jetcityimage

Value Investors Refine Strategy Until Market Turns Bullish

Until the market shakes off this bearish sentiment, many value investors are currently listing stocks that seem poised to fuel the next recovery, adding positions as soon as there is a scent of a market rally.

Almost certainly their lists include Saia, Inc. (NASDAQ:SAIA). Saia is a very interesting investment opportunity. The company continues to make progress on its business expansion program and prepares for a future of strong deliveries in terms of sales and margins.

With these growth prospects, Saia shares have amazing upside potential that should materialize once the stock market returns to bullish mode.

Saia, Inc.

Based in Johns Creek, Georgia, Saia, Inc. is a North American freight forwarding company that provides less-than-truckload [LTL] services for relatively small loads, or freight between 400 and 10,000 pounds.

As of December 31, 2021, Saia’s portfolio comprised 176 [own and leased] facilities as well as around 5,600 tractor units and 19,300 trailers.

The Financial Results for the Third Quarter of 2022

The operating environment was not easy for Saia in the third quarter of 2022 as demand conditions were less favorable than usual, with slightly fewer requests for LTL services than in most recent quarters.

Nevertheless, the US LTL service provider managed to achieve nice operating results. Some of these operating results even represented a significant improvement compared to the previous year, with the operating ratio [OR] and the operating income at the top.

Positive Trends in Operating Ratio [OR] and Operating Income

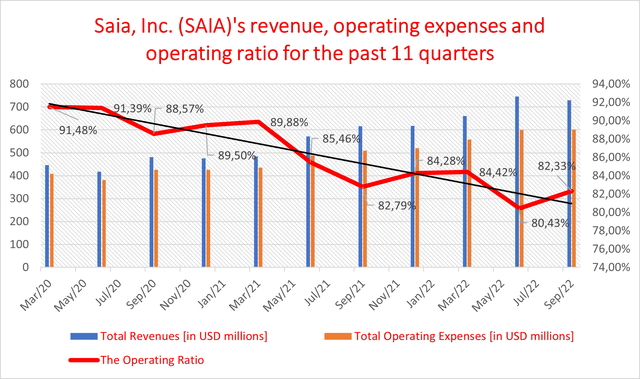

The OR, a metric that investors highly consider when evaluating a transportation company’s performance, was 82.4% in the third quarter of 2022. In general, the value of this operational indicator should be between 80% and a maximum of 90% for the road transport company to be considered an efficient means of transport.

The OR was calculated as the quotient between Saia’s Q3 2022 operating expenses of $601.21 million and Saia’s total Q3 revenue of $729.56 million.

OR has improved compared to the same period last year. But what Saia’s shareholders might like here is that OR is getting better over time, albeit with small swings, as can be seen in the chart below. This is possible despite increased labor costs [higher salaries] and higher depreciation charges due to the addition of new equipment to the fleet, both of which weigh on the total operating expenses.

seekingalpha/symbol/SAIA/income-statement

The growth strategy is bearing fruit, as sales are developing very well and efficiently, and this aspect primarily benefits the operating result.

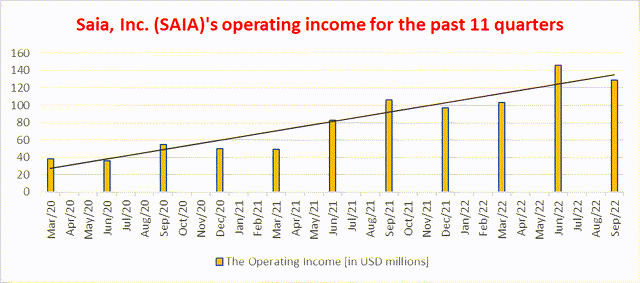

Operating income for the third quarter of 2022 was $128.36 million, up more than 21% year over year, but this was just the continuation of a positive trend that began quarters ago.

seekingalpha/symbol/SAIA/income-statement

A Higher Price Will Be Applied as long as Customers Appreciate the Value Proposition

The company strives to continually improve the quality of its services by increasing coverage through a gradual expansion of locations. Better quality of service allows the company to raise the price its customers pay and offset higher operating costs resulting from higher labor costs, additional depreciation charges and inflationary pressures. With the latter factor potentially lingering for a while due to ongoing macroeconomic and geopolitical issues, the company will have a competitive advantage over many of its peers.

