MovieAboutYou/iStock via Getty Images

Introduction

Vancouver-based Sandstorm Gold Ltd. (NYSE:SAND) released its second-quarter 2022 results on August 11, 2022.

Note: This article updates my previous article on Sandstorm Gold, published on June 6, 2022. I have been following SAND quarterly results since 2015.

1 – 2Q22 Production and revenues snapshot

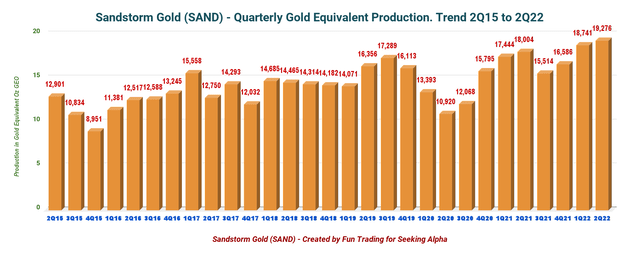

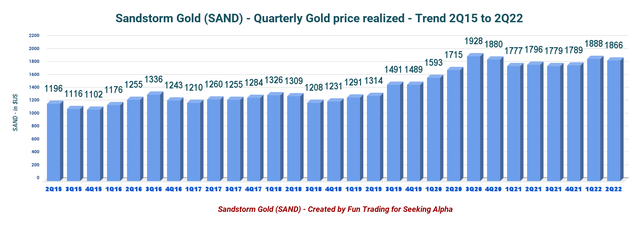

It was a solid quarter, with a record gold equivalent production of 19,276 Au Eq. Oz (18,004 Au Eq. Oz last year) and record revenues of $35.97 million, with an average price per GEO reaching $1,866 per ounce.

Net income was $39.67 million in 2Q22 compared to $8.64 million in the comparable quarter a year ago.

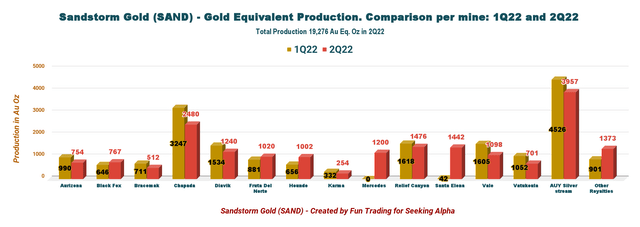

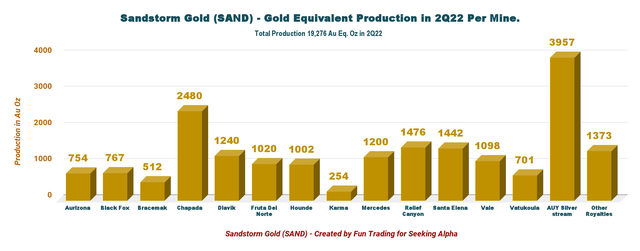

The company added the Mercedes gold mine this quarter with 1,200 GEOs, as shown below:

SAND Quarterly gold production per mine 1Q22 versus 2Q22 (Fun Trading)

Note: In March 2022, the Company closed its $60 million financing package with Bear Creek Mining to facilitate its acquisition of the producing Mercedes gold-silver mine in Mexico from Equinox Gold Corp (EQX). The financing package included a $37.5 million Gold Stream and a $22.5 million convertible debenture.

Sandstorm advanced to the Company $22.5 million (the “Principal Amount”) to subscribe for a 6%, three-year convertible debenture (the “Convertible Debenture”). Interest will be paid quarterly on the outstanding Principal Amount. The Principal Amount is due on April 21, 2025.

More importantly, On May 2, 2022, Sandstorm Gold announced two significant transactions.

For more details, I covered the two transactions in my article on May 3, 2022.

1.1 – SAND acquired Nomad Royalty (merger) for an estimated $590 million.

Nomad owns a portfolio of 20 royalty and stream assets, of which seven are producing mines.

1.2 – Sand acquired nine royalties plus one stream from BaseCore Metals LP for $425 million cash and $100 million in SAND shares.

One crucial asset acquired is the 1.66% NPI on the Antamina mine in Peru (copper/zinc), the World’s third-largest copper mine owned by Teck Resource, BHP Plc., Glencore Plc, and Mitsubishi Corp.

1.3 – SandBox Royalties launched on May 26, 2022.

