imaginima

Overview

Schlumberger Limited (NYSE:SLB) is the leading global provider of oil and gas field services. The business is highly correlated to movements in the global oil price, as this affects customer cashflows. Any shocks, like a looming recession, could lead to demand declines and lower energy prices, thus leading to lower SLB revenues.

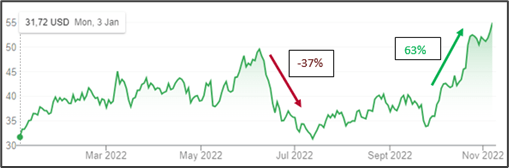

SLB’s share price has experienced strong momentum – and is up 73% YTD (63% of that in the last 6 weeks). It is also quite volatile, as seen on the graph below.

Share Price (Google Finance)

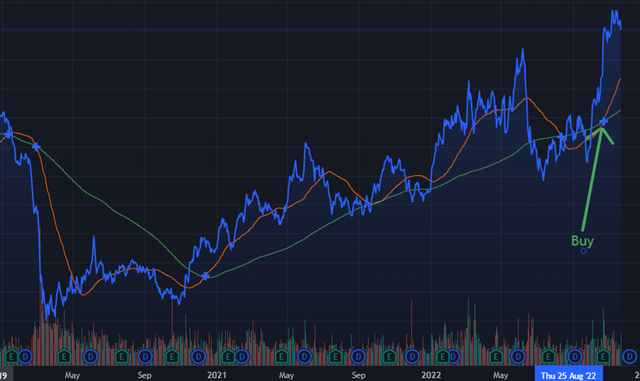

There have recently also been a number of analyst target upgrades and bullish statements from management. This positive sentiment, combined with the current unpredictable macro environment, could easily lead to continued momentum – also see chart below (50D MA breached 200D MA).

50 Day vs 200 Day Moving Average (TradingView)

Profile

Schlumberger, recently rebranded SLB, operates a suite of physical products and digital solutions in the oilfield services industry. They provide their customers with the tools required to extract energy from their assets – primarily oil and gas fields – to supply the needs of the growing world economy – while also trying to decrease the industry’s ecological footprint.

New Logo (SLB Website)

SLB now realizes that they need to transform themselves to remain a leader in a changing energy industry. This led to last month’s SLB rebranding – which is supposed to represent a greater focus on lower emission, and zero-emission energy and a greater focus on digital tools and capabilities to enhance client productivity and energy efficiency. SLB stated that their rebranding reaffirms the following:

“transformation from the world’s largest oilfield services company to a global technology company focused on driving energy innovation for a balanced planet.”

SLB has been operating as a provider of oilfield services for more than a century, and have established themselves as an industry leader. Since 2019, they have been led by CEO Olivier Le Peuch, who has been with the company for more than 3 decades – and, since his appointment, has moved rapidly to reorganize the business.

The business operates in what they refer to as 3 “technology domains”:

- Near Term – The core is technology for oil and gas exploration, development and production. It includes the design and deployment of services and products which are used by clients to extract value from oil and gas assets. SLB believes the future of the core offering will be led by low-carbon technologies.

- Medium Term Digital Solutions – required to deliver a step change in performance and efficiency of energy extraction. AI based tech, combined with IoT used in field service equipment helps customers transition to cloud based operations that maximize the value of assets and data at their disposal, while also increasing environmental efficiency

- Long Term – SLB New Energy and Transition Technologies – this is a new, low-carbon and carbon neutral energy sector. It includes green hydrogen, lithium technologies, and carbon capture and storage, as well as geothermal energies

SLB’s digital capabilities and industry-leading digital platform is crucial to long-term performance. Through partnerships with companies like Google (GOOG, GOOGL), IBM (IBM), Microsoft (MSFT), and AWS (AMZN), they provide an open, digital platform that takes advantage of High-Performance Computing – thereby making capabilities like Machine Learning and AI available to customers.

- New Energy was created in 2020 as part of efforts to position for long term growth opportunities outside of traditional oil and gas. This business looks at low-carbon and carbon-neutral energy technologies.

- Transitions Technologies was launched in 2021 as part of a commitment to reach net-zero emissions by 2050. This venture will aim to reduce emissions from oil and gas operations.

