undefined undefined

A Quick Take On Ryan Specialty Holdings

Ryan Specialty Holdings, Inc. (NYSE:RYAN) went public in July 2021, raising approximately $1.34 billion in gross proceeds from an IPO that was priced at $23.50 per share.

The firm provides Excess & Surplus wholesale insurance coverage, brokerage and related services in the United States.

While RYAN may not always grow at a 20% rate of growth, given current market dynamics of increasing flow into its primary lines, my outlook is a Buy on RYAN at around $45.60 per share.

Ryan Specialty Overview

Chicago, Illinois-based Ryan was founded to provide insurance products, distribution and related services as a wholesale broker and managing underwriter to the E&S (Excess & Surplus) lines market in the U.S.

Management is headed by founder, Chairman and CEO Patrick Ryan, who was previously founder and Chairman or CEO of Aon for 41 years.

The company’s primary offerings include:

-

Distribution

-

Underwriting

-

Product development

-

Administration

-

Risk management

The firm seeks relationships with retail insurance brokers and insurance carriers in the E&S (Excess & Surplus) lines market.

Management says the company is the second-largest U.S. P&C insurance Wholesale Broker with a distribution network of over 650 RSG Producers who provide the company with access to more than 15,500 retail insurance brokerage firms and over 200 carriers.

The company makes money via commissions and fees.

Ryan Specialty’s Market & Competition

According to a 2021 market research report by Insurance Business America, the E&S market premiums in the U.S. market in 2020 were $41.7 billion.

This represents a 14.9% increase over the 2019 result of $37.5 billion.

The main drivers for this expected growth were a low interest rate environment, increased claims costs, and increasingly frequent weather events, among others.

Also, those factors are expected to remain in effect in 2021 with the topic of ransomware potentially becoming a more important factor in many insurance policies.

Major competitive or other industry participants include:

-

Appalachian Underwriters

-

Johnson & Johnson

-

Risk Placement Services

-

Worldwide Facilities

-

Others

Ryan Specialty’s Recent Financial Performance

-

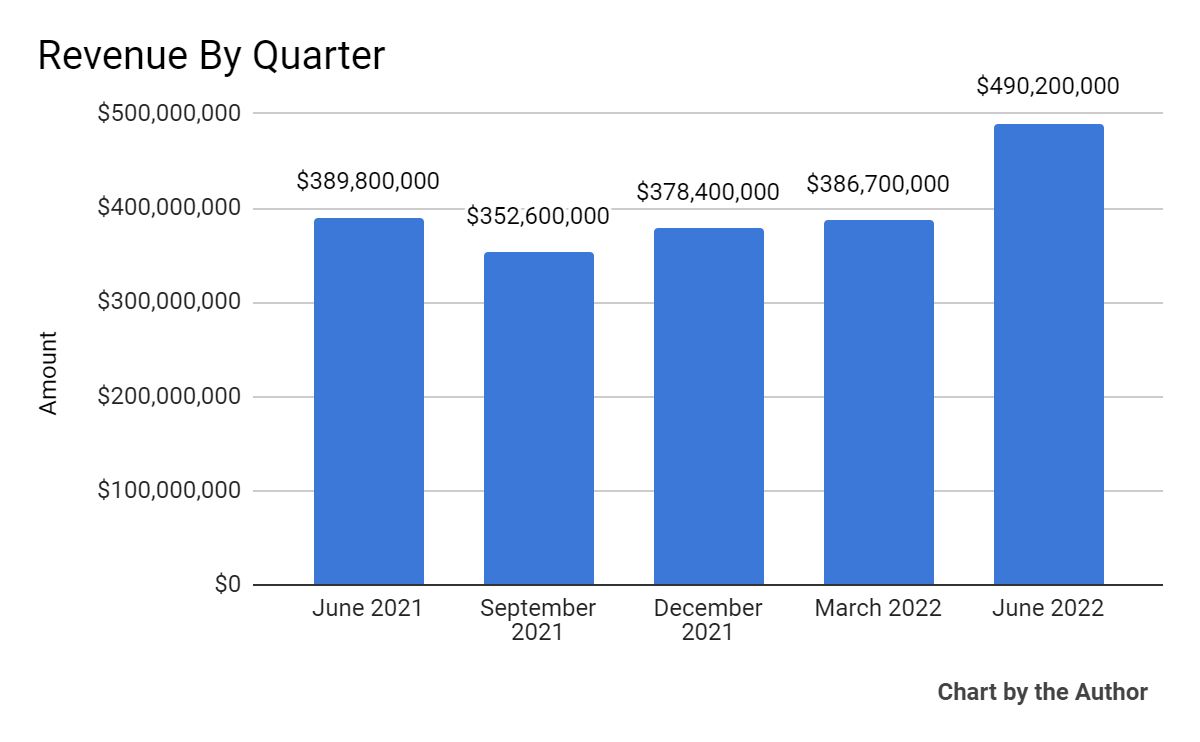

Total revenue by quarter has fluctuated as follows in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

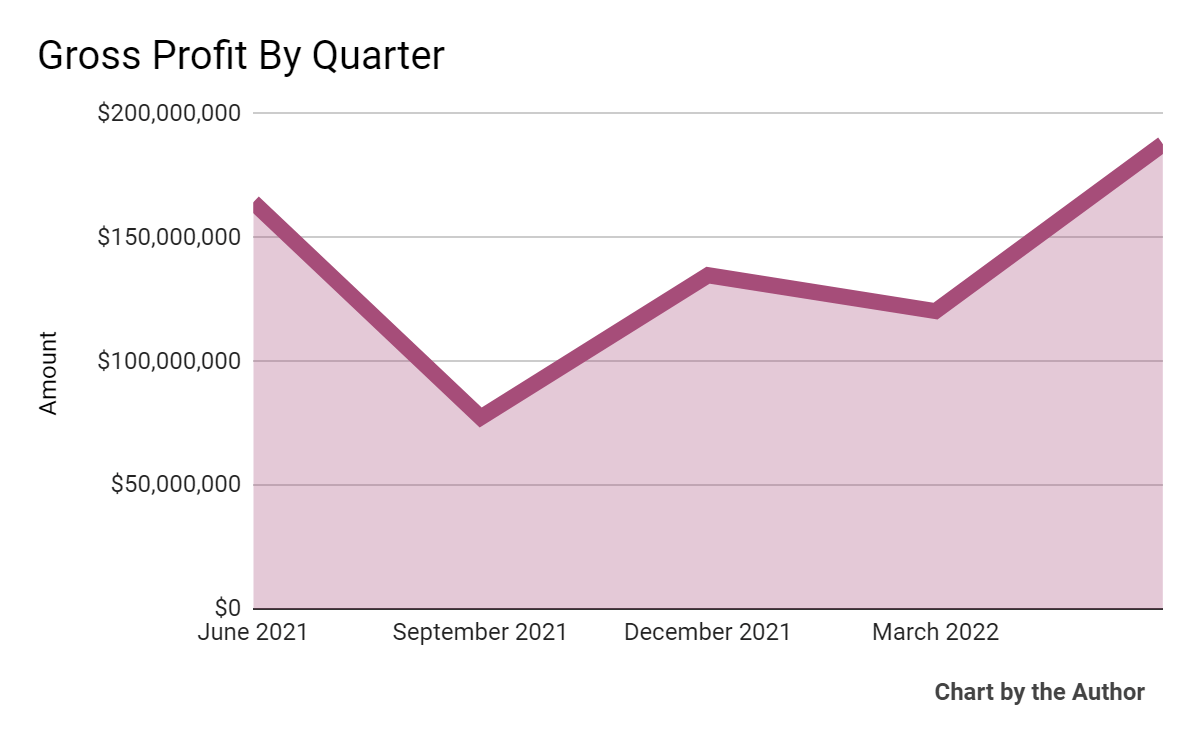

Gross profit by quarter has also varied materially:

