holgs

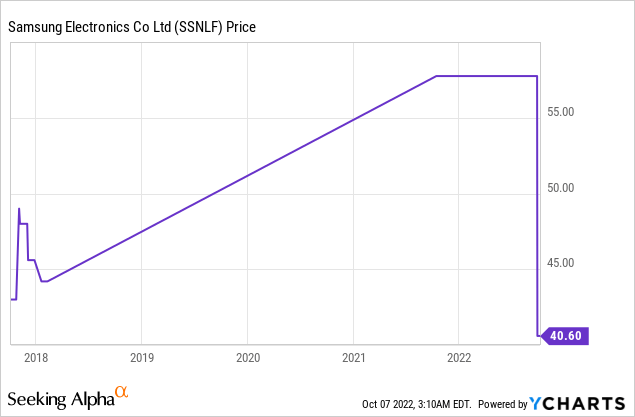

Samsung (OTCPK:SSNLF) is one of the global leaders in smartphones and memory chips. The company recently reported its preliminary financial results for the third quarter of 2022, which showed some disastrous results. In this post, I’m going to put these results into context, analyze its financials, reveal its valuation and derive a prediction based upon competitor/industry data. Let’s dive in.

Third Quarter Prediction

Samsung will announce its full results for the third quarter of 2022, on October 27th. In the meantime, the company has announced preliminary financial results for the third quarter. Operating Profit was butchered by 32% in Q3 to $7.7 billion (10.8 trillion won). These results were also nearly $1 billion under the guidance of the $8.6 billion (12.1 trillion won) forecasted by analysts. This may seem terrible at first glance, but the good news is these results are at a similar level (+3%) to the $8.3 billion reported in the first quarter of 2021. In addition, Operating profit is still up by 40% from the $6.1 billion reported in the pre-pandemic fourth quarter of 2019. Sales also rose by ~3% in the third quarter of 2022, to $54 billion (76 trillion won). However, this was down -9.7% sequentially from the $59.8 billion generated in the second quarter of 2022.

Why the Decline?

Samsung will not reveal the breakdown of its results by segment until October 27th. However, using the company’s prior financial and industry competitor data some inferences can be made. Despite Samsung being well known for its consumer smartphones and TVs, the business’s semiconductor chips actually bring in a substantial portion of revenue and profits. For instance, Samsung’s Device Solutions [DS] segment which consists of DRAM (Dynamic Random Access Memory) and NAND (Flash Memory), brought in 37% of its revenue and 71% of its profits in the second quarter of 2022. The DRAM segment made up the lion’s share or 76% of the DS segment as of the second quarter.

DRAM is a component used for short-term memory storage and as an essential part of any “computer”. If you’ve ever looked inside a laptop you will see there are just a few main components. You have the microprocessor (made by companies such as Intel or ARM), a graphics card (Nvidia), a Hard drive (SanDisk), and of course DRAM.

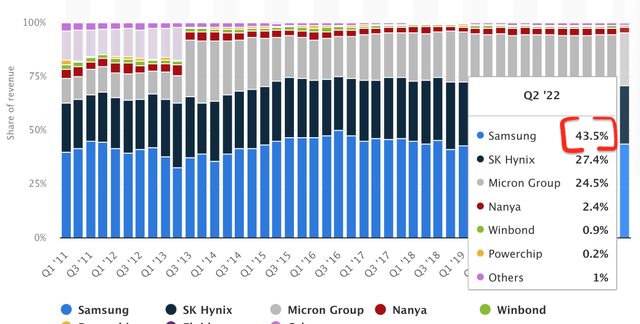

Samsung is the largest supplier of DRAM (Dynamic Random Access Memory) with a 43.5% market share as of the second quarter of 2022.

Samsung DRAM Market share (Statista)

The DRAM or memory industry has consolidated over the past decades and now consists of just three “big three” competitors. We have Samsung with a 43.5% market share, SK Hynix with a 27.4% share, and Micron (MU) with a 24.5% share of the market. The industry relies heavily on supply/demand and thus is prone to boom-bust characteristics. For example, during the “semiconductor shortage” of 2020, demand was super high, but supply was constrained thus we had a major boost in prices and profits for Semiconductor companies. However, in 2022 demand waned and inventory has piled up. Competitors such as Micron recently announced poor financial results in the most recent quarter, as they missed revenue expectations. Micron reported DRAM revenue declined by an eye-watering 23% quarter over quarter and 21% year over year. This was driven by approximately 10% lower bit shipments and a lower average selling price.

These metrics are the first major signs of a cyclical downturn in the semiconductor industry and DRAM especially. I believe Samsung’s recently announced preliminary financial results have also been impacted substantially by these industry headwinds. There were a few hints of this in Samsung’s business results and outlook for the second quarter of 2022. Its demand for consumer products “weakened” due to “macro issues”. As a result, its memory shipments were below bit guidance. The good news is its Average selling price held up due to a strong dollar and a disciplined sales strategy. Its NAND bit growth also came in below guidance for the second quarter of 2022.

Companies such as Micron announced plans to reduce its Capex and use existing supply to fulfill demand, in order to combat the cyclical downturn. I forecast Samsung will need to do the same. On the manufacturing side, Samsung announced major plans to invest a staggering $17 billion towards building a fab plant and 11 production lines in Texas. Like any cyclical industry there will be booms and bust, but Samsung is still the strong market leader in DRAM and thus it will be poised to benefit from tailwinds such as 5G devices which are “hungry for more memory”.