Sandstorm Gold and Equinox Gold (EQX) announced:

the creation of Sandbox Royalties Corp. (“Sandbox Royalties” or “Sandbox”), a new diversified metals royalty company. Equinox Gold and Sandstorm have each entered into definitive purchase and sale agreements (the “Definitive Agreements”) with Rosedale Resources Ltd. (“Rosedale”) whereby Rosedale will acquire a portfolio of royalties from Equinox Gold for consideration of $28.4 million in common shares of Rosedale and from Sandstorm for consideration of $65 million comprising $32.1 million in common shares of Rosedale and $32.9 million in a promissory note convertible into common shares of Rosedale (collectively, the “Transaction”).

Sandstorm Gold and Equinox Gold will hold 34% and 30% basic interest in Sandbox. Post-completion of the Transaction, Sandbox intends to seek a public listing on a Canadian stock exchange.

CEO Nolan Watson said in the conference call:

This transaction required the approval of the TSXE, and I’m pleased to say that we now have that approval in hand, and we’re expecting this transaction to close near the end of August. But we had a lot of moving parts this summer. And going into summer, our goal was that while everyone else was on vacation, we would get all of these transactions completed.

2 – 2022 guidance is raised to 80K-85K GEOs

The transactions raise Sandstorm’s 2022 production guidance by approximately 22% from 65K-70K gold equivalent ounces GEO to 80K-85K GEO and increase long-term production guidance by 55% from 100K GEO to 155K GEO in 2025.

3 – Investment Thesis

As I said in my preceding article, these new transactions and the merger with Nomad have created a significant event for Sandstorm Gold and its shareholders.

It is too early to conclude anything of substance related to the company’s fair value, and we will need a few quarters to evaluate Newco appropriately, where SAND shareholders own about 67%.

As I said, bigger is not necessarily better, and the market reaction was quite hostile when the deal was announced. However, the second quarter results gave a much-needed boost to the stock.

I believe SAND continues to be an excellent trading tool, but I am not confident enough to invest a significant stake long-term in the company. Thus, I suggest starting a small long-term position while trading a large part of your position. My two favorites in this segment are Franco-Nevada (FNV) and Wheaton Precious Metals (WPM).

One excellent strategy that I often recommend in this sector in my marketplace, “The Gold and Oil Corner,” especially for SAND, is trading a minimum of 60% LIFO of your whole SAND position, which allows you to keep a core long-term for a much higher stock price.

Note: The company is paying a small dividend now or about 0.94% (0.71% net for the USA).

4 – Stock Performance

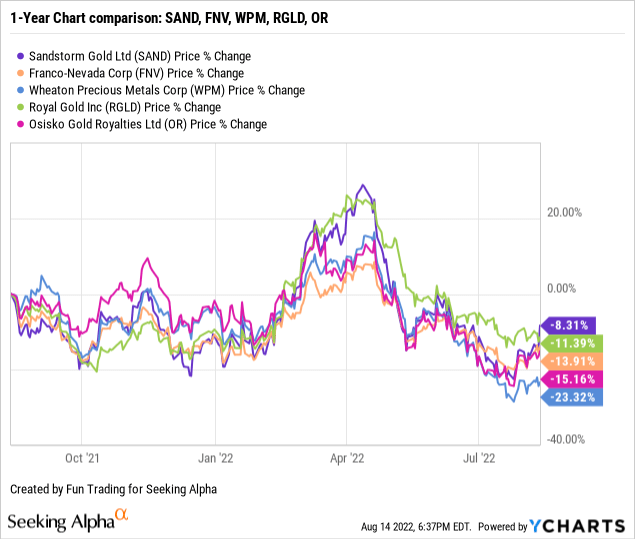

Sandstorm Gold rose significantly after the 2Q22 release and is now down 8% on a one-year basis. SAND is slightly outperforming the group after being a laggard for many quarters.

Sandstorm Gold – Financial Results Snapshot 2Q22 – The Raw Numbers

| Sandstorm Gold | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Revenues in $million | 26.45 | 27.60 | 29.82 | 35.37 | 35.97 |

| Net Income to shareholders in $million | 8.64 | 6.62 | 7.40 | 9.14 | 39.70 |

| EBITDA in $ million | 22.73 | 20.17 | 20.67 | 25.72 | 56.19* |

| EPS Diluted | 0.04 | 0.03 | 0.04 | 0.05 | 0.20 |

| Cash From Operating Activities in $ million | 20.00 | 17.91 | 19.51 | 22.36 | 33.20 |

| CAPEX in $million | 121.04 | 8.96 | 22.69 | 3.11 | 40.02 |

| FCF in $million | -101.04 | 8.95 | -3.19 | 19.25 | -6.82 |

| Total cash in $ million (incl. short-term note) | 45.81 | 37.65 | 21.17 | 31.61 | 23.83 |

| Total Debt in $ million | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Shares outstanding diluted in millions | 199.01 | 198.31 | 194.96 | 194.84 | 195.40* |

| Dividend per share in $ | 0 | 0 | 0 | 0.015 | 0.015 |

| Production | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| In K Au Eq. | 18.0 | 15.5 | 16.6 | 18.7 | 19.3 |

| Gold price | 1,796 | 1,779 | 1,789 | 1,887 | 1,866 |

Source: Company report analysis by Fun Trading (data are available since 2015 only for subscribers)

* As of August 11, 2022, the Company had 205,731,491 common shares outstanding and 1,926,500 restricted share rights outstanding. BaseCore acquisition was completed in July 2022.