5 Quarter Gross Profit (Seeking Alpha)

-

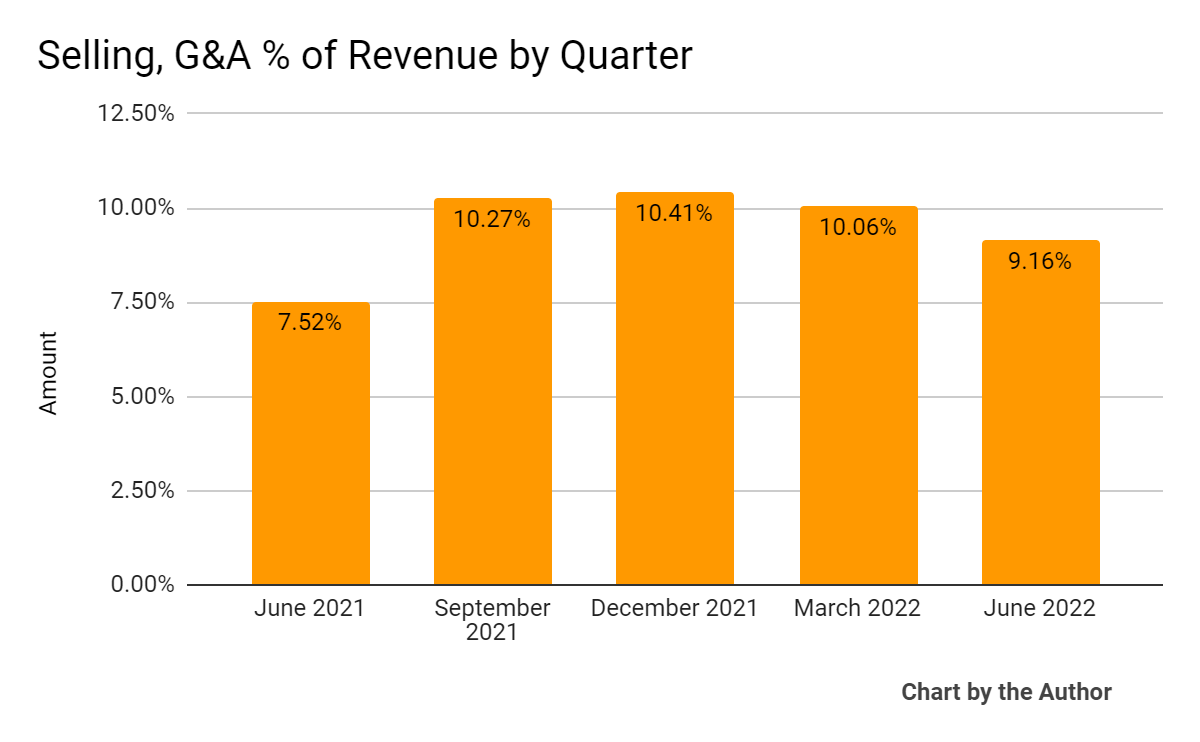

Selling, G&A expenses as a percentage of total revenue by quarter have been dropped in the past 3 quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

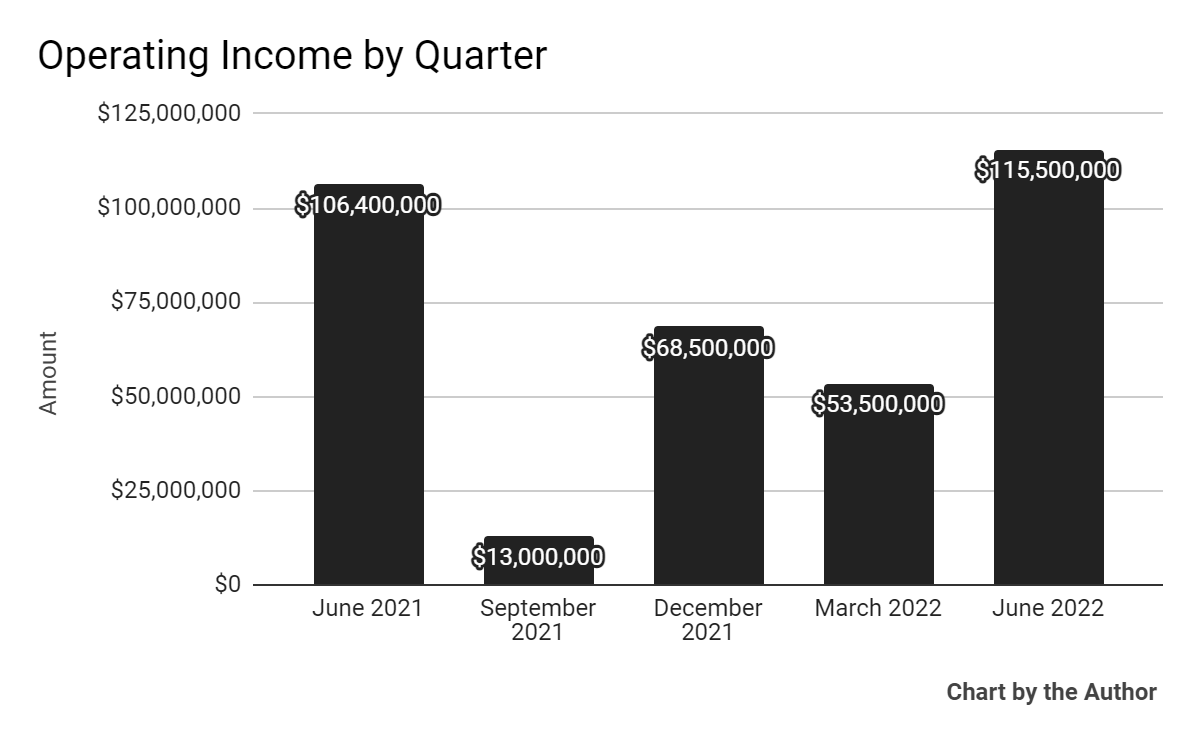

Operating income by quarter has varied significantly:

5 Quarter Operating Income (Seeking Alpha)

-

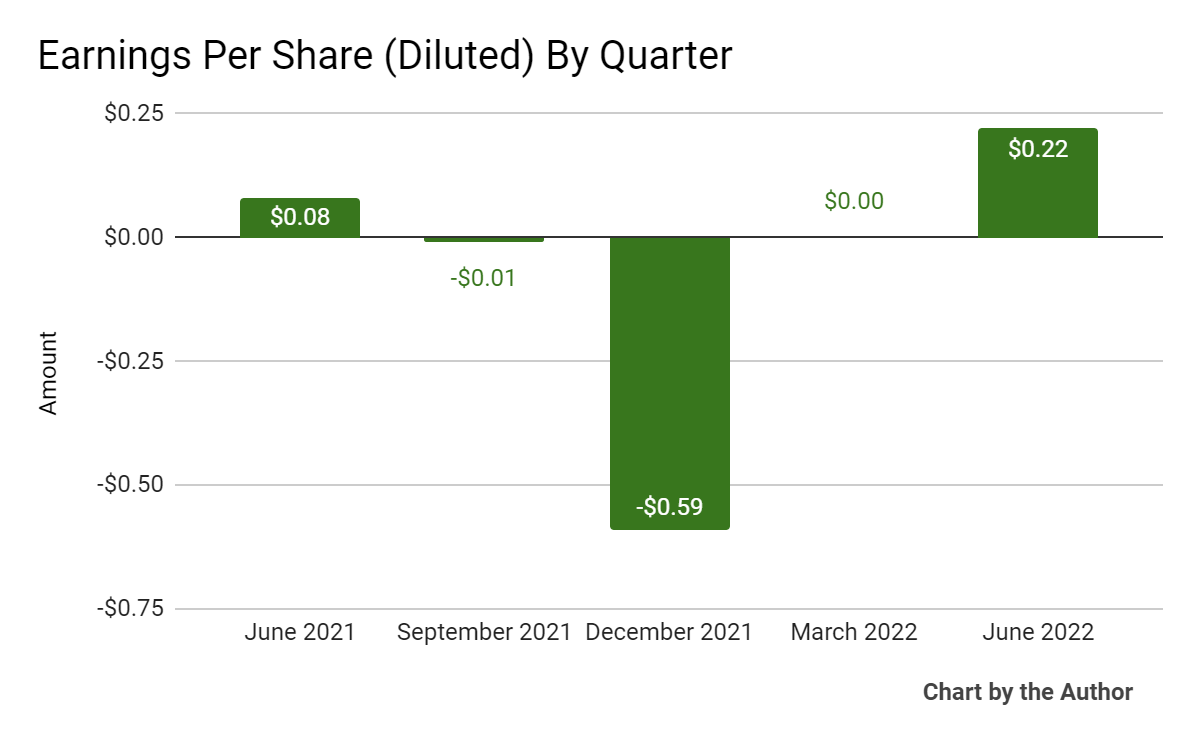

Earnings per share (Diluted) have also produced fluctuating results:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

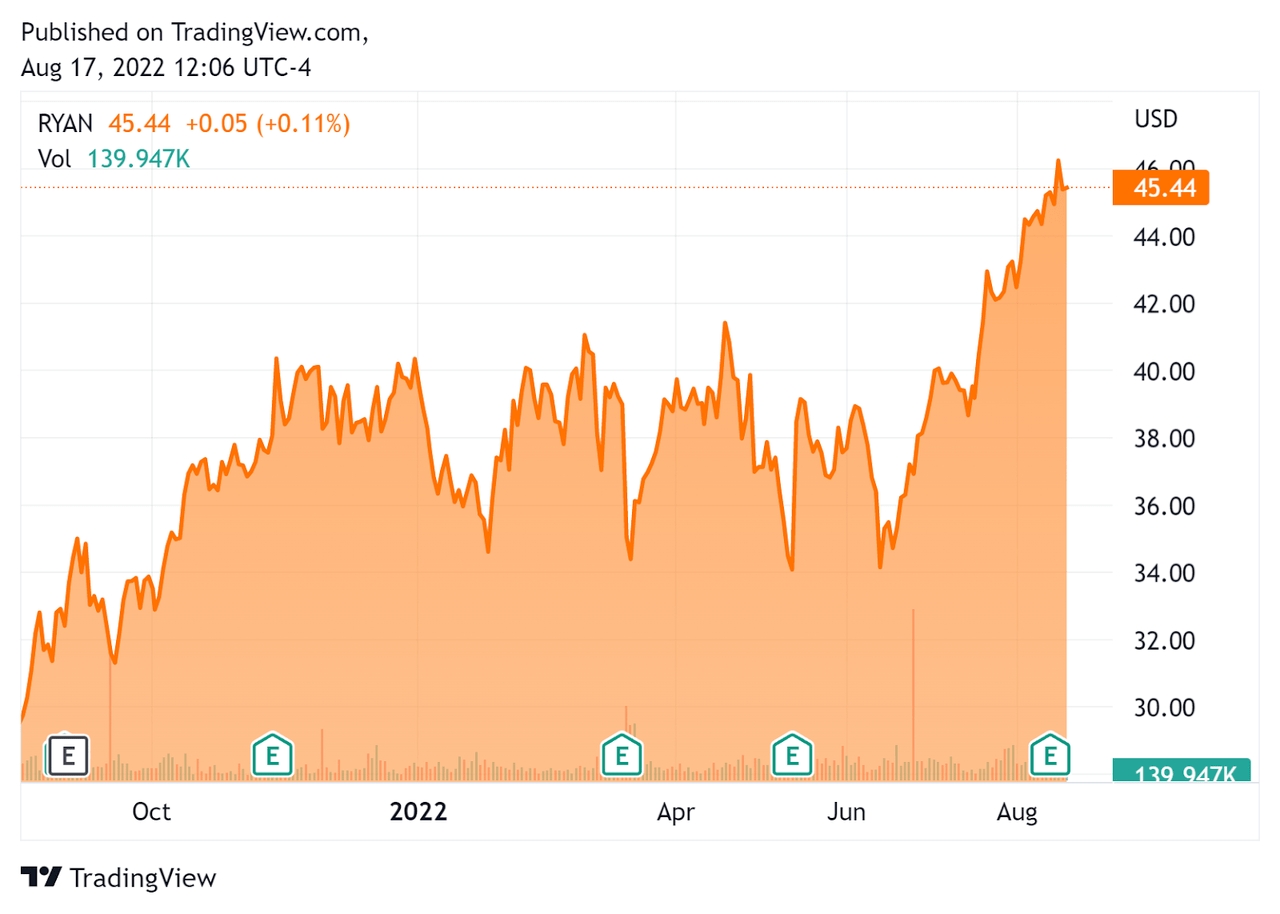

In the past 12 months, RYAN’s stock price has risen 54.3% vs. the U.S. S&P 500 Index’s drop of around 4.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Ryan Specialty

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value |

$6,620,000,000 |

|

Market Capitalization |

$11,780,000,000 |

|

Enterprise Value/Sales |

4.12 |

|

Revenue Growth Rate |

27.1% |

|

Operating Cash Flow |

$330,490,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.38 |

|

Net Income Margin |

2.5% |

(Source – Seeking Alpha)

Commentary On Ryan Specialty

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted that each of the company’s specialty lines produced double-digit growth results.

Founder and CEO Pat Ryan noted that the E&S market ‘remained robust’ during the quarter, with the flow of business into those lines ‘still at historically high levels.’

Reinsurers have been de-risking their portfolios, which has served to push business into the E&S market.

Also, management believes that most cyber risks in the U.S. will come into its E&S channel.

Productivity among its brokers continued to improve, and management expects favorable market dynamics to continue.

Notably, the company is looking for tuck-in or large acquisitions to ‘enhance and differentiate’ its platform, while seeking to remain disciplined in its criteria.

As to its financial results, total revenue rose 26% year-over-year, of which 22% was organic growth.

Adjusted EBITDAC rose 18% period-over-period although margin declined 220 basis points to 33.8%.

For the balance sheet, the company finished the quarter with $867 million in cash and equivalents plus an undrawn revolver of $600 million.

Looking ahead, management raised its full year 2022 outlook for organic revenue growth of 17.25% at the midpoint of the range and adjusted EBITDAC growth of 29.5% at the midpoint.

While upping forward guidance is encouraging, management assumes ‘less favorable external conditions than we saw in H1 of this year.’

The primary risk to the company’s outlook is the potential for an economic slowdown.

A potential upside catalyst to the stock could include continued reinsurer de-risking, favoring its E&S market.

RYAN appears to be well positioned in a segment of the insurance market that has solid growth prospects, and the firm has a strong balance sheet to make any reasonable M&A deals at favorable terms.

While RYAN may not always grow at a 20% rate of growth, given current market dynamics of increasing flow into its primary lines, my outlook is a Buy on RYAN at around $45.60 per share.

Be the first to comment