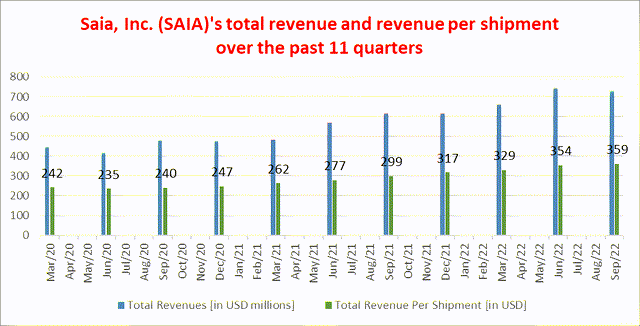

Excluding the fuel surcharge, total revenue increased 9.3% year over year to $729.56 million in Q3 2022. LTL revenue per shipment increased 10.2% year over year.

The fuel surcharge is an additional fee that transport companies charge to protect against fluctuations in fuel prices during transport.

When the fuel surcharge is included in the price of the LTL service, total revenue increased 18.4% year-over-year, while revenue per shipment increased 20.1% year-over-year to $359.04.

The chart below illustrates the progression in total revenue and total revenue per shipment.

seekingalpha/symbol/SAIA/income-statement

The higher price for LTL shipments compensated for a decline in transport volumes [down 0.4% YoY] and shipments per working day [down 2.5% YoY].

The Net Income Margin

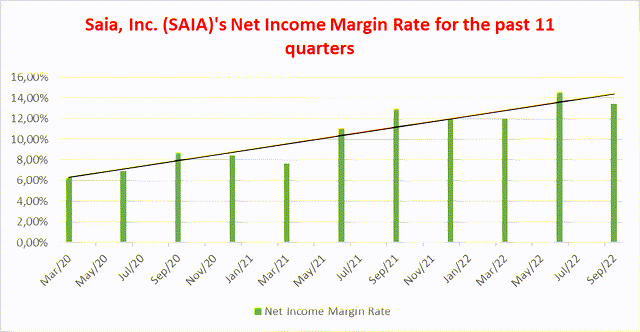

The ability to apply a premium rate in line with the quality of the LTL transportation service will help Saia improve margins and attract investors to the company, which should potentially be reflected in a higher share price.

seekingalpha/symbol/SAIA/income-statement

Two other factors determine Saia’s profit margin, the increase in the truck fleet to better serve an ever-expanding area of potential customers and the opening of new terminals.

The company expects benefits from a larger and better-equipped truck fleet in the coming months in the form of lower maintenance costs in addition to purchased transport costs.

Saia Aims for Further Expansion

The company continues to expand and opens new locations. To date, the company has opened a total of 11 new terminals, in addition to the 176 the company had in use at the end of 2021.

The company intends to increase its presence in North America by opening new terminals. At least 15 should be open next year as Saia expects customer response to its LTL transportation service to remain strong.

Financial Situation and Investment Plan of the Company

As of September 30, 2022, the balance sheet reported net cash of $115 billion which, combined with the funds from operations, should provide the company with important financial resources to support ongoing operations and the business expansion program.

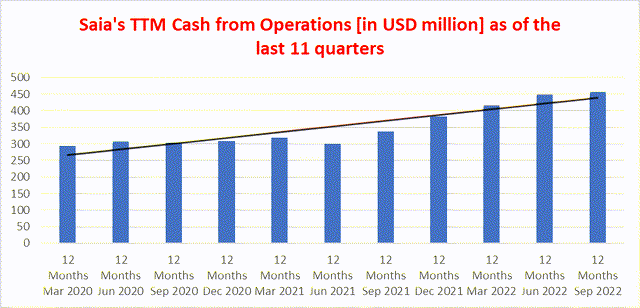

If business continues to do well, Saia could see its operations generate at least $460 million a year, in line with past trends.

seekingalpha/symbol/SAIA/income-statement

In 2022, the company plans to commit approximately $500 million to ensure ongoing operations and sustain business expansion projects.

