Takako Hatayama-Phillips

Thesis

Salesforce’s (NYSE:CRM) FQ2’23 earnings release spooked the market, as CRM gave up all its August gains as it closed in on its mid-July lows. However, we noted nothing significantly amiss in its earnings card, as we posited in our pre-earnings update that much of its near-term challenges had been reflected.

Therefore, we view the recent deep pullback as an opportunity for the market to shake out some weak holders and allow another fantastic opportunity for patient investors to add more exposure.

Consequently, we are confident that the company’s robust profitability profile remains intact, as management maintained its non-GAAP operating profit margins guidance. Despite the worsening macro and forex impact, we view the headwinds highlighted in its earnings commentary as transitory. Structurally, Salesforce remains in pole position as the industry-leading CRM as it expands further into its industry verticals with its 360 strategy.

Therefore, we reiterate our Buy rating and encourage investors to capitalize on its pullback to add exposure.

Salesforce’s Broad Slowdown Was Expected

We noted in our pre-earnings update that enterprise SaaS companies have continued to come under pressure, given the worsening macroeconomic challenges. Therefore, we are not surprised that Salesforce telegraphed that it’s seeing extended sales cycles, exacerbated by more deal approval layers and compression in deal values.

Furthermore, the weakness seen in small and medium businesses (SMBs) through Slack corroborated the recessionary theme, as the slowdown was broad-based.

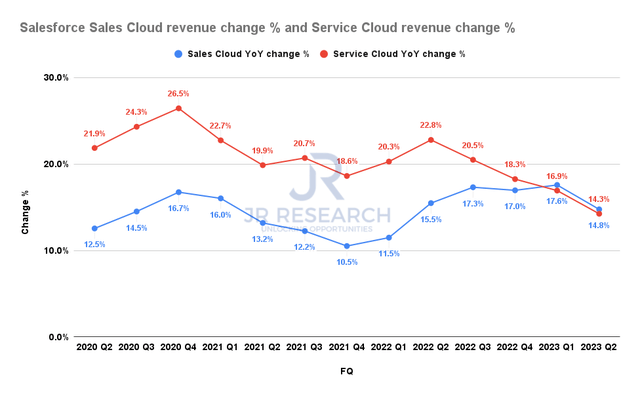

Salesforce sales cloud revenue change % and service cloud revenue change % (Company filings)

As the market leader, Salesforce will not be immune to the macro impact. Consequently, while the momentum in its core Sales Cloud remains resilient, its growth decelerated further to 14.8% YoY in Q2, down from Q1’s 17.6%. Notably, it also indicated a break from the reacceleration in growth over the past four previous quarters, as seen above.

Furthermore, the momentum in its Service Cloud has continued to weaken, as it posted its fifth straight quarter of decelerating growth, at 14.3% YoY. It also came below Q1’s 16.9% uptick, suggesting that Salesforce observed a broad-based deceleration.

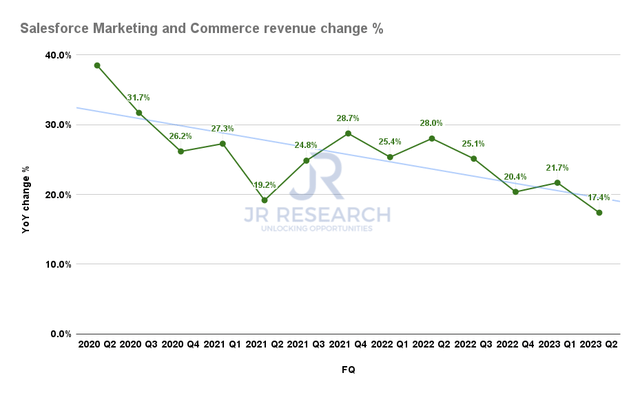

Salesforce marketing and commerce cloud revenue change % (Company filings)

To compound matters further, the company continued to experience post-pandemic normalization in its Marketing and Commerce Cloud, with revenue growth of 17.4%.

Therefore, Salesforce investors are justified to feel anxious about whether these trends represent something more sinister. Questions abound whether Salesforce’s structural growth drivers could be impacted materially over the next few years, even as it laps some transitory near-term headwinds.