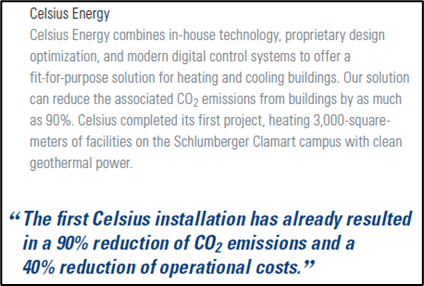

New Energy Example:

Celsius Energy – Through a proprietary small-footprint network of shallow wells, combined with a heat exchange system – the Celsius solution heats and cools buildings.

SLB New Technology (SLB Investor Presentation)

The new direction the company has identified as the future of their business has been relatively well received by most analysts and the market. However, it does introduce execution risk going forward. SLB believes the coming decades will see unprecedented investments into the energy industry in order to realize the energy transition. They also see the new opportunities into which they are expanding as doubling their possible total addressable market (“TAM”) to more than $700 billion. However, given all of this, they still only expect new energy to be about a $3 billion business by 2030, compared to the overall business at more than $50 billion, i.e., less than 5% of total revenue.

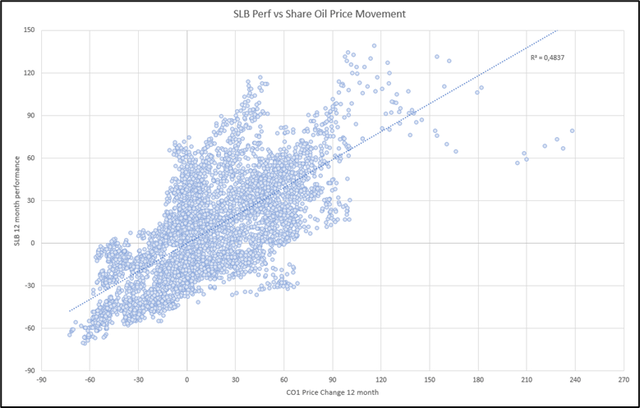

An important aspect to take note of is that oil company cash flows is primarily a function of the prevailing oil price. There is thus a fairly high degree of correlation between the movements in oil price, and oil company cash flows, which are translated into Capex which benefits oilfield service companies like SLB.

Subsequently, there is also a strong correlation between oil prices and SLB’s share price performance.

Over the past 20 years, there have been 5,699 rolling 365-day observations. Out of these, the 30 day-spot price of brent crude has seen:

- 3455 rolling positive observations for CO1 (60%); and in over 75% of these observations, SLB had a rolling positive performance, and over 65% of observations a rolling return of more than 10% p.a.

- 2244 rolling negative observations for CO1 (40%); and in over 75% of these observations, SLB had a rolling negative performance.

From the graph below, we can also see that there is definitely a correlation between the moving 12-month return of SLB vs oil prices:

SLB Correlation with Brent Crude (Created by Author)

This exercise indicates a correlation of:

Which becomes clear when comparing this to non-oil related stocks such as:

Business Breakdown

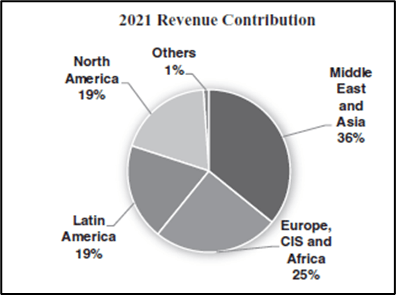

Geographic Spread (SLB 10K)

The business operates in 4 divisions, and across 5 different geographies (basins) – a restructuring that took place in 2020.

Russia only accounts for about 5% of global revenue.

Digital and Integration

- 14 % of total revenue (2021);

- 34% of total EBT (2021);

- EBT Margin of segment: 35%.

SLB claims to be the undisputed leader in their industry in terms of its software solutions at scale.

The division enhances efficiency to improve asset and enterprise-wide performance for customers. It includes proprietary software, digital ecosystem, consulting services, IT solutions to clients in energy sector, consulting services for reservoir characterization, field development planning, production enhancement etc.

Reservoir Performance

- 20 % of total revenue (2021);

- 19% of total EBT (2021);

- EBT Margin of segment: 14%.

Reservoir Centric technology and services. These are critical to optimizing reservoir productivity and performance.

- 2021 revenue decreased by 18% YoY, mainly due to OneStim divestiture in North America. Excluding this, revenue would have increased 5% YoY. However, operating margin improved by 7% to 14% due to the divestiture of the segment, which was margin dilutive.

*Note: SLB exchanged its onshore hydraulic fracking business in the U.S. and Canada to Liberty Oilfield Services, in exchange for a 37% equity stake. This was decreased to 31% by the end of 2021 and has subsequently been further reduced to a 12% position.

Well Construction

- 38 % of total revenue (2021);

- 36% of total EBT (2021);

- EBT Margin of segment: 14%

- Relates to the portfolio of products and services used to optimize well placement and performance, and maximize drilling efficiency. It includes offerings like drilling & measurements, drilling fluids, drill bits, well cementing etc.

- 2021 Revenue increased by 1% YoY, but OM increased by >300 bps to 14% due to cost control measures.

Productions Systems

- 29 % of total revenue (2021);

- 19% of total EBIT (2021);

- EBT Margin of segment: 9.4%.

This segment develops technology and provides expertise to enhance production and recovery from subsurface reservoirs to the surface. (This includes pumping systems and valve systems).

Industry Growth Expectations

A number of industry research reports estimate that the value of global oilfield services market will grow at a rate of around 5-6% CAGR over my forecast period.

Examples of these include the following:

- A Fortune Business Insights Report from November 2020 estimates that the global oilfields services market was $267 billion in 2019 and will be $347 billion by 2027; representing a CAGR of 6.6%

- A 2021 report by Market Research Future (MRFR) estimates that the oilfield services market will reach $409 billion by 2028, after growing at a CAGR of 5.1% over their forecast period.

- Expert Market Research states that the global oilfield services market was $258 billion in 2020, and expects it to reach $377 billion by 2026, growing at a CAGR of 6.5% over the forecast period.

SWOT

Strengths

Diverse global footprint and customer base. SLB generates revenues in more than 120 countries. In 2021, only five of those represented more than 5% of revenues, and only one (USA) represented more than 10%. This limits doubtful accounts risk – such as those experienced in Venezuela in 2017 ($469 million write-off – their only major write-off to date). No single client represents more than 10% of revenues.

Good Market Perception. Richard Spears, vice president of Spears and Associates – a leading researcher on the oil services industry for more than 70 years, stated the following via a Guidepoint call:

“I tend to trust what their management says about their target and their intention to hit a goal because they generally under promise and overdeliver.”

He goes on to state that he agrees with SLB’s comments that they are currently shifting toward a higher margin, higher-priced environment.

“Schlumberger in particular, they are enjoying the fruits of decisions that they made several years ago. “Schlumberger has essentially eliminated those businesses (lower margin, more commoditized) from their portfolio and kept the ones where it takes brains, not brawn, to operate them.”

ESG. ESG considerations in this industry are more important than in most. Oil companies are generally known for (or at least perceived for) poor ESG. The industry has in the past had a lot of corruption and bribery issues, there is generally not a lot of diversity, and activities like fracking have cast a spotlight on the ecological cost, such as the requirement for large quantities of water and chemicals to be pumped into the ground. Peer leading ESG scores set SLB apart in an industry that requires more investment, but has been plagued by weak ESG scores in recent years. They also have peer-leading net zero targets (including Scope 3 emissions). However, like most industry players, they are not squeaky clean. A SLB subsidiary has in the past pled guilty and paid a penalty for illegal trade with Iran and Sudan, while trying to disguise the transactions.

Kimberlite Performance Score. Kimberlite is an organization that surveys around 15 000 customers across the globe, and measures responses on metrics such as equipment reliability, competent personnel, technical support and responsiveness. SLB scores better on this metric than peers.

Industry-recognized domain knowledge.

“We evaluated 16 out of the 18 major exploration discoveries in 2021, demonstrating that customers choose SLB when certainty is needed.” Aparna Raman – Head of Reservoir Performance – Analyst Day, November 2022

Renewed Industry spotlight. The Ukraine invasion has prompted governments and policymakers to realize that the global energy transition cannot happen as rapidly as initially thought, and any shocks in the interim will have major economic side effects – as the Russian invasion has now clearly shown. SLB believes this will cause a re-assessment of long-term strategies, and drive a renaissance in the industry for years to come.