A tighter monetary policy from the US Federal Reserve will result in higher borrowing costs, but that shouldn’t worry Saia’s shareholders.

The interest coverage ratio, which is a solvency measure, indicates that the company has no trouble paying the debt. The debt implies an annual interest expense of $2.7 million while operations could generate earnings of $476 million per year as of Q3 2022. So the TTM interest coverage ratio is 176.3 [ttm operating income/ttm interest expense]. In general, investors aim for an interest coverage ratio of no less than 1.5.

Consensus EPS and Revenue Estimates

For the coming years, analysts expect EPS to grow by 46.39% YoY to $13.70 in 2022, to decline 5% YoY to $13.02 in 2023, and increase 5.16% YoY to $13.69 in 2024.

For the coming years, analysts expect revenue to grow by 22.51% YoY to $2.8 billion in 2022, to decline 0.3% YoY to $2.79 billion in 2023 and increase 2.75% YoY to $2.87 billion in 2024.

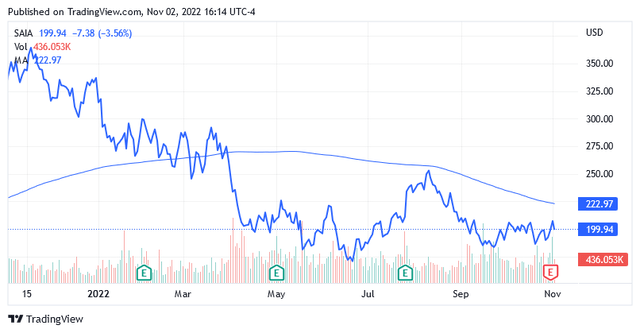

Share Price Is Not Expensive but It Could Trade Lower

Shares are trading at $199.94 per unit as of this writing, after falling more than 39% over the past year. The share price currently gives it a market cap of $5.24 billion and a 52-week range of $168.94 to $365.95.

The stock is not expensive at all as it represents a company whose business continues to expand and deliver higher sales and margins, apart from being significantly lower compared to previous valuations.

To get a better idea of the lower valuation, the stock price is currently more than 10% below the long-term trend of the 200-day moving average of $222.97 and 25.2% below the mean of $267.445 in the 52-week range.

The continued aggressive stance of the US Federal Reserve could allow the bear market to persist for a while and lead Saia shares to test lower levels. More bear markets could ensue as higher interest rates push discount rates higher and raise serious doubts as to whether current market valuations reflect the present value of US-listed equities. In this case, value investors will probably not buy stocks. Instead, Saia appears to be worth more than the market currently suggests, implying a margin of safety of more than 50% according to a valuation model that discounts projected earnings.

But that does not mean that the stock price could not fall further under the influence of the policy of the US central bank with the risk of a recession. A 14-day Relative Strength Index of 56.70 could suggest there is room for additional downside if Saia’s share price so chooses.

As conditions for lower prices are in place, and potentially stronger than those that could help the stock take the opposite direction, a Hold rating here may make sense until most market headwinds disappear.

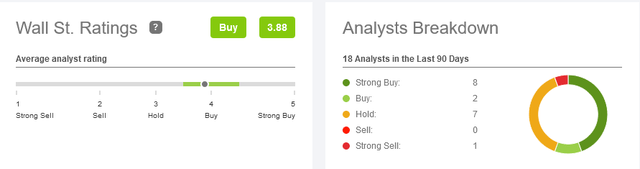

Analyst Recommendation Rating and Average Target Price

Wall Street issued 8 Strong Buys, 2 Buys, 7 Holds and one Strong Sell rating, resulting in a medium rating of Buy.

seekingalpha/symbol/SAIA/ratings/sell-side-ratings

The stock has an average price target of $234.07 per share, reflecting a 17.31% upside from current levels.

seekingalpha/symbol/SAIA/ratings/sell-side-ratings

Conclusion – A Value Stock to Hold for the Time Being

Saia could be on the list of stocks investors are targeting for the next bull market. This stock may be worth more than its market value based on an estimate of intrinsic value. It could offer a significant margin of safety.

As the current bearish sentiment may increase the margin of safety, a Hold rating on this stock seems appropriate at this time.

Be the first to comment