Denis_Vermenko/iStock via Getty Images

Many tech stocks such as Atlassian (TEAM) and Salesforce (CRM) have bounced off from their recent lows, and may no longer be unappealing to value investors looking for bargains. This doesn’t appear to be true, however, for some “old economy” growth stocks that are still trading in the dumps.

This brings me to Cummins (NYSE:CMI), which, as seen below, still has yet to recover, all while paying a decent dividend, which can be reinvested into the stock while it’s cheap. This article highlights why CMI may be a solid candidate for those who seek a good combination of value, growth, and income, so let’s get started.

CMI Stock (Seeking Alpha)

CMI: Buy The Dip And Start The DRIP

Cummins is a large engine manufacturer that has customers in 190 countries and a market cap of nearly $30 billion. The company has a diverse product lineup, including diesel, natural gas, electric, and hybrid powertrain design for the trucking industry.

It also produces powertrain components including filters, transmissions, turbochargers, aftertreatment, and fuel systems. Cummins’ strong reputation for producing high-performance and exceedingly durable engines for the heavy-duty trucking market distinguishes it amongst its competition.

At the current price of $202, CMI is trading well below its 52-week high of $273, achieved during the summer of last year. Meanwhile, its business is performing rather well, with revenues for 2021 growing by 21% over the prior year. This was driven by robust North American sales increasing by 17% and even stronger international revenues growing by 27%.

So why is Cummins trading at sizeable discount to its recent highs? The main reason is that investors are worried about the slowdown in global growth and its impact on Cummins’ sales. This was reflected by fourth-quarter revenues being flat on a YoY basis, with North American sales seeing a 4% decline while international revenues grew by 6%. Additionally, supply chain constraints have pressured CMI’s margins, with EBITDA margin declining by 230 bps YoY to 12.1% during Q4.

Encouragingly, management is taking steps to improve its margin profile this year by responding with price increases, surcharges, and a number of cost reduction initiatives and operational improvements. This is reflected by the 6% revenue growth and 15.5% EBITDA margin that management is guiding for this year.

Additionally, there is some uncertainty around the future of diesel engines with the growing market for electric ones. Fortunately, management believes that the company is well-positioned for a shift to electric powertrain technology, all while maintaining its leadership position in combustion engines. This was highlighted by management during the recent conference call:

Cummins is in a solid position to keep investing in future growth while continuing to return cash to shareholders. The transition to low carbon power across industries will be a significant driver in the fight against climate change and will require a broad mix of innovative technologies to achieve these goals. This decarbonization effort represents a significant growth opportunity for Cummins as many of our OEM partners and end customers look to achieve their climate goals, while still having power solutions that fulfill their needs. Cummins key capabilities uniquely position us to lead in the transition to zero emissions.

CMI maintains a strong A+ rated balance sheet $3.2B of cash and short-term investments on hand. This also marks the 12th straight year of dividend increases and the Board recently authorized another $2B share repurchase program once the current $2B program ends.

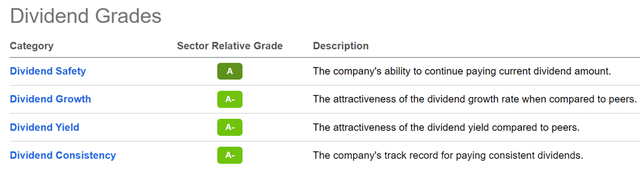

I see no signs of the dividend growth streak ending, as it’s well-protected with a low payout ratio of 38%. As shown below, CMI has earned A/A- grades for dividend safety, growth, and consistency.

CMI Dividend Ratings (Seeking Alpha)

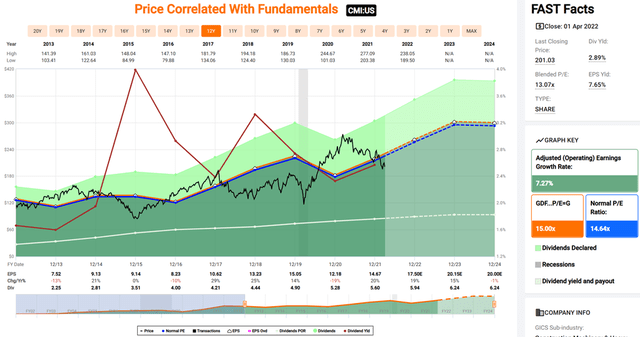

CMI appears to be rather cheap at $202 with a forward PE of 11.5, sitting below its normal PE of 14.6 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $261, implying a potential 32% one-year total return.

CMI Valuation (FAST Graphs)

Investor Takeaway

Cummins is a market leader in the heavy-duty trucking industry with a strong reputation for producing high-quality and durable engines. The company’s business is performing well, with revenues growing by 21% last year. It should be able to weather its near-term challenges, all while navigating towards an increasingly electric future. I see value in CMI at the current price for potentially strong gains and income.

Be the first to comment