Moat Score: 9/10 SLB has been around for a century, and will probably be around for another. They have clearly solidified themselves as one of the key players in the quest for sustainable, accessible energy solutions.

Weaknesses

Sensitive to volatility in the oil price. This was discussed earlier in the report. It means that instead of assessing the stock using a purely bottom-up approach – one has to take a macro view on the direction of global oil prices, which clearly affects SLB’s fortunes.

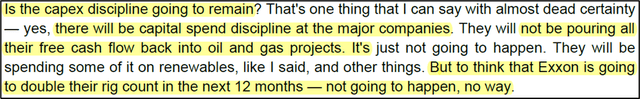

Looming Investment cycle…or no? SLB believes we are on the verge of a massive investment cycle. Richard Spears (Guidepoint call) states that he believes that is wishful thinking. While the market environment might be pro expansion and development (high oil prices vs low input costs during development), SLB’s customers are major oil companies like BP, ExxonMobil, Shell (Big international oil companies), as well as National Oil companies like Petrobras and Saudi Aramco. He agrees that national companies like Petrobras will certainly be looking to expand more in the current environment – and this would benefit SLB. However, he believes the international oil companies with activist shareholders on their boards will be much less inclined to spend significant money on new oil capex. Their company has a forecast of drilling activity which they have done since 1982. Generally, in the current price environment, they would have expected to see the number of rigs in the U.S. (currently about 650), double. However, current forecasts only point to about 800 by end 2022, so only about 150 added. And these are generally by private companies without activist shareholders demanding entry into the renewables market, or reduced exposure in the oil market.

With ESG concerns, companies just do not have the same pools of capital available for expansion compared to 10 years ago in the oil and gas space.

This is in stark contrast to the below statement from SLB’s CEO at a June 2022 Bernstein Presentation and November analyst day:

“Let me share with you our latest view of the industry environment, which is one of the most compelling outlooks I have seen in over 35 years in the business”… “In summary, this combination of macro trends is once in a generation, and we are positioned to take advantage of them with agility and speed.”

Opportunities

Middle East. CEO Olivier Le Peuch stated during the earnings call that the Middle East would, over the next 2-3 years, see their biggest ever investment cycle. Barclays states that this statement, coming from SLB, carries extra weight, as they were the best positioned during the previous Middle East cycle between 2004 and 2009 and should have good insight into the region’s pipeline. Both the CEOs of Halliburton and Baker Hughes also mentioned that international growth is being led by the Middle East.

SLB has significant exposure to the region, more than double that of their closest competitors.

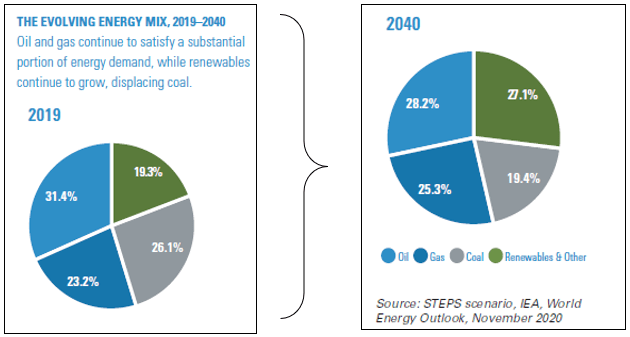

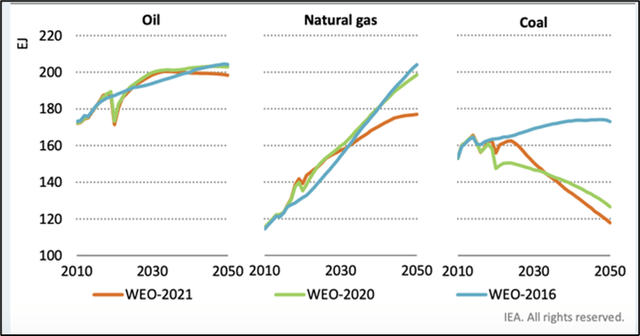

Oil and Gas will stay relevant for a long time. For all the talk of the whole world moving to renewables, the role of fossil fuels, and specifically oil and gas is expected to remain relevant for years to come.

Energy Mix (IEA – World Energy Outlook)

Oil and gas usage is still expected to increase until at least 2035, after which oil is expected to start plateauing and declining.

Energy Mix (IEA World Energy Outlook)

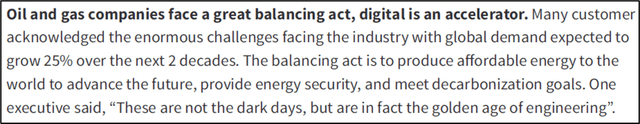

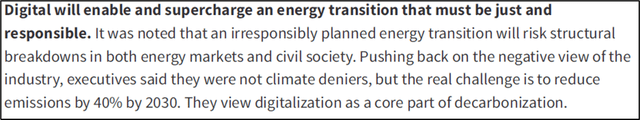

Role of digital. There is a consensus within the industry that digital tools will play a greater role going forward, and as a leader in the space, SLB is set to benefit

Digital Notes (Broker Report) Digital Notes 2 (Broker Report)

Decarbonization – this is both an opportunity and a threat. According to a report by BNY Mellon Investment Management and Fathom Consulting, the net-zero targets from the Paris Climate Agreement are still within reach, but would require a $100 trillion investment, which equates to around 15% of all global investment or 3% of global GDP over the next 30 years.

“Achieving the goal of the Paris Climate Accord and ‘greening’ the world’s capital stock is arguably humanity’s greatest challenge…The transition has the potential to be the largest redeployment of capital in history and it could be just as, if not more, transformational than the Marshall Plan or China’s rise in the 1990s/2000s. Get it right, and the payoff to society and far-sighted investors can be enormous.”

“the sectors that may need most of the investment to achieve net zero by 2050, are, it seems, at least in part, being shunned by some investors for the very same reasons. If the transition is to be achieved, these sectors will need capital and investors will play an important role in providing this capital; for maximum effectiveness in minimizing transition risk and facilitating decarbonization investors will need to identify those companies with the most credible decarbonization and green investment plans.”

SLB might be one of the few companies that manage to tick the correct boxes, should even a portion of this massive required investment materialize.

Threats

Recession could slower demand in the near term. Energy demand is tied to economic cycles and historically closely aligned with GDP growth. China, the U.S., etc., all facing tough times ahead. One of the key findings from IEA’s (International Energy Agency) most recent report (2022) states the following:

There remain huge uncertainties over how this energy crisis will evolve and for how long fossil fuel prices will remain elevated, and the risks of further energy disruption and geopolitical fragmentation are high. In all our scenarios, price pressures and a dim near-term outlook for the global economy feed through into lower energy demand than in last year’s Outlook.

Not managing to successfully pivot out of a purely oil and gas service provider – i.e., execution risk. There is a secular drive toward renewables and less damaging forms of energy. At some stage, SLB will need to pivot substantially away from the core business and have their new ventures account for a larger part of the total – else their services might become irrelevant. This certainly won’t happen overnight – but it seems to be quite clear that it will eventually happen.

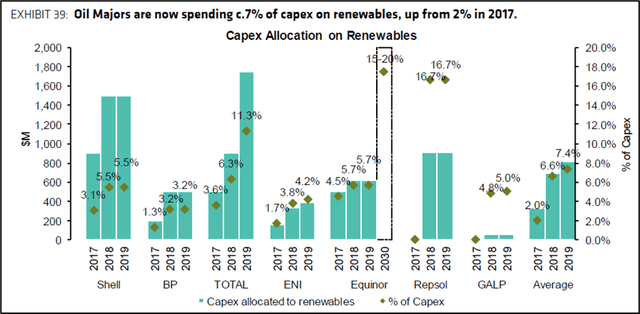

Decarbonization – this is both an opportunity and a threat. Bernstein industry primer in 2020 believes that the oil and gas industry will quickly move to only maintenance capex going forward.

Renewables Extract (Bernstein Research)

This is leading to a massive increase in the portion of capex that is spent on renewables.

Renewables Capex (Bernstein Research)

Financial Performance

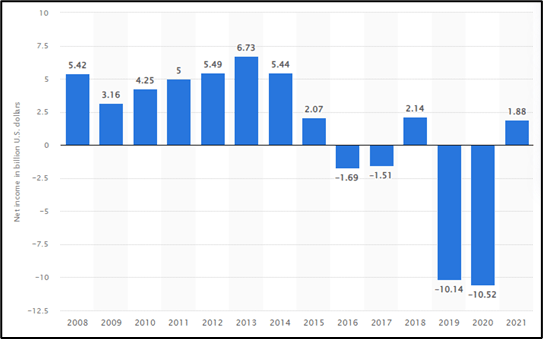

On a GAAP basis, 2019 and 2020 saw big losses:

SLB Net Income (Statista)

2019 and 2020 both saw massive goodwill and intangible asset impairment charges following the restructuring of the business. SLB’s market cap collapsed to levels not seen since 2005, and thus they determined that it was likely that the fair value of certain units was less than the carrying value.

- (2019 = $8.8 billion goodwill and $1.1 billion intangible asset impairment;

- (2020 = $3 billion goodwill and $3.3 billion impairments, and $1 billion in severance related charges, as well as about $2 billion impairments on carrying value of certain APS projects across the Americas);

- 2019 total impairment of $13,148;

- 2020 total impairment of $12,658.

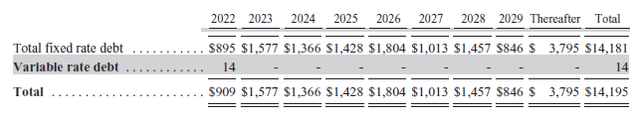

Debt:

All of SLB’s debt is at a fixed rate, meaning a rising interest rate environment will not affect their ability to service debt.

SLB also managed to reduce the amount of net debt over the last 2 years by more than $4 billion, and is on track to get to a net-debt/EBITDA level of less than 1.5x – something they have not been able to do since 2015.

I assume LT debt gets reduced by $6 billion from 2021 to 2026.

Margins:

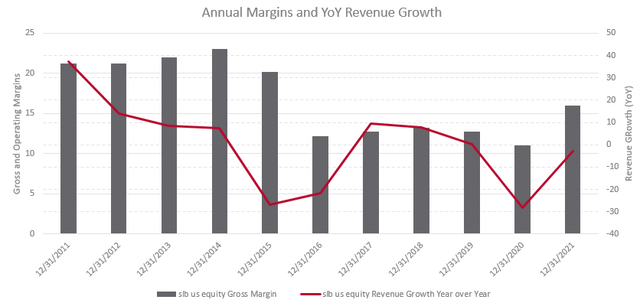

Margins have been under pressure over the last few years as revenues declined and COVID hit:

SLB Annual Margins (Created by Author, info from Bloomberg)

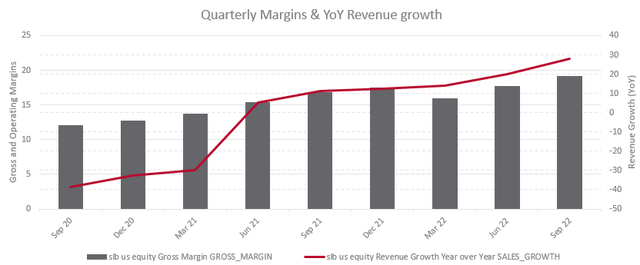

However, the last few quarters saw both revenue and margins recover to a certain extent:

SLB Quarterly margins (Created by Author, info from Bloomberg)

Full year 2021 pre-tax operating margin saw a boost of over 400 bps due to the divestiture of some North American businesses which were margin dilutive. There were also reduced D&A expenses due to asset impairment charges which were recorded in 2020.

BB Intel states that further divestitures could drive another 400 bps of margin expansion through 2025.

Cash to shareholders:

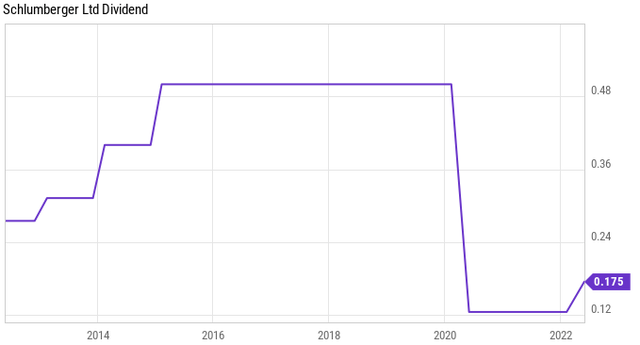

Between 2016 and 2019, SLB returned between 60 and 95% of its free cash flow (“FCF”) to shareholders, primarily via dividends. With the onset of the pandemic, dividends were decreased dramatically, as SLB announced a 75% reduction in their dividend – which saw the annual dividend payments drop from $1.7 billion in 2020 to $0.7 billion in 2021. Prior to this drop, SLB’s dividend was stable for about 5 years.

SLB Dividend Payments (YCharts)

There has since been a 40% increase, although that means it is still far below earlier levels.

At the Analyst Day in Early November, SLB announced that the dividend would again be increased by 43%. Post the increase, dividends will be 25 c/share – about half the previous level. This comes into effect only in 2023 – and pushes the yield closer to 2%.

Valuation

Stated targets and Growth Assumptions

- SLB has announced that they expect FY22 revenues to be at least $27 billion. I have used BB Consensus numbers for 2022, implying growth of 18.3% over 2021.

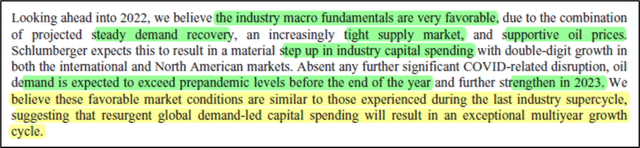

In the 2021 10-K, they expected a constructive multi-year growth cycle – however, this does not take into account the massive inflation, subsequent rate hikes, and possibility of a global recession in 2023:

However, during their analyst day, they reiterated aggressive growth targets.

- During the November analyst day, SLB indicated they are targeting top line CAGR of 15% between FY21 and FY25. Given the higher growth expected in FY22, I have modelled a CAGR of 14% from FY22 onwards, leading to a CAGR of 14.8% from FY21 through the forecast period, thus in line with guidance.

Capex for 2022 is expected to be between $1.9 billion and $2 billion – I have modelled $1.9.

- Capex levels are expected to remain between 5 and 7% in foreseeable future – I have modelled 6%.

Margin Assumption

- In my base case, I assume gross margin recovers to 21% by FY26. The average during the previous investment cycle (’09-’14) was 21.8%, vs 13% average since 2016.

- Operating margin during the cycle was an average of 16.8%, with a high of 19.7% in FY13. I model margin recovery from 12.1% to 17.2% in FY26.

Tax Rate Assumption

- SLB conducts its business in more than 100 tax jurisdictions. Generally, when a larger portion of revenue is generated outside the U.S., their effective tax declines, and vice versa. For simplicity, I have modelled a tax rate of 19% going forward. This is the maximum effective rate during the last 5 years, and perhaps too aggressive.

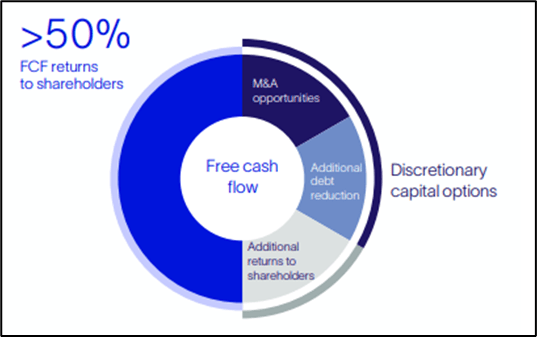

Dividends and Share Buyback Program

- I have increased dividends by 40% from 2021 levels, and by another 43% for 2022 levels, as per company guidance.

- I have then proceeded to grow them by another 46% and 25% in 2024 and 2025, to reach the same levels seen pre-covid. (Around $2.5 billion in total pay-outs).

- I have modelled the full available $9 billion share buyback authorization over the forecast period through 2027.

FCF Spending Targets (SLB Investor Day)

Applying a multiple of 17.5, which I believe is fairly generous given their levels of ROIC and expected future growth rates, leads to a FV of $63, which represented upside of 21% at the time of writing.

Conclusion

I believe SLB is a great company with good prospects, but the current valuation does not offer enough upside potential – even when applying what I believe are fairly aggressive growth rates and multiple assumptions.

Currently, I would rate SLB a hold, but with a stop loss, implemented dynamically as the price moves up – at a level where the investor is satisfied with the gain. As the price increases, the stop loss can be implemented at a larger delta, to avoid an untimely exit if the rally still has legs.

Doing so would lock in current gains, while also capitalizing on continued momentum, and potentially avoids an exit before SLB stock goes ex-div in early December.

Be the first to comment