William_Potter/iStock via Getty Images

Introduction

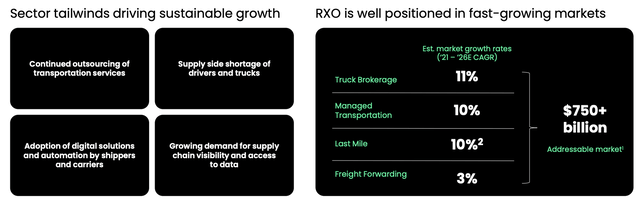

It’s time to look into RXO Inc. (NYSE:RXO), the latest spin-off from XPO Logistics (XPO). The spin-off happened just a few days ago, and (at this point) not all brokers offer clients the opportunity to invest in the tech company. Officially, RXO is not a tech company. With a market cap of $1.8 billion, it’s one of the smaller players in the industrial sector. Within that sector, the company operates in trucking. It runs an asset-light brokerage business model, allowing the company to benefit from increasing outsourcing and efficiency needs in the industry. The latest data shows that the company is growing quickly. The potential addressable market is huge, and the valuation is very fair. I believe RXO offers opportunities as it looks like a great mix between growth and value. In this article, we’re going to take a closer look.

So, bear with me!

What’s RXO?

RXO is the second spin-off from XPO since 2021. The other one is GXO Logistics (GXO), which provides supply chain and warehousing services.

RXO is a leading tech-enabled transportation service giant headquartered in Charlotte, North Carolina.

The company makes most of its money from its truck brokerage. According to Trucking Office:

A truck broker, also known as a freight broker, is the middleman. He’s in an agreement between a shipper who has goods to transport and a carrier who has the ability to move the load.

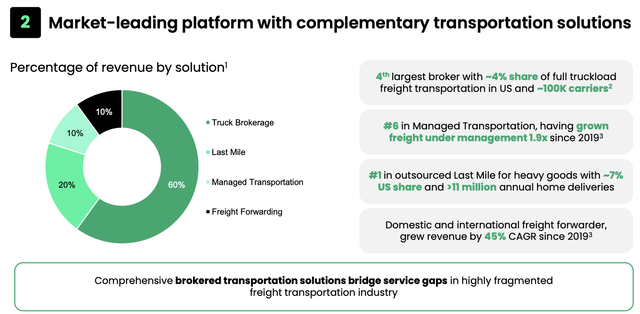

The company is the 4th-largest broker with a 4% market share. That shows how fragmented this industry is. The company is number six in managed transportation, having grown its exposure in that segment by 1.9x since 2019.

Managed Transportation Services Solutions (Managed TMS) involve shippers outsourcing their freight and logistics processes to a third-party logistics (3PL) provider. Third-party logistics companies offering this service are often called logistics service providers (LSPs).

The company is the largest outsourced last-mile service provider for heavy goods, with a 7% market share and 11 million annual home deliveries. Especially in e-commerce, last-mile transportation is key.

In freight forwarding, the company has grown its revenues by 45% per year since 2019.

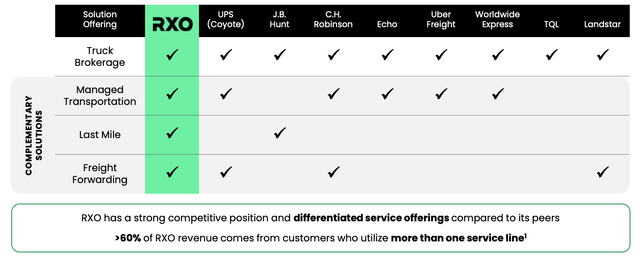

Overall, the company has strong competition in truck brokerage, but limited competition in its other segments.

Just like GXO, RXO benefits from a proprietary technology, which is one of the reasons why I called RXO a tech stock. The company captures volume and revenue at lower cost-to-serve, with fewer touches. In other words, it’s a smoother platform allowing for fast execution. A no-nonsense approach that uses pricing algorithms and machine learning to optimize prices. That’s a benefit in general, but it gives the company an increasing edge over companies that cannot compete with that.

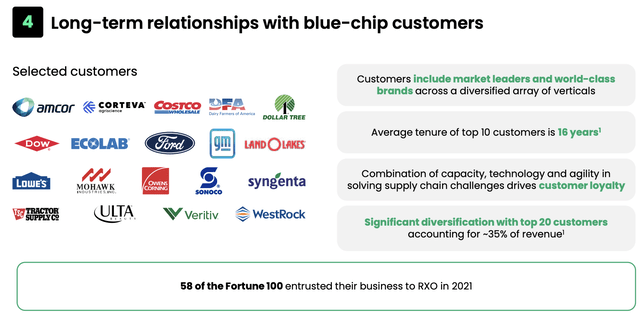

Moreover, while RXO’s business is young, it’s far from a startup finding its way into a large market. The company works with 58 Fortune 100 companies, with major customers in all industries, as the overview below shows. While they all do business in different industries, they have one thing in common: they all rely on flawless supply chains.

Its top 20 customers account for 35% of total revenue. The average tenure of its top 10 customers is 16 years, meaning the biggest players have been with the company since the early stages of its success.

Roughly 37% of its customers are in retail and e-commerce. 16% operate in industrial and manufacturing markets. The other half includes food & beverages, logistics, automotive, and others (22%).

Opportunities & Performance

In its truck brokerage segment, the company is dealing with a $400 billion market opportunity. That’s the total addressable for-hire truckload industry. The current brokered truckload industry is $88 billion. RXO owns 4% of that.

Between 2013 and 2021, the industry has grown by 10% per year. RXO has grown its revenues by 27% per year during this period – from $397 million to $2.7 billion.

Roughly 22% of the truckload industry is penetrated by brokers. That explains the difference between the $88 billion and $400 billion in total addressable market opportunities. This penetration has grown by 6% per year since the year 2000 – back then, it was 7%.

Going forward, penetration growth is expected to slow to 4% per year, which is still remarkable and likely to end in a 28% total penetration by 2026.

In this market, RXO operates 100 thousand carriers with an average fleet size of 11 trucks. The average length of haul is 700 miles. The average 7-day carrier retention is higher than 70%.

85% of carriers operate five or fewer trucks.

Roughly three-quarters of all contracts are based on contractual rates. Just 27% of pricing was dependent on spot pricing over the past 12 months (ending June 30). While contract rates usually follow spot rates, they tend to protect the company in the early stages of economic decline when spot rates start to fall before contract rates come down.

In managed transportation, the company has a 3% market share, making it the 6th-largest operator. In this segment, the company offers load planning and procurement to tailored complex solutions and performance monitoring. This segment allows the company to cross-sell opportunities across its wide portfolio of solutions.

One of the major benefits is that these solutions allow customers to reduce complexities and costs. In this segment, the company has more than 100 customers with an average tenure of 12 years among its top customers. The retention rate is 97%.

In 2019, the company had $2.1 billion in freight under management. In the past four quarters (ending June 30), that number was $3.9 billion, implying 27% annual compounded growth.

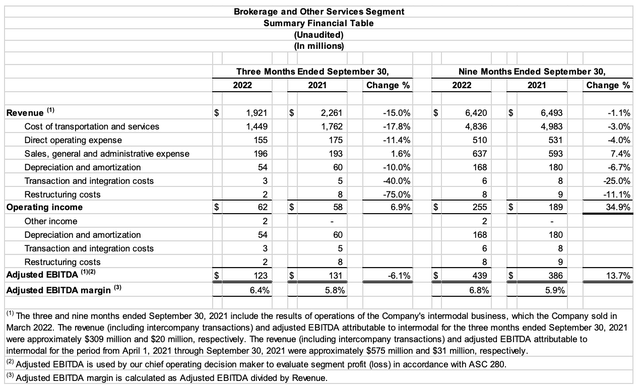

With that said, and looking at more recent data, the company did a great job managing headwinds like slower transportation demand and higher operating costs related to inflation. Third-quarter revenue came in at $1.9 billion, which is a decline of 15.0%. This is not a cyclical weakness but the result of the North American intermodal divestiture. This erased $309 million in quarterly sales. Yet, operating income still rose by 6.9%, as the company effectively managed costs. It also allowed the company to improve the adjusted EBITDA margin to 6.4%.

What needs to be said, however, is that truck brokerage revenue in North America declined by 2% to $686 million. This decline was the result of weaker truckload prices – lower spot prices. However, total truck brokerage volume was up, which is good news as I expect spot rates to improve in 2023 again.

Valuation

RXO has a $1.84 billion market cap. Over the past four quarters, it has generated $125 million in adjusted free cash flow. That implies a 6.8% FCF yield. That’s much higher than I expected. This gives the company the benefit of being in a high-growth industry while benefiting from a free cash flow yield that only mature businesses can compete with. It also shoes that the valuation is too low.

Moreover, because RXO has an asset-light business model, total CapEx has not exceeded 1.3% of total revenues in recent years. It means a lot of free cash flow can be spent on M&A, and eventually shareholder distributions.

It also helps that its balance sheet is already healthy. The company has just $342 million in net debt, that’s 1.1x LTM EBITDA of $302 million.

With that said, the company is currently trading at an enterprise value of $2.2 billion using its market cap and $342 million in net debt (not using expectations). That’s 7.2x LMT EBITDA of $302 million.

We do not have a historic EV/EBITDA chart. However, I don’t need that to make the case that this valuation is ridiculously low.

RXO has a return on invested capital of 42%, its three major segments are all expected to grow by double-digits (annually) until at least 2026, and RXO is expected to outperform that growth.

Yes, macro headwinds persist. And I would not recommend anyone to buy huge stakes in any cyclical company right now.

However, the point of the spin-off was to unlock shareholder value. This valuation is a start. However, we’re nowhere near the price RXO deserves.

Takeaway

I’ve been a fan of XPO Logistics for many years, as it not only grows its business highly successfully, but it uses smart spin-offs to enhance shareholder value. Not enough companies do that, in my opinion.

The RXO spin-off was a great move. It allows investors to buy a pure-play truck broker with connected services that benefit from double-digit long-term growth, its loyal and large customer base providing high free cash flow, and the fact that secular growth is far from slowing.

Moreover, the valuation remains extremely attractive. The debt load is low, the implied free cash flow yield is very high, and EV/EBITDA is at least 3-4 points too low – and even that is putting it conservatively.

I have little doubt that RXO will trade much higher a few years from now. The only way that doesn’t happen is if the economy were to enter an almost unprecedented recession or if management were to mess up so badly that its growth plans go off the rails. I don’t think that any of these risks are highly likely to materialize.

Hence, my strategy will be to pick up some stocks going into next year. I haven’t figured out exactly how I will do that as I have a lot of stocks on my buy list, yet the takeaway is clear: I think the RXO spin-off is a no-brainer. Long-term investors looking for advanced transportation exposure should look no further.

(Dis)agree? Let me know in the comments!

Be the first to comment