Kwarkot/iStock via Getty Images

Investment Thesis

Sabra Health Care REIT, Inc.(NASDAQ:SBRA) is a real estate investment trust (REIT) that invests in the healthcare sector. The company has acquired a high-quality Canadian senior housing portfolio, which will be the primary catalyst for the company. I believe this will help the company grow its earnings at a fast pace. The company is paying an 8.45% dividend yield, making it a very attractive investment opportunity.

About Sabra Health Care REIT

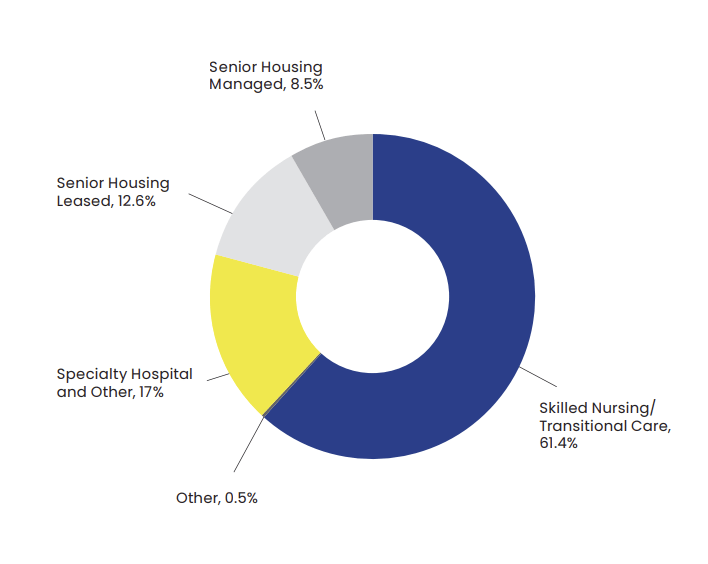

Sabra Health Care REIT invests and acquires real estate property to rent to third-party tenants primarily working in the healthcare sector. The primary revenue source for the company is rent, which it collects by renting out properties to tenants throughout the US and Canada. The company’s asset composition comprises skilled nursing/transitional care facilities, senior housing communities, speciality hospitals and other facilities. 61.4% of the total asset class is associated with skilled nursing/transitional care facilities, 17% is speciality hospitals, 12.6% is senior housing leased, and 8.5% is senior housing managed.

Portfolio Composition (Annual Report Sabra Healthcare REIT)

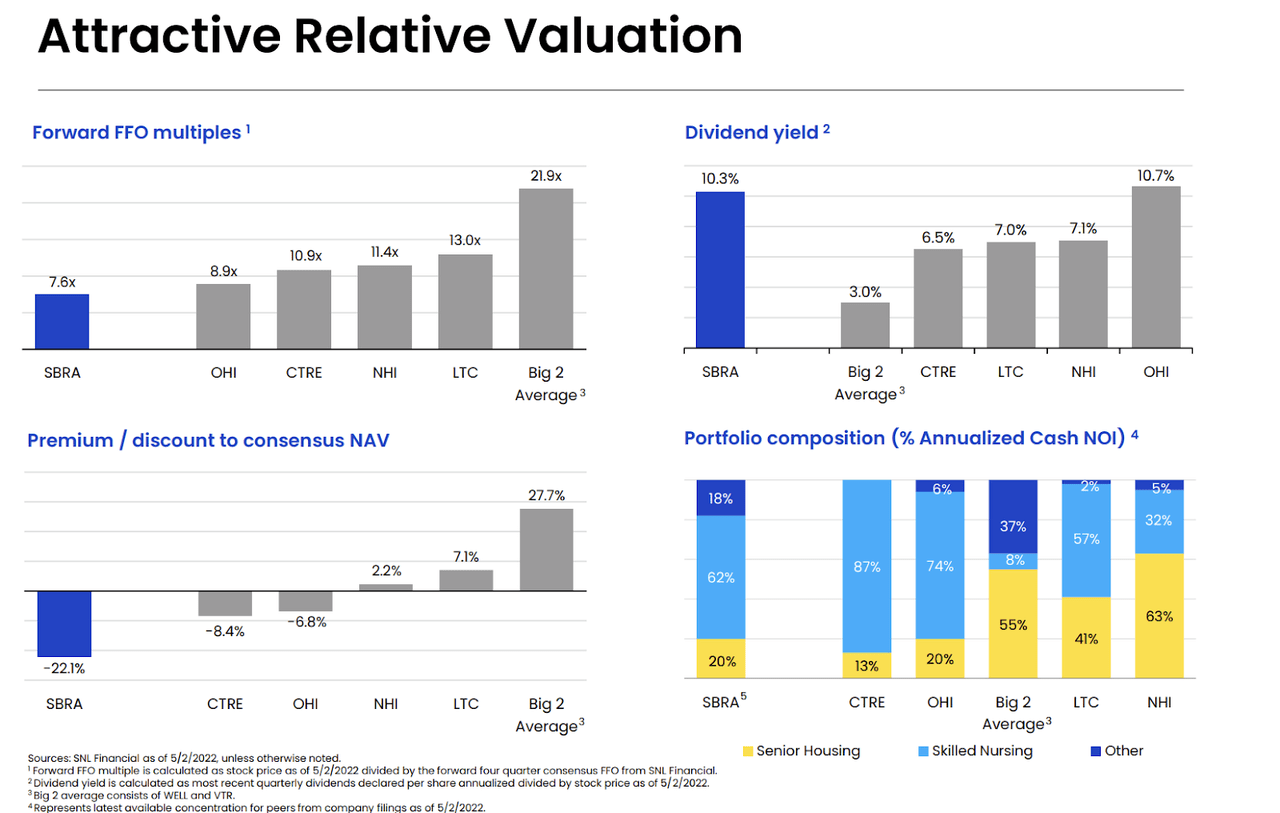

As compared to its peers, the company is better positioned in the industry. According to Q1FY22 data, the company is trading at a 7.6x FFO multiple, while most competitors are trading more than 8.5x. The dividend yield of the company is the second highest in the industry. Currently, it stands at 8.45% because the share price has soared after the positive Q1 results of the company, but before the recent rally, the dividend yield used to be more than 10%. The company’s net operating income has grown at 18.5% CAGR since 2011. The company is trading at a discount to its NAV, and it has a balanced portfolio composition.

Relative Valuation (SBRA Investor Presentation)

The company focuses on acquiring real estate assets such as assisted living, independent living, memory care communities, skilled nursing/transitional care, addiction treatment centers and behavioral health facilities in the US and Canada to grow its asset portfolio. The company looks out for acquisition opportunities to boost its growth at a faster pace.

Acquisition of High-Quality Canadian Senior Housing Portfolio

Sabra Health Care REIT recently announced an acquisition deal in a joint venture with Sienna Senior Living. The company has 50% ownership in this deal. The company has acquired a high-quality Canadian senior housing portfolio comprising 11 high-quality senior housing communities. All of these senior housing communities are situated in Ontario and Saskatchewan and are six years old on average. The company is estimating that the 75+ population will double in the next 20 years, which will demand growth for all these housing communities. With the help of its cash and credit facilities, the company completed this transaction by exchanging $118.25 million. The company intends to use the funds from capital recycling activities now in progress to maintain leverage at or below its long-term aim of 5.0x net debt to adjusted EBITDA.

I think this deal will be a significant catalyst for the company in the future, as I believe the estimate of the company for the next 20 years will hold true. The company will experience fast-paced growth in future with the help of this acquisition, which will be reflected in the coming years. I believe after this acquisition, the company will increase dividend payments soon.

Solid Dividend Yield of 8.45%

SBRA announced a dividend of $0.30, which is an 8.45% annualized dividend yield at the current share price level. The company has paid 79% of its Normalized AFFO per share of $0.38. The company has maintained a history of stable and growing dividend payouts which can be treated for the risk-averse investors and retirees. I believe the company’s earnings will significantly increase with the current acquisition, which will increase the dividend payment in the future.

Analysis of Financial Statements

The company reported rental revenue of $109.8 million in Q1 2022, compared to $113 million in the year-ago period. The rental revenue saw a decline of 3% despite a slight improvement in the occupancy; the main reason was a reduction in rental rates in some segments. The total revenue was reported at $163 million, compared to $152 million in Q1 2021, an effective 8.7% increase. The major contributor to this increase was the steep spike in interest income from $3 million to $11 million. The total expenses saw a 5% jump from $113.8 million to $119.2 million due to an exponential increase of 20% in the senior housing operating expenses. The company reported a net income of $40.6 million, a significant 21.3% increase compared to $33.4 million in the corresponding quarter last year. The company reported diluted EPS of $0.18, a 12% increase from last year. The company paid a dividend of $0.30 per share for Q1 2022 on May 31, 2022.

I believe the company posted strong Q1 2022 results, beating the market estimates in terms of EPS and revenue by 11.5% and 2%, respectively. As per my analysis, the company will continue the growth trajectory with the new acquisition and improve operating margins in the coming quarters.

The company has a liquidity of $1 billion, with cash and cash equivalents of $24.8 million and $983.2 in revolving credit facility. The company has maintained a Net Debt to Adjusted EBITDA ratio of 5.11x. I believe the company has to work on its long-term debts, as the rising interest rates can put massive stress on the firm’s profit margins.

What is the Main Risk Faced by SBRA?

High Debt

SBRA has a huge debt burden in the form of secured debt of $50.6 million and term loans of $556.3 million. REITs, in general, have high debt, but it is something that cannot be ignored. In the past three months, the interest rates have increased exponentially, putting stress on the profit margins of the companies with high debt obligations. The interest rates don’t seem to be going down anytime soon, and it is important for the management to address this issue. Also, the free cash flow can seriously be affected by high-interest obligations. This is one of the most important factors to consider before investing in SBRA.

Technical Analysis and Fundamental Valuation

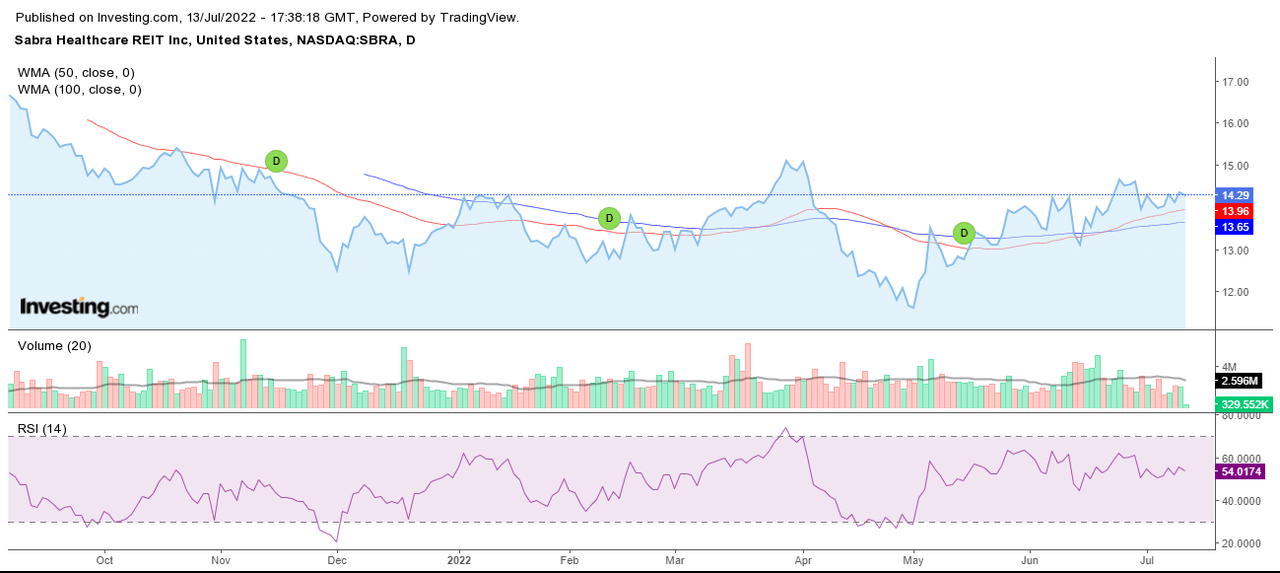

Technical Analysis (Investing.com)

The stock is currently trading above its 50-day and 100-day moving average, which is a really good indicator. The stock has strong support above the 100-day moving average. Since May, the stock has been testing the 100-day moving average support level and rebounding from that level; this suggests that the stock has a very strong support zone at the $13.5 level. We can soon see fresh momentum in stock once the 50-day moving average crosses the 100-day moving average. The stock is consolidating in the 45-60 RSI band, the stock is in buy territory as per RSI, and the stock can test the 70-band range in the coming months. There is no divergence in the RSI indicator, but the overall technical parameters suggest a buy from the current price level.

SBRA currently has a share price of $14.30. I believe the recent acquisition will boost the EPS growth of the firm. With FY22 EPS estimates of $0.85, the stock is trading at a P/E multiple of 16x. I think the stock is fairly valued at the current price level, and there is a limited downside risk. With a dividend yield of 8.45%, investors looking for a solid dividend yield with low-risk exposure can buy the stock at current levels. I see a 15%-20% upside for the stock price, with EPS estimates of $0.85 and a P/E multiple of 19x.

Conclusion

My final thought on SBRA is that the stock is fairly valued at the current share price and has limited downside risk. The latest acquisition will maintain the company’s growth rate and help improve profit margins in future. The company faces the risk of high debt, but the growth factors and strong dividend yield makes it an attractive opportunity. I think the company will increase the dividend payments soon and with a 15%-20% upside potential in the stock price, I assign a buy recommendation for SBRA.

Be the first to comment