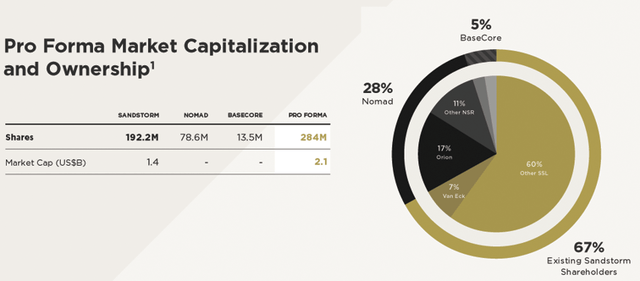

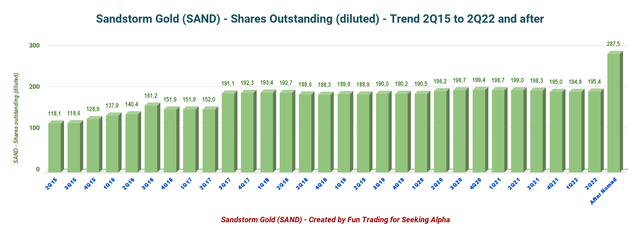

However, on August 9, 2022, SAND shareholders approved the Nomad Royalty Company Ltd. (NYSE: NSR) acquisition, which will significantly increase the company’s outstanding shares to about 287.2 million shares diluted (including Basecore). Existing SAND shareholders will own approximately 67% of Newco.

at an exchange ratio of 1.21 Sandstorm Shares for each common share of Nomad

SAND new shares count (Sandstorm Gold)

The transaction will close on Monday, August 15, 2022.

CEO Nolan Watson said in the conference call:

Nomad shows what a logical combination this is, and we believe that the new Sandstorm will become an even more attractive investment vehicle for large institutional investors looking for high quality, high upside, lower risk exposure to gold.

Part I – Balance Sheet Details

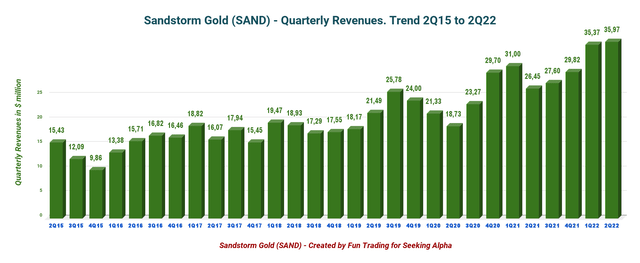

1 – Quarterly Revenues and Trends: Total revenues of $35.97 million in 2Q22

SAND Quarterly Revenues history (Fun Trading)

The net income was $39.67 million in 2Q22 or $0.20 per diluted share compared to $8.64 million or $0.04 per diluted share the same quarter a year ago.

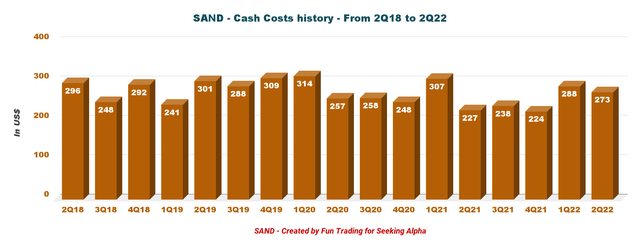

The cash costs per ounce are up to $273 per ounce, resulting in cash operating margins of $1,593 per ounce for the second quarter.

SAND Quarterly Cash cost history (Fun Trading)

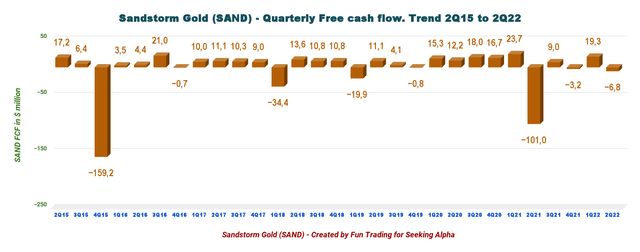

2 – Free Cash Flow was a loss estimated at a loss of $ 6.82 million in 2Q22

SAND Quarterly Free cash flow history (Fun Trading)

The free cash flow was a loss estimated at $6.82 million in the second quarter of 2022, and the trailing 12-month free cash flow was $18.19 million.

