AntonioSolano/iStock via Getty Images

Saga Communications (NASDAQ:SGA) is a closely held, small-market radio broadcaster. The stock has long been viewed as “cheap” when you consider their real estate assets, free cash flow generation, and high cash balance. Despite this, historic stock performance has left much to be desired:

Seeking Alpha

However, due to the recent passing of their CEO, Ed Christian, the business appears positioned for a value-unlocking event. The pioneering CEO held voting control over the company and as a result of his passing, the following has changed per the recent 8-K:

As of the date of his passing on August 19, 2022, Edward K. Christian held approximately 65% of the combined voting power of the Company’s Common Stock based on Class B Common Stock generally being entitled to ten votes per share. As a result, Mr. Christian was generally able to control the vote on most matters submitted to the vote of stockholders and, therefore, was able to direct our management and policies, except with respect to (i) the election of the two Class A directors, (ii) those matters where the shares of our Class B Common Stock are only entitled to one vote per share, and (iii) other matters requiring a class vote under the provisions of our certificate of incorporation, bylaws or applicable law.

Mr. Christian’s passing and the resultant transfer of his Class B shares into an estate planning trust results in an automatic conversion of each Class B Share he held into one fully paid and non-assessable Class A Share. Upon the settling of Mr. Christian’s estate, the Edward K. Christian Trust u/a/d/ December 29, 1998, will be the owner of 965,149 shares of Class A Common Stock, which represents approximately 15.95% of the Company’s outstanding Common Stock when accounting for the conversion of Class B shares to Class A Shares. Michael Dallaire, Esquire (Mr. Christian’s nephew) and Judith A. Christian (Mr. Christian’s spouse) are co-trustees of the trust.

As outlined, the voting dynamic at SGA will drastically change. The super-voting Class B shares convert to Class A shares, leaving a single class of 6.0m total shares. Major shareholders have a new voice in the operations of the company:

-

TowerView –19.4% of pro-forma Class A (and ~15% of Daniel Tisch’s holdings)

-

T. Rowe Price, Dimensional, & FMR – 26.6% of pro-forma Class A

-

Gate City – 5.2% of pro-forma Class A

This is particularly unique as peer public radio businesses are closely held with voting rights not evenly distributed – including Townsquare Media (TSQ) and Audacy (AUD). This wrinkle seems to discourage investment in the space and depress valuations. With Saga now open for activist involvement, I suspect a move will be made to unlock value.

In this vein, TowerView has already filed an updated form 13, with cryptic commentary not present in their prior form 13:

TowerView may in the future have conversations with members of the Board of Directors, senior management of the Company or others regarding the future direction of the Company.

Valuation Build

Saga has earned $22.2m of EBITDA in the trailing twelve months (I include “non-cash” compensation vs the $23.5m figure reported by SGA). They grew EBITDA about 15% in the first six months of FY22 vs FY21 as well, a great sign that the business isn’t too much of a melting ice cube.

Adjusting for $2m of cash taxes and $5m of maintenance CapEx, Saga is about a $15m FCF business in its current form. There is about $10m of SG&A also running through the income statement, of which $3.2m alone in FY21 related to the CEO’s compensation (clearly excessive with CFO and Ops President both earning ~$500k by comparison). We assume most of this corporate expense could be a synergy in a transaction.

Also, real estate. Per the 10-K:

-

As of December 31, 2021, the studios and offices of 25 of our 28 operating locations, including our corporate headquarters in Michigan, are located in facilities we own. The remaining studios and offices are located in leased facilities with lease terms that expire in 0.7 years to 2.9 years. We own or lease our transmitter and antenna sites, with lease terms that expire in 1 year to 69 years.”

Owned PP&E were carried on the balance sheet at $54.3m as of Jun-22, net of depreciation, and the gross carrying value of the land, buildings, and towers exceeds $75m. There has only been one recent sale of real estate:

-

“During the first quarter of 2020, we sold land and a building on one of our tower sites in our Bellingham, Washington market for approximately $1,700,000 to Talbot Real Estate, LLC resulting in a $1,400,000 gain on the sale of assets.”

This is noteworthy as tower sites are rather valuable, and SGA still owns some. I don’t believe all of SGA’s properties could be sold for a 400% gain on book value, but I’m comfortable assuming they are worth at least the stated book value, and could be worth over $100m.

If we assume an 8% cap rate, and do low, base and upside sale values, possible values for SGA are as follows:

|

$ in M except per share |

Low |

Base |

Upside |

|

1. Cash |

$52.3 |

$52.3 |

$52.3 |

|

2. Real Estate |

75.0 |

100.0 |

125.0 |

|

3. Free Cash Flow |

15.0 |

15.0 |

15.0 |

|

3a. Plus Synergies |

3.0 |

5.0 |

8.0 |

|

3b. Less Rent (8% Cap on 2) |

6.0 |

8.0 |

10.0 |

|

4. Pro-Forma FCF (3 +3a – 3b) |

12.0 |

12.0 |

13.0 |

|

4a. Multiple on FCF |

5 |

8 |

10 |

|

5. FCF Value (4 * 4a) |

60.0 |

96.0 |

130.0 |

|

6. Total (1+2+5) |

187.3 |

248.3 |

307.3 |

|

7. Share Count |

6.0m |

6.0m |

6.0m |

|

8. Valuation/Share (6/7) |

31.22 |

41.38 |

51.22 |

|

9. Upside vs $28 share price |

11.5% |

47.8% |

82.9% |

Other Possible Upside

Saga earns less than 10% of their revenue from digital advertising, though they grew digital almost 100% in FY21 over FY20 ($3.4m to $6.3m). YTD-22 digital is $4.0m vs $2.6m (54% growth). Peers like Townsquare have already converted half their revenue to digital (29% margin) vs their legacy broadcast revenue (18% margin). This is a nice growth vertical to be pursued by an acquirer which I have not assigned any value above.

When Townsquare bought Cherry Creek Broadcasting this year, they noted they expect to convert revenue to higher-margin digital:

Last month, we announced the accretive acquisition of Cherry Creek Broadcasting. While it may seem counterintuitive to some to invest in more local radio stations, given that radio is a mature cash cow business, it is because of our Digital First Local Media strategy that this investment makes so much sense. We will bring our large-scale, sophisticated digital platform solutions and expertise to the Cherry Creek markets and team, which today generates only 15% of its revenue from digital solutions, the majority of which is outsourced digital solutions, which generally lowers profit margins. Based on our own experience, we know that we can drive accelerated digital revenue growth at stronger and more profitable margins such that within a few years, the Cherry Creek markets will be approaching a 50% digital revenue contribution and a 30% profit margin just like Townsquare has today in digital.

If you converted Saga to 30% profit margins, TTM gross profit would have been $6.5m higher versus the 24.1% margin they earned on $112.8m. This would increase the company’s value by $32.5-65.0m in the above scenarios using my free cash flow multiples.

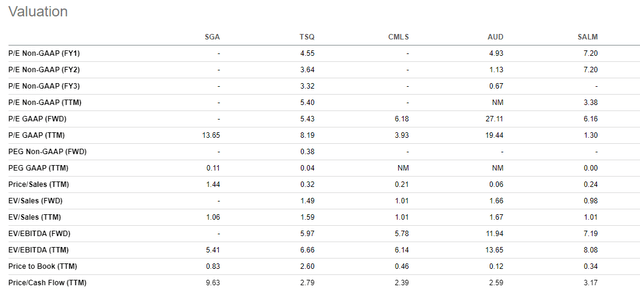

Peer Valuations

Townsquare and Audacy both carry significant debt loads. TSQ has a $150m market cap and $500m of net debt, while AUD carries $1.8B net debt and a $75m market cap, making neither a strong comparison for SGA. TSQ trades about 6x EV/EBITDA, close enough to SGA. Urban One (UONE) trades at a $200m market cap with $650m net debt, again a poor comparison, and Beasley Broadcasting Group (BBGI) carries more than $200m net debt against a $35m market cap. The same problems persist at Cumulus Media (CMLS) with ~$600m net debt and Salem Media Group (SALM) with $150m net debt.

My multiples above are therefore derived by assuming that 5x FCF on a business posting growth in FY22 is not unreasonable for a downside valuation, and even heavily indebted peers don’t trade below 5x EBITDA despite heavy interest expense burdens.

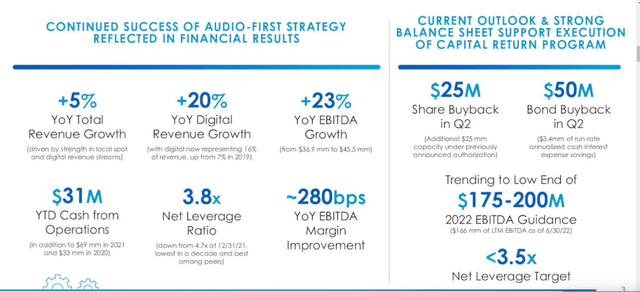

Seeking Alpha

As an interesting data point, a group approached CMLS earlier this year for a buyout between $15-$17/share. The implied $1.2B valuation is 7.2x TTM EBITDA of $166m (or 7.6x ex-political EBITDA of $159m). CMLS grew EBITDA 23% Y/Y in Q2 and digital revenue 20% (up to 16% of revenue vs 7% in FY19), so their financial profile broadly matches Saga. CapEx at CMLS has been ~$30m for the past few years too, suggesting similar FCF conversion.

Cumulus Media Investor Presentation

Risks

- Due to heavy debt loads on peers, buyers for the Saga assets may be limited. Radio is viewed as a dying business, which also may limit buyout interest from non-radio entities.

- In a recessionary environment, spending on local advertising may come under pressure. Given SGA’s strong performance during 2020, we expect the business can navigate reduced ad spending effectively. A recent Value Investor’s Club article highlights this in greater detail.

- The Saga board could choose to adopt defensive measures against an outside bid for their assets.

Conclusion

Saga Communications appears poised for value to be unlocked, and I’m able to get comfortable that the current share price resembles a downside case for any kind of sale. Without any immediate catalyst, you would own a well-capitalized business in a field of heavily indebted peers, but I believe the rebalanced shareholder voting dynamic leaves Saga open to a takeover, which I would expect to happen at a value significantly above the current share price.

Be the first to comment