Stephen Lam

If you take snapshot of Salesforce (NYSE:CRM) as a business, ignoring some aspects of its financial statements, the fact that it has grown almost entirely through acquisitions and of course its valuation, it is nearly impossible not to be impressed.

Of course, CRM has created one of the strongest SaaS ecosystems (software-as-a-service) out there and is thus capturing a large segment of the market, achieves significant customer loyalty (at least for now) and benefits from strong cross-selling opportunities. Moreover, the push towards digitalization in recent years has created a mantra that the sector is immune to downturns and should continue to grow in double digits. Lastly, loose monetary policies around the globe gave the final push to valuations of long duration assets.

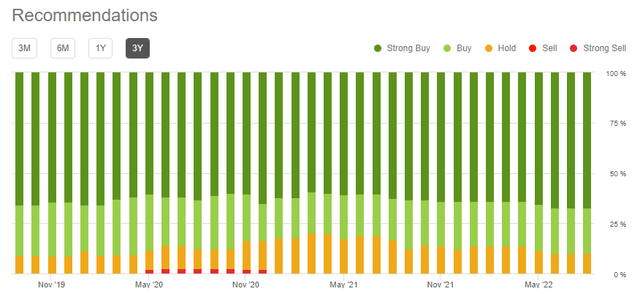

Although Wall Street analysts and market commentators more broadly have been exceptionally optimistic about CRM for a number of years now, the mood around the software giant is once again ecstatic.

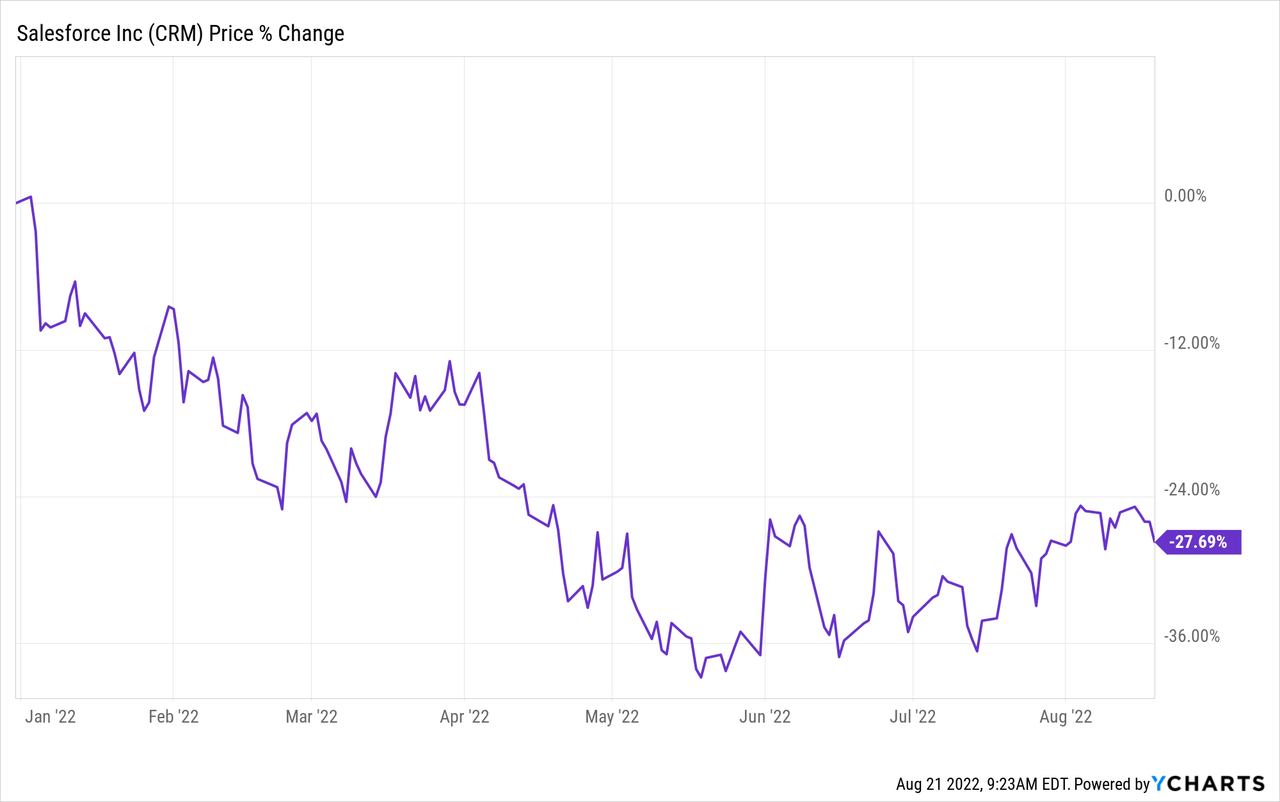

After all, how can one not feel this way, now that CRM continues to grow its topline while also trading nearly 30% lower since the beginning of the year?

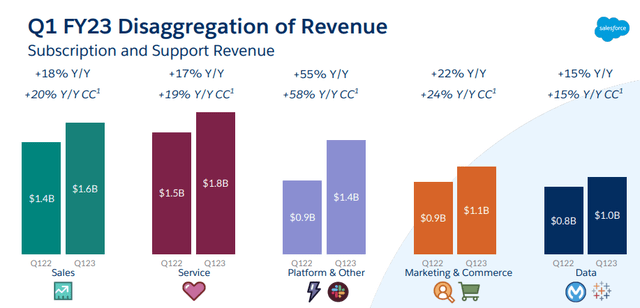

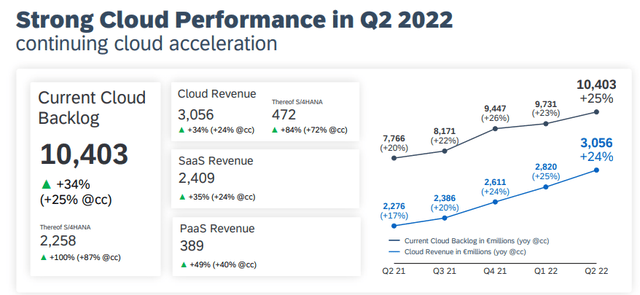

Salesforce Investor Presentation

A simple extrapolation of this line of thought could easily lead us to a conclusion that buying CRM is a ‘no brainer’ and the stock is now suddenly a ‘bargain’ that the market does not appreciate for some reason.

The Problem With Salesforce Valuation

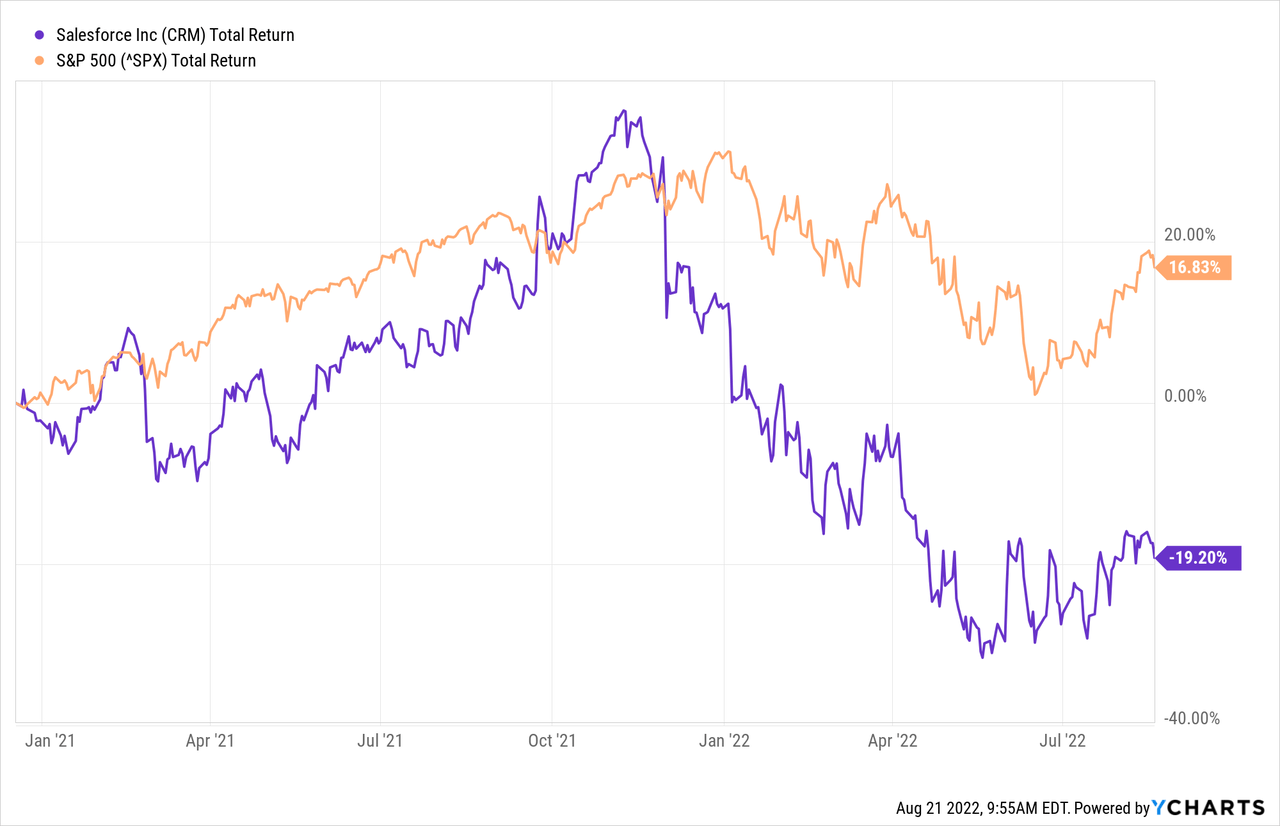

In the real world, unfortunately, things are a bit more complicated than that. Without repeating all the red flags that have been waving above CRM for quite some time now, the company has been a significant disappointment to investors for the past year and a half (see below).

Back in December of 2020, a negative view on the prospects of high returns of CRM was almost unimaginable. And yet, the share price has consistently underperformed the broader market on an absolute basis (not to mention the underperformance on risk-adjusted basis).

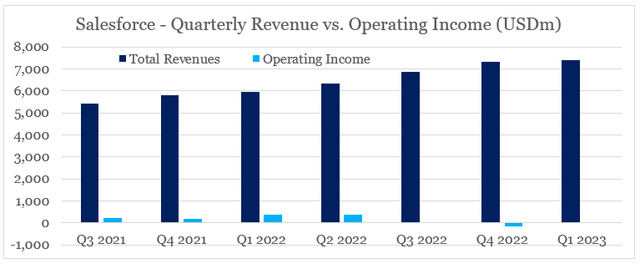

At the same time, the company’s revenues grew from $5.4bn in Q3 of fiscal year 2021 to $7.4bn in the latest reported quarter, a nearly 37% growth in less than two years.

prepared by the author, using data from Seeking Alpha

A major red flag here is the lack of operating profitability, even as the company benefits from its leading positioning and large economies of scale. I took a deeper dive into CRM’s profitability issues in my recent analysis called ‘Salesforce Might Need Another Large Acquisition And Fast‘ and hence will not elaborate further on this issue here.

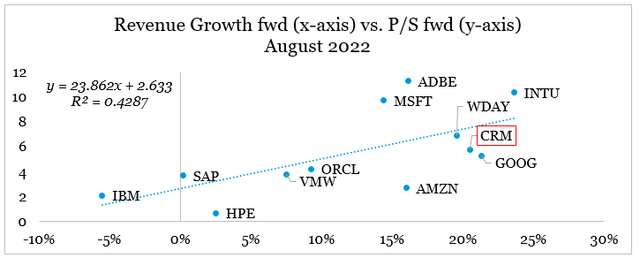

Naturally, this significantly lower valuation coupled with the high revenue growth leads many to believe that CRM is now a ‘bargain’. The problem, however, is the following graph, which shows that expected revenue growth rate is one of the major valuation drivers in the cloud space.

prepared by the author, using data from Seeking Alpha

More specifically, the slope of the trend line above is inversely related with the level of interest rates. I analyzed that phenomenon in my thought piece ‘The Cloud Space In Numbers: What Matters The Most‘ in November of last year.

Therefore, no matter what future assumptions one uses about margins or cash flow, CRM’s performance in the coming months will depend on two major factors:

1) Its ability to sustain the topline revenue growth at above 20%;

2) And the level of interest rates, which impact the premium paid for growth.

The problem here is that the latter is quite speculative to forecast and has little to do with Salesforce’s business. Moreover, given the inflationary pressures, it appears unlikely that the yields would come down significantly without a major recession or a systemic risk to the financial system. This is especially true for the long end of the yield curve, which has a stronger impact on long-duration equities, such as CRM.

The issues with the former is that although CRM’s growth will likely benefit from industry-wide tailwinds over the next months (more on that in the next section), it becomes increasingly harder for the company to find suitable acquisition targets to boost its topline revenue figure.

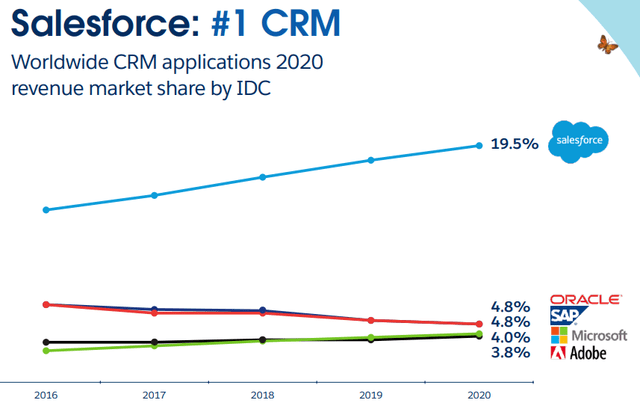

Apart from inorganic growth financed with shareholder dilution, Salesforce management is also doing everything necessary to support the growth narrative – from ever growing acquisitions to changing marketing materials. As we see in the most recent investor presentation, CRM’s market share has been growing in a straight-line fashion since 2016, to reach 19.5% as of 2020

Salesforce Investor Presentation

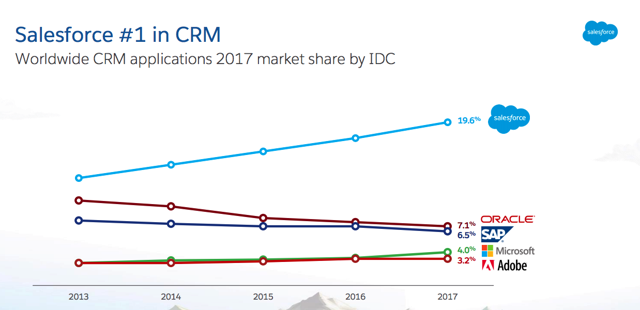

But as we see in the similar slide from 2017, Salesforce market share was once again growing in a straight line fashion and was standing at 19.6% as of that year.

Salesforce Investor Presentation

This begs the question, how is it possible that Salesforce’s market share is growing so steeply (as per its most recent presentation), while at the same time it is slightly lower than it was back in 2017? Surely, there must be an explanation for all that, however, every vigilant shareholder will grow skeptical of CRM’s narrative of sustainable topline growth in the coming years.

What to expect from CRM going forward?

As Salesforce is about to report its second quarter earnings for its fiscal year 2023, it is not unreasonable to expect that the company will once again feel the industry-wide tailwinds on its back.

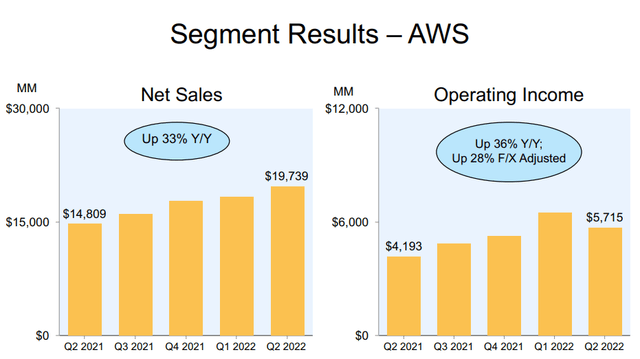

From cloud-infrastructure to SaaS and platform-based services, overall demand for digitalization remains high. As we saw from recently reported results of Amazon Web Services and SAP (SAP), topline revenue growth remains high across the board, even though profitability issues begin to surface

Amazon Investor Presentation SAP Investor Presentation

However, as we saw in the previous section, as long as revenue growth remains exceptionally high, profitability is not an issue. At least for short-term oriented investors it is not.

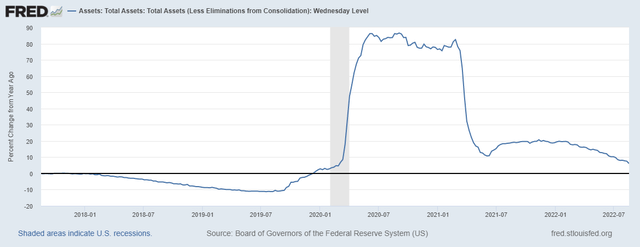

In terms of outside influence, the Federal Reserve seems committed to the tightening cycle, although its impact has been felt mostly on the short-end of the curve which resulted in the recent yield curve inversion. Having said that, liquidity within the system is still high and thus supportive for valuations of high duration stocks, such as CRM.

This highlights a significant risk going forward, if the Federal Reserve’s balance sheet begins shrinking and yields on the long-end make a more meaningful movement in upward trajectory.

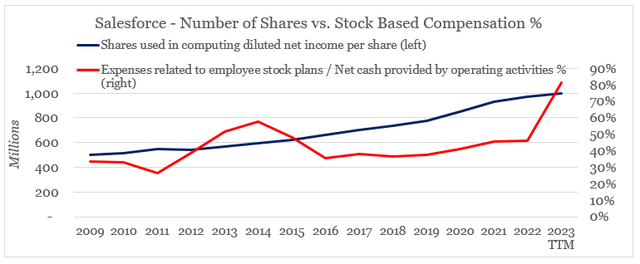

Lastly, shareholder dilution at CRM will likely continue to accelerate and a new major acquisition could also be announced as soon as topline growth de-accelerates. This will likely be used as a tool to dispel any fears that the company’s growth rate is peaking.

prepared by the author, using data from SEC Filings

Stock-based shareholder compensation packages also continue to accelerate and thus significantly increase business related risks, should Salesforce’s share price keep underperforming the market.

Investor Takeaway

Salesforce’s share price will most likely continue to benefit from industry-wide tailwinds, supportive monetary conditions and short-term benefits from the most recent acquisitions. For the time being, this would likely be enough to support the valuation and appease short-term oriented shareholders.

At the same time, GAAP profitability will most likely remain under pressure and shareholder dilution will continue due to the generous compensation packages and the growing need for ever larger M&A deals. Monetary policy decisions would also have a disproportionately higher impact on CRM’s valuation which makes future returns highly dependent on outside factors and speculations about future monetary policy decisions.

Having said all that, CRM might appeal to short-term speculators looking for momentum trades, but it fails to quality as attractive long-term investment.

Be the first to comment