alengo/E+ via Getty Images

Saga Communications (NASDAQ:SGA) reported Q3-22 results on 11/3, -$0.01 EPS and $29.98m revenue. Without further digging, this result was an unexpected loss and somewhat disappointing. However, the reported loss reflects a one-time $3.8m accrual for a payment to the deceased CEO’s estate. Without this, EPS would have been $0.62/share, up $0.04 from Q3-21. The following update considers what has changed since my initial writeup.

Capital Returns

In October, Saga paid a $2 special dividend and increased their regular payment from $0.20/quarter to $0.25. They also noted in their press release:

Consistent with its strategic objective of maintaining a strong balance sheet and with returning value to our shareholders, the Board of Directors will also continue to consider declaring special cash dividends, establishing a variable dividend policy and stock buybacks in the future.

Management appears to be getting serious about shareholder returns, though a buyback might better maximize the valuation of shares and increase future dividends. A tender offer for 1m shares around $25/share seems appropriate given the illiquidity of the stock, which should increase the value for remaining shareholders.

Earnings

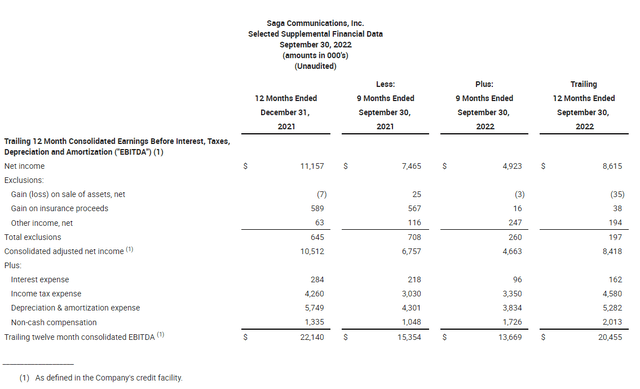

Saga TTM EBITDA (Saga Q3 Results)

Without the one-time accrual, TTM EBITDA exceeds $24m and normalized free cash flow remains comfortably around $15m, less than 10x their market cap and 7x the EV, even after the special dividend. The company should have lower SG&A going forward as I previously highlighted, and has avoided the revenue deterioration of peers through their focus on local relationships.

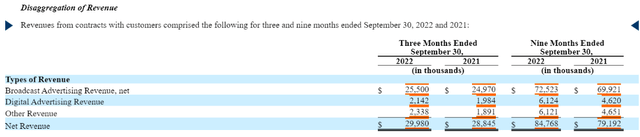

Saga’s revenue gains have been broad based in all categories, another encouraging sign:

Saga 10-Q

For anyone concerned this was a temporary bump from midterms, Management noted on the call:

Gross political revenue during the nine-month period was $1.8 million compared to $894,000 for the same period last year. Without political, gross revenue increased 6.1%. So we had a very strong quarter and have had a very strong year even without the political revenue, although the political revenue is always a nice stimulus to have.

Q4-22 also is trending well, with management adding:

Fourth quarter ’22 is currently pacing ahead of the same period last year by approximately 3.5% to 4%, although we continue to watch the current interest rate environment, the potential recession on the horizon and the ongoing global turmoil.

Peers

One other radio operator caught my eye as I was reviewing Q3 results, Townsquare Media (TSQ), which reported similarly strong revenue and earnings growth for Q3. Townsquare has some issues not present at Saga, like a large debt balance and controlling super voting shares, and some of their growth was inorganic due to their Cherry Creek acquisition. I have no position in the stock but think it’s worth investigating for an investor looking for a more torqued way to get exposure to a local radio operator. I could see an all-stock merger between the two businesses to solidify Townsquare’s balance sheet and help grow Saga’s digital efforts, producing an advantageous outcome for both parties.

Risks

One of the concerns I highlighted centered around reduced ad spend, which Saga navigated well thus far. Peers are showing some weakness and Saga is continuing annual growth, so I believe their local focus allows them to weather a spending slowdown better than national brands.

I also worried that the Saga board would take proactive measures to prevent activism now that the company is not controlled. I’m encouraged that they instead seem focused on operating the business well and returning capital to shareholders.

Conclusion

Despite a disappointing headline, I believe investors should be enthused by Saga’s most recent quarter, which has addressed some concerns about the strength of the business and increased expectations for future shareholder returns. Going forward, I will be watching for growing cash generation and digital revenue streams, and hoping for a tender offer to consolidate outstanding shares.

Be the first to comment