Kanoke_46

The month of July 2022 has seen various companies going ex-dividend, especially those making high yields in the REIT and energy sectors. Companies such as City Office (CIO) declared a yield of 6.27% with a payout ratio of $0.80 while PennyMac Mortgage Investment Trust (PMT) yielding 12.57% and an annual payout of $1.88 is expected to go ex-dividend on July 13, 2022. Others scheduled for this month also include ARMOUR Residential REIT (ARR) yielding 16.85% with a payout of $1.20 and Lument Finance Trust (LFT) yielding 9.76% with an annual payout of $0.24. The first half of 2022 saw Sabine Royalty Trust (NYSE:SBR) hit a high dividend yield above 11% on annualized distributions while paying investors on a monthly schedule.

Thesis

Income investors looking for exposure to the oil and gas industry will find Sabine Royalty Trust an attractive venture not only due to its high yield but also its strengthening business model. Despite a lower cash distribution in July 2022, the Trust anticipates growing its oil and gas producing properties which will ensure investor returns in the long run.

Business Overview

Sabine Royalty Trust has operated as a small-cap stock since its establishment on December 31, 1982. It has a market capitalization of $873.30 million and is currently trading 34% below its 52-week high of $90.73. Its business model is based on income received from royalty and mineral interests in oil and gas assets across the US.

As it stands, SBR is well-positioned to take advantage of the rapidly surging energy and inflation trends.

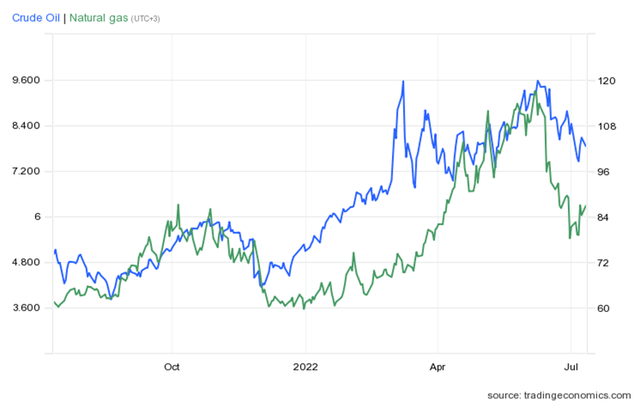

WTI Crude oil traded to a high of $120 per barrel in June 2022 with the futures buoyed by the ongoing Russian invasion of Ukraine. Notably, the G7 leaders have agreed on price caps to tame Russian oil and limit oil revenues to Moscow. Further, the ease of restrictions in China could also increase oil and gas demand into Q4 2022.

Gasoline prices in the US are also averaging at $4.721 with up to 5,800 gas stations offering the commodity at $3.99 per gallon. At the outset, both gasoline and crude oil prices are falling from their quarterly highs as the nation continues to stabilize supplies to avoid shortages. The Biden Administration reportedly released 145 million barrels of crude oil from the Strategic Petroleum Reserves to ease prices. Additionally, the US has asked OPEC+ to produce more oil despite the group not living up to its expectations. Still, fears of a recession have contributed to the decrease in energy prices.

However, long-term oil trends indicate high prices for the commodity due to continued demand increase for both metals, and minerals.

Pass-through Security

Traditionally, Sabine Royalty Trust has operated as a pass-through vehicle or security. While the Trust does not generate earnings, it provides a channel for SBR investors, especially those selling their shares to transfer their accrued cash flows to other unit holders.

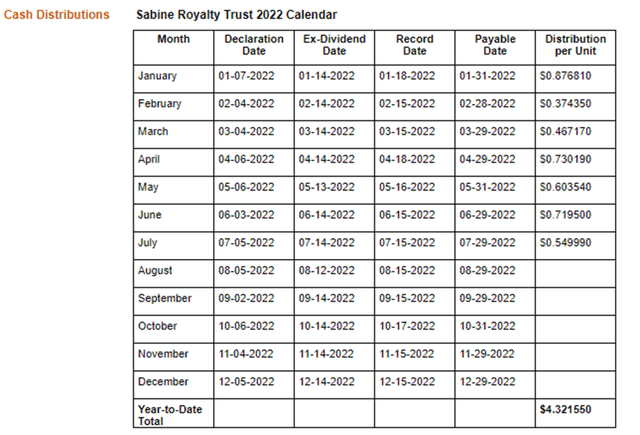

In essence, SBR is a servicing intermediary that collects monthly payments from issuers. After deducting a fee, it remits or passes them through to the unit holders. Over the years, SBR has produced stable and consistent annual cash distributions to investors. The distributions are sensitive to the volatility of oil and gas (the reason for decreased cash distributions in July 2022). However, their expenses are typically lower than other commodity-focused companies.

As we know, the cash received by investors is not a qualified dividend but simply royalty or ordinary income that is taxed at a marginal rate.

Cash distributions in July 2022 have declined 23.56% (MOM) to $0.549990 as compared to $0.719500 recorded in June 2022. Additionally, July’s amount is still 37.27% below January’s level at $0.876810.

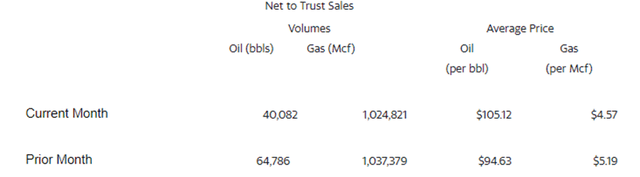

SBR reiterated that the reduced distribution reflected oil production for April 2022 and gas production for March 2022. In context, preliminary production volumes stood at 40,082 barrels of oil (from 64,786 barrels in March 2022) and 1,024,821 Mcf of gas (from 1,037,379 Mcf of gas in February 2022). For crude oil, preliminary prices stood at $105.12 per barrel of oil while gas stood at $4.57 per Mcf of gas.

Investors expect that SBR will post approximately $900,762 of its revenue in July. Quarterly revenue as of March 2022 stood at $23.9 million against an operating income of $23.0 million. Total cash and short-term investments declined by 4.9% but we must remember that the company’s security is stable since it does not have any debt.

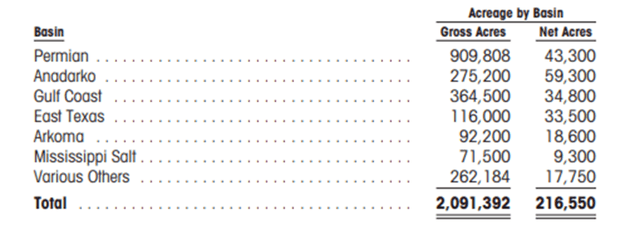

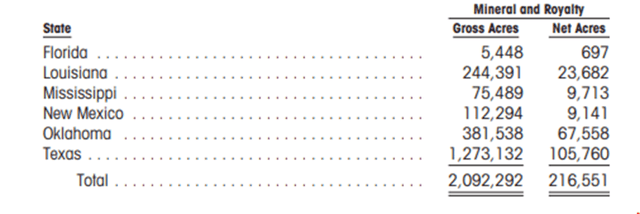

A point to note is that SBR has traditionally reported its acreage by state. In its 2021, 10-K, Sabine Royalty Trust displayed its acreage by basin (arguably for the first time in its filings). The document shows that the Permian Basin represented almost 50% of SBR’s total acreage which is also 20% of its net acres.

Sabine Royalty Trust stated that the properties are represented by approximately 5,400 tracts of land. Of these, there are an estimated 2,950 tracts in Oklahoma, 1,750 in Texas, 330 in Louisiana, 200 in New Mexico, 150 in Mississippi, and 12 in Florida.

Therefore, SBR owns minerals in 6 states, Texas, Oklahoma, Louisiana, Mississippi, New Mexico, and Florida. This ownership gives the Trust exposure within the producing basins.

In Texas, gas production in the new horizontal gas wells in Panola County contributed an estimated $880,000 showing a strong March gas production. The wells averaged a daily production of 752 Mcf per well bringing the total to 186,000 Mcf in the month selling at an average of $4.41 per Mcf. There was also an additional $200,000 contributed by 8 new wells added in March 2022 at an average of 215 Mcf per well per day. Still, in Panola County (Texas) SBR expects that the additional 3 new wells will be paid and accounted for in April 2022 since they were not received in time for distribution.

We expect SBR to record a higher level of distributable income for the year ending on December 31, 2022. In the fiscal year 2021, SBR recorded $57,855,882 in distributable income at $3.97 per unit. Total royalty income for the year stood at $60,904,253 with interest at $5,815 from temporary cash investments from the royalty income.

To put it into perspective, gas production that was attributable to SBR’s royalty interests (inclusive of plant products) for the year ending December 31, 2021, stood at 5,657,458 Mcf. It resulted in a daily average production of 15,500 Mcf at an average price of $3.12 per Mcf. As noted earlier, the average price of gas as of February 2022 had ticked 46.47% higher than that of 2021.

In turn, oil production in 2021 stood at 431,181 barrels of oil, or a daily average of 1,181 barrels. The average price for one barrel of oil in the year 2021 stood at $60.52 per barrel, translating to 73.69% below the 2022 high of $105.12 per barrel.

Risks

Global oil and gas prices have been highly volatile subject to demand and supply shocks realized since the beginning of 2022. However, the average prices of commodities upon which SBR attained its royalty income are still lower than the current prices being offered in 2022. We expect the Trust to increase its cash distributions in tandem with the increase in commodity prices as the year progresses.

Investors need to factor in payment delays for new wells added by the Trust that may affect future distributions. The April distribution did not factor in the payment of 3 new wells that were added in Panola County (Texas) since the payment was not received on time for distribution.

Bottom Line

Sabine Royalty Trust is doing a good job adding horizontal wells for gas and oil production. These increased capital expenditures are expected to improve the company’s earnings and support future production. SBR has sustained good dividend yields for investors currently trending at 9.47% notwithstanding the monthly cash distributions. We expect the annual cash distributions for 2022 to exceed payments made in 2021 due to the commodity price increases witnessed in 2022. Still, price fluctuations for these minerals continue to pose a risk to the stock’s upside but it remains a good investment in the long run. For these reasons, we recommend a buy rating for the stock.

Be the first to comment