The quarterly dividend is now $0.015 per share, or a dividend yield of 0.94%

3 – Total shares outstanding diluted are about to increase after the Nomad acquisition.

This topic is essential for Sandstorm Gold because of the number of previous warrants and options the company has used to expand its assets base.

SAND Quarterly Share outstanding diluted (Fun Trading)

The total outstanding shares diluted is now 195.40 million at the end of 2Q22. However, as I have explained earlier, the transaction with Nomad and BaseCore will increase the outstanding shares diluted to about 287.5 million.

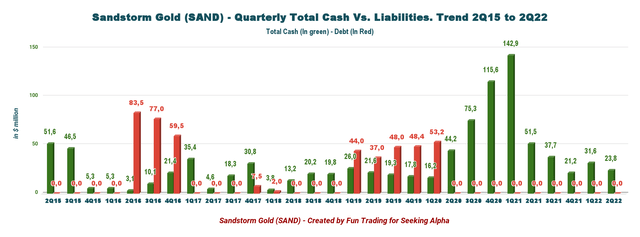

4 – The company has no debt, and its cash position was $23.83 million at the end of June 30, 2022.

SAND Quarterly Cash versus debt history (Fun Trading)

The total cash includes the cash and cash equivalent of $18.536 million and $5.289 million, classified as short-term investments.

Part 2 – Gold Production details

SAND Quarterly gold equivalent production history (Fun Trading) SAND Quarterly GEO per mine in 2Q22 (Fun Trading) SAND Quarterly gold price history (Fun Trading)

Technical Analysis and commentary

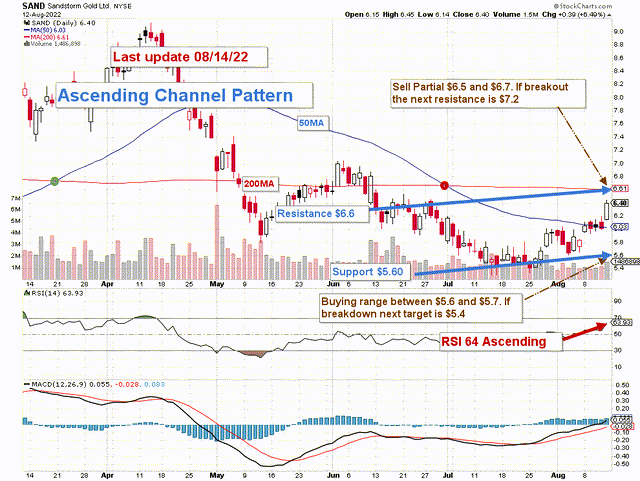

SAND TA chart short-term (Fun Trading)

The trading strategy for SAND is to sell at a resistance range of $6.5 to $6.7, about 40% of your position, and eventually sell another part on any pattern breakout at $7.20.

Conversely, it is reasonable to buy and accumulate between $5.60 and $5.70, with potential lower support at $5.40. However, the 50MA is now a mid-point pattern considered a support, and it is convincing to start accumulating at $6.00.

It is crucial to trade SAND with the gold price and what the FED will decide soon for the next hike in interest.

Analysts believe a 50-point is the next move, but a few feel a 75-point may be necessary again. If the FED opts for a 75-point, the gold miners may drop further, and conversely, with a 50-point, we could experience a new uptrend which has started with the expectation that inflation has peaked.

The gold and silver prices are at $1,804 and $20.87, but it is fragile support due to the Fed’s hawkish position. Any downside could hurt SAND significantly.

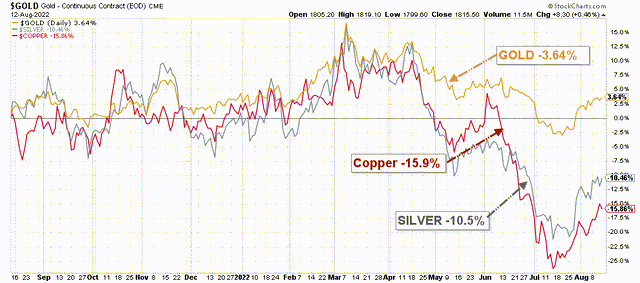

SAND Gold silver copper comparison 1 year (Fun Trading StockCharts)

Watch gold like a hawk.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment