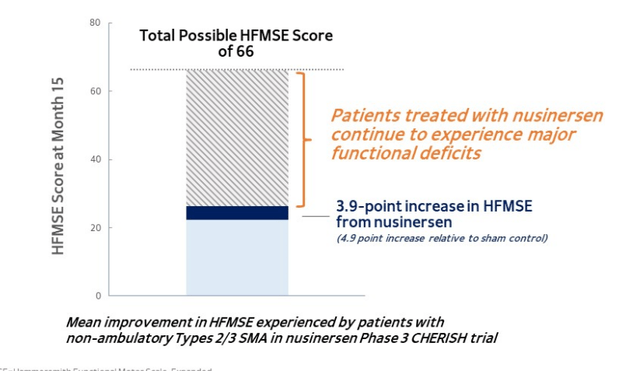

- Looking below at the HFMSE score (validated measure of motor assessment in these patients), we can see that maximum score is 66 and that without treatment patients on average score in the high 20s. Spinraza treatment gives them around 4 to 5 more points, which is significant but still leaves a long way to go to reach that score of 66.

Figure 3: Patients with types 2 and 3 SMA experience major functional deficits despite improvements with nusinersen

- Nusinersen, along with newer treatment risdiplam, have a significant impact in the initial dosing period. However, in both cases patients start to plateau. Here then, is the opportunity for Scholar Rock with apitegromab to further increase the levels of muscle strength and muscle function in SMA patients.

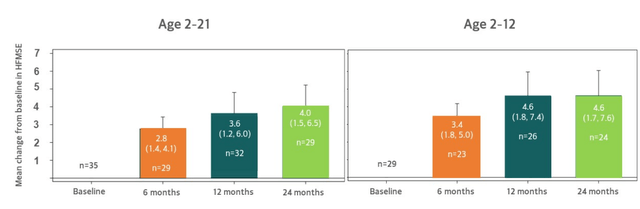

- TOPAZ 24-month extension results showed sizeable and sustained motor function gains for patients treated with apitegromab and background treatment on nusinersen. Additionally, there was additional evidence for continued improvement in the Revised Upper Limb Module (RULM), a key secondary endpoint. There was continued observation of dose response as well (2mg/kg cohort vs 20 mg/kg). In ambulatory type 3 population, there was generally stability observed in Revised Hammersmith Scale (RHS) measure of muscle function in subgroup of patients on apitegromab with background use of nusinersen. Importantly, there were no identified serious safety risks.

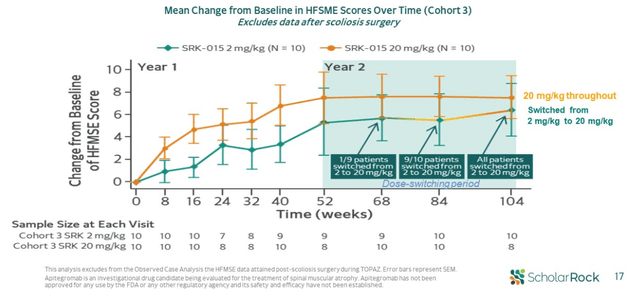

- Interestingly 57 of 58 patients on TOPAZ opted to receive apitegromab for another 12 months, and in the third year of therapy 54 of 55 patients remained on treatment as of June 1st, 2022. Keep in mind that in year two, low dose patients were switched to high dose. There were four patients who underwent scoliosis surgery as part of routine standard of care for their underlying SMA disease (in addition to primary analysis, supplemental analysis took into consideration effects of this surgery).

Figure 4: Pooled analysis shows sustained increases in HFMSE at 24 months from the non-ambulatory TOPAZ cohort receiving background nusinersen

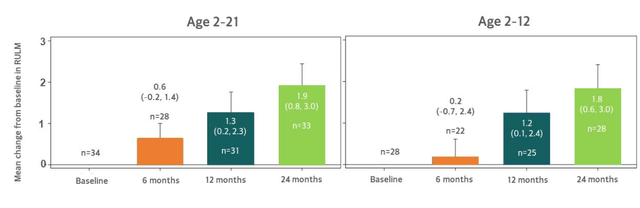

- Results above include patients treated on low dose, high dose and does not exclude patients who missed doses due to COVID-19 site restrictions. Mean HFMSE increase at 3.6 points grew to 4.0 points at 24 months (left graph). Graph on right (exploratory subset 2 to 12 years old) shows 4.6 point increase. Together, 24-month HFMSE results highlight potential of this drug candidate which company is trying to confirm in SAPPHIRE phase 3 study.

- Supplemental look at data taking into consideration impact of scoliosis surgery, considering that natural history study showed most patients have subsequent decline of at least 3 points on HFMSE following this surgery (mean 12-point decrease). Thus, excluding these patients 4-point increase improves further to 4.4 points (2 to 12 subset improves from 4.6 points to 5.2 points).

- Below, we can see that high dose numerically outperformed low dose in terms of mean HFMSE change from baseline across every time point in the 2-year treatment period. Also, as patients on low dose switched to high dose at various time points in the second year, signs suggested this group had further increases in their HFMSE. PK and target engagement data provide further color in interpreting dose response, as 20 mg/kg dose offered higher levels of drug exposure relative to 2 mg/kg dose. Dose switch led to further increases in serum drug concentration.

Figure 5: Evidence of dose response further supported by data from low to high dose switch

- Moving on to RULM results in TOPAZ, this data adds to conviction that apitegromab is doing what it’s supposed to do (improvements over time are encouraging). As with HFMSE measure, these results improve even further if scolios surgery patients are taken out of the measure. These results provide evidence of apitegromab aiding upper limb function, of particular importance for non-ambulatory patients.

Figure 6: Continued increase in RULM observed at 24 months

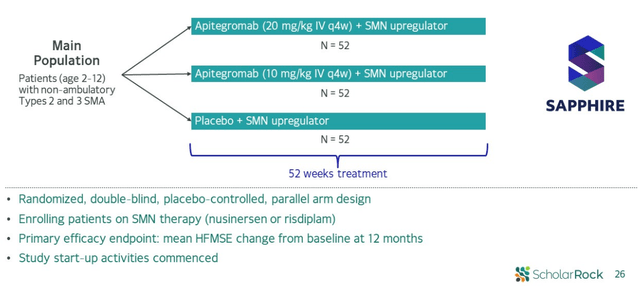

- Currently, phase 3 SAPPHIRE study is enrolling patients in randomized, double-blind, placebo-controlled design evaluating two different doses (20mg/kg and 10mg/kg) with background treatment on SMN upregulator. It is enrolling non-ambulatory type 2 and 3 patients aged 2 to 12, and given that this was the best performing subset in phase 2 I wouldn’t be surprised if phase 3 readout positively surprised Wall Street in regards to efficacy on HFMSE measure.

Figure 7: SAPPHIRE phase 3 design

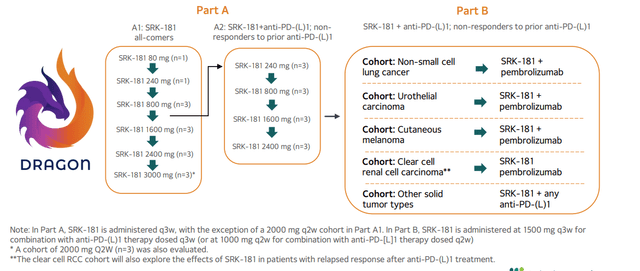

- As for SRK-181 DRAGON study in solid tumors, management reminds us that biomarker data is expected first in the latter part of this year, followed by (hopefully) efficacy data. On that second point, it does not sound like confidence is high at this point. A later press release states that data will be shared at SITC- my expectations remain low, as additional Part A and B data will be available later in 2023 (where efficacy will be seen IF it is there).

corporate presentation

Figure 8: DRAGON phase 1 POC study designed to evaluate SRK-181’s ability to overcome primary resistance to checkpoint inhibitors

- Despite the 25% workforce reduction, they have retained core research group that are prosecuting next-generation programs (opportunity to build sustainable long-term pipeline). Financing extends cash runway into 2025. Management says it’s too early to provide guidance on enrollment for SAPPHIRE and data readout timeframe.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $371M as contrasted to research and development costs of $32.1M along with G&A expenses of $11.1M. Quarterly net loss rose by about 50% to $44M, so that estimated runway into 2025 sounds about right. Accumulated deficit to date was $376M per annual report, which seems reasonable considering the company has run a 3-year OLE study and is in the middle of a pivotal phase 3 study in SMA (along with oncology trial now nearing efficacy portion of the study).

As for institutional investors of note, Artal International owns 19.4% stake and Redmile Group owns 9.9% stake. Keep in mind that investors in the recent financing included Invus, Polaris Partners, Redmile, Samsara BioCapital, and other institutional investors (purchases reflected in insider buying activity).

As for relevant leadership experience, recently appointed CEO Jay Backstrom served prior as Executive Vice President, Research and Development at Acceleron Pharma (acquired by Merck in late 2021 for $11.5B). I find it interesting (green flag) that he chose Scholar Rock as his next venture. Chief Operating and Financial Officer Ted Myles served prior as CFO of AMAG Pharmaceuticals and Ocata Therapeutics. Otherwise, it seems like leadership lineup lacks depth and that could be a negative factor to consider. On board of directors, we find managing partners of Samsara Capital, ARCH Venture Partners and Polaris Venture Partners. It’s interesting to see President of Alnylam Pharmaceuticals Akshay Vaishnaw on the board as well.

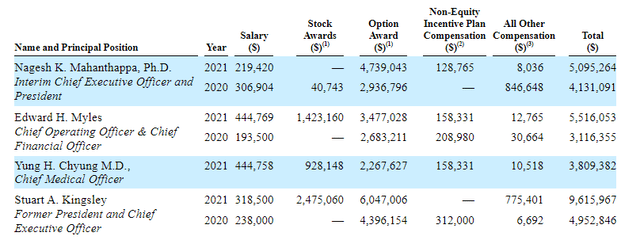

Moving on to executive compensation, we can see cash portion of salary on the lower to mid end of typical range. Stock and options awards also appear standard (perhaps on the high side for former President and CEO Stuart Kingsley).

Figure 9: Compensation table

As for nuggets of information from the ROTY community, DomAlt questions the relevance of apitegromab considering it has not been tested yet with Zolgensma and Evrysdi which are taking considerable share in the SMA market. The big question here being whether the drug is arriving way too late or not.

As for IP, patent portfolio is extensive with issued patents projected to expire well into the 2030s (excluding patent term adjustments or extensions). Scholar Rock has 26 pending patent families across multiple programs including 15 having matured into US issued patents. Collectively, there are 203 national or direct utility applications pending or issued.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), keep in mind that the company does not own facilities but instead relies on third-party manufacturers (perhaps increases supply risk).

As for competition, last year Roche announced initiation of a Phase 2/3 clinical trial evaluating anti-myostatin antibody RO7204239 in SMA patients. In terms of indirect competition, Biogen continues expanding their SMA pipeline with antisense oligonucleotide BIIB115 (may have the potential for extending dosing intervals). Also, Cytokinetics has completed a phase 2 clinical trial with reldesemtiv (fast-skeletal muscle troponin activator).

Final Thoughts

To conclude, with a proven new CEO at the helm and encouraging TOPAZ open label results in hand, not to mention bolstered balance sheet with key healthcare funds on board, it seems like Scholar Rock could be set to turn the corner in the next 12 to 24 months. Prior data along with trial design and inclusion criteria of SAPPHIRE study lead me to believe it has a higher probability of success with primary completion date of June 2024 per clinical trials gov website. Also, corporate presentation reminds us of the potential for interim analysis opportunity when ≥ 50% of patients in main efficacy population have completed 12 months.

On the other hand, we have yet to see a convincing efficacy signal for SRK-181 in the DRAGON study for solid tumor indications, so I remain skeptical until we start seeing actual responses (especially in patients who have failed checkpoint inhibitor therapy).

For readers who are interested in the story and have done their due diligence, SRRK is a Buy. One potential strategy could be to purchase small pilot position and wait for either SRK-181 to report actual clinical responses in the DRAGON study or for SAPPHIRE readout to loom closer before adding exposure to one’s position.

From an ROTY perspective (focus on next 12 months), I will wait for further clarity on SRK-181’s potential in oncology via DRAGON data updates in 2023 (strengthen thesis if we see activity, discontinued if they fail to see responses). From there, I can see the case for us accumulating a position here when SAPPHIRE readout is closer.

As for risks, delays in the clinic would weigh heavily on shares as they key milestone is phase 3 readout in SMA. SRK-181 could be discontinued in the clinic if responses in solid tumor patients are not observed. Competition in the SMA space should not be discounted and investors should keep an eye on progress for Roche’s RO7204239 as well (primary readout December 2026).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment