Sundry Photography

Mixed results, muted outlook, and another executive exit

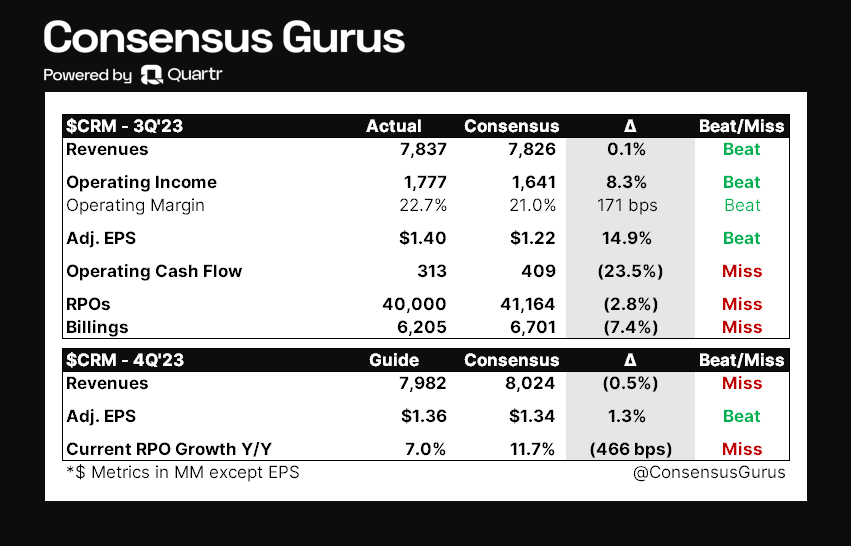

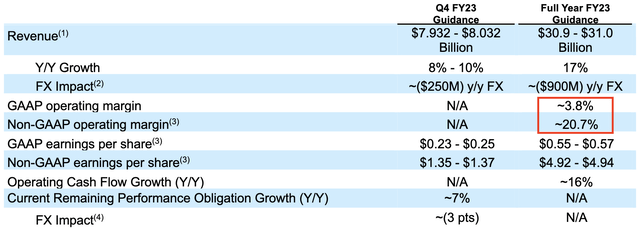

Salesforce, Inc. (NYSE:CRM) reported mixed FY3Q23 (C3Q22) results and underwhelming FY4Q23 (C4Q22) guidance that sparked some growth concerns, which sent shares down almost 7% post-market. In calendar Q3, Salesforce delivered revenue of $7.8 billion (+14% YoY/ 19% in constant currency) and adjusted EPS of $1.4 that both beat consensus estimates. However, cRPO (current remaining performance obligation) of $20.9 billion was up 11% YoY (15% ex-FX) against the Street’s +13%. While management guided Q4 revenue of ~$8 billion (+10% YoY/13% CC) in line with Street estimates, cRPO growth was guided to 7% (10% CC) vs. 11.7% consensus, pointing to slower top-line growth going forward.

Consensus Gurus

So what exactly is going on? Customers are changing their behaviors in a challenging macro with slowing/flat growth in industry verticals such as tech, e-commerce, and financial services. In a slower deal environment where company CFOs are scrutinizing every expense item, many Salesforce products are understandably being impacted. For example, Sales and Marketing Cloud are slowing with reduced corporate marketing spend and hiring as companies tighten the belt. Normalizing e-commerce activities are also having an impact on Commerce Cloud. During Cyber Week, Commerce page views were up 14%, but Commerce orders only increased by 2%.

Additionally, co-CEO Bret Taylor announced he would be leaving the company, with CEO and co-founder Marc Benioff now running the show solo. This is the second C-suite executive departure, following the resignation of Chief Strategy Officer Gavin Patterson in early November.

Growth is slowing, so profitability matters

Like many software peers, Salesforce benefited tremendously from the pandemic where companies had to embark on digital transformations quickly. Following a massive IT investment cycle, customers are pulling back in key areas like marketing, sales and commerce to prepare for a slower environment. No surprise here, to be honest.

While the shift appears to be more cyclical than secular, Salesforce is nevertheless a relatively mature business considering top-line growth is unlikely to return to 25%+ without a broad-based re-acceleration in digital transformation. As investors start to think about Salesforce as a low-double-digit growth story, profitability becomes an important source of value. Unfortunately, this is the part where Salesforce scores rather poorly, despite management’s goal of bringing operating margin to at least 25% by FY26 (C25).

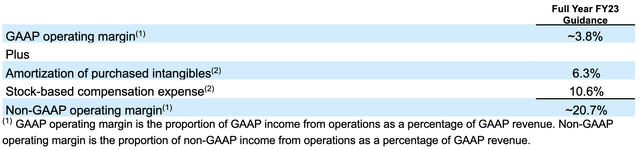

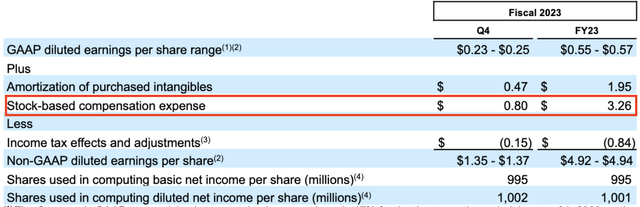

Per management’s guidance, non-GAAP operating margin for FY23 is expected to be 20.7% vs. 3.8% GAAP in FY23. The almost 17-point delta between GAAP vs. non-GAAP EBIT margin primarily comes from stock-based compensation (“SBC”), which accounts for more than half of the company’s EBIT margin.

On the bottom line, SBC is expected to be $3.26 on a per share basis in FY23, representing 66% of $4.93 non-GAAP EPS. While FY23 non-GAAP net income will come in around $4.9 billion for a net margin of ~16%, GAAP net income of $560 million represents just a 1.8% net margin. From an earnings quality perspective, it’s difficult to see Salesforce as a high-margin business.

For a long time, Silicon Valley has become used to convincing the analyst community to exclude SBC in the judgment of a company’s earnings power. This was not a problem when revenue was growing strongly, as investors could rationalize their decision with the narrative that the company could “one day become superbly profitable.” Now as a low-teens grower, however, Salesforce has a lot of work to do on the bottom line. Call me old-fashioned, but Warren Buffett is right on the money when it comes to SBC.

“If options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And, if expenses shouldn’t go into the calculation of earnings, where in the world should they go?”

How to think about the stock?

Salesforce has officially transformed from a fast grower to an industry stalwart, albeit not a very profitable one. In my opinion, the market’s valuation framework will eventually shift from price to non-GAAP EPS to price to GAAP EPS. For FY24 (C23), the Street expects revenue of $34.9 billion (+12.6% YoY) and GAAP EPS of $1.38. This implies a forward P/E of over 100x based on the current share price of $145.

While valuation on an adjusted basis appears “reasonable” at 25.6x FY23 non-GAAP EPS vs. 60-70x during the pandemic, there is probably a good reason why it’s now at a historic low. As much as some analysts think the stock isn’t exactly “down-gradable” due to such a low multiple, I continue to see a very luxuriously valued stock that’s at risk of further correction.

All told, I believe it’s best to avoid Salesforce as a low-teens growth business that’s marginally profitable. Perhaps valuation will enjoy some upside when markets see a high probability of interest rates returning to 0%, but it’s unlikely that we’ll see another external shock leading to another violent wave of digital transformation. Despite shares of Salesforce being down 44% YTD, I see better opportunities elsewhere.

Be the first to comment