Mobile Segment

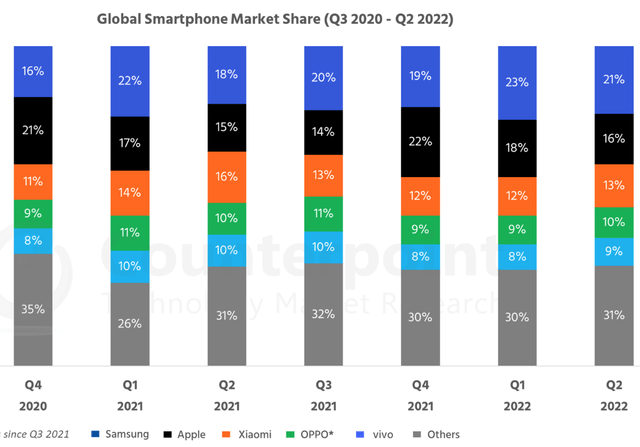

Samsung is arguably most famous for its smartphone business of which the company has the largest market share (21%) of any company globally. Tech giant Apple trails behind with a 16% global market share, although Apple has an edge in some western markets.

Samsung Market Share (Market Monitor Service/CounterPoint)

In Samsung’s second-quarter financial results, management announced they had experienced “contracted” quarter-over-quarter demand due to a combination of weak seasonality, inflation, and geopolitical issues. Despite the headwinds, revenue did manage to increase thanks to an early release of new premium smartphones such as the S22. However, in September Apple announced its new iPhone 14, and despite mixed reviews, I believe this will negatively impact Samsung. The Samsung S23 is not out until early 2023, thus I believe Apple will be able to eat market share over the holiday period, capturing a larger share of wallet from the consumer.

Samsung Displays and TVs

In an earnings call for the second quarter of 2022, management announced that there was economic “uncertainty” on overall TV demand, despite peak seasonality. The business aims to focus on profitability while focusing on the demand for its B2B signage displays. In addition, the company has won innovation awards for its Odyssey Ark curved gaming monitor, which I must admit looks spectacular. I am expecting a boost in this segment during the fourth quarter earnings thanks to holiday season demand, but for the third quarter, I forecast tepid demand.

Advanced Valuation

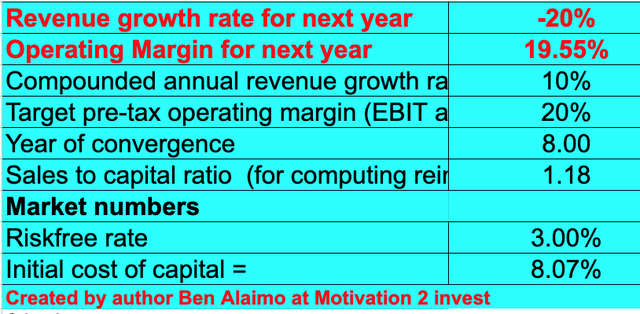

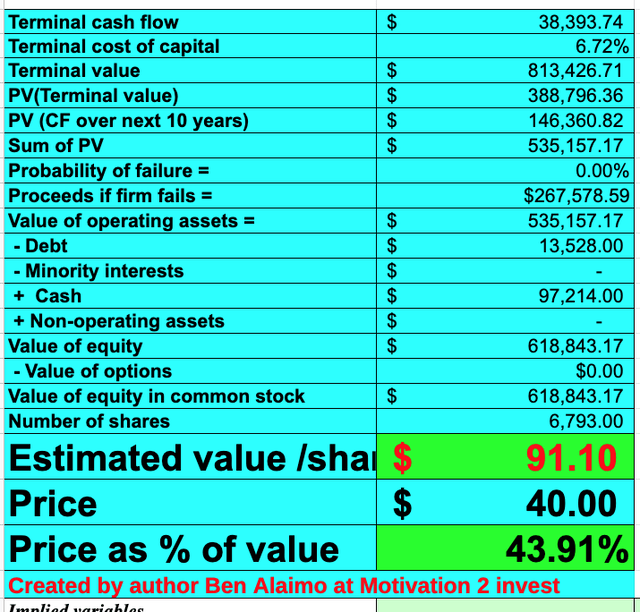

In order to value Samsung, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a pretty bad scenario with a revenue decline of 20% next year, before recovering with a 10% compounded annual growth rate per year, over the next 2 to 5 years, driven by the aforementioned cyclical industry declines and macroeconomic headwinds.

Samsung stock valuation (created by author Ben at Motivation 2 Invest)

I have also forecasted a target pre-tax operating margin of 20%, over the next 8 years, which includes an adjustment boost from R&D expenses which I have capitalized.

Samsung stock valuation (Created by author ben at Motivation 2 Invest)

Given these factors I get a fair value of $91 per share, the stock is currently trading at $40 per share and thus is ~56% undervalued.

As an extra data point, Samsung trades at a Price to Earnings ratio = 8.2 which is 60% cheaper than the IT sector. As a comparison Apple trades at a Price to Earnings ratio = 22, which is substantially more expensive despite the pullback. However, Micron trades at a PE ratio = 6.5 which is cheaper than Samsung, although the company is less diversified. I wrote a full analysis post on Micron, and I own shares you can read more here.

Risks

Recession/Inflation

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Therefore I expect consumer demand to continue to slowdown and some volatility in the short term. The supply chain issues also don’t help companies such as Samsung, which need to manufacture and ship goods globally.

Final Thoughts

Samsung is a market leader in consumer electronics and DRAM technology. The company is currently facing macroeconomic headwinds and undergoing a cyclical downturn. I forecast things to get worse before they get better and the business’s initial Q3 financial results play into this thesis. However, I believe the company’s market-leading position will still remain and given the stock’s undervaluation, I suspect a rebound by next year. I have labeled the stock as a “hold” just till we have more clarity on when the macroeconomic issues will resolve.

Be the first to comment