However, we are highly convinced that Salesforce’s competitive moats through its 360 strategy and industry verticals cloud present a formidable advantage in helping it secure its medium-term roadmap toward $50B in revenue by FY26. The company’s leadership as the leading CRM cloud has expanded tremendously to multi-cloud and various industry verticals, delivering tremendous value to spur customer adoption and confidence. Management accentuated:

Digital transformation remains our customers’ top priority, and digital transformation starts and ends with the customer. Our results demonstrate the durability of our business model and the strength of our strategy. Our Customer 360 product portfolio is the industry standard and the market leader. Our 12 industry clouds [grew] faster than our line of business cloud as our customers are increasingly focused on time to value and reducing their implementation costs. The out-of-the-box industry processes we’ve built into our industry clouds are a compelling value proposition in this more measured buying environment. (Salesforce FQ2’23 earnings call)

Strong Profitability Profile Should Support CRM’s Battered Valuation

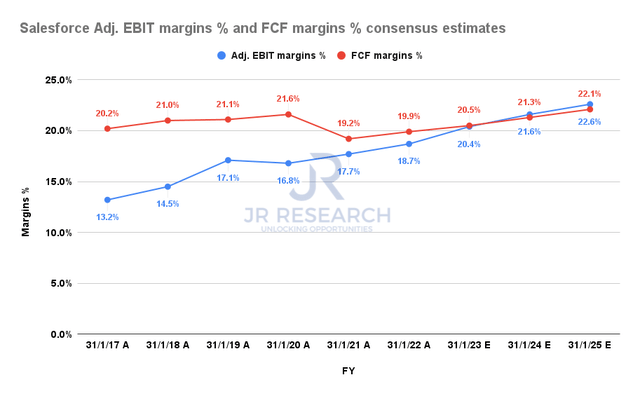

Salesforce adjusted EBIT margins % and FCF margins % consensus estimates (S&P Cap IQ)

Furthermore, the consensus estimates (very bullish) suggest that Salesforce’s profitability profile is projected to improve further, even as its growth normalizes.

We are confident that management’s ability to maintain its non-GAAP operating margin guidance of 20.4% is a testament to its ability to unlock more operational efficiencies, demonstrating the inherent leverage in its underlying model.

Furthermore, we are confident that the forex headwind baked into its full-year guidance could reverse itself, as we posit that the surge in the dollar index is likely unsustainable.

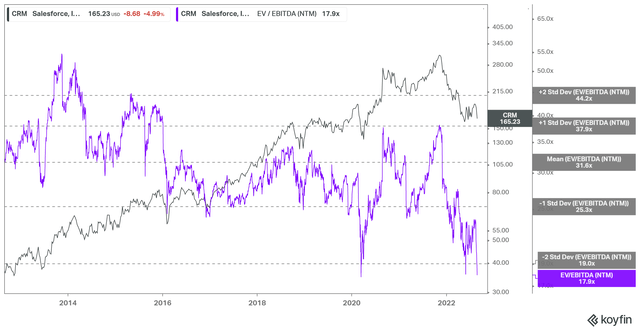

CRM EV/NTM EBITDA valuation trend (koyfin)

Therefore, we are confident that CRM should continue to find robust support at its July lows, as it last traded at the two standard deviation zone below its 10Y NTM EBITDA multiples mean.

Coupled with the company’s robust profitability guidance, we posit that the downside volatility should be limited compared to the potential for a medium-term re-rating as those transitory headwinds subside.

Is CRM Stock A Buy, Sell, Or Hold?

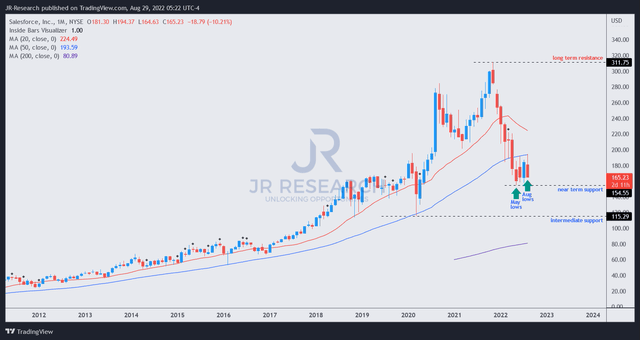

CRM price chart (monthly) (TradingView)

With the recent pullback, CRM has given up all its August gains, as the market sent it collapsing close to its near-term support ($155).

However, we are confident that its near-term support should hold resiliently, with the basing price action constructive as an accumulation phase.

Therefore, investors should not fear the pullback. Instead, they should consider it another fantastic opportunity to add exposure, as the market shakes out some weak holders who couldn’t stomach the near-term volatility.

Accordingly, we reiterate our Buy rating on CRM.

Be the first to comment